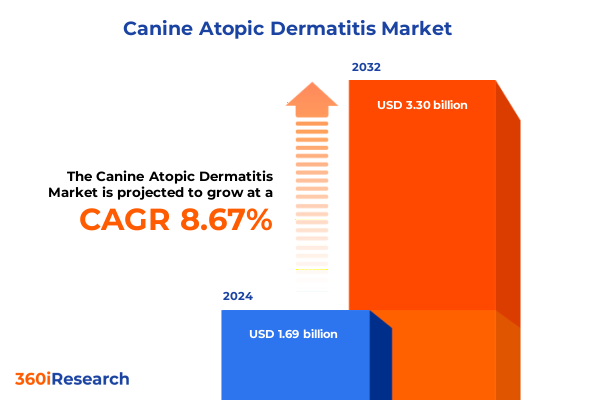

The Canine Atopic Dermatitis Market size was estimated at USD 1.83 billion in 2025 and expected to reach USD 1.98 billion in 2026, at a CAGR of 8.75% to reach USD 3.30 billion by 2032.

An industry-defining overview that situates canine atopic dermatitis at the crossroads of clinical innovation, consumer behavior, and supply-chain dynamics

Canine atopic dermatitis has matured from a narrowly recognized dermatologic complaint to a multidimensional challenge that intersects clinical care, consumer expectations, and supply-chain realities. Practitioners now balance rapidly evolving therapeutic options, from targeted biologics to systemic immunomodulators and evidence-backed nutraceuticals, with rising owner expectations for convenience, safety, and wellness-aligned products. This convergence has increased the complexity of clinical decision-making: veterinarians must weigh efficacy, route of administration, comorbidity considerations, and owner adherence when designing individualized treatment regimens.

At the same time, macro trends reshaping pet care-continued pet ownership growth, expanding preventive health behaviors, and a shift toward omnichannel purchasing-have raised the stakes for manufacturers and distributors. These forces are prompting companies to invest in differentiated product formats, patient-support services, and supply-chain resilience. The net effect is a market environment where clinical innovation, consumer behavior, and geopolitical trade policy interact, creating both strategic risk and new commercial opportunity for organizations aligned to the needs of dogs, practitioners, and pet owners.

Deep structural shifts are redefining how canine atopic dermatitis is treated, accessed, and supplied as therapies, preferences, and distribution converge

The landscape for managing canine atopic dermatitis is undergoing transformative shifts driven by new classes of therapy, changing owner expectations, and digitization of care delivery. Biologic therapies and targeted small molecules have altered clinical pathways by offering faster relief, improved tolerability in many patients, and options that reduce reliance on long-term broad immunosuppression. These clinical advances are complemented by growing veterinarian familiarity and changing prescribing norms, which together are encouraging earlier, more personalized intervention strategies in routine practice.

Simultaneously, pet humanization is reshaping product development and marketing, prompting demand for safer, cleaner formulations and convenient dosage forms that mirror human trends in wellness. This has accelerated investment in palatable chewables, long-acting injectables, and topical vehicles formulated for owner preferences. Digital channels and telehealth platforms have reduced friction in access and follow-up care, enabling remote triage, adherence support, and subscription-style product fulfillment. Lastly, the industry is experiencing a renewed focus on supply-chain resilience: manufacturers and purchasers are actively reassessing sourcing, packaging, and manufacturing footprints in response to rising geopolitical trade risk and regulatory scrutiny of imported inputs. These shifts are fostering an environment in which cross-functional capabilities-clinical development, regulatory affairs, manufacturing, and commercial operations-must coordinate more closely than ever before to sustain growth and clinical impact.

How the 2025 U.S. trade measures are intensifying supply-chain vulnerability and forcing strategic realignment across pharmaceutical and veterinary product supply networks

U.S. tariff actions and related trade policy measures enacted or announced in 2025 have introduced an elevated degree of cost and supply uncertainty for industries that rely on imported active pharmaceutical ingredients, intermediates, and specialty excipients. Pharmaceutical and veterinary supply chains have historically relied on a geographically concentrated base of API and intermediate manufacturers, and that concentration means broad import duties or targeted levies can rapidly increase input costs and create spot shortages as buyers scramble to re-source or secure inventory. The practical consequences include longer lead times for imported inputs, accelerated efforts to onshore or nearshore critical production steps, and higher landed costs that stakeholders must manage across procurement, pricing, and reimbursement negotiations.

