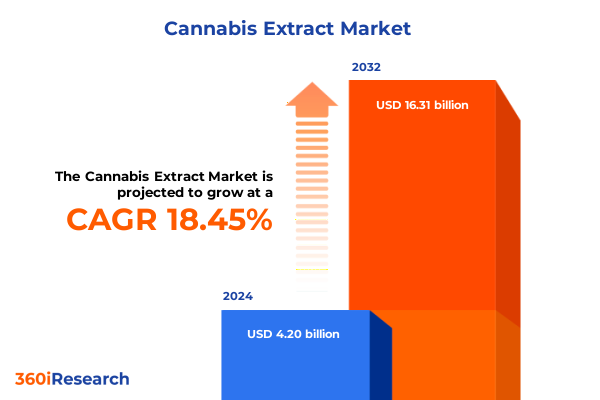

The Cannabis Extract Market size was estimated at USD 4.95 billion in 2025 and expected to reach USD 5.84 billion in 2026, at a CAGR of 18.54% to reach USD 16.31 billion by 2032.

Navigating the Dynamic Cannabis Extract Ecosystem Amid Regulatory Evolution, Scientific Breakthroughs, and Rapid Consumer Demand Shifts Worldwide

The cannabis extract landscape has undergone profound evolution in recent years as scientific advancements, shifting consumer preferences, and evolving regulatory frameworks converge. What began as a niche segment populated by early adopters has matured into a dynamic industry underpinned by rigorous quality standards, precise extraction technologies, and sophisticated product formulations. Stakeholders across the value chain-from raw material cultivators and processing laboratories to branded product developers and distribution channels-are navigating a complex environment marked by rapid innovation, heightened compliance demands, and intensifying competition.

As industry participants chart their course forward, understanding the intricate interplay between policy developments, technological breakthroughs, and consumer behavior has become indispensable. Market leaders are pivoting toward evidence-based product differentiation, placing a premium on laboratory-certified purity profiles, verifiable potency claims, and novel delivery formats designed to enhance user experience. Concurrently, regulatory authorities are tightening oversight, mandating transparent labeling protocols and stringent testing requirements to ensure consumer safety and maintain market integrity.

Against this backdrop of flux, industry decision-makers must synthesize diverse data points to anticipate emerging trends, optimize supply chains, and craft resilient growth strategies. The ensuing sections of this executive summary will unpack transformative shifts, tariff impacts, segmentation nuances, regional dynamics, competitive landscapes, and actionable recommendations to guide leaders through the next chapter of cannabis extract development.

Unprecedented Shifts in Cannabis Extract Development Driven by Technological Innovation, Consumer Behavior Evolution and Regulatory Reforms

In recent years, the cannabis extract sector has experienced seismic shifts driven by technological innovations that have redefined production efficiencies and product capabilities. Advanced extraction methodologies, such as supercritical carbon dioxide processes and solventless techniques, have enabled the creation of high-purity concentrates with tailored cannabinoid profiles. These scientific breakthroughs have catalyzed the emergence of novel formulations, from terpene-rich live resins that preserve plant aromatics to precision-engineered distillates optimized for consistency and potency.

Concurrently, consumer behavior has evolved beyond recreational consumption toward health and wellness paradigms. Sophisticated users now seek functional benefits-ranging from pain management to neurological support-prompting product developers to formulate broad-spectrum and isolate offerings that align with therapeutic use cases. This demand shift has spurred innovation in delivery systems, giving rise to discreet oral strips, targeted topicals, and user-friendly vape cartridge platforms that cater to nuanced consumption preferences.

Moreover, regulatory reforms across multiple jurisdictions have reshaped market accessibility and compliance landscapes. Policymakers are crafting harmonized testing protocols and labeling requirements to foster consumer trust while maintaining rigorous safety standards. This regulatory momentum is compelling brands to invest in traceability technologies and third-party lab partnerships. As a result, industry incumbents and entrants alike must continuously adapt to an evolving rulebook, calibrating their operations to maintain both legal conformity and competitive differentiation.

