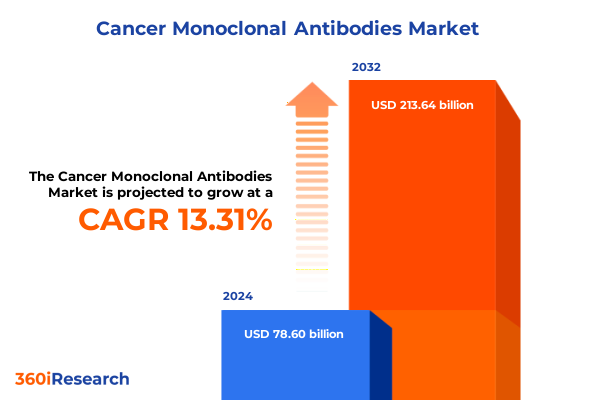

The Cancer Monoclonal Antibodies Market size was estimated at USD 88.89 billion in 2025 and expected to reach USD 99.61 billion in 2026, at a CAGR of 13.34% to reach USD 213.64 billion by 2032.

Pioneering the Future of Cancer Immunotherapy Through Monoclonal Antibodies: An Overview of Innovations and Strategic Imperatives

The development and application of monoclonal antibodies have revolutionized cancer therapy, positioning these biopharmaceutical agents as a cornerstone of modern oncology treatment. With their high specificity for antigens expressed on malignant cells, monoclonal antibodies have not only expanded the therapeutic arsenal available to clinicians but also opened new avenues for personalized and targeted interventions. From early chimeric constructs to today’s advanced humanized and fully human formats, continuous innovation has driven efficacy improvements and safety enhancements, establishing monoclonal antibodies as indispensable in the fight against diverse tumor types.

In recent years, breakthroughs in antibody engineering and conjugation technologies have accelerated the translation of novel constructs from bench to bedside. These advancements have fostered the emergence of multifunctional molecules capable of precise cell targeting, immune modulation, and direct cytotoxicity. At the same time, regulatory pathways have evolved to accommodate the unique characteristics of antibody-based therapies, facilitating faster approvals while maintaining rigorous safety and efficacy standards. Consequently, stakeholders across the pharmaceutical and biotech sectors are doubling down on research and development efforts, forging collaborations that span academic laboratories, contract research organizations, and leading hospitals.

As this report delves deeper into the transformative shifts, tariff impacts, segmentation insights, and regional dynamics shaping the cancer monoclonal antibody market, decision-makers will gain a comprehensive overview of opportunities and challenges ahead. By synthesizing the latest industry findings and expert perspectives, this executive summary lays the foundation for strategic planning, investment prioritization, and competitive positioning in a landscape defined by rapid technological progress and evolving patient needs.

Revolutionary Advances and Paradigm Shifts Redefining the Cancer Monoclonal Antibody Landscape Through Cutting-Edge Mechanisms and Technologies

The landscape of cancer monoclonal antibody development has undergone a series of transformative shifts, driven by paradigm-changing advances in molecular engineering and therapeutic strategy. First, the advent of bispecific antibody constructs that engage both tumor antigens and immune effector cells has unlocked new mechanisms for directing cytotoxic T lymphocytes to malignant targets, thereby enhancing antitumor responses. Parallel innovations in antibody drug conjugates have integrated highly potent cytotoxic payloads with targeted antibody moieties, enabling precise delivery of therapeutic agents and minimizing off-target effects. These dual modalities, when combined with novel conjugation chemistries, have expanded the therapeutic index of conventional treatments.

Checkpoint inhibitors have also redefined immune-oncology by unleashing the body’s own defenses against cancer. Targeting immune checkpoints such as CTLA-4, PD-1, and PD-L1, these antibodies reverse tumor-induced immune suppression and have demonstrated durable responses across a range of indications. In addition, the emergence of radioimmunotherapy agents conjugated with alpha and beta emitters has reintroduced radiation as a targeted approach, synergizing with immunomodulatory therapies to amplify antitumor efficacy.

Moreover, the integration of digital biology tools-ranging from AI-driven target discovery to real-time biomarker monitoring-has accelerated candidate selection and optimized clinical trial design. As a result, the pipeline is increasingly populated with next-generation constructs that blend multiple modalities, reflecting a shift from monotherapy paradigms toward combination and multifunctional approaches. Together, these transformative advances usher in a new era of precision oncology, compelling industry stakeholders to adapt strategies across research, manufacturing, and commercialization domains.

