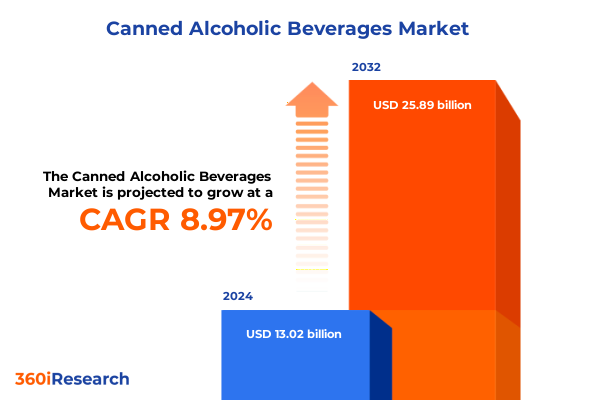

The Canned Alcoholic Beverages Market size was estimated at USD 14.03 billion in 2025 and expected to reach USD 15.12 billion in 2026, at a CAGR of 9.14% to reach USD 25.89 billion by 2032.

Steadfast Growth in Canned Alcoholic Beverages Brings New Opportunities and Complexity to Consumer Markets Worldwide

Canned alcoholic beverages have transcended their humble origins to become a defining segment of the modern adult beverage landscape. Once perceived as a niche offering, ready-to-drink options now resonate with consumers seeking portability, convenience, and consistent quality across occasions ranging from outdoor festivals to intimate at-home gatherings. The meteoric rise of hard seltzers exemplifies this shift, as brands successfully repositioned their products as low-calorie, flavorful alternatives to beer and wine, capturing the interests of health-conscious millennials and Gen Z drinkers who prize transparency and authentic ingredients.

Building on the initial momentum of seltzers, the category has diversified to include spirit-based seltzers, hard lemonades, coffee-infused beverages, tea blends, and ready-to-drink cocktails. Companies like California’s wine powerhouse behind High Noon have leveraged existing distribution networks and marketing partnerships to introduce vodka-based seltzers, rapidly scaling to tens of millions of cases annually. This evolution highlights how beverage giants and craft producers alike are innovating to cater to evolving palates, driving product extensions that blend nostalgic flavors with premium alcohol bases to sustain consumer engagement.

Rapid Evolutions in Flavors Packaging Innovation and Regulatory Liberalization Are Redefining the Canned Alcoholic Beverage Sector

The canned alcoholic beverage sector is experiencing multi-dimensional transformation as consumer preferences, regulatory environments, and supply chain realities converge to reshape market dynamics. Health and wellness imperatives are at the forefront, propelling brands to spotlight low-calorie profiles, natural fruit infusions, and gluten-free formulations that align with active lifestyles. This movement is driving experimentation with adaptogens, functional ingredients, and vitamin fortification, signaling an era where indulgence coexists with self-care aspirations.

Simultaneously, legislative developments have broadened the retail footprint for ready-to-drink offerings. Texas’s recent Senate advancement of legislation to permit grocery and convenience store sales of spirit-based cocktails underscores a national trend toward regulatory liberalization. These reforms not only expand consumer access but also challenge traditional category boundaries, creating new battlegrounds for market share among breweries, distilleries, and wine producers alike.

Comprehensive Examination of 2025 US Tariffs Reveals Escalating Costs and Supply Chain Challenges for Canned Beverage Producers

In 2025, U.S. trade policy intensified with a series of escalating tariffs that have substantially influenced the cost structures and sourcing strategies of canned beverage manufacturers. On March 12, 2025, a 25% duty was imposed on all steel and aluminum imports, followed by an expansion on April 2 that specifically encompassed empty aluminum cans and canned beer under similar rates. These measures eliminated prior exemptions and introduced stringent origin requirements, mandating that aluminum must be smelted and cast domestically to qualify for duty-free treatment.

By June 4, 2025, the administration further raised steel and aluminum tariffs to 50%, applying the higher rate to a broader array of inputs, including beverage-grade aluminum. This escalation has placed significant pressure on profit margins, prompting manufacturers to explore alternative suppliers, bulk procurement strategies, and material substitution. Even large-scale producers like Constellation Brands have reported rising production costs linked to tariff-induced aluminum price increases, leading to narrowed operating margins and upward price adjustments in the market.

In-Depth Analysis of Product Distribution Packaging and Alcohol Content Segments Illuminates Diverse Consumer Preferences

The canned alcoholic beverage market is segmented along multiple dimensions, each revealing unique consumer behaviors and growth vectors. Differentiation by product type spans hard coffee, hard lemonade, hard seltzer, hard tea, and ready-to-drink cocktails, illustrating how flavor innovation and base spirits drive appeal across diverse taste profiles. As the seltzer craze evolves into a broader preference for nutrient-infused and cocktail-inspired offerings, brands are tailoring formulations to capture both niche enthusiasts and mainstream audiences.

