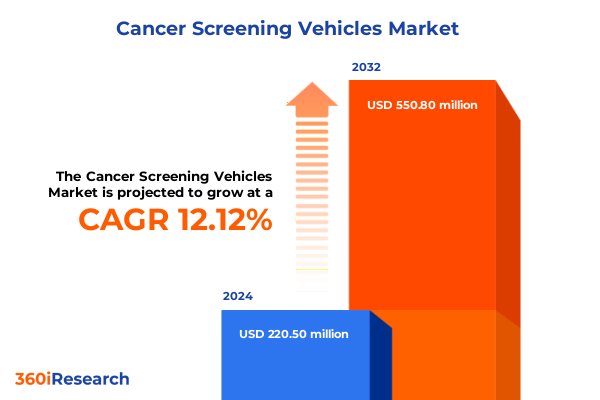

The Cancer Screening Vehicles Market size was estimated at USD 245.75 million in 2025 and expected to reach USD 276.31 million in 2026, at a CAGR of 12.22% to reach USD 550.80 million by 2032.

Driving the Future of On-the-Go Cancer Screening With Innovations That Empower Early Detection and Improve Patient Outcomes Nationwide

In an era where timely cancer detection can mean the difference between life and death, mobile cancer screening vehicles have emerged as critical enablers of early diagnosis and improved patient outcomes. These specialized units bring advanced imaging technologies directly to underserved communities and remote regions, breaking down geographical and logistical barriers that often delay crucial testing. By integrating high-performance equipment into bespoke trailers, trucks, and vans, healthcare providers can deliver mammography, computed tomography, magnetic resonance imaging, positron emission tomography, and ultrasound services on wheels.

This mobile-first paradigm not only expands access to comprehensive screening programs but also streamlines operational efficiencies for hospitals, diagnostic centers, and outpatient clinics. Moreover, government-sponsored initiatives and public–private partnerships increasingly leverage these solutions to bolster preventive health measures, reflecting a broader shift toward decentralized care delivery. As demographic pressures mount and cancer incidence rates continue to rise, the strategic importance of flexible, deployable screening platforms cannot be overstated.

Subsequently, this executive summary delves into the transformative shifts reshaping this market, examines the cumulative effects of new U.S. tariff policies, and presents in-depth segmentation, regional insights, and competitive profiles. Together, these analyses equip decision-makers with the knowledge required to navigate a complex landscape and capitalize on emerging opportunities in the mobile cancer screening vehicle sector.

Identifying Key Transformational Shifts That Are Redefining Mobile Cancer Screening Services Across Equipment Technology and Healthcare Delivery Models

Healthcare delivery is experiencing several transformational shifts that are radically redefining how and where cancer screening occurs. Rapid advancements in imaging hardware, including the proliferation of low-dose computed tomography and the migration from analog to digital 3D mammography, are enhancing diagnostic precision. Coupled with sophisticated post-processing algorithms and artificial intelligence–driven image analysis, these technologies empower clinicians to detect subtle lesions at earlier stages, thereby improving prognosis and reducing downstream treatment costs.

Furthermore, patient expectations and regulatory guidelines have evolved in tandem, placing greater emphasis on accessibility, comfort, and safety. As a result, manufacturers and mobile screening providers are investing in quieter, lower-radiation equipment and ergonomic vehicle designs. This shift not only aligns with public demand for minimally invasive procedures but also fosters higher screening adherence among vulnerable populations. In parallel, healthcare payers and government bodies are increasingly incentivizing preventive care, channeling resources into outreach programs that leverage mobile units to maximize screening coverage.

Consequently, the convergence of technological innovation, policy support, and shifting consumer preferences is driving a new generation of mobile cancer screening services. The subsequent section evaluates the influence of tariff policies on this evolving ecosystem, highlighting implications for cost structures and investment strategies.

Evaluating the Multifaceted Effects of New 2025 U.S. Tariff Policies on the Supply Chain Cost Structures of Mobile Cancer Screening Platforms and Investment Strategies

The implementation of newly enacted U.S. tariff policies in 2025 has introduced a multifaceted impact on the mobile cancer screening vehicle market, influencing procurement costs, supply chain resilience, and strategic sourcing decisions. By imposing additional duties on imported imaging components and finished medical equipment, these policies have led to a noticeable increase in baseline capital expenditures for fleet operators. The resultant cost pressures have prompted several manufacturers to explore alternative supply routes or to relocate assembly lines domestically, seeking to mitigate tariff burdens and sustain competitive pricing.

Moreover, the tariff-induced realignments have intensified lead times for critical components such as CT detectors, MRI superconducting coils, and high-sensitivity ultrasound transducers. As a consequence, production schedules for customized trailers, trucks, and vans experience greater variability, challenging providers to adapt inventory management and service-level agreements accordingly. Despite these headwinds, some organizations view the policy environment as an impetus to bolster local manufacturing ecosystems, partnering with U.S.-based foundries and fabricators to secure supply continuity and reduce long-term import dependencies.

