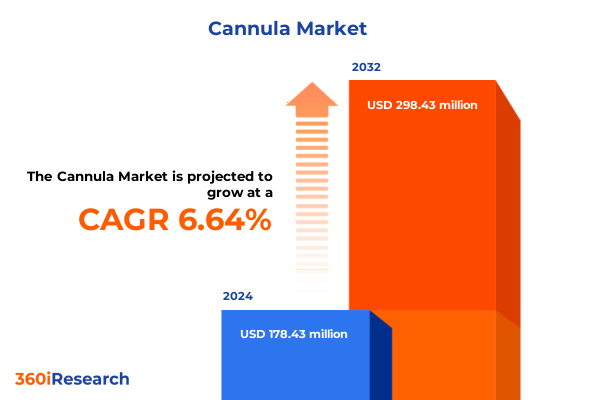

The Cannula Market size was estimated at USD 188.32 million in 2025 and expected to reach USD 204.77 million in 2026, at a CAGR of 6.79% to reach USD 298.43 million by 2032.

Exploring the Multifaceted Importance of Cannula Devices in Modern Healthcare and the Scope of This Comprehensive Executive Summary

Cannula devices have become indispensable across a wide spectrum of medical specialties, serving as thin tubes that facilitate fluid administration, gas delivery, medication infusion, and drainage within the human body. Originating from the Latin word “canna,” meaning tube or reed, these instruments trace their lineage to early surgical practices and have continuously evolved to meet modern clinical demands. Today, they encompass a diverse array of designs-from intravenous and arterial catheters to nasal oxygen prongs-each tailored to specific therapeutic and diagnostic applications.

Revolutionary Trends Shaping the Cannula Landscape Through Technological Breakthroughs and Evolving Clinical Practices

In recent years, the cannula landscape has undergone transformative shifts driven by both technological innovation and evolving patient preferences. In aesthetic medicine, the rise of microcannulas has enabled surgeons to sculpt delicate regions such as the chin and ankles with enhanced precision, yielding minimal tissue trauma and accelerated recovery times. Concurrently, high-definition liposuction techniques that integrate ultrasound and laser energy exemplify the industry’s pursuit of refined contouring and muscle definition without compromising safety. Transitioning to respiratory care, advancements in high-flow nasal cannula systems now deliver warmed, humidified oxygen at unprecedented flow rates, enhancing mucociliary clearance and patient comfort while reducing the risk of oxygen toxicity and epistaxis. Furthermore, the integration of imaging modalities and AI-driven guidance in robotic platforms is redefining surgical precision, with systems such as spatial surgery assistants offering real-time navigation to optimize cannulation pathways and mitigate complications. These converging currents underscore a broader trend toward minimally invasive procedures, bespoke device configurations, and data-empowered clinical workflows that collectively redefine patient care paradigms.

Assessing the Comprehensive Effects of United States Tariffs on Cannula Assemblies and Medical Device Supply Chains Throughout 2025

The implementation of escalated tariffs under Section 301 has introduced significant cost pressures on imported medical devices, including cannulae and related surgical consumables. As of September 2024, tariff rates for products such as syringes and needles increased to 100%, while rubber medical gloves and respirators faced duties ranging from 25% to 50%, triggering a ripple effect through device manufacturing and distribution networks. Complementing these measures, a 10% levy on Chinese medical supplies took effect in early 2025, tightening margins and prompting stock market adjustments for leading device companies. Healthcare providers have voiced concerns over potential supply chain disruptions and heightened operational costs, with hospital associations urging exemptions for essential devices to safeguard critical procedures and avoid therapeutic delays. Consequently, manufacturers and health systems alike face the dual challenge of navigating complex import regulations while preserving quality standards and continuity of patient care.

