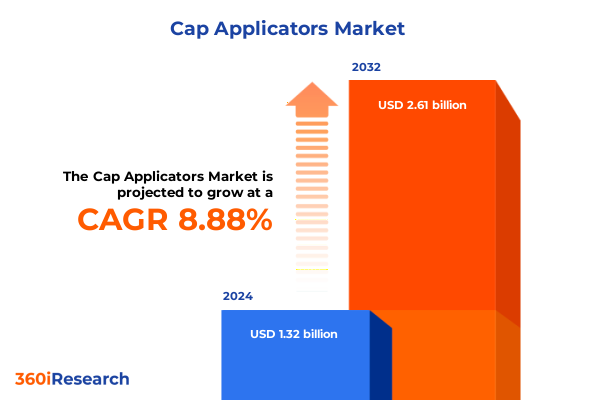

The Cap Applicators Market size was estimated at USD 1.42 billion in 2025 and expected to reach USD 1.53 billion in 2026, at a CAGR of 9.03% to reach USD 2.61 billion by 2032.

Unveiling the Current State of Cap Applicators Market Dynamics and Strategic Drivers Shaping Industry Adoption and Innovation Trends

The cap applicators market is undergoing a period of rapid evolution driven by rising demand for packaging precision, enhanced production speeds, and stringent quality control mandates across industries. In industries ranging from food and beverage to pharmaceuticals, manufacturers are seeking advanced technologies that reduce downtime while maintaining high throughput and consistency. This report provides a comprehensive examination of the current state of cap application systems, highlighting the key forces shaping their development and adoption.

Within this dynamic landscape, stakeholders are encountering a convergence of technological innovation and regulatory pressures that is redefining equipment specifications and performance benchmarks. Growing pressure to deliver tamper-evident, leak-proof, and aesthetically pleasing packages has pushed original equipment manufacturers and end users alike to deploy solutions that integrate seamlessly with upstream filling operations and downstream labeling and inspection processes. As part of our executive summary, we lay the groundwork for understanding these imperatives and set the stage for deeper insights into how the market is responding to contemporary challenges and opportunities.

Examining the Transformative Technological and Operational Shifts Redefining Efficiency Quality and Sustainability Across Cap Application Processes

The cap applicator landscape has been transformed by the integration of automation technologies, where manual, semi-automatic, and fully automatic systems are evolving to deliver higher throughput and adaptability. Many manufacturers have migrated from legacy manual cappers to sophisticated automated lines equipped with vision guidance systems, reducing human error and ensuring tighter torque control. This shift toward automation not only amplifies production rates but also supports predictive maintenance strategies, allowing for scheduled service interventions that minimize unexpected downtime.

Concurrently, the rise of the Industrial Internet of Things (IIoT) and machine-to-machine communication has catalyzed a new era of data-driven decision making. Cap applicators now often feature embedded sensors and connectivity modules that stream real-time torque, speed, and error data to centralized management platforms. By leveraging advanced analytics and cloud-based dashboards, operations leaders gain unprecedented visibility into bottlenecks and quality deviations, enabling responsive process adjustments and continuous improvement initiatives.

Sustainability considerations have also emerged as a transformative force. The transition from traditional materials toward lighter or recycled components has spurred innovation in application head design, requiring precise torque calibration to accommodate differing cap geometries and material properties. Manufacturers are increasingly adopting stainless steel or aluminum applicator heads to ensure corrosion resistance and longevity, while third-party providers offer upgrade kits that retrofit existing equipment for compatibility with greener materials.

Taken together, these technological and operational shifts are redefining performance expectations for cap applicators. Companies that embrace these advancements, while fostering cross-functional alignment between production, maintenance, and IT teams, are well-positioned to achieve both cost efficiencies and quality enhancements that align with contemporary market and regulatory demands.

Understanding the Cumulative Effects of 2025 United States Tariffs on Supply Chains Material Costs and Competitive Positioning in the Cap Applicator Landscape

Since early 2025, the implementation of escalated United States tariffs on imported aluminum and steel has reverberated throughout the cap applicator ecosystem. Raw material surcharges have driven component prices upward, compelling OEMs and end users to reevaluate supply chain strategies and seek alternative sourcing arrangements. As a result, many equipment manufacturers have accelerated qualification processes for domestic steel and aluminum suppliers to mitigate lead-time risks and dampen cost volatility.