In addition, healthcare networks and governmental screening initiatives are undergoing budgetary reviews to accommodate revised cost profiles. These assessments often translate into renegotiated contracts, collaborative investment frameworks, and performance-based procurement models. The ensuing section explores the granular segmentation insights that inform targeted strategies across technologies, cancer types, vehicle formats, and end-user categories.

Uncovering Detailed Market Segmentation Insights Spanning Diverse Technologies Cancer Types Vehicle Configurations and End-User Applications

A nuanced understanding of market segmentation reveals critical insights into how different technologies, cancer types, vehicle configurations, and end-user applications converge to define success factors in mobile screening. Within the technology realm, standard-dose and low-dose computed tomography platforms cater to lung screening and advanced vascular assessments, whereas digital two- and three-dimensional mammography systems optimize breast cancer detection pipelines. Magnetic resonance imaging modules deliver unparalleled soft-tissue contrast for complex diagnostic cases, while positron emission tomography outfits integrated metabolic imaging for targeted oncology applications. High-resolution ultrasound units, by contrast, offer portability and cost-efficiency for prostate screening and abdominal evaluations.

When considered by cancer type, early-stage breast cancer detection benefits significantly from the enhanced tissue differentiation of three-dimensional digital mammography, while analog and two-dimensional digital systems maintain relevance in areas with limited infrastructure. In colorectal applications, polyp detection often leverages computed tomography colonography, whereas tumor screening may combine PET-CT fusion for precise localization. Lung cancer protocols split between small-cell disease-where metabolic imaging can uncover micrometastases-and non-small-cell presentations suited to low-dose CT surveillance. Meanwhile, prostate screening advances rely on portable transrectal ultrasound arrays embedded within van-based units.

Vehicle choice and end-user needs further refine deployment models: trailers house multi-modality suites for extended community outreach, trucks serve as mobile hubs for specialized imaging sessions, and smaller vans deliver targeted services in urban corridors. Diagnostic centers and outpatient clinics alike integrate these vehicles to augment fixed-site capacity, while government programs and mobile screening providers orchestrate fleet rotations to maximize geographic penetration. In the next section, regional dynamics will underscore how these segmented drivers translate across the Americas, Europe, Middle East & Africa, and Asia-Pacific.

This comprehensive research report categorizes the Cancer Screening Vehicles market into clearly defined segments, providing a detailed analysis of emerging trends and precise revenue forecasts to support strategic decision-making.

- Technology

- Cancer Type

- Vehicle Type

- End User

Analyzing Critical Regional Perspectives Highlighting Unique Market Dynamics Across the Americas EMEA and Asia-Pacific for Mobile Screening Solutions

Regional dynamics shape the trajectory of mobile cancer screening solutions by dictating policy frameworks, funding streams, and healthcare infrastructure readiness. In the Americas, robust preventive health policies and substantial public–private investment have spurred the deployment of mobile units across urban, suburban, and rural areas, particularly within the United States and Canada. Consequently, carriers of low-dose computed tomography and digital three-dimensional mammography have gained prominence in regions targeting high-risk populations, while underserved communities benefit from customized trailers equipped for multiple modalities.

Across Europe, the Middle East, and Africa, regulatory harmonization within the European Union has facilitated cross-border deployment of standardized vehicle platforms, enabling efficient scaling of breast and colorectal cancer screening campaigns. Meanwhile, nascent government programs across parts of Africa and the Gulf region are increasingly commissioning trucks and vans to bridge diagnostic gaps, supported by international health organizations and philanthropic partnerships. These initiatives emphasize affordability and ease of maintenance, often favoring ultrasound and two-dimensional digital mammography due to lower operational complexity.

Asia-Pacific presents a tapestry of market maturity levels, from advanced screening networks in Japan and Australia to rapidly expanding programs in China and India. Here, van-based ultrasound and low-dose CT units play a pivotal role in national early detection initiatives, reflecting a growing commitment to rural healthcare outreach. Private healthcare providers in urban centers adopt specialized PET-CT trailers for high-value oncology diagnostics, while integrated government schemes leverage digital mammography fleets to address rising incidence rates. The following section examines how leading companies are capitalizing on these diverse regional conditions to solidify their competitive positions.

This comprehensive research report examines key regions that drive the evolution of the Cancer Screening Vehicles market, offering deep insights into regional trends, growth factors, and industry developments that are influencing market performance.