Unveiling Critical Segmentation Insights Illuminating How Cannula Applications, End Users, Product Types, and Materials Shape Clinical Utilization

Analyzing application segments reveals distinct usage patterns: cannula utilization in arthroscopy encompasses procedures ranging from hip to shoulder interventions, catering to both diagnostic evaluations and minimally invasive repairs; liposuction applications span from laser-assisted energy delivery to tumescent fluid techniques and ultrasound-powered emulsification; and ophthalmic surgeries leverage cannula designs for cataract extraction, glaucoma filtration, and vitreous body removal. Within end-user settings, ambulatory surgical centers harness cannulae for outpatient interventions, while hospitals integrate advanced systems in critical care suites; home healthcare leverages pre-sterilized kits and specialized services to support patient self-administration; and specialty clinics focusing on dermatology, ophthalmology, and cosmetic surgery adopt tailored cannula technologies to meet precise procedural demands. By product typology, disposable cannulae-offered in non-sterile and pre-sterilized variants-address high-volume applications, whereas microcannulas provide finesse in confined anatomical sites; penetrating options distinguish between blunt and trocar tips for controlled tissue entry; and standard cannulae, available in curved and straight geometries, serve general infusion and drainage uses. Material distinctions further define performance attributes: plastic cannulae lend flexibility for respiratory and short-term infusions; silicone-coated steel units balance pliability with smooth tissue passage; stainless steel devices offer durability for repeated sterilization cycles; and titanium cannulae deliver biocompatibility and corrosion resistance for specialized interventions.

This comprehensive research report categorizes the Cannula market into clearly defined segments, providing a detailed analysis of emerging trends and precise revenue forecasts to support strategic decision-making.

- Product Type

- Material Type

- Application

- End User

Dissecting Regional Variations in Cannula Adoption Across the Americas, EMEA, and Asia-Pacific Healthcare Markets

Across the Americas, robust healthcare infrastructures and centralized reimbursement mechanisms have accelerated the adoption of advanced cannula innovations, with providers emphasizing precision devices to optimize outpatient procedures and reduce hospital stays. Meanwhile, shifting trade policies have compelled manufacturers to localize production and diversify supply chains within North America, reinforcing resilience against external cost fluctuations. In Europe, Middle East, and Africa, regulatory harmonization under CE marking protocols has driven incremental safety enhancements and performance validations, yet diverse national frameworks continue to influence market entry timelines and procurements, prompting device makers to tailor approval strategies and partner with regional distributors. In the Asia-Pacific region, rising surgical volumes, expanding insurance coverage, and government incentives for onshore manufacturing catalyze demand for both consumable and reusable cannula formats; rapid urbanization and demographic shifts further fuel investments in hospital capacity and outpatient facilities, making APAC a focal point for growth and strategic localization efforts.

This comprehensive research report examines key regions that drive the evolution of the Cannula market, offering deep insights into regional trends, growth factors, and industry developments that are influencing market performance.

- Americas

- Europe, Middle East & Africa

- Asia-Pacific

Key Company Strategies Revealing How Market Leaders Are Innovating Cannula Technologies and Operational Models to Navigate Competitive Pressures

Leading device manufacturers are pursuing diverse strategies to strengthen their cannula portfolios and capture evolving clinical needs. Smith & Nephew’s recent performance update highlights that a majority of its growth stems from products introduced within the last five years, supported by a rigorous innovation pipeline that includes next-generation arthroscopic navigation, digital video guidance, and new intramedullary fixation systems. Meanwhile, Cook Medical has reconfigured its product breadth through targeted investments in minimally invasive technologies, exemplified by its strategic partnership in urology with Zenflow aimed at advancing obstruction-relief solutions. Medtronic’s focus on high-precision cannula manufacturing is underscored by its recent receipt of CE Mark approval for vessel-sealing technology integration on its robotic surgery platform, demonstrating a commitment to synergizing consumable designs with digital surgery systems. Across the industry, companies are consolidating clinical evidence through randomized controlled trials, real-world data registries, and systematic reviews to reinforce product differentiation and guide reimbursement discussions, while operational initiatives emphasize supply chain resilience and cost efficiency in response to tariff uncertainties.

This comprehensive research report delivers an in-depth overview of the principal market players in the Cannula market, evaluating their market share, strategic initiatives, and competitive positioning to illuminate the factors shaping the competitive landscape.

- B. Braun Melsungen AG

- Baxter International Inc.

- Becton, Dickinson and Company

- Cardinal Health, Inc.

- Cook Medical LLC

- Fisher & Paykel Healthcare Ltd

- Flexicare Medical Limited

- Merit Medical Systems

- Merit Medical Systems, Inc.

