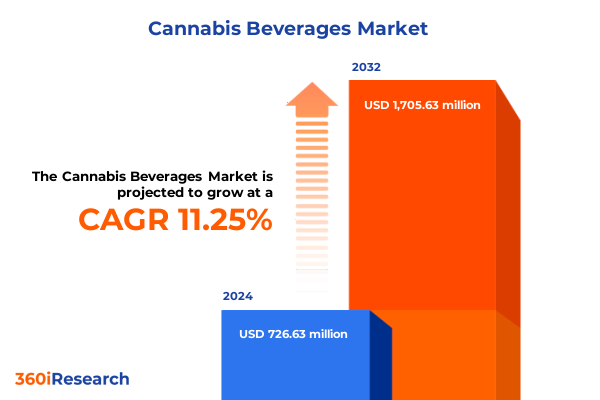

The Cannabis Beverages Market size was estimated at USD 809.12 million in 2025 and expected to reach USD 906.33 million in 2026, at a CAGR of 12.15% to reach USD 1,805.63 million by 2032.

Exploring the Emergence of Cannabis-Infused Beverages as a Dynamic Force Redefining Consumer Preferences and Industry Innovation Everywhere

The cannabis-infused beverage category has evolved from a niche experiment into a mainstream segment capturing the attention of lifestyle consumers, wellness advocates, and adventurous drinkers alike. Initially propelled by the relaxation of state-level cannabis regulations and the federally sanctioned status of hemp-derived cannabinoids, market pioneers have harnessed this momentum by leveraging advances in nanoemulsion and emulsification processes to deliver superior bioavailability and flavor stability. As consumers increasingly seek functional drinks that offer relaxation, energy modulation, or social enhancement without the drawbacks of alcohol, cannabis beverages have emerged as a compelling alternative that redefines traditional consumption occasions.

Emerging demographic studies indicate that core consumers straddle a broad age continuum, with younger adults intrigued by novelty and wellness-focused older cohorts seeking alternative delivery methods. The interplay between flavor innovation, precise dosing protocols, and compelling brand narratives is cultivating an ecosystem in which portfolio diversification and consumer education coalesce. As this category continues to mature, brands that harmonize compliance, transparency, and sensory appeal will define the competitive frontier, making it essential for industry leaders to comprehend the underlying currents driving this market expansion and to anticipate the transformative shifts that lie ahead.

How Shifting Legal Frameworks and Technological Innovations are Transforming the Cannabis Beverage Market at a Rapid Pace

Since the passage of the 2018 U.S. Farm Bill and subsequent state-level legalization measures, the regulatory landscape for cannabis beverages has undergone seismic change. As more jurisdictions clarify licensing procedures for cannabinoid-infused products and adjust labeling requirements to address consumer safety, industry participants are capitalizing on these openings by scaling operations and refining compliance protocols. At the same time, the emergence of cutting-edge extraction techniques such as supercritical CO2 and ethanol-based methods has unlocked purer cannabinoid profiles, enabling manufacturers to engineer precise dosage formulations resonant with health-conscious populations.

Technological breakthroughs extend beyond extraction to encompass infusion platforms that optimize droplet size and stability, ensuring reliable dosing and rapid onset of effects. Brands are investing in proprietary nanoemulsion and liposomal delivery systems, while research partnerships with universities and contract manufacturers forge new pathways for taste-masking and enhanced bioavailability. As consumer demand for customized functional benefits intensifies, product developers are integrating botanical adjuncts, adaptogens, and natural flavor complexes to create multifaceted beverage experiences. This interplay between regulation, technology, and consumer expectations is reshaping the competitive arena, compelling both traditional beverage firms and emerging cannabis-focused challengers to reposition their portfolios in alignment with evolving market dynamics.

Assessing the Ripple Effects of 2025 United States Tariff Adjustments on Cost Structures and Supply Chains in Cannabis Beverages

The early months of 2025 saw the implementation of new U.S. tariffs targeting imported packaging materials and key formulation components used by cannabis beverage producers. Glass bottles, aluminum cans, and specialized infusion equipment imported from certain trading partners now face elevated duties, prompting manufacturers to reevaluate sourcing strategies and renegotiate supplier agreements. For producers reliant on imported nanoemulsifiers or CBD isolate, these increased import costs have translated into higher production expenditures. In response, several industry leaders have begun to shift toward domestically produced packaging alternatives or to explore recyclable and compostable substrates, thereby qualifying for lower duty brackets and reinforcing their commitments to sustainability.