Assessing the 2025 United States Tariff Measures on Cannabis Extract Imports and Their Far-Reaching Economic and Supply Chain Consequences

The introduction of new tariff measures by the United States government in 2025 has fundamentally altered the import dynamics of cannabis extract inputs and finished goods. By imposing elevated duties on select extraction equipment components, concentrate raw materials, and ancillary consumables, these measures have exerted upward pressure on production costs for domestic processors who rely on globally sourced supplies. As a consequence, processing facilities have faced the dual challenge of mitigating margin compression while maintaining stringent quality standards.

Trade tensions with key exporting regions have further complicated sourcing strategies, prompting firms to diversify supplier networks and explore near-shoring alternatives. Some operators have relocated critical extraction workflows to jurisdictions with preferential trade agreements to alleviate tariff burdens, although this transition has introduced new compliance considerations and extended logistical lead times. In parallel, small and mid-sized enterprises have encountered capital constraints that hinder rapid adaptation, leading to consolidation pressures and strategic partnerships aimed at achieving economies of scale.

Despite these headwinds, forward-looking organizations are leveraging the tariff environment as an impetus for vertical integration, investing in domestic extraction infrastructure to secure input availability and enhance supply chain resilience. By internalizing critical processes, these firms aim to offset import costs, streamline operational workflows, and foster closer alignment between raw material selection and end-product innovation. Such strategic pivots will likely define competitive positioning and long-term viability in a tariff-impacted landscape.

Revealing Critical Segment-Based Perspectives Shaping the Future of Cannabis Extract Markets Through Product Type Purity and Distribution Nuances

Analysis of the sector’s segmentation reveals that product type differentiation plays a pivotal role in shaping consumer perception and market positioning. Butane hash oil remains a flagship concentrate, prized for its robust cannabinoid yield, while CO₂ oil and distillate formulations attract consumers seeking versatile applications across edibles and vape platforms. Kief, live resin, and rosin each occupy niche segments where botanical terpenes and solventless purity command premium valuations in connoisseur circles.

Purity grade segmentation underscores the growing importance of full-spectrum profiles for users pursuing entourage-effect benefits, whereas broad-spectrum extracts and isolate products cater to audiences prioritizing specific cannabinoid dosing or THC-free experiences. The gradations between these categories influence product labeling strategies, laboratory certification protocols, and consumer education initiatives, ultimately dictating brand credibility and market acceptance.

Form-based segmentation highlights the diversification of consumption channels, spanning capsules, edibles, tinctures, topicals, and vape cartridges. Within edibles, beverage offerings are gaining traction alongside traditional chocolates and gummies, while the emergence of oral strips under tinctures exemplifies innovation in discreet delivery. Vape cartridge developments hinge on device compatibility, bifurcated between industry-standard 510 thread designs and proprietary hardware ecosystems.

Extraction method classification-from CO₂ and ethanol to hydrocarbon and solventless techniques-drives supply chain and production cost considerations. Solventless processes, particularly kief sieving and rosin pressing, appeal to craft-oriented producers focused on artisanal quality. Cannabinoid type segmentation, encompassing CBD, CBG, CBN, multi-compound blends, and THC-dominant extracts, dictates regulatory pathways and consumer targeting, influencing educational outreach and distribution strategies.

Finally, packaging and distribution distinctions, including bottles, cartridges, jars, and sachets, intersect with application segments such as medicinal use for neurological, oncology support, and pain management purposes, as well as recreational access. Distribution routes through dispensaries, online retail platforms, and pharmacies further modulate product visibility and consumer accessibility, with sub-channels like medical dispensaries, direct-to-consumer websites, and third-party marketplaces shaping purchasing behaviors.

This comprehensive research report categorizes the Cannabis Extract market into clearly defined segments, providing a detailed analysis of emerging trends and precise revenue forecasts to support strategic decision-making.