- Smiths Group plc

- Teleflex Incorporated

- Terumo Corporation

- Vyaire Medical, Inc.

Actionable Strategies for Industry Leaders to Safeguard Supply Chains, Elevate Clinical Evidence, and Differentiate Through Digital Integration

Industry leaders should prioritize strategic diversification of manufacturing footprints to mitigate tariff impacts and ensure uninterrupted device availability. Establishing regional hubs closer to key end-user markets can reduce lead times and enhance responsiveness to localized regulatory requirements. In parallel, deepening collaborations with clinician advisory panels and academic institutions will accelerate iterative design refinements and bolster clinical evidence, strengthening product positioning during tender evaluations. Embracing digital integration-linking cannula consumables to intelligent monitoring platforms-will create new value propositions in patient safety and procedural analytics, differentiating offerings in an increasingly data-driven healthcare ecosystem. Finally, adopting modular commercialization models that empower specialty clinics and homecare services with tailored device bundles can unlock underserved segments and reinforce customer loyalty in both emerging and developed healthcare markets. Each of these actions aligns with proven industry precedents and addresses the dual imperatives of cost containment and clinical excellence.

Comprehensive Research Methodology Combining Secondary Analysis, Primary Expert Interviews, and Rigorous Data Triangulation for Robust Insights

This report synthesizes insights from a robust research framework that integrates secondary and primary data streams. The secondary phase involved systematic analysis of peer-reviewed literature, regulatory filings, industry news, and company disclosures to map current technologies, tariff landscapes, and regional dynamics. Subsequently, primary research encompassed expert interviews with clinicians, procurement professionals, and device engineers to validate findings and uncover emerging trends. Quantitative data points underwent cross-validation through triangulation against industry benchmarks and financial disclosures, ensuring accuracy and consistency. Finally, key findings were subjected to stakeholder reviews, incorporating feedback loops with seasoned market participants to refine thematic narratives and actionable recommendations. This multi-layered approach underpins the report’s credibility, offering a balanced perspective grounded in empirical evidence and real-world experience.

This section provides a structured overview of the report, outlining key chapters and topics covered for easy reference in our Cannula market comprehensive research report.

- Preface

- Research Methodology

- Executive Summary

- Market Overview

- Market Insights

- Cumulative Impact of United States Tariffs 2025

- Cumulative Impact of Artificial Intelligence 2025

- Cannula Market, by Product Type

- Cannula Market, by Material Type

- Cannula Market, by Application

- Cannula Market, by End User

- Cannula Market, by Region

- Cannula Market, by Group

- Cannula Market, by Country

- United States Cannula Market

- China Cannula Market

- Competitive Landscape

- List of Figures [Total: 16]

- List of Tables [Total: 2226 ]

Synthesis of Key Findings Highlighting Technological Evolution, Supply Chain Imperatives, and Strategic Imperatives for Precision Care

The evolving cannula landscape reflects a convergence of innovation, regulatory change, and shifting clinical paradigms. Technological advancements-from microcannulas in cosmetic applications to AI-enabled surgical guidance-have expanded procedural capabilities while prioritizing patient comfort. Conversely, rising tariffs have underscored the need for agile supply chains and localized manufacturing to sustain device affordability and access. Segmentation insights highlight the diverse anatomical, end-user, and material considerations that shape product design and deployment, while regional analysis reveals how distinct market forces influence adoption trajectories. Collectively, these insights chart a roadmap for stakeholders to align product development, market access, and operational strategies with the imperatives of precision medicine and value-based care.

Contact Ketan Rohom to Unlock Tailored Insights and Acquire the Comprehensive Cannula Market Research Report

For personalized inquiries or to secure access to the full market research report on cannula devices and industry dynamics, please reach out to Ketan Rohom, Associate Director of Sales & Marketing. Ketan can guide you through our tailored solutions, discuss custom research requirements, and facilitate your organization’s strategic decision-making with comprehensive data insights. Engage with our expert team to explore how this report can empower your business objectives and accelerate growth in the evolving cannula market.

- How big is the Cannula Market?

- What is the Cannula Market growth?

- When do I get the report?

- In what format does this report get delivered to me?

- How long has 360iResearch been around?

- What if I have a question about your reports?

- Can I share this report with my team?

- Can I use your research in my presentation?