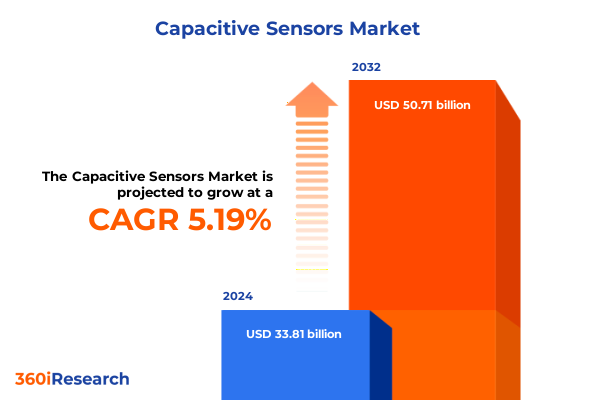

The Capacitive Sensors Market size was estimated at USD 35.54 billion in 2025 and expected to reach USD 37.21 billion in 2026, at a CAGR of 5.20% to reach USD 50.71 billion by 2032.

Laying the Groundwork for Capacitive Sensor Innovation by Exploring Foundational Principles and Emerging Industry Catalysts Driving Market Evolution

Capacitive sensors operate on fundamental electrostatic coupling principles to detect the presence and movement of conductive objects. These devices harness minute changes in capacitance created when an object, such as a finger or a conductive tool, approaches or contacts a sensing surface. A thin dielectric layer separates conductive plates or traces, and variations in the electric field between these elements are monitored by advanced electronics. As a result, capacitive sensing has emerged as a leading approach for touch detection, noncontact proximity monitoring, and gesture recognition across a breadth of applications.

Beyond basic detection, capacitive sensors deliver remarkable sensitivity and multi-touch functionality. This adaptability has enabled intuitive interfaces in smartphones, tablets, and interactive kiosks, reshaping user interactions. Consequently, the low-profile construction and flexibility of capacitive technologies have unlocked new possibilities in wearable electronics and automotive interiors, where seamless design and robustness are paramount.

In addition to user interface enhancements, capacitive detection plays a vital role in safety systems and industrial automation. Advanced proximity sensors mitigate collision risks in robotics and machinery, while environmental controls leverage capacitive monitoring to detect fluid levels and material presence. With rising demand for seamless human-machine interaction and automated oversight, the foundational principles of capacitive sensing continue to inspire innovation across sectors.

Looking ahead, integrating capacitive sensors with edge computing frameworks promises to elevate system intelligence by enabling local data processing and adaptive responses. This convergence supports predictive maintenance and remote monitoring, paving the way for more responsive environments in smart infrastructure and autonomous systems.

Revolutionizing the Industry Landscape through Connectivity, Artificial Intelligence, and Miniaturization Driving Next-Generation Capacitive Sensor Applications

The rise of connected devices and Internet of Things architectures has reshaped capacitive sensing by demanding lower power consumption and higher precision. Sensor modules are increasingly designed to integrate seamlessly with wireless protocols such as Bluetooth Low Energy, enabling real-time communication and intelligent asset tracking. As a result, touch and proximity sensors now serve as critical interface components in diverse systems, from smart home controllers to industrial monitoring networks.

Breakthroughs in artificial intelligence and machine learning have further enhanced capacitive sensor capabilities, transforming basic contact detection into sophisticated gesture and environmental interpretation. By applying neural network filters, systems can distinguish deliberate touches from inadvertent triggers such as moisture or metallic debris. Context-aware sensitivity adjustments enable optimized performance across applications, ensuring consistent operation in medical devices, automotive controls, and public kiosks where reliability and user experience are paramount.

Concurrently, advances in miniaturization and material science have broadened design possibilities for capacitive sensors. Utilizing thin-film substrates, microfabrication techniques, and durable coatings, manufacturers embed detection elements into curved surfaces, wearable fabrics, and sterilizable enclosures. This fusion of scale reduction and robust materials empowers innovators to introduce capacitive sensing into new product categories, delivering seamless interfaces in medical wearables, automotive interiors, and next-generation consumer electronics.

Unpacking the Strategic Impacts of 2025 United States Tariffs on Capacitive Sensor Supply Chains Procurement Costs and Industry Adaptation Dynamics

In early 2025, the United States implemented revised tariff schedules affecting a broad range of electronic components, including critical capacitive sensor modules and raw materials such as specialized glass substrates and conductive films. These duties, aimed at addressing trade imbalances, have driven up procurement costs and altered pricing structures throughout the supply chain. Manufacturers reliant on overseas fabrication and assembly are now assessing the cumulative financial impact of levies that have introduced new cost unpredictability into capacitive sensor production.