The cumulative impact of these tariffs extends beyond material costs. Import restrictions have disrupted the spare parts market, leading to extended replacement intervals and increased costs for maintenance operations. Machinery downtime has become a critical concern, propelling service providers to stock critical inventory or to enter into strategic partnerships with distributors capable of rapid response across major production hubs. This shift has underscored the value of aftermarket agreements that guarantee parts availability within compressed timeframes.

Moreover, the broader cost pressures have triggered a gradual shift in total cost of ownership calculations. End users are placing greater emphasis on application solutions that deliver extended service intervals and modular designs capable of easy component swaps. This has bolstered interest in semi-automatic systems among small and medium manufacturers, where capital investment thresholds and operational flexibility often outweigh the benefits of fully automated lines. The trend underscores a recalibration of procurement criteria, with emphasis on lifecycle costs rather than upfront capital expenditure alone.

In response to these dynamics, cap applicator suppliers have intensified product development efforts aimed at lowering material dependencies and enhancing modularity. Some providers now offer hybrid systems that accommodate both plastic and aluminum caps with minimal changeover time, while others have introduced corrosion-resistant materials to extend component longevity. Such innovations represent strategic responses to the persistent uncertainty introduced by US tariff policy, reaffirming the market’s resilience and adaptability under shifting regulatory landscapes.

Gaining Deep Segmentation Insights Into Type Material Application and End User Dynamics That Influence Decision-making and Product Differentiation Strategies

Insight into the cap applicator market is enriched by examining how offerings vary based on type, material, application, end user, and distribution channel. Automatic systems, prized for high-speed production environments, have seen robust adoption in large-scale beverage bottling operations, while manual and semi-automatic alternatives maintain relevance among contract packagers and small to medium manufacturers prioritizing flexibility over volume. Torque control precision and ease of integration often guide the decision between semi-automatic and fully automatic solutions.

Material composition of application heads exerts a significant influence on performance and maintenance cycles. Aluminum heads offer lightweight handling and corrosion resistance but may require frequent calibration adjustments when switching between plastic and metal caps. Plastic components deliver cost-effective solutions for low-corrosion environments typically found in personal care applications, whereas stainless steel heads provide durability for aggressive cleaning regimes prevalent in pharmaceutical and dairy packaging.

Within application segments, differentiation emerges through both product specifications and process requirements. In the food and beverage arena, cap applicators must accommodate diverse subsegments such as carbonated and still beverages; torque consistency is paramount to prevent seal failure in carbonated lines. Paint and coating manufacturers demand applicators that withstand solvent exposure and operate reliably in variable viscosity environments. Personal care and pharmaceutical producers emphasize sterility and precision, often opting for stainless steel or hybrid-material systems that align with regulatory hygiene protocols and batch traceability mandates.

End users-comprising contract packagers and manufacturers-exhibit distinct purchasing criteria shaped by operational scale and strategic objectives. Private label packagers often value systems that prioritize rapid changeover and modular upgrades, enabling them to serve multiple clients with differing cap styles. Large-scale manufacturers emphasize fully integrated solutions with advanced monitoring features to support continuous production, while small and medium enterprises balance capital constraints with the need for robust, easy-to-maintain equipment. Distribution channels further color market dynamics; direct sales arrangements enable bespoke system design, whereas distributors and authorized aftermarket providers offer rapid parts supply and localized service, enhancing overall equipment availability.

This comprehensive research report categorizes the Cap Applicators market into clearly defined segments, providing a detailed analysis of emerging trends and precise revenue forecasts to support strategic decision-making.

- Type

- Cap Material

- Distribution Channel

- Application

- End User

Analyzing Regional Performance Variations Across Americas EMEA and Asia-Pacific to Uncover Growth Opportunities Regulatory Challenges and Market Nuances

Regional performance disparities in the cap applicator market reflect localized industry structures, regulatory environments, and supply chain ecosystems. In the Americas, strong demand from beverage and food producers drives uptake of high-speed automated capping lines, with industry hubs in the United States and Brazil serving as focal points for innovation and equipment procurement. Tariff impacts have spurred manufacturers to establish North American supply agreements, reinforcing regional resilience.

