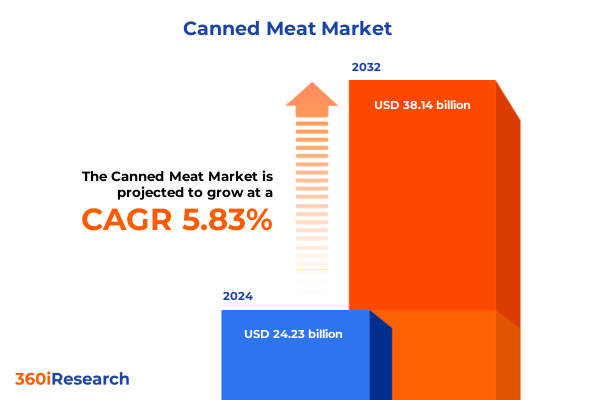

The Canned Meat Market size was estimated at USD 25.62 billion in 2025 and expected to reach USD 26.87 billion in 2026, at a CAGR of 5.84% to reach USD 38.14 billion by 2032.

Exploring the Current State of the Canned Meat Industry Amid Evolving Consumer Preferences Supply Chain Resilience and Nutritional Priorities

In recent years, canned meat has solidified its position as a cornerstone in global nutrition, offering consumers sustained shelf life, protein density, and unparalleled convenience. As busy lifestyles and value-driven purchasing habits converge, these products have transitioned from emergency pantries to everyday meal solutions. The industry’s resilience was notably underscored during periods of economic uncertainty, when demand surged for cost-effective, transportable protein options that meet nutritional requirements without sacrificing taste or convenience. Amid ongoing supply chain recalibrations, manufacturers have leveraged streamlined production processes to maintain consistent availability and quality across diverse markets while navigating ingredient sourcing challenges.

Uncovering the Transformative Forces of Plant-Based Innovations Digital Engagement and Sustainable Packaging Redefining Canned Meat Dynamics

The canned meat sector is experiencing transformative shifts driven by innovation, consumer health consciousness, and digital engagement. Leading food companies and nimble startups alike are introducing plant-based counterparts, addressing environmental concerns and the rise of flexitarian diets with protein-rich alternatives that replicate traditional textures and flavors. These developments underscore a broader movement toward transparency and clean-label formulations, as traceability and ingredient integrity become pivotal purchase drivers. Moreover, advanced packaging technologies-ranging from lightweight aluminum cans to eco-friendly pouches-are enhancing product preservation while aligning with sustainability imperatives.

Analyzing the Cumulative Impact of 2025 U.S. Tariff Measures on Canned Meat Input Costs Supply Chains and Industry Resilience

In 2025, a series of U.S. trade actions have compounded cost pressures across the canned meat value chain. A universal 10% tariff was enacted effective April 5, 2025, applying broadly to imports from all trading partners under the reciprocal tariff framework, heightening landed costs for raw ingredients and finished goods alike. Concurrently, on March 4, 2025, a 25% duty was levied on imports originating from Canada and Mexico, further intensifying import costs for producers reliant on cross-border supply networks. Simultaneously, proclamations under Section 232 of the Trade Expansion Act introduced 25% tariffs on steel and aluminum imports beginning March 12, 2025, directly affecting the cost of cans and packaging materials crucial to canned meat operations.

Beyond final goods, sector stakeholders face additional tariffs on specialized tin mill imports, which underpin domestic can manufacturing. Industry experts warn that these measures threaten to erode processor margins and disrupt longstanding production models by inflating upstream material expenses. In response, manufacturers are exploring alternative metallurgy, reshoring certain processes, and negotiating supplier contracts to buffer against evolving duties. Collectively, these tariff layers underscore a strategic imperative for agile cost management and diversified sourcing strategies in 2025 and beyond.

Illuminating Segmentation Insights That Highlight Product Preservation Packaging Distribution and End-User Diversity in Canned Meat Markets

The canned meat market’s segmentation landscape reveals nuanced demand patterns shaped by product specifications and end uses. Within product type, consumers increasingly differentiate between chicken offerings-where chunk and shredded variants cater to both quick-prep recipes and premium culinary applications-and luncheon meats available in beef, chicken, or pork formulations that appeal to distinct regional palates. Pâté variants featuring liver, seafood, or vegetable bases demonstrate a blend of tradition and innovation, while sausage subtypes such as chorizo, frankfurter, and salami serve both deli-deli and gourmet segments.