As a consequence of elevated tariffs, companies have accelerated efforts to qualify alternative suppliers, diversify sourcing strategies, and increase domestic production capacity. Original equipment manufacturers are negotiating long-term agreements with North American and European partners to mitigate exposure to import duties. In parallel, strategic inventory buffers and demand forecasting models are being refined to navigate tariff fluctuations and minimize stockouts. Moreover, cross-border partnerships have emerged to leverage tariff-free trade agreements or bonded warehousing arrangements.

Furthermore, the shifting economics have influenced research and development priorities, prompting engineers to explore materials and assembly techniques that offer similar performance at reduced cost basis. Some innovators are investing in automated inline inspection systems to streamline quality assurance and counterbalance added expenses. In addition, industry consortia and trade associations have intensified advocacy to clarify tariff classifications and secure exemptions for essential sensing technologies. Collectively, these adaptations underscore an industry-wide imperative to maintain competitiveness amid evolving trade policies.

Illuminating Segmentation Insights by Examining How Application, Technology, Product Type, and Material Shape Capacitive Sensor Use Cases

Capacitive sensors must be tailored to distinct application domains where performance parameters diverge. Automotive systems rely on infotainment displays, interior control panels, and safety proximity sensors that prioritize reliability and precision. In consumer electronics, laptops, smartphones, tablets, and increasingly wearables employ multi-touch detection with ergonomic design considerations. Healthcare devices such as diagnostic instruments and portable monitoring equipment demand sensitive and hygienic touch interfaces. Industrial environments integrate sensors for automated assembly, process monitoring, and robotic collision avoidance to optimize throughput.

Technology choice further informs implementation strategies, as mutual and self-capacitance architectures present complementary strengths. Mutual capacitance enables robust multi-point tracking with superior resolution, while self capacitance offers efficient single-axis proximity detection. Surface capacitive configurations deliver simplified electrode designs suited to basic touch panel applications. Additionally, the form factor of touch panels, touch screens, and touchpads dictates integration flexibility, allowing product developers to align sensor characteristics with user interaction expectations and device footprint constraints.

Material selection critically influences sensor durability and user experience, with film substrates like polycarbonate and polyethylene terephthalate providing lightweight flexibility for curved or foldable designs. Alternatively, glass materials such as alkali free and soda lime glass offer enhanced hardness and resistance to abrasion, ideal for sterilizable or high contact surfaces. Innovative hybrid laminates blend film flexibility with glass robustness, enabling capacitive elements to meet rigorous environmental and mechanical demands without compromising design aesthetics or functional integrity.

This comprehensive research report categorizes the Capacitive Sensors market into clearly defined segments, providing a detailed analysis of emerging trends and precise revenue forecasts to support strategic decision-making.

- Technology

- Product Type

- Material

- Application

Distilling Key Regional Dynamics Illustrating How the Americas, Europe Middle East Africa, and Asia Pacific Shape Capacitive Sensor Adoption and Innovation

In the Americas, strong innovation ecosystems and established manufacturing capabilities underpin capacitive sensor development. The United States leads in cutting-edge research, especially in autonomous vehicle controls and high-performance consumer electronics, while Canada’s technology clusters contribute advanced materials research. Mexico serves as a critical assembly hub, benefiting from nearshore manufacturing advantages and trade agreements. Consequently, regional collaboration fosters a resilient value chain that supports both rapid prototyping and large-scale production to meet North American demand.

Across Europe, the Middle East, and Africa, diverse regulatory and industry landscapes influence sensor adoption. Western Europe emphasizes stringent quality and environmental standards, driving demand for robust capacitive interfaces in automotive and healthcare sectors. Emerging markets in Eastern Europe and the Gulf region invest in industrial automation, where proximity sensing enhances safety and productivity. Furthermore, pan-regional coordination of research initiatives and harmonized certification processes streamline cross-border deployment, strengthening the competitive position of EMEA stakeholders.

Asia Pacific remains a powerhouse for capacitive sensor manufacturing and deployment, fueled by mass consumer electronics production in China, Japan, and South Korea. High-volume smartphone and wearable device assembly lines benefit from extensive supply chain networks and material sourcing efficiencies. Meanwhile, regional advances in robotics and factory automation spur adoption of proximity and touch sensing in industrial settings. Collaborative ventures between APAC technology firms and global OEMs continue to accelerate innovation, particularly in flexible sensor technologies and emerging IoT applications.