- Product Type

- Purity Grade

- Form

- Extraction Method

- Cannabinoid Type

- Packaging Type

- Application

- Distribution Channel

Geographically Driven Demand Patterns and Regional Growth Drivers Defining the Cannabis Extract Market Across Global Landmarks

Regional dynamics within the cannabis extract industry reflect a tapestry of regulatory philosophies, consumer demographics, and infrastructure maturity across the Americas, Europe, Middle East & Africa, and Asia-Pacific territories. In the Americas, liberalized cannabis policies in multiple states and provinces have catalyzed robust research investments and capital inflows, fostering advanced extraction hubs and distribution networks. This region benefits from established ancillary sectors, including specialized equipment manufacturing and analytical testing laboratories, enabling faster time-to-market for innovative formulations.

Conversely, the Europe, Middle East & Africa cluster exhibits a more fragmented regulatory environment, where a patchwork of national frameworks shapes market access. Countries within the European Union are gradually harmonizing directives, emphasizing therapeutic applications and rigorous quality standards. In the Middle East and Africa, nascent medicinal programs are emerging, yet supply chain complexities and limited processing capacity pose significant entry barriers. Nevertheless, strategic partnerships between established producers and local stakeholders are beginning to unlock opportunities for targeted product introductions.

In the Asia-Pacific region, a combination of cautious policy liberalization and strong cultural affinity for botanical remedies underpins a unique market trajectory. Nations such as Australia and Thailand have expanded medical cannabis initiatives, driving demand for high-purity extracts and standardized dosing formats. Meanwhile, markets like Japan and South Korea maintain stringent controls, focusing primarily on CBD applications with tight import regulations. Despite these constraints, the region’s robust pharmaceutical infrastructure and consumer openness to wellness innovations position it as a critical geography for future extract development.

Cross-regional trade flows, intellectual property rights considerations, and localized consumer education campaigns will continue to shape the global diffusion of extract innovations. Companies seeking to scale internationally must tailor market entry strategies that align with regulatory landscapes, distribution ecosystems, and cultural consumption patterns to unlock sustained growth.

This comprehensive research report examines key regions that drive the evolution of the Cannabis Extract market, offering deep insights into regional trends, growth factors, and industry developments that are influencing market performance.

- Americas

- Europe, Middle East & Africa

- Asia-Pacific

Comprehensive Overview of Market-Leading Organizations Driving Innovation, Strategic Partnerships and Competitive Differentiation in Cannabis Extract Sector

Leading enterprises within the cannabis extract sector are forging competitive advantages through synergistic alliances, proprietary formulation portfolios, and vertically integrated operations. Key global players are investing in cutting-edge research centers to isolate rare cannabinoids like CBN and CBG, while simultaneously enhancing terpene preservation techniques to deliver signature flavor and efficacy profiles. These product innovation efforts are increasingly supported by partnerships with academic institutions and specialized contract research organizations to validate therapeutic claims and optimize extraction parameters.

Strategic mergers and acquisitions have emerged as a critical growth lever, enabling companies to expand geographic footprints and diversify product offerings. Notable collaborations include alliances between equipment manufacturers and processing facilities to co-develop next-generation extraction systems, as well as joint ventures between branded product labels and major retail chains to streamline distribution. Such engagements underscore a broader trend toward consolidation as market participants seek scale benefits, streamlined supply chains, and enhanced negotiating power with regulatory agencies.

At the same time, agile startups are differentiating through niche positioning, focusing on ultra-premium solventless extracts or bespoke cannabinoid blends tailored to specialized therapeutic applications. These innovators often leverage direct-to-consumer digital channels to cultivate brand loyalty and rapidly iterate product portfolios based on real-time consumer feedback. The resulting mosaic of large-scale incumbents and entrepreneurial challengers drives a vibrant competitive landscape where speed to market and brand authenticity are paramount.

In this environment, intellectual property strategies and brand equity investments will play pivotal roles in determining long-term market leadership. Companies that effectively protect novel extraction processes and proprietary cannabinoid formulations, while maintaining transparent quality assurance, will be best positioned to capitalize on evolving consumer expectations and regulatory requirements.