Distribution channels further delineate market dynamics, with off-premise outlets-ranging from convenience stores and e-commerce platforms to liquor stores and supermarkets-catering to at-home and on-the-go consumption. On-premise venues such as bars, restaurants, and hotels remain vital for experiential engagement, allowing brands to trial unique formats and seasonal variants. This duality underscores the importance of omnichannel strategies that integrate digital engagement with targeted in-store activations. Packaging choices reinforce brand positioning: aluminum cans dominate for their recyclability and portability, while steel cans offer alternative value propositions in specific markets. Within can formats, slim cans and standard cans differentiate usage occasions, from lifestyle-focused single serves to value-driven multi-packs. Finally, products classified by alcohol content-high, standard, or low-further satisfy consumer preferences for potency and moderation, driving targeted innovation in ABV offerings to accommodate wellness and social norms.

This comprehensive research report categorizes the Canned Alcoholic Beverages market into clearly defined segments, providing a detailed analysis of emerging trends and precise revenue forecasts to support strategic decision-making.

- Product Type

- Packaging Type

- Alcohol Content

- Packaging Material

- Distribution Channel

Regional Consumption and Preference Patterns Highlight Americas EMEA and Asia-Pacific as Distinct Growth and Innovation Centers

Regional dynamics in the canned alcoholic beverage industry reveal distinct consumption patterns and competitive landscapes. In the Americas, the United States accounts for more than 90% of global hard seltzer volume, reflecting a mature market driven by brand proliferation, sports partnerships, and e-commerce adoption. Canada and Latin American markets exhibit growing interest, particularly in flavored malt beverages and RTD cocktails, as younger demographics embrace novel formats for social and leisure occasions.

Across Europe, the Middle East, and Africa, regulatory frameworks vary significantly, influencing pricing, labeling, and market entry strategies. European consumers show a strong preference for ready-to-pour cocktail cans and premium seltzer blends, while select Gulf markets prioritize luxury packaging and low-ABV profiles. In Africa, growth is emerging from localized flavor adaptations and mobile retail solutions, catering to expanding urban populations. The Asia-Pacific region, led by markets in Australia, Japan, and select Southeast Asian hubs, is experiencing rapid uptake of hard seltzers and spirit-based RTDs. Domestic producers and global brands are launching region-specific innovations-such as tropical fruit and tea-infused varieties-to align with local palates and capture early-mover advantages.

This comprehensive research report examines key regions that drive the evolution of the Canned Alcoholic Beverages market, offering deep insights into regional trends, growth factors, and industry developments that are influencing market performance.

- Americas

- Europe, Middle East & Africa

- Asia-Pacific

Leading Producers and Emerging Challengers Showcase Strategic Collaborations Innovations and Marketing Ingenuity in the Canned Beverage Arena

Prominent players in the canned alcoholic beverage arena are deploying varied strategies to assert market leadership. Constellation Brands has navigated tariff pressures and shifting consumer tastes by optimizing its squeeze-and-spray can technology and reinforcing the distribution of legacy brands alongside emerging RTD lines. Meanwhile, Gallo’s pivot via High Noon has leveraged premium spirit bases and strategic sports partnerships to reshape consumer perceptions of canned offerings. Boston Beer Company, the parent of Truly, has adopted aggressive marketing investments and packaging redesigns to stabilize volume declines and differentiate amidst category saturation.

Emerging challengers are capitalizing on niche segments, introducing craft-inspired hard coffees, botanical-infused teas, and adaptogen-enhanced seltzers that cater to evolving wellness and lifestyle trends. Collaborative ventures between beverage startups and technology firms are automating flavor development and personalized packaging solutions, while strategic alliances with distributors and retail chains broaden market access. These initiatives underscore the competitive imperative to combine brand authenticity with operational agility in an environment defined by rapid innovation and regulatory flux.

This comprehensive research report delivers an in-depth overview of the principal market players in the Canned Alcoholic Beverages market, evaluating their market share, strategic initiatives, and competitive positioning to illuminate the factors shaping the competitive landscape.

- Anheuser-Busch InBev SA/NV

- Asahi Group Holdings, Ltd.

- Bacardi Limited

- Brown‑Forman Corporation

- Carlsberg Breweries A/S

- Constellation Brands, Inc.

- Diageo plc

- E. & J. Gallo Winery

- Heineken N.V.

- Mark Anthony Brands International, Inc.

- Molson Coors Beverage Company

- National Beverage Corp.

- Pabst Brewing Company, LLC

- Pernod Ricard SA

- Suntory Holdings Limited

- The Boston Beer Company, Inc.

- The Coca-Cola Company

- Treasury Wine Estates Limited

Practical Strategies for Manufacturers Distributors and Brands to Navigate Tariffs Regulatory Changes and Evolving Consumer Demands

Industry leaders seeking to thrive amid tariff headwinds and shifting consumer expectations should prioritize integrated sourcing strategies that blend domestic procurement with diversified international suppliers. Negotiating long-term supply agreements and investing in on-site recycling and remelting partnerships can mitigate aluminum cost surges, while material innovation-such as exploring lighter-gauge alloys or alternative container formats-enhances resilience. Concurrently, enhancing in-market agility through modular production cells and rapid flavor-changeovers enables responsiveness to regional preferences and seasonal trends.

