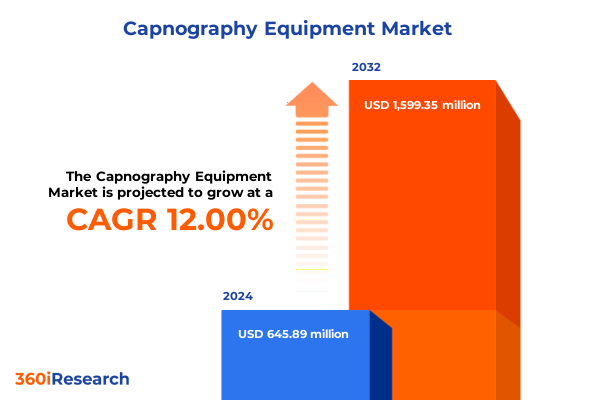

The Capnography Equipment Market size was estimated at USD 717.76 million in 2025 and expected to reach USD 799.32 million in 2026, at a CAGR of 12.12% to reach USD 1,599.34 million by 2032.

Revolutionizing Patient Safety Through Advanced Precision Carbon Dioxide Monitoring in the Evolving Landscape of Modern Capnography Equipment Technologies

Capnography, the real-time monitoring of carbon dioxide concentration in respiratory gases, has become an indispensable tool for clinicians seeking immediate insights into a patient's ventilatory status. This technology, originally developed for anesthesia and intensive care settings, generates capnograms that enable the detection of hypoventilation, circuit disconnection, or esophageal intubation, thereby significantly enhancing patient safety and clinical decision-making.

Over the past decade, the application of capnography has expanded beyond the operating room into non-traditional clinical environments such as emergency departments, ambulatory surgery centers, and critical care transport. The adoption of portable devices and user-friendly interfaces has facilitated continuous monitoring even during procedural sedation and opioid administration, reflecting a broader shift towards safeguarding patients against respiratory compromise across the continuum of care.

Navigating a New Era of Respiratory Monitoring as Technological, Clinical, and Regulatory Dynamics Accelerate Capnography Evolution

Technological innovations are reshaping capnography equipment as manufacturers integrate advanced sensor modalities and algorithm-driven analytics. Mainstream infrared absorption spectroscopy and microstream molecular correlation spectroscopy technologies now deliver faster response times and accurate measurements at lower flow rates, thus accommodating neonatal to adult patient populations with unprecedented precision. Concurrently, the convergence of capnography waveforms with patient monitoring platforms underscores a trend towards unified, multi-parameter monitors, enabling seamless exchange of data across anesthesia machines, ventilators, and electronic health record systems.

From a clinical perspective, updated guidelines by anesthesia and airway societies mandate continuous capnographic monitoring during intubations and procedural sedation, positioning CO₂ monitoring as a cornerstone of minimal anesthesia safety standards. This regulatory endorsement has prompted hospitals to retrofit existing monitoring systems with capnography modules, while emerging markets are prioritizing affordable mainstream and sidestream options to meet guideline-driven demands in resource-constrained environments.

Assessing How the 2025 U.S. Tariff Regime Reshapes Supply Chains and Cost Structures in Capnography Equipment Markets

Since early 2025, the United States has implemented a series of tariffs on medical device imports, including equipment containing semiconductors, steel, and aluminum components, raising duties to 25% or higher. These measures have introduced significant cost pressures for capnography manufacturers reliant on global supply chains, compelling procurement teams to reevaluate total cost of ownership and prompting some vendors to nearshore assembly operations to mitigate duty burdens.

Industry leaders such as Philips have reported an estimated €250-300 million net impact on their 2025 earnings due to ongoing trade tensions and tariff effects, despite efforts to localize manufacturing in key markets. These financial headwinds have led to revised profit margin forecasts and strategic price adjustments aimed at preserving market share in North America, the largest capnography revenue region.

Similarly, leading global innovator Siemens Healthineers has highlighted the risk of product delays and inflated capital costs for U.S. hospitals, underscoring the broader implications for access to critical monitoring technologies. Hospital administrators have expressed concerns over budget uncertainties, with some deferring noncritical equipment upgrades until trade policies stabilize, further complicating the procurement landscape for capnography solutions.