The cumulative impact of these tariff measures extends beyond direct material costs to influence broader logistics and distribution dynamics. Transportation expenses have risen in tandem with extended lead times due to customs clearance complexities, disproportionately affecting smaller craft producers and disrupting shelf availability. Conversely, larger enterprises possessing integrated supply chains and strategic warehousing capabilities have been able to absorb or pass through incremental costs more effectively. This evolving cost landscape has catalyzed interest in nearshoring strategies and the vertical integration of extraction and packaging operations, generating competitive differentiation through enhanced supply chain resilience and the ability to maintain consistent market access despite shifting trade policies.

Unlocking Deep Segmentation Insights to Navigate Consumer Diversity and Product Complexity in the Cannabis Beverage Sector

Understanding the nuanced fabric of consumer preferences and product specifications demands a segmentation prism that accounts for intrinsic and extrinsic variables. Within the product type dimension, beverage category subdivisions such as carbonated options-including energy drink analogues, flavored sodas, and sparkling waters-and noncarbonated variants including coffee, juice, and tea delineate consumption contexts and sensory expectations. Simultaneously, cannabis ratio distinctions between CBD-dominant, THC-CBD balanced, and THC-dominant formulations inform not only anticipated psychoactive or therapeutic outcomes but also regulatory classification and retail placement choices, laying the groundwork for targeted product development.

Distribution channels further shape market accessibility and brand perception, with off-premise vendors such as dispensaries and specialty retailers granting regulated access, on-premise venues offering curated brand experiences, and online retail platforms providing direct-to-consumer convenience. Packaging format considerations-ranging from single-serve bottles and aluminum cans to multipacks and pouches-drive shelf presence and usage ease, while dosage tiers of low, medium, or high potency cater to ritualistic versus episodic consumption occasions. Price tier segmentation spanning accessible mass-market, premium, and super-premium brackets reflects brand positioning strategies that balance volume objectives with aspirational consumer narratives.

Delving into infusion methodologies reveals that alcohol tinctures, nanoemulsion-based systems, oil emulsions, and powdered preparations each confer unique advantages in bioavailability, taste neutrality, and formulation flexibility. These technological choices intersect with consumer age groups, where adults aged 21 through 25 often gravitate toward novel delivery formats, those aged 26 to 35 and 36 to 45 balance social and wellness motivations, and individuals aged 46 and above typically prioritize therapeutic outcomes through lower-dose offerings. This rich segmentation tapestry empowers brand leaders to craft portfolios that resonate across multiple audience segments and consumption scenarios, optimizing appeal and retention.

This comprehensive research report categorizes the Cannabis Beverages market into clearly defined segments, providing a detailed analysis of emerging trends and precise revenue forecasts to support strategic decision-making.

- Product Type

- Packaging Format

- Dosage

- Infusion Technology

- Distribution Channel

Understanding Regional Market Nuances to Capitalize on Growth Drivers Across Global Cannabis Beverage Markets

Geographical context exerts profound influence on regulatory frameworks, consumer acceptance, and distribution ecosystems, making regional analysis indispensable for strategic planning. In the Americas, progressive state-level legalization in the United States coexists with federally sanctioned hemp-derived products, creating a vibrant marketplace characterized by both mature and emerging subzones. Canadian frameworks for recreational cannabis serve as a blueprint for provincial licensing and quality control, while Latin American initiatives are piloting adult-use beverage programs. Within this mosaic, urban centers often display high receptivity to innovation, whereas rural regions demand culturally attuned engagement approaches that account for local attitudes and legal interpretations.

Across Europe, the Middle East, and Africa, a patchwork of regulations presents both obstacles and avenues for market entry. Select European nations have established thresholds for low-THC beverages, fostering functional wellness product innovation, while others maintain stringent prohibitions. Middle Eastern discussions on cannabis reform progress amid rich traditions of herbal infusions, yet policy uncertainty persists. In Africa, burgeoning agricultural capacity signals long-term potential as a raw material source, albeit tempered by infrastructural and regulatory challenges. Success in these regions hinges on forging alliances with local stakeholders, tailoring formulations to jurisdiction-specific potency limits, and deploying adaptive distribution models.