Europe, Middle East, and Africa (EMEA) present a heterogeneous landscape marked by strict regulatory standards around packaging safety and environmental compliance. German and Italian OEMs lead with advanced torque-controlled applicators that integrate with Industry 4.0 platforms, while emerging markets in Eastern Europe and North Africa show growing interest in cost-effective semi-automatic solutions. Consumer awareness around sustainability has also elevated demand for equipment capable of accommodating recycled materials and recyclable cap designs.

In the Asia-Pacific region, a confluence of large-scale food and beverage producers and expanding contract packaging facilities fuel robust growth in both manual and automated cap applicators. Japan and South Korea emphasize precision and integration with fully automated filling lines, while China and India increasingly prioritize systems that balance cost and adaptability. Local manufacturers in these markets have begun to offer competitively priced semi-automatic machines, prompting global OEMs to bolster service networks and localized support offerings.

Across these regions, distribution and service networks serve as critical differentiators. Aftermarket service providers offering spare parts, upgrades, and retrofits have become essential partners, particularly in regions where logistical constraints challenge rapid maintenance response. Authorized distributors and OEM supplier networks reinforce equipment uptime, while online offerings from supplier websites and third-party platforms expand accessibility for smaller operators seeking low-volume purchases.

This comprehensive research report examines key regions that drive the evolution of the Cap Applicators market, offering deep insights into regional trends, growth factors, and industry developments that are influencing market performance.

- Americas

- Europe, Middle East & Africa

- Asia-Pacific

Highlighting Key Industry Players Strategic Partnerships and Innovation Pathways Driving Product Development Operational Excellence and Market Leadership

Major players in the cap applicator market are delineating competitive advantage through targeted partnerships, technological alliances, and regional expansions. Several leading OEMs have forged collaborations with robotics integrators to expedite the deployment of turnkey solutions, enabling faster line commissioning and reducing integration risk for end users. These strategic alliances enhance the ability to deliver fully automated cells that seamlessly link filling, capping, and inspection processes.

Innovation pathways are increasingly driven by product enhancements centered on modularity and digitalization. Key manufacturers have introduced upgrade kits that retrofit existing machines with IIoT sensors, torque logging capabilities, and remote diagnostics portals. This approach addresses the growing demand for lifecycle management tools that enable predictive maintenance while lowering barriers to entry for smaller manufacturers seeking advanced performance features.

Mergers and acquisitions remain a focal point for expanding global footprints. Some multinational OEMs have acquired regional service specialists and spare-parts distributors to strengthen localized support networks, ensuring rapid response for maintenance and part replacements. These investments illustrate a dual strategy of reinforcing after-sales capabilities and acquiring niche technologies, bolstering competitive positioning and fostering end-to-end customer loyalty.

This comprehensive research report delivers an in-depth overview of the principal market players in the Cap Applicators market, evaluating their market share, strategic initiatives, and competitive positioning to illuminate the factors shaping the competitive landscape.

- Accutek Packaging Equipment Companies

- AROL S.r.l.

- Closure Systems International

- Coesia S.p.A.

- Crown Holdings, Inc.

- Federal Mfg. Co.

- GEA Group Aktiengesellschaft

- Karmelle Liquid Filling & Capping Solutions

- KHS GmbH

- Krones AG

- Marchesini Group

- New England Machinery, Inc.

- ProMach Inc.

- Sacmi Imola Società Cooperativa

- Sidel S.p.A.

- Syntegon Technology GmbH

- Tecnocap Group

- Tetra Pak International S.A.

Offering Actionable Recommendations to Industry Leaders for Leveraging Innovation Operational Agility and Strategic Positioning to Maximize Cap Applicator Success

Industry leaders should prioritize flexibility in equipment specifications by selecting cap applicator solutions with modular components that accommodate rapid changeovers and material variances. Investing in semi-automatic or hybrid systems during periods of tariff uncertainty can mitigate capital exposure while enabling future upgrades to fully automated lines as market conditions stabilize. This staged approach balances cost control with long-term performance objectives.