For canine dermatology specifically, these tariff developments have meaningful downstream implications. Many companion-animal products, whether systemic therapies, injectable biologics, or finished topical formulations, incorporate components that are globally sourced. When duties or import controls rise, manufacturers face three imperfect choices: absorb added cost and compress margins, pass increased costs to buyers in a market that is sensitive to price, or seek alternative suppliers which can introduce material qualification timelines and regulatory complexity. Each path has trade-offs for patient access and commercial strategy. Where biologics require specialized cold-chain and sterile manufacturing investments, the option set is narrower, which elevates the strategic importance of prior supplier diversification, multi-sourcing, and contractual protections to limit exposure to tariff-driven supply shocks. These policy changes therefore incentivize a reassessment of supply resilience, manufacturing footprint, and portfolio-level margin management.

A multi-dimensional segmentation synthesis showing how treatment class, regulatory access, channel, and formulation uniquely shape commercial and clinical strategies

Insights derived from the principal segmentation frameworks reveal differentiated risk and opportunity across treatment classes, product access categories, channels, and formulation formats. Based on treatment type, the market must be examined across biologics, nutraceuticals, systemic therapies, and topicals, with biologics further characterized by monoclonal antibodies and nutraceuticals commonly delivered as supplements; systemic therapies are segmented into injections and oral tablets; and topicals are typically formulated as creams and gels, shampoos, and sprays. This treatment-centric lens highlights where clinical differentiation and margin profiles diverge: biologics and injectable systemics usually carry higher clinical value per unit and require specialized cold-chain logistics, whereas nutraceuticals and topicals emphasize consumer trust, branding, and over-the-counter accessibility.

When viewed through a product-type axis, the market is studied across over-the-counter and prescription categories, an important distinction that affects regulatory pathways, distribution controls, and the level of clinical oversight required for initiation and monitoring. Distribution channel segmentation-spanning online retail, pet specialty stores, pharmacies, and veterinary hospitals and clinics-illuminates how customer journeys and price sensitivity vary by touchpoint; for example, veterinary clinics remain primary sites for initiating prescription therapies and delivering injectable biologics, while online and specialty retailers are powerful gateways for supplement discovery and repeat-buy convenience. Finally, analyzing form types such as creams and gels, injections, oral tablets, shampoos, and sprays surfaces design considerations for adherence, palatability, and compliance. Combining these segmentation lenses allows manufacturers and channel partners to prioritize product development, select fitting commercial models, and align supply-chain investments with the structural economics of each segment.

This comprehensive research report categorizes the Canine Atopic Dermatitis market into clearly defined segments, providing a detailed analysis of emerging trends and precise revenue forecasts to support strategic decision-making.

- Treatment Type

- Form Type

- Distribution Channel

Regional clinical, regulatory, and commercial dynamics across the Americas, Europe Middle East and Africa, and Asia Pacific demand distinct product and channel playbooks

Regional dynamics continue to influence product development priorities, regulatory complexity, and distribution approaches across the Americas, Europe Middle East and Africa, and Asia Pacific. In the Americas, mature clinical pathways and a high degree of consumer willingness to spend on preventive and therapeutic pet care make the region an essential focal point for differentiated, veterinarian-prescribed therapies and support services. The regulatory environment emphasizes safety and evidence, and market access is heavily influenced by clinical adoption patterns and the established role of veterinary clinics as primary points of care.

Across Europe, the Middle East, and Africa, heterogeneous regulatory regimes and diverse purchasing power require tailored go-to-market approaches that balance centralized European approvals with country-level distribution partnerships and pricing strategies. In these markets, formulations that accommodate human-safety expectations and environmental regulations often gain traction, and partnerships with regional distributors are critical to navigate fragmented channels. Asia Pacific is notable for rapid premiumization and fast adoption of digital channels, with urban consumers showing strong interest in preventive wellness, supplements, and convenient product formats. However, supply-chain sourcing and manufacturing capacity in the region also make it a critical node for both production and export, meaning tariff or trade-policy changes may have reciprocal impacts on regional manufacturing decisions and export-oriented investments. Taken together, these regional characteristics prescribe differentiated product portfolios, regulatory approaches, and channel strategies to capture clinical and commercial value across diverse markets.