In the Asia-Pacific region, a spectrum of approaches to cannabis consumption emerges. Australia’s medicinal cannabis licenses now encompass beverage applications, and certain ASEAN markets are exploring pilot programs, resulting in a nascent yet steadily growing sector. By contrast, major markets like China and India uphold conservative controls, limiting recreational use while exhibiting rising interest in CBD-infused functional drinks among urban consumers. Regional strategies therefore emphasize partnerships with licensed domestic manufacturers, targeted consumer education campaigns, and omnichannel distribution tactics that leverage both modern retail and digital commerce platforms to optimize market entry and growth potential.

This comprehensive research report examines key regions that drive the evolution of the Cannabis Beverages market, offering deep insights into regional trends, growth factors, and industry developments that are influencing market performance.

- Americas

- Europe, Middle East & Africa

- Asia-Pacific

Analyzing Strategic Moves and Competitive Dynamics Among Pioneering Companies in the Cannabis-Infused Beverage Space

The competitive architecture of the cannabis beverage market is defined by legacy beverage conglomerates, agile start-ups, and specialized ingredient innovators, each carving distinct pathways to leadership. Established beverage firms are leveraging their expansive distribution networks, procurement scale, and brand equity to introduce co-branded or private-label cannabis-infused drink lines. These strategic alliances with boutique extraction experts and formulation specialists expedite market entry while ensuring regulatory compliance through shared best practices in quality assurance and traceability.

Nimble start-up ventures, in contrast, differentiate themselves through deep specialization in advanced infusion technologies and experiential consumer engagement. By focusing on nanoemulsion platforms that deliver rapid onset and precise dosing, these challengers craft narratives around functional benefits such as stress relief, mental clarity, and social connection. Their direct-to-consumer digital channels and pop-up tasting events generate engaged communities and actionable insights into flavor preferences, informing agile product iteration and targeted marketing.

Ingredient technology providers have emerged as the linchpin of category innovation, developing proprietary emulsion systems, botanical extraction techniques, and encapsulation methods that solve longstanding challenges in cannabinoid solubility and taste neutrality. These partners collaborate closely with beverage formulators to optimize product performance, and their intellectual property protections create high barriers to entry. As the ecosystem matures, cross-sector partnerships that integrate R&D capabilities with distribution expertise are becoming strategic imperatives, shaping consolidation trends and defining the future competitive landscape of cannabis-infused beverages.

This comprehensive research report delivers an in-depth overview of the principal market players in the Cannabis Beverages market, evaluating their market share, strategic initiatives, and competitive positioning to illuminate the factors shaping the competitive landscape.

- ARTET, LLC

- Aurora Cannabis Inc.

- BellRock Brands Inc.

- CANN Social Tonics

- Cannabis Beverages Inc.

- Canopy Growth Corporation

- Cronos Group Inc.

- Curaleaf Holdings, Inc.

- Hexo Corp

- Keef Brands, LLC

- Organigram Holdings Inc.

- Tilray Brands, Inc.

- Trulieve Cannabis Corp.

- Truss Beverage Co., LLC

Actionable Strategies for Industry Leaders to Drive Growth and Navigate Challenges in the Cannabis Beverage Landscape

To capitalize on the dynamic momentum of the cannabis-infused beverage sector, industry stakeholders should adopt a multi-pronged strategic approach integrating technology, regulatory foresight, supply chain resilience, and consumer engagement. Prioritizing investment in advanced infusion platforms-such as nanoemulsion or encapsulation methods-will enhance bioavailability and sensory appeal, enabling premium positioning and differentiation in an increasingly crowded market. Collaborating with ingredient specialists and research institutions can accelerate access to proprietary delivery systems and optimize formulation performance.

Simultaneously, establishing a dedicated regulatory intelligence function is essential to navigate the complex and fluid policy environment that governs cannabis products. Real-time monitoring of state, federal, and international legislation will empower stakeholders to anticipate compliance adjustments, refine labeling protocols, and leverage available tariff relief initiatives. Close collaboration with legal advisers and compliance consultants will ensure adaptability to shifting requirements, minimizing market disruptions and reinforcing brand credibility.

Strengthening supply chain resilience through nearshoring initiatives and diversified sourcing strategies is also critical. Cultivating relationships with domestic packaging suppliers and local extractors can reduce exposure to import tariffs and customs delays, while vertically integrated operations enable tighter quality controls and faster innovation cycles. Finally, elevating consumer education through data-driven marketing and experiential activations will build informed loyalty. Clear communication around dosing guidelines, functional benefits, and safety protocols, supported by digital platforms and community events, will foster trust and drive repeat engagement. By entwining these strategic pillars into a cohesive roadmap, leaders can outpace competitors and navigate the evolving cannabis beverage landscape with confidence.