Evaluating the Aggregate Influence of United States 2025 Tariff Policies on Cancer Monoclonal Antibody Development Supply Chains and Cost Structures

United States tariff policies implemented in 2025 have exerted significant cumulative effects on the development and distribution of cancer monoclonal antibodies. Increased duties on imported bioreactor components, raw materials such as single-use filters, and specialty chemicals have elevated production costs for domestic and international manufacturers alike. This shift has prompted several organizations to reassess supply chain strategies, with some seeking to onshore critical manufacturing processes to mitigate the financial risks associated with cross-border tariffs. However, the transition to localized production requires capital-intensive investments in infrastructure, regulatory compliance, and workforce training, which can delay timelines for product launches.

Tariff-induced cost pressures have also rippled through research and development ecosystems. Contract research organizations that rely on imported assays and reagents have experienced margin compression, leading to renegotiated service contracts and extended project delivery schedules. Academic and clinical research centers, particularly those already operating on constrained budgets, have had to prioritize key studies, potentially slowing the pace of early-stage antibody discovery and validation.

Despite these challenges, companies have identified opportunities to innovate around tariff constraints by diversifying supplier networks and leveraging regional trade agreements. Collaborative initiatives aiming to establish tariff-exempt manufacturing zones and negotiating preferential terms under bilateral agreements are gaining traction. Through these efforts, stakeholders are seeking to ensure that cost escalations do not undermine patient access to cutting-edge antibody therapies or compromise the long-term viability of the oncology pipeline.

Comprehensive Exploration of Segmentation Dynamics Revealing How Mechanism, Target, Antibody Type, Indication, Administration and End Users Drive Market Trends

Analyzing market segmentation yields crucial insights into the multifaceted nature of the cancer monoclonal antibody arena. Within mechanism of action classifications, antibody drug conjugates utilizing both DNA alkylating agents and microtubule inhibitors illustrate how cytotoxic payload selection can be tailored to specific tumor profiles, while bispecific antibodies exemplify a shift toward dual checkpoint modulation and T cell engagement strategies. Checkpoint inhibitors, subdivided into CTLA-4, PD-1 and PD-L1 targeted therapies, underscore the nuanced approaches to reversing tumor-induced immunosuppression. Radioimmunotherapy segments reveal the tactical deployment of alpha and beta emitters for localized radiotoxicity. When considered alongside target antigen categories-ranging from CD20 and HER2 to PD-1/PD-L1 and VEGF-these mechanisms inform a layered understanding of therapeutic specificity.

Antibody type distinctions between chimeric, humanized, fully human, and murine formats further influence immunogenicity profiles and development pathways, while therapeutic indications such as breast, colorectal, lung cancer and lymphoma dictate clinical trial designs, combination regimens, and regulatory endpoints. Route of administration preferences for intravenous and subcutaneous delivery impact patient convenience and outpatient management protocols, whereas end user categories spanning cancer research centers, contract research organizations, hospitals and specialty clinics determine market access strategies and distribution models. Finally, formulation considerations, encompassing liquid and lyophilized powder presentations, affect storage logistics and on-site handling practices. By integrating these segments, stakeholders gain a comprehensive framework to align product development pipelines with clinical needs and operational imperatives.

This comprehensive research report categorizes the Cancer Monoclonal Antibodies market into clearly defined segments, providing a detailed analysis of emerging trends and precise revenue forecasts to support strategic decision-making.

- Target Antigen

- Antibody Type

- Therapeutic Indication

- Route Of Administration

- End User

- Mechanism Of Action

- Formulation

Analyzing Regional Divergence in Cancer Monoclonal Antibody Adoption Highlighting Growth Patterns Across the Americas, EMEA, and Asia-Pacific Territories

Regional analysis highlights distinctive growth trajectories for cancer monoclonal antibodies across key geographies. In the Americas, strong reimbursement policies, robust clinical trial infrastructure and established biomanufacturing capacities have cemented North America as the epicenter of antibody innovation. Investors continue to channel capital into local biotech hubs, fostering collaborations that expedite translational research and commercial launches. Latin American markets, while exhibiting slower regulatory timelines, are advancing efforts to integrate antibody therapies into national cancer care protocols, often through public–private partnerships aimed at broadening access.

Europe, the Middle East and Africa present a heterogeneous landscape characterized by variable regulatory environments and healthcare spending patterns. Western European nations benefit from coordinated approval pathways and well-established oncology networks that facilitate rapid adoption of next-generation antibodies. Meanwhile, emerging markets in Eastern Europe and the Gulf Cooperation Council region are prioritizing the development of regional manufacturing sites and streamlined import processes to overcome logistical barriers and reduce time-to-market.