This comprehensive research report examines key regions that drive the evolution of the Canine Atopic Dermatitis market, offering deep insights into regional trends, growth factors, and industry developments that are influencing market performance.

- Americas

- Europe, Middle East & Africa

- Asia-Pacific

Competitive dynamics and cross-sector partnerships are accelerating therapeutic innovation, evidence generation, and supply capabilities across veterinary dermatology

The competitive and innovation environment for canine atopic dermatitis is shaped by a blend of established animal-health pharmaceutical developers, specialty dermatology innovators, contract manufacturers, and an expanding set of consumer-health suppliers offering nutraceuticals and topicals. Clinically active products such as targeted monoclonal antibodies and JAK inhibitors have altered treatment algorithms and set new expectations for efficacy and tolerability, encouraging legacy manufacturers and new entrants to invest in differentiated delivery systems, palatable formulations, and adherence-support services. Moreover, clinical evidence and real-world data collection around these therapies have become material differentiators, as prescribers and owners increasingly demand long-term safety data and comparative effectiveness information to guide choices.

At the same time, consumer-facing brands in the supplement and topical segments are leveraging direct-to-consumer distribution, brand storytelling, and veterinarian endorsements to expand penetration. Contract development and manufacturing organizations are responding by scaling sterile fill-finish, cold-chain logistics, and specialty packaging capabilities that align with injectable biologics and temperature-sensitive products. Strategic partnerships across research institutions, diagnostics, and telehealth platforms are also emerging as companies seek to link diagnostics-driven care pathways to product ecosystems. These cross-sector collaborations represent a pragmatic route to accelerate innovation while sharing development risk and addressing the growing demand for integrated, evidence-based care solutions.

This comprehensive research report delivers an in-depth overview of the principal market players in the Canine Atopic Dermatitis market, evaluating their market share, strategic initiatives, and competitive positioning to illuminate the factors shaping the competitive landscape.

- AbbVie Inc.

- Animal Dermatology Group, Inc.

- Aratana Therapeutics, Inc.

- Aventix Animal Health

- Bayer AG

- Bimeda Inc.

- BioCeltix Corporation

- Bioiberica S.A.U.

- Boehringer Ingelheim International GmbH

- Ceva Santé Animale S.A.

- Dechra Pharmaceuticals plc

- Elanco Animal Health Incorporated

- Hill's Pet Nutrition, Inc.

- Huvepharma EOOD

- LEO Pharma A/S

- Merck Sharp & Dohme Corp.

- Nextmune AB

- Novartis AG

- OKAVA Pharmaceuticals, Inc.

- PetIQ, Inc.

- Pilgrim Animal Health

- Royal Canin S.A.S.

- Vetoquinol S.A.

- Virbac S.A.

- Zoetis Inc.

Practical strategic actions leaders should implement to protect supply continuity, accelerate adoption, and sustain commercial competitiveness amid policy shifts

Industry leaders should pursue a set of actionable priorities that align clinical value, commercial execution, and supply-chain resilience. First, prioritize supplier diversification and contractual safeguards for imported APIs, excipients, and specialty packaging to reduce exposure to sudden tariff or export-policy changes. This includes maintaining qualified alternative suppliers, increasing safety stock for critical components where feasible, and investing in onshore or nearshore capacity for processes that most constrain time-to-market or quality control. Second, invest in formulation and delivery innovations that reduce logistical complexity and increase owner adherence; palatable oral formulations, long-acting injectables, and user-friendly topical systems can improve outcomes while enabling broader channel reach.

Third, strengthen evidence-generation programs and real-world data initiatives to demonstrate comparative effectiveness, safety, and value in typical practice settings; this data supports both clinician adoption and premium positioning. Fourth, adopt differentiated commercial models across channels: prioritize clinic-based engagement for prescription biologics and systemics while scaling omnichannel capabilities for nutraceuticals and topicals, including subscription services and teletriage workflows to retain repeat buyers. Finally, integrate tariff-sensitivity and scenario planning into commercial and R&D budgeting processes to anticipate cost changes and maintain pricing flexibility without compromising access. These actions, executed in parallel, will help firms preserve clinical credibility, protect margins, and capture share in an environment where policy shifts and consumer trends change rapidly.

