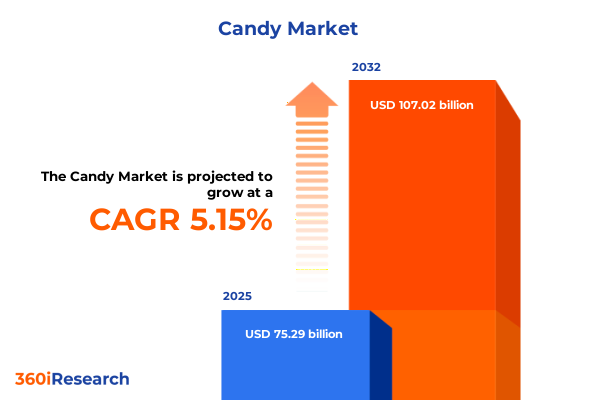

The Candy Market size was estimated at USD 75.29 billion in 2025 and expected to reach USD 78.96 billion in 2026, at a CAGR of 5.15% to reach USD 107.02 billion by 2032.

Discover the ever-evolving dynamics of the candy market and how emerging consumer tastes, wellness trends, and digital innovation are reshaping each segment

The global candy market continues to experience remarkable transformation as consumer preferences evolve at an unprecedented pace. Once dominated by traditional sweet treats, the sector now spans a spectrum of indulgent chocolate bars, functional chewing gums, artisanal sugar confections, and beyond. Rising demand for wellness-inspired formulations alongside a resurgence of nostalgic flavors is prompting manufacturers to innovate across every product line. Moreover, the integration of digital technologies into marketing, distribution, and product development has unlocked new ways to engage consumers and drive brand loyalty.

Within this dynamic environment, established players and emerging niche brands alike are racing to capture shifting tastes. Premiumization has taken hold, with dark, white, ruby, and specialty milk chocolate variants commanding attention for their sensory complexity. Simultaneously, gum and bubble gum offerings infused with functional ingredients are attracting health-focused shoppers, while chewy, hard, and soft sugar candies incorporating exotic flavor profiles are carving out new niches. These dual forces of indulgence and wellness set the stage for a competitive landscape defined by agility and innovation.

This executive summary presents a concise overview of the evolving candy market, highlighting the transformative forces at play and examining six distinct segmentation categories, three major regional markets, and the strategies adopted by leading manufacturers. In addition, it explores the cumulative effects of recent U.S. tariff developments, offers actionable recommendations for industry leaders, and outlines our rigorous mixed-method research framework. By synthesizing these insights, decision-makers will be equipped to navigate emerging opportunities and position their organizations for sustainable success.

Explore the transformative shifts reshaping the candy industry with personalized wellness solutions, ingredient breakthroughs, and omnichannel strategies

Consumer attitudes toward confectionery are undergoing a fundamental shift driven by an increased focus on health, sustainability, and personalization. Wellness-oriented shoppers now scrutinize ingredient labels for natural sweeteners such as honey and maple syrup, while also considering artificial substitutes like aspartame and sucralose when seeking reduced-sugar options. Meanwhile, spicy infusions and sour tang have found favor among adventurous millennials and Gen Z, prompting brands to experiment with bold flavor pairings that fuse traditional candy profiles with savory or functional attributes. This heightened emphasis on consumer well-being has accelerated partnerships between confectioners and nutrition scientists to develop formulations that satisfy taste buds without compromising health goals.

In parallel, the digitization of retail has redefined how candy is marketed and purchased. E-commerce platforms and company websites now serve as critical channels for launching limited-edition products, gathering real-time consumer feedback, and deploying targeted promotions based on purchase history. Traditional convenience stores, supermarkets, and hypermarkets have responded by enhancing their in-store digital experiences with interactive displays and scan-and-go kiosks, creating seamless omnichannel journeys. Furthermore, innovative packaging solutions-ranging from flow-wrap formats ideal for single-serve consumption to bulk and wrapper packs designed for group sharing-have been tailored to meet the needs of both online and offline environments.

Sustainability has emerged as another key driver of change. Brands are investing in recyclable packaging materials and exploring circular economy initiatives to reduce waste. Ingredient sourcing is being reimagined to prioritize transparent supply chains and responsible cocoa farming practices. As these trends converge, the candy industry is evolving into a landscape where taste, health, convenience, and environmental stewardship intersect, laying the groundwork for long-term growth and differentiation.