This comprehensive research report delivers an in-depth overview of the principal market players in the Cannabis Extract market, evaluating their market share, strategic initiatives, and competitive positioning to illuminate the factors shaping the competitive landscape.

- Aphria, Inc

- Aurora Cannabis Inc.

- Ayr Wellness Inc.

- Becanex GmbH

- British American Tobacco PLC

- Cannbit Pharmaceuticals

- Canopy Growth Corporation

- CBD American Shaman, LLC

- Folium Biosciences

- Freedom Leaf, Inc.

- High Tide Inc.

- Indiva Limited

- Jazz Pharmaceuticals PLC

- JULABO GmbH

- Maricann Inc.

- Medical Marijuana, Inc.

- Medicine Man Technologies, Inc.

- Optimum Extracts

- Organigram Holding, Inc.

- Peridot Labs

- PharmaHemp d.o.o.

- The Cronos Group

- Tilray Brands Inc

- VIVO Cannabis Inc

- Wayland Group Corp.

Strategic Guidance for Industry Stakeholders to Capitalize on Emerging Opportunities and Optimize Operations in Cannabis Extract Sector

Leaders in the cannabis extract sphere must adopt a multi-pronged approach to sustain momentum and navigate a complex operating environment. It is essential to establish integrated supply chain frameworks that reduce dependency on single-source providers and anticipate potential tariff or regulatory disruptions. Companies should evaluate opportunities to invest in scalable domestic extraction capacities, leveraging advanced automation and modular processing units to maintain agility under evolving trade and compliance conditions.

Equally important is the continuous optimization of product portfolios through evidence-based research. Organizations are encouraged to allocate resources toward clinical collaborations that substantiate therapeutic claims, thereby fortifying brand credibility among medical professionals and discerning consumers alike. By prioritizing laboratory-backed efficacy and safety data, stakeholders can differentiate their offerings in an increasingly crowded market.

Digital transformation initiatives also warrant strategic emphasis. Leveraging data analytics platforms to gain real-time visibility into consumer preferences, purchasing trends, and regional demand patterns enables more targeted marketing campaigns and streamlined inventory management. Furthermore, cultivating omnichannel distribution networks that seamlessly integrate dispensaries, licensed pharmacies, and e-commerce platforms will expand market reach and enhance customer engagement.

Finally, embedding sustainability principles into extraction practices and packaging solutions can reinforce corporate social responsibility commitments while resonating with environmentally conscious consumers. Stakeholders should explore renewable energy integration, solvent recovery systems, and recyclable materials to minimize ecological footprints alongside profit objectives. This holistic strategy will drive operational resilience and position organizations as responsible industry stewards.

Transparency in Research Approaches Leveraging Multi-Source Data Collection, Expert Interviews and Rigorous Validation for Cannabis Extract Analysis

This research methodology is grounded in a comprehensive framework that synthesizes data from multiple channels to ensure robust insights. An extensive review of publicly available regulatory texts, industry white papers, and technical publications served as the foundational layer for understanding policy trends, extraction technologies, and market structures. To enrich this secondary research, structured interviews were conducted with senior executives, laboratory directors, and field specialists across cultivation, processing, and formulation disciplines.

Quantitative data collection involved collating operational metrics, patent filings, and distribution footprints from leading industry databases. These data points were normalized and cross-validated through triangulation techniques, ensuring consistency and accuracy. A series of expert panel workshops provided critical feedback on preliminary findings, enabling iterative refinement of thematic priorities and strategic imperatives. Throughout the process, rigorous validation protocols were applied to confirm the reliability of third-party sources and to reconcile any discrepancies in dataset reporting.

A tailored segmentation model was developed in collaboration with domain experts to capture the full spectrum of product types, purity grades, delivery formats, extraction methodologies, cannabinoid variants, packaging options, application categories, and distribution routes. This model facilitated granular analysis of consumer preferences, competitive positioning, and supply chain dynamics. The integrated methodology ensures that conclusions and recommendations are underpinned by transparent, reproducible research standards.