This comprehensive research report examines key regions that drive the evolution of the Capacitive Sensors market, offering deep insights into regional trends, growth factors, and industry developments that are influencing market performance.

- Americas

- Europe, Middle East & Africa

- Asia-Pacific

Unveiling Competitive Company Strategies Highlighting Product Innovations Partnerships and Market Positioning among Leading Capacitive Sensor Providers

Key industry participants have concentrated on refining capacitive sensing solutions to meet evolving performance and integration requirements. Leading semiconductor companies have introduced advanced multi-touch controllers that embed on-chip signal processing capabilities, reducing component count and streamlining system design. Meanwhile, module vendors collaborate with display and material specialists to deliver turnkey sensor integration kits, enabling faster time to market. This emphasis on integrated platforms underscores a drive toward complete hardware and software ecosystems rather than standalone components.

Strategic partnerships and mergers have propelled competitiveness, as chipmakers seek complementary strengths in materials expertise, packaging, and algorithm development. Several major players have acquired small innovative startups specializing in advanced haptic feedback or novel electrode designs, thereby expanding their intellectual property portfolios. Cross-industry collaborations with automotive and medical device manufacturers enable co-development of customized sensor solutions that address stringent regulatory and functional requirements. These alliances facilitate shared roadmaps and align product evolution with end-user demands.

Companies differentiate their offerings through proprietary material science and tailored software toolchains that deliver optimized performance in specific scenarios. Advanced coating technologies, flexible circuit substrates, and embedded calibration routines enhance sensor resilience against environmental stressors such as temperature variations and mechanical wear. Moreover, open ecosystem initiatives provide developers with comprehensive design guides, reference code, and evaluation platforms, fostering broader adoption and innovation. As a result, leading suppliers position themselves as strategic partners capable of delivering holistic sensing ecosystems.

This comprehensive research report delivers an in-depth overview of the principal market players in the Capacitive Sensors market, evaluating their market share, strategic initiatives, and competitive positioning to illuminate the factors shaping the competitive landscape.

- 3M Company

- Alps Alpine Co., Ltd.

- ams-OSRAM AG

- Analog Devices, Inc.

- Azoteq (Pty) Ltd.

- Broadcom Inc.

- Cirque Corporation (part of Wacom Co., Ltd.)

- Cypress Semiconductor Corporation

- Infineon Technologies AG

- Integrated Device Technology, Inc.

- Melexis NV

- Microchip Technology Inc.

- NXP Semiconductors N.V.

- ROHM Co., Ltd.

- Semtech Corporation

- Silicon Laboratories Inc.

- STMicroelectronics N.V.

- Synaptics Incorporated

- Texas Instruments Incorporated

- Vishay Intertechnology, Inc.

Driving Capacitive Sensor Innovation with Actionable Recommendations to Strengthen Supply Chain Resilience and End User Engagement Strategies

To maintain a leadership position, organizations should prioritize investment in modular sensing architectures that accelerate time to market and support scalable feature upgrades. By establishing cross-functional teams that integrate hardware engineers, software developers, and user experience designers, companies can streamline development cycles and align product roadmaps with emerging use cases. It is also beneficial to allocate resources toward exploring novel materials and packaging processes that reduce component costs while preserving sensor performance and reliability in harsh environments.

In response to evolving trade policies and component availability, it is advisable to diversify supplier networks and cultivate strategic sourcing agreements with regional partners. Establishing multi-tiered inventory management and just-in-time delivery frameworks can mitigate risk from tariff fluctuations and logistical disruptions. Furthermore, evaluating alternative assembly locations and participating in bonded warehousing programs will provide added flexibility. Companies should also engage in collaborative forecasting exercises with key suppliers to improve visibility and optimize production planning.

Enhancing end user engagement requires delivering comprehensive development support and accessible evaluation tools. Firms should consider launching online platforms offering reference designs, calibration utilities, and interactive training modules to reduce integration complexity. Forming advisory councils with key customers will enable the collection of real-world feedback and inform iterative product enhancements. Additionally, pursuing joint marketing initiatives and co-branded demonstrations at industry events will reinforce brand authority and foster deeper relationships with design-in community and OEM stakeholders.