Preservation methods further segment the market by taste profile and functional application. While brine-preserved lines deliver familiar salt-enhanced notes, oil-based products emphasize rich mouthfeel, and sauces-whether barbecue, curry, or tomato-introduce ready-to-serve formats that resonate with global flavor trends. Packaging preferences reflect consumer priorities for convenience and sustainability: aluminum and steel cans remain staples for bulk storage but are complemented by flexible and stand-up pouches that support on-the-go consumption, alongside tray configurations suited to foodservice.

Distribution channels articulate divergent growth trajectories. Foodservice outlets including catering, hotels, and restaurants rely on consistent quality and volume, whereas online retail platforms leverage digital discovery and subscription models to reach direct-to-consumer audiences. In traditional retail, convenience stores prioritize single-serve offerings, hypermarkets drive value through large-format merchandising, and supermarkets balance assortment across mainstream and niche brands. Finally, end-user segmentation underscores household consumption trends favoring easy meal solutions, while industrial buyers in catering services and food processing sectors seek bulk supply agreements underpinned by cost efficiency and supply reliability.

This comprehensive research report categorizes the Canned Meat market into clearly defined segments, providing a detailed analysis of emerging trends and precise revenue forecasts to support strategic decision-making.

- Product Type

- Preservation Type

- Packaging

- Distribution Channel

- End User

Delivering Key Regional Insights on Consumption Trends Regulatory Enablers and Growth Potential Across Americas Europe Middle East Africa and Asia-Pacific

Regionally, the Americas present a mature landscape characterized by consumption patterns that have recently plateaued despite historically robust volumes. U.S. intake of canned meat receded nearly 10% in 2024 amid shifting dietary preferences, even as manufacturers introduced value-driven innovations to reengage budget-conscious shoppers. In Canada and Latin America, opportunities persist for niche brands leveraging locally relevant flavors and heritage recipes.

In Europe, Middle East & Africa, regulatory frameworks and cultural traditions shape distinct market contours. The European Union’s canned meat sector grew by over 5% in 2024, supported by steady production across Germany, France, and Spain, and bolstered by demand for organic, natural formulations that align with stringent labeling standards. Meanwhile, the Middle East and African markets exhibit heterogeneity driven by halal certification requirements and evolving urban demographics.

Asia-Pacific remains a high-impact region with consumption exceeding 24 million tons in 2024, underpinned by populous markets in China, India, and Southeast Asia. After a brief contraction, the region rebounded with double-digit growth in select categories, as rising disposable incomes and the expansion of modern retail channels fuel demand for both traditional canned fish and innovative meat variants. This region’s trajectory underscores significant potential for market entrants focusing on localized flavor adaptations and streamlined logistics.

This comprehensive research report examines key regions that drive the evolution of the Canned Meat market, offering deep insights into regional trends, growth factors, and industry developments that are influencing market performance.

- Americas

- Europe, Middle East & Africa

- Asia-Pacific

Unveiling Critical Company-Level Insights Spanning Established Food Titans and Disruptive Plant-Based Entrants in the Canned Meat Sphere

Competitive dynamics in the canned meat sector feature established multinationals alongside agile entrants redefining value propositions. Leading companies such as Conagra Brands and Kraft Heinz have responded to economic pressures with promotional strategies and expanded affordable offerings, including revamped chicken patties and cost-effective luncheon lines, to sustain engagement among price-sensitive consumers. Globally, Century Pacific Food’s unMEAT has captured flexitarian interest with plant-based luncheon alternatives, while Shinsegae Food’s foray into plant-based ham reflects broader diversification by Asian conglomerates.

Regional champions rely on strategic partnerships and innovation pipelines to drive differentiation. Hormel Foods, with its iconic brands, continues to invest in clean-label formulations, and European processors emphasize artisanal pâtés and premium sausage portfolios tailored to local taste profiles. Collaboration on sustainable sourcing, particularly for poultry and seafood inputs, is becoming a critical factor in maintaining brand equity.

This comprehensive research report delivers an in-depth overview of the principal market players in the Canned Meat market, evaluating their market share, strategic initiatives, and competitive positioning to illuminate the factors shaping the competitive landscape.

- Bolton Group S.p.A.

- Campbell Soup Company

- Campofrío Food Group S.A.U.

- CDO Foodsphere, Inc.

- Conagra Brands, Inc.

- Danish Crown AmbA

- Denis Frères Group (Ayam Brand)

- Goya Foods, Inc.

- Hormel Foods Corporation

- JBS S.A.

- Keystone Foods

- Maple Leaf Foods Inc.