Detailing a Robust Research Framework Combining Primary and Secondary Approaches for Rigorous Cannabis Beverage Market Analysis

This research employs a rigorous, multi-faceted methodology designed to capture a panoramic view of the cannabis beverage market through both primary and secondary data sources. Primary research included in-depth, semi-structured interviews with beverage developers, extraction experts, channel distributors, and regulatory officials, uncovering firsthand insights into formulation hurdles, compliance tactics, and emerging consumer needs. Concurrently, structured consumer surveys gauged usage behaviors, flavor and dosage preferences, packaging expectations, and attitudes toward various infusion technologies, ensuring that quantitative data reinforced qualitative findings.

Secondary research efforts involved an exhaustive review of public records, legal frameworks, and industry publications to trace the evolution of cannabis beverage regulations, tariff adjustments, and licensing prerequisites. Patent databases and technical whitepapers were analyzed to map the landscape of extraction and infusion innovations, while trade association reports and customs data shed light on packaging import trends and supply chain pressures. This triangulation of sources allowed for validation of primary insights against documented market behaviors and regulatory developments.

Analytically, the study integrated thematic coding of qualitative interviews with statistical analysis of survey results, identifying correlations between demographic segments and consumption motivations. Cross-sectional analysis of policy environments illuminated how regional regulatory variables influence technology adoption rates, and supply chain assessments highlighted cost drivers arising from tariff changes and logistical constraints. Together, these methodological pillars form a robust framework that delivers actionable intelligence and a dependable foundation for strategic decision-making in the rapidly advancing cannabis beverage sector.

This section provides a structured overview of the report, outlining key chapters and topics covered for easy reference in our Cannabis Beverages market comprehensive research report.

- Preface

- Research Methodology

- Executive Summary

- Market Overview

- Market Insights

- Cumulative Impact of United States Tariffs 2025

- Cumulative Impact of Artificial Intelligence 2025

- Cannabis Beverages Market, by Product Type

- Cannabis Beverages Market, by Packaging Format

- Cannabis Beverages Market, by Dosage

- Cannabis Beverages Market, by Infusion Technology

- Cannabis Beverages Market, by Distribution Channel

- Cannabis Beverages Market, by Region

- Cannabis Beverages Market, by Group

- Cannabis Beverages Market, by Country

- United States Cannabis Beverages Market

- China Cannabis Beverages Market

- Competitive Landscape

- List of Figures [Total: 17]

- List of Tables [Total: 1590 ]

Drawing Evidence-Based Conclusions to Illuminate the Current State and Future Trajectory of the Cannabis Beverage Market

The convergence of regulatory liberalization, technological advancements, and evolving consumer preferences has established cannabis-infused beverages as a rapidly growing frontier within the broader beverage industry. Insights drawn from stakeholder interviews and consumer surveys confirm that innovations such as bitter-masking nanoemulsions, artisanal botanical blends, and precision dosing platforms are key adoption drivers. Regional studies demonstrate that jurisdictions with streamlined licensing processes and favorable duty structures are advancing more swiftly, creating models that newer markets can emulate to accelerate category maturation.

Looking forward, future success will hinge on the ability of companies to synthesize technological prowess with strategic agility. Entities that invest in supply chain optimization, regulatory foresight, and differentiated product portfolios are poised to capture consumer loyalty and expand their market presence. Conversely, those that fail to adapt to tariff fluctuations, compliance evolutions, or shifting consumer expectations risk losing ground to more nimble operators. Ultimately, the interplay between innovative infusion technologies and disciplined execution will determine leadership in this dynamic space, illuminating pathways for brands seeking to transform cannabis-infused beverages from novel experiences into indispensable lifestyle staples.

Seize the Opportunity Today by Engaging with Ketan Rohom to Access Essential Insights from the Cannabis Beverage Market Report

Unlock the competitive advantages and nuanced intelligence encapsulated within this in-depth market research report by reaching out to Ketan Rohom, Associate Director, Sales & Marketing. Gain tailored guidance on navigating regulatory complexities, refining product segmentation strategies, and reinforcing supply chain resilience. Secure your copy of the comprehensive cannabis beverage analysis today and position your organization to capitalize on this transformative market opportunity.

- How big is the Cannabis Beverages Market?

- What is the Cannabis Beverages Market growth?

- When do I get the report?

- In what format does this report get delivered to me?

- How long has 360iResearch been around?

- What if I have a question about your reports?

- Can I share this report with my team?

- Can I use your research in my presentation?