Asia-Pacific is emerging as a catalyst for price-sensitive yet high-volume adoption of antibody therapies. Nations such as China, Japan and South Korea are investing heavily in domestic biopharma capabilities, while Southeast Asian countries are enhancing regulatory harmonization through regional trade blocs. As a result, Asia-Pacific is poised to offer strategic growth opportunities, particularly for companies able to adapt cost-effective production models and forge partnerships with local stakeholders.

This comprehensive research report examines key regions that drive the evolution of the Cancer Monoclonal Antibodies market, offering deep insights into regional trends, growth factors, and industry developments that are influencing market performance.

- Americas

- Europe, Middle East & Africa

- Asia-Pacific

Profiling Leading Biopharmaceutical Innovators Shaping the Cancer Monoclonal Antibody Sphere Through Strategic Pipelines, Partnerships, and Technological Investments

Leading biopharmaceutical players are driving the oncology monoclonal antibody space through expansive pipelines, strategic alliances and technological innovation. Established industry titans have leveraged decades of antibody discovery expertise to launch high-impact therapeutics targeting key antigens and immune checkpoints, setting industry benchmarks for efficacy and safety. At the same time, specialized biotechnology firms have emerged as agile contributors, focusing on novel modalities such as bispecific constructs and antibody drug conjugates with next-generation payloads.

Strategic partnerships have intensified, with collaborations between large pharma companies and contract research organizations enabling accelerated preclinical validation and streamlined clinical development. Investments in proprietary platforms for antibody humanization, conjugation chemistries and manufacturing scale-up have become critical differentiators, allowing companies to shorten development timelines and lower production costs. Meanwhile, acquisitions of niche technology providers have augmented in-house capabilities, from advanced analytics that predict immunogenicity to modular manufacturing systems designed for rapid changeovers between product lines.

Collectively, these corporate maneuvers illustrate a dynamic competitive environment where pipeline depth, platform innovation and strategic collaboration define success. By continuously refining therapeutic portfolios and forging alliances across the value chain, leading companies are well positioned to capture emerging opportunities and address unmet needs in oncology care.

This comprehensive research report delivers an in-depth overview of the principal market players in the Cancer Monoclonal Antibodies market, evaluating their market share, strategic initiatives, and competitive positioning to illuminate the factors shaping the competitive landscape.

- AbbVie Inc

- Amgen Inc

- AstraZeneca plc

- BeiGene, Ltd

- Bristol‑Myers Squibb Company

- Daiichi Sankyo Company, Limited

- Eli Lilly and Company

- F. Hoffmann‑La Roche Ltd

- Genmab A/S

- GlaxoSmithKline plc

- Johnson & Johnson

- Merck & Co., Inc

- Mitsubishi Tanabe Pharma Corporation

- Novartis AG

- Pfizer Inc

- Regeneron Pharmaceuticals, Inc

- Sanofi S.A.

- Seagen Inc

- Spectrum Pharmaceuticals, Inc

- WuXi Biologics Co., Ltd

Actionable Strategic Pathways for Industry Leaders to Capitalize on Emerging Opportunities in Cancer Monoclonal Antibodies and Enhance Competitive Positioning

To capitalize on evolving opportunities in cancer monoclonal antibodies, industry leaders should prioritize investment in multimodal constructs that combine cytotoxic payloads with immune engagement to maximize clinical benefit. Strengthening regional manufacturing networks-particularly in tariff-sensitive jurisdictions-will help mitigate supply chain risks and secure reliable access to critical raw materials. In parallel, expanding digital biology capabilities for in silico target validation and real-time patient monitoring can accelerate candidate selection and reduce late-stage attrition.

Leaders must also embrace collaborative consortium models that pool resources and expertise across academia, biotech innovators and contract organizations, fostering open innovation without compromising intellectual property. Tailoring market entry strategies to each region’s regulatory and reimbursement landscape is essential; this may include leveraging compassionate use programs in emerging markets and devising co-pay assistance schemes in more developed healthcare systems. Finally, ongoing engagement with healthcare providers and patient advocacy groups will ensure that development priorities remain aligned with clinical realities, anchoring R&D investment in meaningful patient outcomes.