Outlining Research Framework Integrating Primary Interviews Secondary Analysis and Data Triangulation for Reliable Capacitive Sensor Industry Intelligence

Our research framework begins by leveraging a comprehensive secondary analysis of publicly available technical papers, patent filings, regulatory filings, and corporate disclosures. These sources provide a detailed baseline of technology roadmaps, material innovations, and historical industry developments. In parallel, trade association reports and relevant academic literature contribute deeper insights into emerging sensing techniques and regulatory trends. This broad literature review establishes a solid foundation for subsequent primary data collection and validation.

In the primary research phase, structured interviews are conducted with executives, product engineers, and supply chain managers across key semiconductor firms and system integrators. These conversations elicit firsthand perspectives on design challenges, deployment strategies, and tariff impacts. Additionally, surveys distributed to end user organizations capture practical considerations related to installation, maintenance, and performance metrics. The integration of diverse stakeholder viewpoints ensures that qualitative findings reflect real world priorities and constraints.

Data triangulation unites findings from secondary sources, primary interviews, and survey feedback to reconcile inconsistencies and reinforce robustness. Quantitative analytics techniques are applied to synthesize performance attributes, material preferences, and technology adoption patterns. Moreover, expert validation panels review preliminary insights to refine interpretations and confirm applicability across regional contexts. This mixed methods approach guarantees that the final insights are grounded in empirical evidence and aligned with current industry dynamics.

This section provides a structured overview of the report, outlining key chapters and topics covered for easy reference in our Capacitive Sensors market comprehensive research report.

- Preface

- Research Methodology

- Executive Summary

- Market Overview

- Market Insights

- Cumulative Impact of United States Tariffs 2025

- Cumulative Impact of Artificial Intelligence 2025

- Capacitive Sensors Market, by Technology

- Capacitive Sensors Market, by Product Type

- Capacitive Sensors Market, by Material

- Capacitive Sensors Market, by Application

- Capacitive Sensors Market, by Region

- Capacitive Sensors Market, by Group

- Capacitive Sensors Market, by Country

- United States Capacitive Sensors Market

- China Capacitive Sensors Market

- Competitive Landscape

- List of Figures [Total: 16]

- List of Tables [Total: 1749 ]

Concluding Synthesis Emphasizing Strategic Imperatives in Capacitive Sensing and Charting the Path ahead for Continued Technological Advancement

Throughout this summary, we have explored the foundational principles, transformative shifts, tariff impacts, and segmentation nuances that define the current landscape of capacitive sensing. By examining the interplay of connectivity, artificial intelligence, and material innovation, it is clear that the industry has entered a phase of rapid convergence. Regional dynamics and supply chain realignments underscore the importance of agility and collaborative partnerships, while leading companies demonstrate the power of integrated hardware, software, and ecosystem strategies.

Crucially, the evolving regulatory environment and trade policies necessitate proactive supply chain diversification and supplier collaboration. Organizations that streamline sourcing, invest in domestic assembly, and engage in industry advocacy will be better positioned to maintain cost competitiveness and product availability. Simultaneously, prioritizing sensor architectures that support flexible form factors and advanced gesture recognition will unlock new user experiences and revenue streams across automotive, healthcare, industrial, and consumer electronics applications.

Looking forward, capacitive sensing is poised to play an increasingly integral role in next generation interfaces, smart infrastructure, and autonomous systems. Industry stakeholders should embrace a holistic approach that bridges technical innovation with customer centricity and resilient operational models. By synthesizing the strategic imperatives outlined herein, decision makers can chart a course that leverages capacitive technologies to deliver compelling product differentiation and sustainable growth in an ever more connected world.

Take the Next Step to Secure Premium Capacitive Sensor Market Intelligence by Engaging with Ketan Rohom to Acquire the Comprehensive Industry Report

To capitalize on the insights detailed in this report, reach out to Associate Director of Sales & Marketing, Ketan Rohom. By connecting with Ketan, you will gain access to the full suite of analysis covering technological trends, tariff implications, segmentation strategies, and regional dynamics critical to driving your business forward.

Secure your copy of the comprehensive market research report today to equip your team with actionable intelligence and strategic foresight on capacitive sensing. Partner with a trusted advisor who can guide you through tailored service options and deliver the in depth support required to leverage emerging opportunities and overcome industry challenges.

- How big is the Capacitive Sensors Market?

- What is the Capacitive Sensors Market growth?

- When do I get the report?

- In what format does this report get delivered to me?

- How long has 360iResearch been around?

- What if I have a question about your reports?

- Can I share this report with my team?

- Can I use your research in my presentation?