To capitalize on evolving consumer lifestyles, companies should adopt a “phygital” approach that synchronizes e-commerce, direct-to-consumer subscriptions, and experiential on-premise activations. Leveraging data analytics to segment audiences by occasion, generation, and health orientation can inform targeted product development and marketing campaigns. Finally, forging partnerships with regulatory bodies and industry associations will facilitate proactive navigation of labeling requirements and tariff negotiations, positioning organizations to influence policy development while safeguarding market access and cost stability.

Rigorous Mixed Methods Research Integrates Executive Interviews Scanner Analytics and Policy Data to Uncover Market Dynamics

This study employs a mixed-methods research design, integrating qualitative interviews with executives from leading beverage producers, packaging suppliers, and trade associations alongside quantitative analysis of trade data, retail scanner statistics, and tariff schedules. Primary interviews were conducted with stakeholders across the Americas, EMEA, and Asia-Pacific, ensuring nuanced insights into regional regulatory impacts and distribution challenges. Secondary sources include governmental trade databases, policy publications, and industry journals to validate cost modeling and supply chain adaptations.

Survey instruments captured consumer preferences related to flavor profiles, packaging formats, and health attributes, while conjoint analyses quantified willingness-to-pay across ABV tiers and can designs. The segmentation framework was informed by standardized product-type classifications and channel matrices, allowing for cross-regional benchmarking. Data triangulation and scenario planning techniques were employed to test stakeholder assumptions regarding tariff fluctuations and legislative reforms, ensuring robust strategic recommendations reflective of both current realities and near-term contingencies.

This section provides a structured overview of the report, outlining key chapters and topics covered for easy reference in our Canned Alcoholic Beverages market comprehensive research report.

- Preface

- Research Methodology

- Executive Summary

- Market Overview

- Market Insights

- Cumulative Impact of United States Tariffs 2025

- Cumulative Impact of Artificial Intelligence 2025

- Canned Alcoholic Beverages Market, by Product Type

- Canned Alcoholic Beverages Market, by Packaging Type

- Canned Alcoholic Beverages Market, by Alcohol Content

- Canned Alcoholic Beverages Market, by Packaging Material

- Canned Alcoholic Beverages Market, by Distribution Channel

- Canned Alcoholic Beverages Market, by Region

- Canned Alcoholic Beverages Market, by Group

- Canned Alcoholic Beverages Market, by Country

- United States Canned Alcoholic Beverages Market

- China Canned Alcoholic Beverages Market

- Competitive Landscape

- List of Figures [Total: 17]

- List of Tables [Total: 1272 ]

Synthesis of Key Insights Underscores the Future Trajectory of Canned Alcoholic Beverages Amid Global and Local Pressures

The canned alcoholic beverage category stands at an inflection point, defined by the convergence of consumer-driven innovation, regulatory evolution, and supply chain complexity. Health and wellness trends will continue to shape product formulations, driving the proliferation of functional and low-calorie offerings, while premiumization and spirit-based variants will distinguish compelling value propositions. Simultaneously, regional legislative changes and escalating tariff regimes will require dynamic sourcing models and collaborative policy engagement to sustain competitive margins and market access.

Looking ahead, success will hinge on the ability of manufacturers, distributors, and retailers to marry agility with scale, leveraging advanced analytics and modular production to tailor portfolios across geographies and demographics. Embracing sustainability in packaging and sourcing, fostering consumer trust through ingredient transparency, and forging strategic alliances will be essential to navigate the evolving terrain. In this context, the comprehensive insights presented herein offer a strategic roadmap for stakeholders aiming to capture emerging opportunities and mitigate risks in the dynamic world of canned alcoholic beverages.

Secure Your Competitive Edge by Contacting Associate Director Ketan Rohom for a Tailored Market Research Report on Canned Alcoholic Beverages

For a comprehensive exploration of consumer behaviors, competitive dynamics, and regulatory impacts shaping the canned alcoholic beverage category, connect directly with Ketan Rohom, Associate Director of Sales & Marketing. His expertise in guiding senior executives through strategic decision-making processes ensures that your organization gains actionable intelligence tailored to your unique objectives. Whether you aim to optimize supply chain resilience, accelerate portfolio innovation, or navigate evolving tariff landscapes, Ketan will provide a bespoke presentation of insights derived from primary interviews, rigorous data analysis, and industry best practices. Reach out today to secure your copy of the full market research report and position your business to capitalize on emerging opportunities in this dynamic sector.

- How big is the Canned Alcoholic Beverages Market?

- What is the Canned Alcoholic Beverages Market growth?

- When do I get the report?

- In what format does this report get delivered to me?

- How long has 360iResearch been around?

- What if I have a question about your reports?

- Can I share this report with my team?

- Can I use your research in my presentation?