Unveiling Market Nuances Through In-Depth Analysis of Product Types, Technologies, End Users, and Application Domains in Capnography

In examining product portfolios, capnography offerings are delineated between portable, handheld configurations and standalone monitoring systems. Portable solutions cater to pre-hospital and bedside mobility demands, enabling rapid deployment in emergency and transport settings, while standalone units provide comprehensive module integration for operating suites and intensive care units.

Technological bifurcation into mainstream and sidestream methods further differentiates market positioning, as clinicians balance the direct measurement fidelity of mainstream infrared sensors against the lower dead space and wider versatility of sidestream microstream sampling lines. The trade-off between accuracy, sampling rate, and disposables cost informs procurement decisions in diverse clinical scenarios.

End-user segmentation encompasses ambulatory surgery centers, where high procedural volumes demand cost-efficient disposable tubing and rapid device turnover; outpatient clinics focusing on procedural sedation; and hospitals, which include government-run institutions prioritizing standardization and private hospitals emphasizing advanced analytics and integration with enterprise monitoring systems.

Finally, application-based analysis reveals that critical care monitoring remains the most pervasive use case, with capnography integral to ventilator management and sepsis screening, followed by emergency department applications where rapid airway assessment is vital. Operating rooms continue to rely on continuous CO₂ waveforms for anesthesia delivery oversight, driven by regulatory mandates and patient safety protocols.

This comprehensive research report categorizes the Capnography Equipment market into clearly defined segments, providing a detailed analysis of emerging trends and precise revenue forecasts to support strategic decision-making.

- Product Type

- Technology

- End User

- Application

Understanding Regional Variances: Examining Capnography Demand Drivers Across the Americas, Europe, Middle East & Africa, and Asia-Pacific

Across the Americas, robust healthcare infrastructure, elevated anesthesia procedural volumes, and stringent patient safety regulations drive widespread adoption of advanced capnography systems. The region’s high prevalence of chronic respiratory conditions further underscores the critical need for continuous CO₂ monitoring, positioning North America as a strategic bedrock for leading OEMs.

In Europe, Middle East & Africa, demand is characterized by a dual landscape. Western European markets emphasize system integration and software analytics within established hospital networks, while emerging markets in Eastern Europe and the Middle East are increasingly investing in both mainstream and sidestream devices to address growing surgical caseloads. Collaborative initiatives to bolster domestic manufacturing and localize after-sales support are gaining traction to enhance supply chain resilience.

In Asia-Pacific, rapid expansion in outpatient and ambulatory care settings, coupled with rising procedural sedation volumes, is catalyzing the uptake of portable and cost-effective capnography modules. Governmental incentives for domestic innovation, alongside an aging population and escalating respiratory disease burden, underscore the region’s position as the fastest-growing market segment, offering significant growth potential for adaptable and scaled manufacturing strategies.

This comprehensive research report examines key regions that drive the evolution of the Capnography Equipment market, offering deep insights into regional trends, growth factors, and industry developments that are influencing market performance.

- Americas

- Europe, Middle East & Africa

- Asia-Pacific

Profiling Leading Innovators and Strategic Collaborators Driving Competitive Advantage and Technological Progress in the Capnography Sector

Masimo continues to advance capnography innovation through its acquisition of Phasein and the development of NomoLine ISA sampling lines, integrating both mainstream and sidestream OEM solutions within its ROOT patient monitoring platform. The company’s focus on low-dead-space waterless sampling and flexible module configurations has bolstered its role as a preferred technology partner for system integrators and device manufacturers.

Medtronic’s Microstream technology, underpinned by Molecular Correlation Spectroscopy and proprietary Smart Breath Detection (SBD) and Smart Alarm for Respiratory Analysis (SARA) algorithms, delivers high-precision CO₂ waveforms with minimal calibration requirements. The integration of Microstream modules into GE’s CARESCAPE monitoring platform exemplifies a successful OEM partnership, enhancing global access to multi-parameter patient monitoring solutions.

GE HealthCare has fortified its capnography portfolio by embedding CO₂ Microstream parameter devices into its enterprise CARESCAPE monitors and forging collaborations with Medtronic and other OEM suppliers. These strategic alliances underscore a broader shift towards interoperable monitoring ecosystems, enabling healthcare providers to leverage unified interfaces and data analytics across diverse care settings.

Philips has focused on localizing production in North America and China to navigate tariff pressures, while embedding capnography modules in IntelliVue patient monitors through its partnership with Masimo. The company’s efforts to harmonize device ecosystems aim to streamline user training and reduce integration complexity within hospital IT infrastructures.