Understand how U.S. tariff revisions have cumulatively impacted ingredient sourcing, pricing strategies, and trade flows in the candy sector throughout 2025

The implementation of updated U.S. tariffs throughout 2025 has introduced new complexities to ingredient sourcing and cost management within the candy sector. Import duties applied to cocoa derivatives, sugar, and select flavors have prompted manufacturers to reassess traditional supply chains and explore alternative procurement strategies. In response, some producers have diversified their supplier base by forging direct relationships with cocoa cooperatives in West Africa, thereby securing more stable pricing and enhancing traceability. Others have increased utilization of natural sweeteners such as honey and maple syrup to mitigate the impact of raised sugar tariffs, shifting formulation strategies without compromising on taste or texture.

Pricing strategies have similarly adapted to maintain margin integrity. Brands with stronger premium positioning have leveraged value-added claims-organic certification, functional ingredients, and reduced-sugar profiles-to justify selective price adjustments. Conversely, mass-market labels have optimized production efficiencies by consolidating packaging formats into multipack bag and box offerings, reducing per-unit costs. In addition, regional manufacturing hubs located closer to end-markets have played a pivotal role in controlling landed costs and minimizing exposure to currency fluctuations, thereby limiting the pass-through of tariff impacts to consumers.

Trade flows have realigned as a result of these shifts. Whereas imports from traditional confectionery powerhouses faced heightened duty burdens, increased intra-regional sourcing has emerged as a resilient alternative. Stockpiling strategies adopted in late 2024 have given way to just-in-time procurement models that leverage domestic and near-shore suppliers. Collectively, these adjustments underscore the sector’s agility in navigating evolving trade policy, ensuring consistent product availability while preserving competitive pricing.

Gain segmentation insights into how product types, packaging formats, flavor profiles, sweetener preferences, demographics, and channels fuel industry evolution

Segmenting the candy market reveals a tapestry of opportunities driven by six distinct approaches. Based on product type, the ecosystem encompasses Chocolate Candy, distinguished by sub-segments such as Dark Chocolate, Milk Chocolate, Ruby Chocolate, and White Chocolate, each attracting unique sensory and premium demands. Alongside chocolate, Gum & Chewing Products, split into Bubble Gum and Chewing Gum, cater to both nostalgic indulgence and functional breath-freshening needs. Sugar Candy further enriches the landscape with Chewy Candy, Hard Candy, and Soft Candy, appealing to consumers seeking classic textures and playful innovations.

Packaging type differentiation underscores consumer convenience and gifting rituals, with options ranging from resealable bags for on-the-go snacking to elegantly designed box presentations for premium gifting occasions. Flow Wrap formats dominate single-serve segments, while bulk offerings satisfy food service and value-seekers. Wrapper Packs sustain traditional grab-and-go habits at checkout counters. Flavor profiling drives trial and loyalty, as Fruity sensations continue to lead, Minty variants deliver familiarity, Sour expressions entice younger cohorts, and Spicy blends invite adventurous palates. This confluence of taste stimuli enables brands to tailor introductions that resonate across multiple consumer segments.

The choice of sweetener type further refines positioning, with Artificial Sweeteners such as Aspartame and Sucralose meeting sugar-reduction mandates, and Natural Sweeteners like Honey and Maple Syrup answering calls for cleaner labels. Meanwhile, Sugar-Based Sweeteners retain a place for consumers prioritizing traditional indulgence. Demographically, adults seeking premium and functional benefits, kids drawn to playful packaging and familiar characters, and teens on the hunt for novelty and shareable experiences shape demand trajectories. Finally, distribution channels bifurcate into Offline and Online pathways, where company websites and eCommerce platforms coalesce with brick-and-mortar convenience stores, supermarkets, and hypermarkets to deliver omnipresent accessibility. Together, these segmentation layers illuminate the nuanced preferences that drive market differentiation and growth.

This comprehensive research report categorizes the Candy market into clearly defined segments, providing a detailed analysis of emerging trends and precise revenue forecasts to support strategic decision-making.

- Product Type

- Packaging Type

- Flavor Type

- Sweetener Type

- Age Group

- Distribution Channel

Analyze the distinctive growth trajectories, consumer preferences, and innovation drivers across the Americas, Europe Middle East & Africa, and the Asia-Pacific candy markets

Regional market dynamics in the Americas reflect a robust appetite for both premium and value-oriented candy. North America’s mature retail infrastructure, anchored by supermarkets, hypermarkets, and convenience outlets, has facilitated the rapid adoption of limited-edition launches and seasonal varieties. In South America, rising disposable incomes and expanding e-commerce ecosystems have accelerated the uptake of international brands alongside local artisanal producers, fostering a vibrant competitive landscape.

