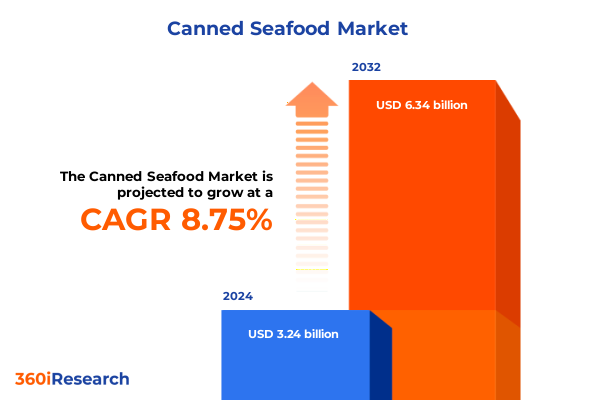

The Canned Seafood Market size was estimated at USD 3.48 billion in 2025 and expected to reach USD 3.75 billion in 2026, at a CAGR of 8.91% to reach USD 6.34 billion by 2032.

Discover How Evolving Consumer Preferences, Sustainability Demands, and Technological Breakthroughs Are Shaping the Canned Seafood Market Landscape

The global canned seafood market stands at an inflection point, shaped by evolving consumer tastes, heightened sustainability expectations, and relentless innovation. Shifting dietary preferences toward protein-rich and convenient meal solutions have propelled canned seafood from a pantry staple to a culinary mainstay across diverse demographics. As health-conscious consumers seek nutrient-dense proteins and omega-rich options, industry participants are responding with fortified formulations, premium sourcing claims, and flavor-forward offerings. Concurrently, advancements in processing technology and cold chain logistics have unlocked new efficiencies, enabling brands to deliver consistent quality and meet stringent safety standards. These developments collectively underscore the growing strategic importance of canned seafood within the broader protein landscape, warranting a thorough exploration that spans market drivers, competitive dynamics, and emerging opportunities.

Looking ahead, the interplay of sustainability imperatives and digital transformation will define the trajectory of the canned seafood sector. Businesses that integrate traceability solutions, eco-friendly packaging innovations, and transparent supply chain partnerships will gain an edge in an era of heightened stakeholder scrutiny. For decision-makers and investors alike, this report provides an essential orientation to the core market forces at play, setting the stage for deeper analysis across regulatory shifts, segmentation nuances, and regional dynamics. By framing these key themes up front, we offer a consolidated lens through which to assess both immediate challenges and long-term growth potential.

Uncover the Sustainability, Packaging, and Digital Innovations That Are Redefining Competitive Dynamics in the Canned Seafood Sector

In recent years, the canned seafood industry has undergone a fundamental transformation driven by an array of disruptive forces. Advances in sustainable fishing practices, catalyzed by both regulatory frameworks and NGO advocacy, have elevated traceability from a compliance requirement to a consumer expectation. Brands are now investing in blockchain-enabled sourcing platforms to verify provenance and to ensure ethical harvest methods. Meanwhile, packaging innovation has expanded beyond traditional metal cans to include recyclable composite materials and easy-open designs that enhance convenience without compromising shelf stability. This shift toward eco-conscious packaging aligns with broader industry efforts to reduce environmental footprints and to adhere to circular economy principles.

Parallel to sustainability, digital sales channels have revolutionized distribution and consumer engagement. The proliferation of e-marketplaces and direct-to-consumer brand websites has created novel opportunities for curated seafood offerings, subscription models, and personalized product recommendations. Data analytics and AI-driven customer insights now enable companies to tailor promotions, forecast demand more accurately, and refine their assortment strategies. These technological breakthroughs are complemented by agile manufacturing processes, where modular canning lines and rapid recipe prototyping support product diversification at speed. As a result, market entrants of all sizes can compete on innovation, ensuring a dynamic competitive environment that favors adaptability and customer-centricity.

Evaluate How Recent Tariff Modifications Have Prompted Supply Chain Realignments, Strategic Sourcing Shifts, and Pricing Responses Across the Canned Seafood Chain

In the first half of 2025, adjustments to United States tariff policies have exerted a tangible ripple effect across the canned seafood ecosystem. Import duties on key species prompted recalibrations in pricing strategies, as distributors and retailers sought to maintain margin stability without transferring full cost increases to end consumers. This delicate balance has led to heightened collaboration between importers and offshore processors to optimize production efficiencies and to offset tariff-related expenses through leaner operations. Simultaneously, domestic sourcing initiatives have gained momentum, as companies explore partnerships with U.S. fisheries to diversify supply origins and to mitigate exposure to international trade fluctuations.

The combined impact of tariffs has also influenced competitive positioning, prompting a realignment of supplier relationships. While premium and niche brands have absorbed a greater share of cost pass-through to reinforce quality and sustainability credentials, value-oriented private labels have leveraged scale and streamlined logistics to safeguard shelf price parity. Overall, these dynamics have fostered a bifurcated landscape, with market participants differentiating on either quality-driven branding or cost leadership. As tariff frameworks continue to evolve, the agility of procurement teams and the strength of agile supply chains will remain critical to sustaining operational resilience and to seizing new opportunities.