- Morliny Foods Holding Limited

- Princes Group Ltd

- Robert Damkjaer A/S

- Siniora Food Industries Company

- The Kraft Heinz Company

- Tyson Foods, Inc.

- Zur Mühlen Group

- Zwanenberg Food Group

Formulating Actionable Recommendations for Industry Leaders on Innovation Packaging Supply Partnerships and Digital Engagement Strategies

Industry leaders must prioritize a multi-pronged approach to navigate evolving market forces. First, investing in agile R&D to develop low-sodium, preservative-free, and plant-based alternatives will capture health-conscious and flexitarian segments. Second, innovating packaging through lightweight materials and resealable designs can meet sustainability targets while enhancing convenience. Third, forging supply partnerships in regions with stable raw material access can hedge against tariff volatility and facilitate rapid response to regulatory changes.

Simultaneously, strengthening digital marketing capabilities will elevate direct-to-consumer engagement and accelerate market feedback loops. Companies should also leverage data analytics to optimize pricing strategies in response to input cost fluctuations, ensuring margins are preserved amid shifting tariff landscapes. Finally, cross-industry alliances-such as collaborations with logistics providers to enhance cold chain resiliency-can unlock operational efficiencies critical for maintaining consistent supply and quality standards.

Outlining a Robust Mixed-Methods Research Methodology Combining Executive Interviews Quantitative Data and Expert Validation

This research integrates a rigorous mixed-methods framework combining primary interviews with executives across the canned meat value chain and secondary analysis of trade data, policy documents, and consumption statistics. Initially, comprehensive discussions with procurement, R&D, and marketing leaders provided qualitative insights into strategic priorities and operational challenges. These findings were triangulated against tariff notices, government publications, and industry periodicals to validate emerging trends.

Quantitative data sourcing encompassed a review of import-export datasets, consumption volumes, and production statistics from government agencies and reputable market platforms. All inputs were cross-referenced with company disclosures and expert consultations to ensure consistency. The segmentation model was crafted through iterative workshops, mapping product, preservation, packaging, distribution, and end-user dimensions. Finally, the research underwent peer review by sector specialists to confirm methodological integrity and factual accuracy.

This section provides a structured overview of the report, outlining key chapters and topics covered for easy reference in our Canned Meat market comprehensive research report.

- Preface

- Research Methodology

- Executive Summary

- Market Overview

- Market Insights

- Cumulative Impact of United States Tariffs 2025

- Cumulative Impact of Artificial Intelligence 2025

- Canned Meat Market, by Product Type

- Canned Meat Market, by Preservation Type

- Canned Meat Market, by Packaging

- Canned Meat Market, by Distribution Channel

- Canned Meat Market, by End User

- Canned Meat Market, by Region

- Canned Meat Market, by Group

- Canned Meat Market, by Country

- United States Canned Meat Market

- China Canned Meat Market

- Competitive Landscape

- List of Figures [Total: 17]

- List of Tables [Total: 2544 ]

Concluding the Executive Summary with Strategic Reflections on Market Challenges Innovations and Growth Pathways

Throughout this executive summary, we have charted the strategic contours of the canned meat industry amid shifting consumer preferences, regulatory interventions, and competitive innovations. The landscape is marked by both challenges-such as rising input costs driven by new tariffs-and opportunities unlocked by health-driven product innovation and digital channel expansion. Companies that harness data-driven insights, embrace agile supply chain configurations, and foster consumer-centric product development are poised to excel.

Connect Directly with Associate Director Ketan Rohom to Access the Definitive Canned Meat Market Research Report and Accelerate Your Strategic Decision Making

Engage with Ketan Rohom, Associate Director, Sales & Marketing to secure comprehensive insights and data-driven strategies tailored to drive success in the evolving canned meat market report narrative. His expertise will guide you through the report’s detailed analysis, enabling your organization to capitalize on emerging opportunities, mitigate risks stemming from regulatory shifts, and optimize market positioning. Don’t miss the chance to leverage this authoritative resource to inform your strategic decisions and fortify your competitive edge in a landscape shaped by shifting consumer behaviors, tariff developments, and segmentation dynamics. Contact Ketan to purchase the full market research report today and propel your business towards sustained growth.

- How big is the Canned Meat Market?

- What is the Canned Meat Market growth?

- When do I get the report?

- In what format does this report get delivered to me?

- How long has 360iResearch been around?

- What if I have a question about your reports?

- Can I share this report with my team?

- Can I use your research in my presentation?