- Americas

- Europe, Middle East & Africa

- Asia-Pacific

Examining Strategically Important Company Profiles and Competitive Strategies Driving Innovation and Growth in Mobile Cancer Screening Vehicle Solutions

Leading equipment manufacturers and service providers continue to drive innovation and market penetration through targeted product offerings, strategic alliances, and customer-centric service models. One leading medical imaging firm has introduced a modular trailer concept that integrates low-dose CT and digital mammography under one roof, enabling rapid redeployment between community health events and hospital-supported programs. Another global technology leader has expanded its digital two-dimensional and three-dimensional mammography portfolio into compact mobile van configurations, emphasizing ease of installation and streamlined power requirements.

In parallel, a prominent European conglomerate has collaborated with fleet specialists to deploy all-in-one PET/CT trucks, leveraging its advanced radiotracer distribution network to support oncology screening across metropolitan areas. Meanwhile, a major Japanese manufacturer has penetrated emerging markets by offering mobile magnetic resonance imaging vans designed for high-throughput mass screening, complemented by remote diagnostics and maintenance services. Additionally, specialist integrators focusing exclusively on oncology have emerged, customizing lightweight vehicle chassis for ultrasound and digital X-ray modules, thereby addressing the needs of outpatient clinics and diagnostic centers.

Competitive strategies extend beyond product differentiation to encompass service-level innovations: extended warranties, telemaintenance platforms, and pay-per-scan financing models reduce customer risk and improve utilization rates. As these companies continue to refine their offerings and expand strategic partnerships, the mobile cancer screening vehicle landscape evolves into a sophisticated ecosystem characterized by interoperability, data-driven performance metrics, and scalable deployment architectures.

This comprehensive research report delivers an in-depth overview of the principal market players in the Cancer Screening Vehicles market, evaluating their market share, strategic initiatives, and competitive positioning to illuminate the factors shaping the competitive landscape.

- Anangpuria Medtech LLP

- Autofabrico Manufacturing Pvt. Ltd.

- Azael Manufacturing Private Limited

- Canon Medical Systems Corporation

- GE HealthCare Technologies Inc.

- Harmony Overseas Pvt. Ltd.

- Jagan Automobiles Manufacturing Private Limited

- Jye Health Systems Modularzz Pvt. Ltd.

- Kiran Techno Services Private Limited

- Lifewheels Technologies Private Limited

- Marwah Mobile Vehicles Pvt. Ltd.

- Philips Medical Systems Nederland B.V.

- Pinnacle Specialty Vehicles Pvt. Ltd.

- Pleasure Paradise Pvt. Ltd.

- Sarvottam Appliances Private Limited

- Siemens Healthineers AG

- Spencer India Technologies Private Limited

- SSS India Pvt. Ltd.

- Sunmedics Labs Pvt. Ltd.

- Valuable Wheels India Private Limited

Delivering Action-Oriented Recommendations to Enable Industry Leaders to Capitalize on Emerging Opportunities and Optimize Mobile Screening Program Operations

Industry leaders seeking sustained growth in the mobile cancer screening domain must adopt an action-oriented playbook that aligns technological capability with operational agility. First, prioritizing investment in low-dose computed tomography platforms will not only improve patient safety profiles but also unlock new screening protocols for early lung cancer detection. Simultaneously, upgrading mammography fleets to include digital three-dimensional systems will enhance lesion characterization and support advanced-stage breast cancer monitoring.

In addition, fostering partnerships with governmental health initiatives and nonprofit screening programs can secure stable utilization pipelines and enable shared funding models. These collaborations often accelerate regulatory approvals and facilitate access to underserved demographics. At the same time, diversifying vehicle types-balancing high-capacity trailers with nimble trucks and compact vans-ensures optimal deployment across varying geographical contexts and patient walk-in volumes. Consequently, organizations can achieve both broad outreach and high-frequency screening.

To maximize service differentiation, integrating remote monitoring, artificial intelligence analytics, and real-time reporting will create a competitive advantage by delivering actionable insights to clinicians and administrators. Leaders should also establish training programs for technologists and driver-operators to maintain consistency in image quality and patient experience. Finally, evaluating strategic sourcing options in light of evolving tariff policies will mitigate cost fluctuations and secure uninterrupted supply chains. By implementing these recommendations, industry participants can strengthen market positions and deliver meaningful improvements in cancer detection rates.

Detailing a Robust Research Methodology Integrating Primary Insights Secondary Analysis and Rigorous Data Triangulation Techniques for Ensuring High Validity

The foundation of this analysis rests on a rigorous methodology that synthesizes primary insights, secondary analysis, and data triangulation to ensure robust and reliable findings. Initially, in-depth interviews with radiologists, hospital administrators, fleet operators, and government health officials provided firsthand perspectives on deployment challenges, technology preferences, and funding mechanisms. These qualitative inputs informed the development of a comprehensive survey deployed to mobile screening providers, capturing operational metrics, equipment utilization rates, and strategic priorities.