Decode the Layered Dimensions of Product Types, Packaging Choices, Distribution Channels, and Application Niches to Target Canned Seafood Consumers Effectively

A nuanced segmentation approach reveals distinct consumer cohorts and purchase behaviors within the canned seafood market, offering tailored paths to value creation. By type, product offerings span foundational favorites such as mackerel, sardines, and tuna, alongside specialized salmon variants that include Atlantic, Coho, and Pink fillets. Each species category carries unique taste profiles, nutritional attributes, and consumer appeal, which brands leverage to craft differentiated positioning. Packaging design also plays a pivotal role, encompassing traditional metal cans, glass jars that communicate artisanal quality, and lightweight tins that emphasize portability and convenience.

Distribution channels further subdivide market access points, with convenience stores delivering on-the-go snacking solutions, supermarkets and hypermarkets anchoring mass-market visibility, foodservice segments-encompassing hotels’ catering operations and restaurant menus-showcasing premium and large-format presentations, and online retail channels, from brand websites to leading e-marketplaces, enabling direct engagement and subscription-based consumption. Finally, application contexts bifurcate between institutional use and household preparation, with institutional catering services and restaurant operators relying on bulk packaging and standardized quality, while home cooks seek portion-controlled, ready-to-eat options that align with health-conscious meal planning. Understanding these complementary segmentation dimensions equips stakeholders to devise finely tuned marketing, distribution, and product development strategies.

This comprehensive research report categorizes the Canned Seafood market into clearly defined segments, providing a detailed analysis of emerging trends and precise revenue forecasts to support strategic decision-making.

- Type

- Packaging Type

- Distribution Channel

- Application

Illuminate Regional Nuances and Consumer Preferences Across the Americas, EMEA, and Asia-Pacific That Drive Divergent Canned Seafood Opportunities

Geographical analysis underscores the heterogeneity of demand and innovation across key regions. In the Americas, strong affinity for tuna and salmon drives premiumization trends, while sustainability campaigns and fishery certification programs bolster consumer confidence. Retailers in North America and Latin America alike partner with local fisheries to showcase origin stories, reinforcing product authenticity. Conversely, Europe, the Middle East, and Africa exhibit a rich tapestry of culinary traditions that inform product form and flavor. Mediterranean markets favor sardine and mackerel varieties infused with regional spices and sauces, while Gulf countries emphasize high-end tuna preparations for upscale foodservice applications.

The Asia-Pacific region remains a growth focal point, propelled by rising incomes, rapid urbanization, and a cultural legacy of seafood consumption. Coastal markets in East Asia demonstrate a strong preference for tins of skipjack and yellowfin tuna, often incorporated into ready-to-eat meal kits and health-centric functional foods. Moreover, emerging Southeast Asian economies exhibit robust demand for value-driven sardine offerings, presented in innovative packaging formats that appeal to young, on-the-go consumers. Each region’s distinct regulatory frameworks, tariff regimes, and distribution networks necessitate bespoke market entry and expansion strategies that align with local consumer expectations and competitive landscapes.

This comprehensive research report examines key regions that drive the evolution of the Canned Seafood market, offering deep insights into regional trends, growth factors, and industry developments that are influencing market performance.

- Americas

- Europe, Middle East & Africa

- Asia-Pacific

Analyze How Major Conglomerates, Retail Private Labels, and Sustainable Niche Brands Are Strategizing to Gain Competitive Advantage in Canned Seafood

Leading market participants are deploying an array of strategic initiatives to fortify their positions amidst intensifying competition. Global seafood conglomerates are investing in vertically integrated supply chains, encompassing vessel-level harvesting, in-house processing plants, and proprietary distribution networks. Through these end-to-end capabilities, they achieve greater cost control and rapid innovation cycles. Meanwhile, private-label manufacturers have capitalized on retailer partnerships, leveraging scale to secure prime shelf real estate and to introduce value-oriented product lines that resonate with budget-conscious shoppers.

At the same time, specialized sustainable brands are carving out niche share by highlighting responsibly sourced ingredients and transparent traceability. These players often collaborate with certification bodies and environmental NGOs to validate their claims, appealing to ethically minded consumers. Additionally, a wave of strategic alliances between technology startups and traditional canning houses has emerged, integrating AI-driven supply forecasting tools and advanced packaging technologies. This hybrid model fosters agility, enabling rapid experimentation with new flavors, formats, and cross-category applications under reduced risk parameters.

This comprehensive research report delivers an in-depth overview of the principal market players in the Canned Seafood market, evaluating their market share, strategic initiatives, and competitive positioning to illuminate the factors shaping the competitive landscape.

- American Tuna, Inc. by World Wise Foods Ltd.

- Cooke Seafood USA Inc.

- FCF Co, Ltd.

- Fishwife Tinned Seafood Co.

- Golden Prize India by Ashokasha Group

- HIC-ABF Special Foods Pvt Ltd

- Maruha Nichiro Corporation

- Patagonia Provisions, Inc.

- Pinhais & Ca Lda

- Salmon Sisters

- Sea Watch International

- StarKist Co.