Embracing digital transformation is equally essential. Decision-makers must collaborate with suppliers offering IIoT-enabled accessories, real-time monitoring dashboards, and remote diagnostic services. Such partnerships facilitate proactive maintenance scheduling, optimize torque calibration practices, and provide data-driven insights into production efficiencies. Leaders who harness these capabilities will reduce unplanned downtime and achieve higher overall equipment effectiveness.

To navigate regional complexities, companies should cultivate robust distribution and service frameworks. Engaging authorized distributors who provide rapid spare parts delivery, retrofitting services, and localized technical support ensures consistent uptime across geographically dispersed operations. In parallel, organizations can explore online procurement channels to secure low-volume components and aftermarket accessories, enhancing agility in responding to unanticipated maintenance needs.

Detailing Rigorous Research Methodology Emphasizing Comprehensive Data Collection Triangulation and Analytical Frameworks Underpinning Market Insights

Our research methodology combines primary interviews with packaging engineers, operations managers, and procurement officers, alongside secondary analysis of industry publications, regulatory filings, and academic studies. This dual approach ensures that our findings reflect both hands-on operational realities and broader market dynamics. Through structured interviews, we captured firsthand perspectives on equipment performance, changeover challenges, and service expectations across diverse end users.

In parallel, we conducted a thorough review of white papers, trade association reports, and technical standards to map regulatory requirements and technological trends influencing the cap applicator sector. Data triangulation between primary insights and secondary sources allowed us to validate emerging themes in digitalization, sustainability, and supply chain adaptation. Our analysis deliberately excluded unverified speculation, focusing instead on documented case studies and performance benchmarks.

Quantitative data on equipment deployment, spare parts lead times, and maintenance intervals were synthesized from anonymized survey results provided by industry participants. These metrics were supplemented with qualitative narratives to contextualize the drivers behind procurement decisions, highlighting how variables such as capital constraints, production volumes, and regulatory pressures intersect to shape buyer preferences.

This section provides a structured overview of the report, outlining key chapters and topics covered for easy reference in our Cap Applicators market comprehensive research report.

- Preface

- Research Methodology

- Executive Summary

- Market Overview

- Market Insights

- Cumulative Impact of United States Tariffs 2025

- Cumulative Impact of Artificial Intelligence 2025

- Cap Applicators Market, by Type

- Cap Applicators Market, by Cap Material

- Cap Applicators Market, by Distribution Channel

- Cap Applicators Market, by Application

- Cap Applicators Market, by End User

- Cap Applicators Market, by Region

- Cap Applicators Market, by Group

- Cap Applicators Market, by Country

- United States Cap Applicators Market

- China Cap Applicators Market

- Competitive Landscape

- List of Figures [Total: 17]

- List of Tables [Total: 2067 ]

Concluding with Core Takeaways on Market Trends Technological Adoption Competitive Dynamics and Strategic Imperatives for Cap Applicator Stakeholders

In summary, the cap applicator market is defined by a continual push toward enhanced automation, digital integration, and material adaptability. Technological innovations in sensor-driven torque control and IIoT connectivity are elevating performance standards, while cost pressures arising from material tariffs are reshaping procurement strategies and supplier relationships. Sustainability initiatives and regulatory mandates add further complexity, compelling market participants to seek flexible, modular solutions.

Through a nuanced understanding of segmentation dynamics, regional nuances, and competitive strategies, stakeholders can navigate this evolving terrain with confidence. Whether optimizing production lines in high-volume beverage plants or deploying agile semi-automatic systems for contract packaging, informed decision-making underpinned by robust data will be critical. As the industry continues to adapt to both technological and geopolitical influences, those who embrace adaptability and strategic foresight will secure leadership positions in the cap applicator market.

Empowering Strategic Decisions with a Specialized Market Research Report and Personalized Consultation with Associate Director Sales and Marketing

Elevate your strategic decision-making by accessing the comprehensive market research report on cap applicators and securing a tailored consultation with Ketan Rohom, Associate Director of Sales & Marketing, to explore customized insights and partnership opportunities that align with your organization’s growth objectives

- How big is the Cap Applicators Market?

- What is the Cap Applicators Market growth?

- When do I get the report?

- In what format does this report get delivered to me?

- How long has 360iResearch been around?

- What if I have a question about your reports?

- Can I share this report with my team?

- Can I use your research in my presentation?