The Europe Middle East & Africa region exhibits a mosaic of consumer sensibilities. Western Europe’s emphasis on high-quality, ethically sourced chocolate has spurred certifications and origin-based labeling, while Eastern European markets display strong demand for nostalgic sugar candy and functional gums. Across the Middle East, younger demographics are embracing innovative flavor fusions and premium gifting sets, with distribution anchored in bustling retail malls. In Africa, informal retail networks still play a pivotal role, though modern trade channels are gaining traction in urban centers.

Asia-Pacific stands out for its dynamic growth and swift innovation cycles. In markets such as Japan and South Korea, spicy and sour sugar candies resonate with adventurous consumers, whereas Australia and New Zealand demonstrate a clear shift toward natural sweeteners and premium dark chocolate offerings. Southeast Asia’s rapidly expanding e-commerce landscape has enabled niche brands to scale quickly, leveraging social media influencers to drive trial. Across all subregions, digital engagement, localized flavors, and agile supply chains are crucial success factors.

This comprehensive research report examines key regions that drive the evolution of the Candy market, offering deep insights into regional trends, growth factors, and industry developments that are influencing market performance.

- Americas

- Europe, Middle East & Africa

- Asia-Pacific

Highlight how top confectionery companies leverage innovation, partnerships, and digital marketing to outpace competitors in an evolving candy landscape

The competitive landscape of confectionery is defined by both global giants and nimble challengers, each leveraging distinctive strengths to capture market share. Established multinationals have invested heavily in product innovation, introducing hybrid offerings that blend chocolate, gum, and functional ingredients to appeal to health-conscious demographics. Strategic partnerships with ingredient innovators, such as natural sweetener specialists, have accelerated new product development cycles and facilitated rapid market entry in key regions.

Mergers and acquisitions continue to reshape the industry, with leading players acquiring niche brands to bolster their portfolios in hot-growth segments like premium dark chocolate and sugar-free chewing gum. These transactions enable access to specialized production facilities and proprietary formulation expertise, while also broadening geographic reach through established regional networks. Additionally, joint ventures with local manufacturers have proven effective in navigating complex regulatory environments and catering to culturally specific taste preferences.

Digital marketing and direct-to-consumer initiatives have become cornerstone tactics for competitive differentiation. Top confectioners employ data analytics to personalize promotional offers and optimize assortment planning across both online platforms and brick-and-mortar outlets. Loyalty programs integrated with mobile apps and social media channels enhance engagement and facilitate real-time feedback loops, empowering brands to refine flavor profiles, packaging designs, and promotional strategies in alignment with consumer preferences.

This comprehensive research report delivers an in-depth overview of the principal market players in the Candy market, evaluating their market share, strategic initiatives, and competitive positioning to illuminate the factors shaping the competitive landscape.

- AUGUST STORCK KG

- Cacau Show

- Canel's Group

- Cloetta AB

- Colombina S.A.

- Confiseries Mondoux Inc.

- CÉMOI Group

- Delfi Limited

- Delica AG by Migros

- Ferrero International S.A.

- General Mills, Inc.

- Grupo Arcor

- HARIBO GmbH & Co. KG

- Just Born, Inc.

- Krüger GmbH & Co. KG

- Lindt & Sprüngli Group

- LOTTE Corporation

- Mars, Incorporated

- Meiji Holdings Co., Ltd.

- Mondelēz International, Inc.

- Morinaga & Co., Ltd.

- Naeem Foods

- Nestlé S.A.

- Orion Corporation

- Orkla Confectionery & Snacks by Orkla ASA

- Palmer Candy

- Parle Products Pvt. Limited

- Perfetti Van Melle Group B.V.

- PIM Brands Inc.

- Pladis Foods Ltd.

- Quality Candy Company

- Roshen Confectionery Corporation

- Samkan Products Pvt. Ltd.

- Shanghai Want Want Food Group Co., Ltd.

- Sugarfina

- Sweet Candy Company, Inc.

- The Hershey Company

- The Simply Good Foods Company

- Tootsie Roll Industries, Inc.

- United Confectioners LLC by Guta Group

- Vidal Golosinas S.A

Implement strategies combining product diversification, digital transformation, supply chain resilience, and sustainability to drive market leadership in candy

To capitalize on emerging opportunities, industry leaders should adopt strategies that emphasize agility, consumer-centric innovation, and operational resilience. Prioritizing product diversification through the introduction of premium and functional variants will enable brands to address evolving health and wellness demands while preserving indulgent appeal. Concurrently, investing in digital transformation-ranging from e-commerce enablement to advanced data analytics-will enhance consumer targeting, streamline supply chains, and optimize pricing strategies in real time.