- Taylor Shellfish Farms

- Thai Union Group PCL

- The J.M. Smucker Company,

- Tri Marine Group

- Trident Seafoods Corporation

- Universal Canning Incorporated

- Wild Planet Foods, Inc.

Implement Traceability, Sustainable Packaging, Omnichannel Engagement, and Strategic Collaborations to Build Resilience and Drive Growth

To thrive in this dynamic market environment, industry leaders should prioritize the integration of end-to-end traceability solutions that enhance supply chain transparency and support premium positioning. Implementing blockchain-based provenance platforms can not only satisfy regulatory requirements but also resonate with ethically minded consumers. Simultaneously, investment in lightweight, fully recyclable composite packaging will address sustainability mandates and differentiate offerings on retail shelves. These eco-friendly formats can be marketed as part of a broader corporate environmental stewardship narrative.

Furthermore, stakeholders must embrace omnichannel distribution models by deepening partnerships with leading e-commerce platforms and by enhancing direct-to-consumer engagement through subscription services. Leveraging data analytics to personalize product recommendations and to forecast demand trends will optimize inventory management and elevate customer retention. Finally, forging cross-industry collaborations-such as co-branded menu integrations with quick-service restaurants and meal kit providers-can create incremental revenue streams and broaden brand visibility. By executing these targeted strategies, organizations will be well-positioned to capitalize on emerging trends and to secure sustainable growth trajectories.

Detail the Rigorous Qualitative and Quantitative Approaches Employed to Capture Industry Perspectives and Validate Market Insights

The research methodology underpinning this analysis encompasses a blend of primary exploration and secondary data synthesis, designed to deliver robust, actionable insights. Primary research was conducted through in-depth interviews with senior executives across leading seafood processors, retail buyers, and foodservice operators, supplemented by expert consultations with supply chain analysts and sustainability advocates. These qualitative inputs were triangulated with quantitative data drawn from trade associations, public filings, and industry reports to ensure contextual accuracy and to validate emerging trends.

Complementing these sources, proprietary databases tracking shipment volumes, import-export patterns, and price movements were leveraged to map historical dynamics. Analytical frameworks such as SWOT (strengths, weaknesses, opportunities, threats) and PESTEL (political, economic, social, technological, environmental, legal) were applied to systematically evaluate market forces and regulatory impacts. The combined methodological rigor ensures that insights presented herein capture both the current state of the market and the directional signals that will inform strategic decision-making over the near to mid term.

This section provides a structured overview of the report, outlining key chapters and topics covered for easy reference in our Canned Seafood market comprehensive research report.

- Preface

- Research Methodology

- Executive Summary

- Market Overview

- Market Insights

- Cumulative Impact of United States Tariffs 2025

- Cumulative Impact of Artificial Intelligence 2025

- Canned Seafood Market, by Type

- Canned Seafood Market, by Packaging Type

- Canned Seafood Market, by Distribution Channel

- Canned Seafood Market, by Application

- Canned Seafood Market, by Region

- Canned Seafood Market, by Group

- Canned Seafood Market, by Country

- United States Canned Seafood Market

- China Canned Seafood Market

- Competitive Landscape

- List of Figures [Total: 16]

- List of Tables [Total: 1590 ]

Synthesize the Core Transformations, Segmentation Dynamics, and Strategic Imperatives That Define Today’s Canned Seafood Industry

Throughout this executive summary, we have outlined the pivotal shifts shaping the canned seafood market, from evolving consumer preferences and technological innovations to tariff-induced supply chain realignments. The multifaceted segmentation across species types, packaging variants, distribution pathways, and application contexts reveals opportunities for targeted growth and differentiation. Regional analyses underscore the importance of tailored market strategies that respect cultural tastes, regulatory environments, and channel dynamics. Moreover, leading companies’ strategic postures-from vertical integration to sustainability-driven branding-highlight the competitive levers available to market participants.

In sum, the canned seafood industry presents a compelling landscape marked by both challenges and prospects. By embracing transparency, leveraging digital channels, and forging strategic partnerships, industry leaders can navigate external pressures, capture new demand segments, and foster enduring brand loyalty. As the sector continues to evolve, proactive, data-driven decision-making will remain essential to harnessing untapped potential and to driving sustainable value creation.

Engage with Ketan Rohom for Immediate Access to the Comprehensive Canned Seafood Market Report and Personalized Strategic Insights

To explore the full breadth of our in-depth canned seafood market analysis and to secure a tailored briefing, interested stakeholders are encouraged to connect with Ketan Rohom (Associate Director, Sales & Marketing). By engaging directly, you will gain expedited access to the comprehensive report, including all strategic chapters, segmentation deep dives, and proprietary insights. His expertise ensures that your organization can swiftly leverage critical market intelligence to inform partnerships, product innovations, and growth strategies. Reach out without delay to schedule a personalized consultation and to elevate your competitive positioning with actionable data-driven recommendations.

- How big is the Canned Seafood Market?

- What is the Canned Seafood Market growth?

- When do I get the report?

- In what format does this report get delivered to me?

- How long has 360iResearch been around?

- What if I have a question about your reports?

- Can I share this report with my team?

- Can I use your research in my presentation?