Concurrently, secondary research drew upon peer-reviewed medical journals, regulatory publications, equipment technical datasheets, and public health reports to corroborate primary-data trends and validate technology performance characteristics. Industry white papers and conference proceedings supplemented the literature review, offering insights into emerging imaging modalities and vehicle integration best practices. This step was followed by meticulous data triangulation, reconciling discrepancies between quantitative survey responses and qualitative interview observations, thereby enhancing overall confidence in the conclusions.

Finally, a panel of subject matter experts reviewed draft findings to provide critical feedback and ensure alignment with market realities. Their input refined segmentation frameworks, regional analyses, and competitive profiling. Throughout the process, quality assurance protocols-including consistency checks, source verification, and transparent documentation-upheld the highest standards of analytical integrity and industry relevance. This methodological rigor underpins the reliability of the insights presented herein.

This section provides a structured overview of the report, outlining key chapters and topics covered for easy reference in our Cancer Screening Vehicles market comprehensive research report.

- Preface

- Research Methodology

- Executive Summary

- Market Overview

- Market Insights

- Cumulative Impact of United States Tariffs 2025

- Cumulative Impact of Artificial Intelligence 2025

- Cancer Screening Vehicles Market, by Technology

- Cancer Screening Vehicles Market, by Cancer Type

- Cancer Screening Vehicles Market, by Vehicle Type

- Cancer Screening Vehicles Market, by End User

- Cancer Screening Vehicles Market, by Region

- Cancer Screening Vehicles Market, by Group

- Cancer Screening Vehicles Market, by Country

- United States Cancer Screening Vehicles Market

- China Cancer Screening Vehicles Market

- Competitive Landscape

- List of Figures [Total: 16]

- List of Tables [Total: 1590 ]

Drawing Comprehensive Conclusions That Synthesize Key Insights and Illuminate the Roadmap for the Evolution of Mobile Cancer Screening Services and Future Industry Trajectory

In synthesizing the multifaceted analyses presented, it becomes clear that mobile cancer screening vehicles stand at the intersection of technological innovation, policy evolution, and strategic execution. The convergence of advanced imaging modalities-from low-dose CT and digital three-dimensional mammography to integrated PET/CT and high-resolution ultrasound-has redefined diagnostic capabilities in community-centric settings. Segmentation insights underscore the pivotal role of tailored vehicle formats and end-user partnerships in delivering specialized services for diverse cancer types.

Regional perspectives reveal that while high-income markets continue to push the frontiers of mobile screening sophistication, emerging economies leverage cost-effective configurations to broaden access. The introduction of additional U.S. tariffs in 2025 has injected complexity into procurement strategies, prompting a balanced approach between domestic sourcing and strategic import pathways. Competitive benchmarking illustrates that leading firms differentiate through product modularity, data-driven service models, and flexible financing arrangements.

Overall, industry stakeholders must navigate a landscape characterized by evolving regulatory standards, dynamic patient expectations, and shifting economic pressures. By internalizing segmentation intricacies, regional nuances, and supplier dynamics, decision-makers can craft strategies that enhance screening penetration, optimize fleet utilization, and improve patient journey outcomes. The insights distilled here provide a strategic compass for stakeholders aiming to shape the future of mobile cancer screening delivery.

Empower Your Decision-Making Today by Connecting With Ketan Rohom to Secure Essential Insights From the Complete Mobile Cancer Screening Vehicle Market Intelligence

Are you ready to elevate your strategic planning with unparalleled intelligence on mobile cancer screening vehicles? Reach out directly to Ketan Rohom, Associate Director of Sales & Marketing, to secure the full breadth of our market research insights. By speaking with Ketan, you will gain detailed analysis on emerging vehicle platforms, granular segmentation insights across technologies, cancer types, regions, and end users, and expert recommendations designed to inform your next steps.

Partnering with Ketan provides you with a bespoke walk-through of our rigorous methodology, competitive benchmarking of leading industry players, and clarity on navigating the effects of evolving tariff policies. Whether you seek to optimize fleet composition, align with government screening initiatives, or explore partnerships with diagnostic networks, Ketan will guide you to the precise market intelligence needed.

Don’t miss your opportunity to secure this definitive resource before the competitive landscape shifts further. Contact Ketan Rohom today and gain the vital market foresight necessary to drive growth, improve patient outreach, and outpace industry peers in the rapidly advancing realm of mobile cancer screening vehicles.

- How big is the Cancer Screening Vehicles Market?

- What is the Cancer Screening Vehicles Market growth?

- When do I get the report?

- In what format does this report get delivered to me?

- How long has 360iResearch been around?

- What if I have a question about your reports?

- Can I share this report with my team?

- Can I use your research in my presentation?