Detailing a Rigorous Mixed-Method Research Framework Underpinning the Analyses of Cancer Monoclonal Antibody Developments With Transparent Validation Processes

The research underpinning this report employs a robust mixed-method approach, integrating primary interviews, secondary data analysis and systematic data triangulation to ensure comprehensive coverage of the cancer monoclonal antibody landscape. Primary research comprised in-depth discussions with key opinion leaders, manufacturing experts and clinical investigators, providing nuanced perspectives on technological advancements and operational challenges. Secondary research involved evaluation of peer-reviewed publications, regulatory filings and patent databases to validate clinical efficacy data and track intellectual property trends.

Data credibility was reinforced through cross-verification of multiple sources, including clinical trial registries and public financial disclosures, ensuring that insights reflect both qualitative expert opinions and quantitative performance metrics. The segmentation framework was meticulously designed to capture diversity across mechanism of action, target antigens, antibody formats, therapeutic indications, administration routes, end-user environments and formulation types. Finally, all findings underwent rigorous internal review by multidisciplinary analysts, ensuring that conclusions present a balanced, objective view of market dynamics and strategic imperatives.

This section provides a structured overview of the report, outlining key chapters and topics covered for easy reference in our Cancer Monoclonal Antibodies market comprehensive research report.

- Preface

- Research Methodology

- Executive Summary

- Market Overview

- Market Insights

- Cumulative Impact of United States Tariffs 2025

- Cumulative Impact of Artificial Intelligence 2025

- Cancer Monoclonal Antibodies Market, by Target Antigen

- Cancer Monoclonal Antibodies Market, by Antibody Type

- Cancer Monoclonal Antibodies Market, by Therapeutic Indication

- Cancer Monoclonal Antibodies Market, by Route Of Administration

- Cancer Monoclonal Antibodies Market, by End User

- Cancer Monoclonal Antibodies Market, by Mechanism Of Action

- Cancer Monoclonal Antibodies Market, by Formulation

- Cancer Monoclonal Antibodies Market, by Region

- Cancer Monoclonal Antibodies Market, by Group

- Cancer Monoclonal Antibodies Market, by Country

- United States Cancer Monoclonal Antibodies Market

- China Cancer Monoclonal Antibodies Market

- Competitive Landscape

- List of Figures [Total: 19]

- List of Tables [Total: 1908 ]

Synthesizing Key Insights on Cancer Monoclonal Antibodies to Guide Stakeholders Toward Informed Decision-Making and Sustainable Innovation Strategies

Cancer monoclonal antibodies continue to redefine oncology treatment paradigms by harnessing targeted mechanisms and innovative delivery modalities. Driven by groundbreaking platforms in bispecific antibodies, antibody drug conjugates, checkpoint inhibitors and radioimmunotherapy, this sector has achieved unparalleled therapeutic milestones. Concurrently, the evolving tariff landscape and regional dynamics underscore the importance of proactive supply chain strategies and localized manufacturing. Segmentation analysis reveals that diverse mechanisms of action and antigen specificities, coupled with nuanced formulation and administration choices, underpin market differentiation and clinical success.

As leading companies invest in technology platforms and strategic partnerships, the market trajectory will be shaped by integrated approaches that balance scientific rigor with patient-centric considerations. Recommendations to industry stakeholders emphasize the imperative for agile development, digital integration and cross-sector collaboration. Through adherence to these principles, organizations can navigate complex regulatory terrains and capitalize on emerging opportunities, ultimately delivering transformative therapies that improve patient outcomes. This synthesis of key insights provides a strategic roadmap for decision-makers, highlighting pathways to sustainable innovation and clinical excellence in the fight against cancer.

Engage with Ketan Rohom to Access In-Depth Cancer Monoclonal Antibody Market Research and Position Your Organization for Strategic Growth

To secure unparalleled competitive insight, reach out to Ketan Rohom, Associate Director of Sales & Marketing, whose expertise in oncology markets will ensure your organization gains immediate access to comprehensive data and strategic analyses that drive success in the cancer monoclonal antibody space. By partnering with Ketan Rohom, you will benefit from personalized support, tailored deliverables, and real-time updates that enable swift, informed decision-making. Connect with Ketan Rohom today to obtain the full market research report and position your team at the forefront of drug development innovation

- How big is the Cancer Monoclonal Antibodies Market?

- What is the Cancer Monoclonal Antibodies Market growth?

- When do I get the report?

- In what format does this report get delivered to me?

- How long has 360iResearch been around?

- What if I have a question about your reports?

- Can I share this report with my team?

- Can I use your research in my presentation?