Furthermore, reinforcing supply chain resilience through multi-sourcing arrangements and near-shore manufacturing hubs will mitigate the impacts of trade policy fluctuations and ingredient shortages. Sustainability initiatives, such as recyclable packaging and responsible cocoa sourcing partnerships, should be embedded within core operational strategies to meet rising consumer expectations and regulatory requirements. Engaging in cross-industry collaborations with technology providers, ingredient innovators, and retail partners can accelerate time-to-market for breakthrough formulations and elevate brand perception.

By integrating these approaches into a cohesive strategic framework, manufacturers can strengthen their competitive positioning, optimize cost structures, and deliver differentiated offerings across all key segments and regions. A proactive stance that balances short-term tactical adjustments with long-term innovation roadmaps will prove essential for securing leadership in the rapidly evolving candy marketplace.

Adopt a rigorous mixed-method research framework encompassing primary interviews, secondary data validation, quantitative analysis, and expert panel reviews

Our research methodology blends qualitative and quantitative techniques to deliver a comprehensive understanding of the candy market. Primary interviews with C-level executives, product developers, and supply chain managers provided firsthand perspectives on strategic priorities, innovation pipelines, and operational challenges. These insights were complemented by discussions with retail buyers and distributors, yielding nuanced views on assortment strategies, promotional tactics, and channel dynamics.

Secondary data validation included examination of public financial disclosures, trade statistics, industry journals, and regulatory filings. This robust data set underwent quantitative analysis to identify trend trajectories and relative segment performance. To ensure accuracy, triangulation of data points was conducted across multiple sources, minimizing the risk of bias and enhancing reliability. Expert panel reviews further refined our interpretations, confirming key findings and highlighting emerging areas of opportunity.

By integrating these layers of evidence, our research framework produces actionable insights grounded in rigorous analysis. This mixed-method approach ensures balanced coverage of market drivers, competitive strategies, and consumer behaviors, equipping decision-makers with the clarity needed to navigate a complex and dynamic industry landscape.

This section provides a structured overview of the report, outlining key chapters and topics covered for easy reference in our Candy market comprehensive research report.

- Preface

- Research Methodology

- Executive Summary

- Market Overview

- Market Insights

- Cumulative Impact of United States Tariffs 2025

- Cumulative Impact of Artificial Intelligence 2025

- Candy Market, by Product Type

- Candy Market, by Packaging Type

- Candy Market, by Flavor Type

- Candy Market, by Sweetener Type

- Candy Market, by Age Group

- Candy Market, by Distribution Channel

- Candy Market, by Region

- Candy Market, by Group

- Candy Market, by Country

- United States Candy Market

- China Candy Market

- Competitive Landscape

- List of Figures [Total: 18]

- List of Tables [Total: 2226 ]

Synthesize core findings and strategic imperatives into a narrative that underscores opportunities and challenges shaping the future of the candy market

In summary, the candy industry stands at a pivotal juncture defined by converging trends in health, personalization, and digital engagement. Tariff revisions have spurred supply chain innovation, while segmentation across product types, packaging, flavors, and channels continues to unlock new growth pathways. Regional dynamics underscore the importance of localized strategies, as consumer preferences vary markedly across the Americas, Europe Middle East & Africa, and Asia-Pacific.

Leading confectioners are responding through targeted M&A, strategic partnerships, and enhanced digital capabilities, ensuring they remain agile in the face of evolving trade policies and shifting consumer demands. Our analysis highlights the critical importance of sustainability and operational resilience, recommending a balanced approach that marries immediate tactical adjustments with long-term innovation roadmaps.

By synthesizing these findings into a cohesive narrative, this executive summary equips industry stakeholders with the insights necessary to identify strategic imperatives, mitigate risks, and seize emerging opportunities. As the candy market continues to evolve, organizations that proactively align their strategies with consumer trends, supply chain realities, and competitive benchmarks will be best positioned to lead the next chapter of growth and transformation.

Connect with Ketan Rohom Associate Director Sales & Marketing to access a tailored candy market research report aligned with your strategic growth objectives

I appreciate your interest in our specialized candy market research. To access a tailored report with in-depth analysis, actionable strategies, and region-by-region insights, please connect directly with Ketan Rohom, Associate Director, Sales & Marketing. By engaging with Ketan, you will receive personalized guidance on aligning these findings with your organization’s unique objectives, ensuring you make informed decisions that drive growth and competitive advantage. Reach out today to secure your comprehensive candy market research report and begin leveraging critical intelligence that translates into tangible results.

- How big is the Candy Market?

- What is the Candy Market growth?

- When do I get the report?

- In what format does this report get delivered to me?

- How long has 360iResearch been around?

- What if I have a question about your reports?

- Can I share this report with my team?

- Can I use your research in my presentation?