A rigorous mixed-methods research approach blending practitioner interviews, regulatory evidence, and trade analysis to underpin the market intelligence

The research that informs these insights combined primary and secondary evidence sources to ensure a balanced view of clinical practice, consumer behavior, and trade policy impacts. Primary inputs included interviews with practicing veterinarians, procurement managers, and formulation scientists to capture real-world prescribing patterns, supply-chain constraints, and product design priorities. Secondary research drew on regulatory filings, company announcements, peer-reviewed clinical literature, and reputable industry data to triangulate trends across therapy classes and channels. Trade-policy and supply-chain analysis incorporated government reports on pharmaceutical manufacturing and testimony on API sourcing, along with journalistic reporting on recent tariff developments and industry reaction.

Data integrity protocols emphasized source triangulation, transparent citation of government and regulatory documents where available, and conservative interpretation of forward-looking policy signals. Where interview data diverged from public sources, the methodology prioritized practitioner-reported operational constraints and validated those claims against procurement and regulatory records. The final deliverables include a reproducible evidence trail, explicit assumptions, and scenario appendices that map tariff changes, supplier requalification timelines, and likely operational responses. This methodological rigor supports both immediate commercial decision-making and longer-term strategic planning.

This section provides a structured overview of the report, outlining key chapters and topics covered for easy reference in our Canine Atopic Dermatitis market comprehensive research report.

- Preface

- Research Methodology

- Executive Summary

- Market Overview

- Market Insights

- Cumulative Impact of United States Tariffs 2025

- Cumulative Impact of Artificial Intelligence 2025

- Canine Atopic Dermatitis Market, by Treatment Type

- Canine Atopic Dermatitis Market, by Form Type

- Canine Atopic Dermatitis Market, by Distribution Channel

- Canine Atopic Dermatitis Market, by Region

- Canine Atopic Dermatitis Market, by Group

- Canine Atopic Dermatitis Market, by Country

- United States Canine Atopic Dermatitis Market

- China Canine Atopic Dermatitis Market

- Competitive Landscape

- List of Figures [Total: 15]

- List of Tables [Total: 954 ]

A concise synthesis underscoring the need to pair clinical innovation with robust supply and commercial safeguards to secure long-term success

The management of canine atopic dermatitis now sits at the intersection of meaningful clinical progress and rising systemic complexity. New targeted therapies and better-informed clinical practice offer clearer paths to improved outcomes, yet the commercial environment has become more intricate as consumer expectations, channel dynamics, and trade-policy volatility converge. Stakeholders that align clinical differentiation with resilient sourcing, clear evidence-generation, and channel-appropriate commercial models will be best positioned to translate scientific advances into sustained patient and business impact.

In closing, achieving durable success in this space requires coordinated investments across product design, supply-chain architecture, and practitioner engagement. Companies that take a proactive stance-diversifying suppliers, accelerating clinical evidence capture, and designing products with the end-user in mind-will mitigate policy-driven shocks while seizing the growth created by heightened owner engagement and evolving treatment paradigms.

Purchase a comprehensive canine atopic dermatitis market intelligence package and schedule a tailored briefing with the sales lead to finalize scope and deliverables

To secure a detailed, professionally curated market research report that synthesizes clinical, commercial, and trade-policy intelligence on canine atopic dermatitis, contact Ketan Rohom, Associate Director, Sales & Marketing, to arrange a purchase and tailored briefing. The report package includes a comprehensive executive summary, segmentation matrices aligned to treatment, product, distribution, and form types, a tariff-sensitivity analysis with scenario planning for U.S. trade measures, and a prioritized list of tactical actions for commercialization teams. A dedicated briefing can be scheduled to walk through the research team’s evidence, methodology, and how the intelligence maps to your pipeline, sourcing strategy, or commercial plan.

Reach out to book a consultative session so you can evaluate the content and confirm scope customizations, licensing options, and how to access proprietary exhibits and raw research deliverables. The engagement process is designed to be consultative: purchase decisions begin with a short discovery conversation and progress to a formal proposal that outlines deliverables, timelines, and the rights associated with report redistribution and internal use. Engaging with Ketan will also enable you to request bespoke add-ons such as competitive landscaping, supplier diligence, or an expanded tariff-impact model specific to your product set, route of administration, and supply footprint.

- How big is the Canine Atopic Dermatitis Market?

- What is the Canine Atopic Dermatitis Market growth?

- When do I get the report?

- In what format does this report get delivered to me?

- How long has 360iResearch been around?

- What if I have a question about your reports?

- Can I share this report with my team?

- Can I use your research in my presentation?