By combining systematic secondary research, primary stakeholder engagement, and iterative expert validation, this report delivers a holistic and credible assessment of the global cannabis extract industry landscape.

This section provides a structured overview of the report, outlining key chapters and topics covered for easy reference in our Cannabis Extract market comprehensive research report.

- Preface

- Research Methodology

- Executive Summary

- Market Overview

- Market Insights

- Cumulative Impact of United States Tariffs 2025

- Cumulative Impact of Artificial Intelligence 2025

- Cannabis Extract Market, by Product Type

- Cannabis Extract Market, by Purity Grade

- Cannabis Extract Market, by Form

- Cannabis Extract Market, by Extraction Method

- Cannabis Extract Market, by Cannabinoid Type

- Cannabis Extract Market, by Packaging Type

- Cannabis Extract Market, by Application

- Cannabis Extract Market, by Distribution Channel

- Cannabis Extract Market, by Region

- Cannabis Extract Market, by Group

- Cannabis Extract Market, by Country

- United States Cannabis Extract Market

- China Cannabis Extract Market

- Competitive Landscape

- List of Figures [Total: 20]

- List of Tables [Total: 2544 ]

Synthesis of Key Insights Underscoring the Strategic Imperatives and Future Trajectories of the Global Cannabis Extract Ecosystem

The global cannabis extract industry stands at a critical juncture where technological sophistication, regulatory harmonization, and consumer sophistication intersect. The key insights distilled from this research emphasize the strategic importance of agile supply chains, evidence-based product differentiation, and purposeful digital transformation. Companies that align their operations with evolving policy frameworks and leverage advanced extraction science will establish durable competitive advantages.

Segmentation analysis reveals that product innovation must be undergirded by a nuanced understanding of consumer needs, whether targeting medical applications in neurological and oncology support or catering to recreational users through premium live resins and artisanal rosin. Regional dynamics underscore the necessity of customized market entry strategies that reflect localized regulatory environments and cultural preferences, from liberalized North American markets to cautious Asia-Pacific jurisdictions.

Forward-looking enterprises will prioritize integrated growth strategies encompassing vertical integration, sustainability initiatives, and strategic partnerships with research institutions. Digital platforms and data analytics should be harnessed to inform real-time decision making, optimize inventory flows, and enhance consumer engagement across omnichannel networks. Ultimately, the interplay of these imperatives will determine which organizations emerge as industry leaders in a rapidly evolving ecosystem.

As the landscape continues to mature, maintaining an unwavering commitment to quality assurance, scientific validation, and regulatory compliance will be essential. Firms that navigate these complexities with foresight and operational excellence will not only capture near-term market share but also shape the future trajectory of the global cannabis extract domain.

Engage Directly with Ketan Rohom to Unlock Comprehensive Cannabis Extract Research Insights and Drive Strategic Growth with Tailored Market Intelligence

For tailored insights and customized strategic support in the cannabis extract sector, reach out directly to Ketan Rohom, Associate Director of Sales & Marketing at our firm. Engaging with Ketan empowers stakeholders to access in-depth market intelligence aligned with specific business objectives and operational priorities. By discussing your requirements, you can acquire targeted data sets, competitive benchmarking, and scenario analyses to drive confident decision making and capitalize on emerging market opportunities. Initiate a dialogue to explore bespoke research solutions designed to address your unique challenges, optimize investment strategies, and accelerate growth in an evolving industry landscape. Don’t miss the opportunity to leverage specialized expertise and cutting-edge analysis to steer your organization toward sustainable competitive advantage in the global cannabis extract ecosystem

- How big is the Cannabis Extract Market?

- What is the Cannabis Extract Market growth?

- When do I get the report?

- In what format does this report get delivered to me?

- How long has 360iResearch been around?

- What if I have a question about your reports?

- Can I share this report with my team?

- Can I use your research in my presentation?