Nihon Kohden maintains leadership in mainstream CO₂ sensing with its cap-ONE sensor and OLG-3800 portable monitor, offering a heaterless, motorless design that meets stringent shock resistance standards. This compact form factor, coupled with high-resolution displays and battery operation, addresses both intubated and non-intubated patient monitoring requirements across procedural and transport scenarios.

Mindray’s introduction of the BeneVision V Series and MRV Pod enhances bedside versatility by integrating ultrasound-derived hemodynamics with optional cable-lite capnography modules via its BeneLink Connectivity Module. The system’s open-architecture framework and wireless capabilities reflect a growing emphasis on interoperability and workflow optimization in critical care environments.

This comprehensive research report delivers an in-depth overview of the principal market players in the Capnography Equipment market, evaluating their market share, strategic initiatives, and competitive positioning to illuminate the factors shaping the competitive landscape.

- Avante Health Solutions, LLC

- Becton, Dickinson and Company

- BPL Medical Technologies Private Limited

- Burtons Medical Equipment Limited

- Criticare Technologies, Inc.

- Diamedica (UK) Limited

- Drägerwerk AG & Co. KGaA

- Edan Instruments, Inc.

- General Electric Company

- Hamilton Medical AG

- ICU Medical, Inc.

- Infinium Medical, Inc.

- Koninklijke Philips N.V.

- Masimo Corporation

- Medtronic plc

- Mindray Medical International Limited

- Nihon Kohden Corporation

- Nonin Medical, Inc.

- Schiller AG

- Spacelabs Healthcare, Inc.

- Welch Allyn, Inc.

- Zoe Medical, Inc.

- ZOLL Medical Corporation

Strategic Roadmap for Industry Leaders to Capitalize on Emerging Capnography Opportunities and Mitigate Trade and Technological Challenges

As tariff-driven cost escalations and supply chain disruptions persist, industry leaders should pursue diversified manufacturing footprints, incorporating nearshore assembly sites in the U.S., Europe, and Asia-Pacific to hedge against trade policy volatility. Establishing robust partnerships with regional suppliers and securing long-term component agreements can further insulate profit margins from abrupt tariff adjustments and geopolitical risks.

To capitalize on the digital transformation of patient monitoring, organizations should invest in AI-enabled waveform analytics that detect respiratory compromise patterns, such as early sepsis and airway obstruction, and integrate subscription-based software updates into service agreements. Emphasizing cybersecurity compliance and adherence to FDA pre-market software guidance will foster stakeholder trust and facilitate seamless EHR interoperability.

Adoption of modular capnography architectures, supporting both mainstream and sidestream modalities through interchangeable OEM modules, can reduce capital expenditures and streamline maintenance workflows. Training initiatives for clinical staff, focused on interpreting advanced capnography metrics and leveraging integrated monitoring platforms, will drive higher utilization rates and improve patient safety outcomes.

Comprehensive Research Framework Employing Multi-Source Data Collection, Primary Expert Interviews, and Rigorous Validation for Report Credibility

This research report was developed through a rigorous methodology encompassing extensive secondary research, primary expert interviews, and data triangulation. Secondary data was sourced from peer-reviewed journals, regulatory guidelines, company press releases, and industry white papers, while primary inputs were gathered through structured interviews with capnography OEM executives, clinical end users, and leading procurement specialists.

Data validation involved cross-referencing multiple information streams, reconciling discrepancies through follow-up consultations, and applying statistical checks to ensure consistency across datasets. Market trends and strategic insights were contextualized against historical policy shifts, such as U.S. tariff escalations and guideline updates from anesthesia societies, providing a robust analytical framework to underpin executive recommendations and future forecast scenarios.

This section provides a structured overview of the report, outlining key chapters and topics covered for easy reference in our Capnography Equipment market comprehensive research report.

- Preface

- Research Methodology

- Executive Summary

- Market Overview

- Market Insights

- Cumulative Impact of United States Tariffs 2025

- Cumulative Impact of Artificial Intelligence 2025

- Capnography Equipment Market, by Product Type

- Capnography Equipment Market, by Technology

- Capnography Equipment Market, by End User

- Capnography Equipment Market, by Application

- Capnography Equipment Market, by Region

- Capnography Equipment Market, by Group

- Capnography Equipment Market, by Country

- United States Capnography Equipment Market

- China Capnography Equipment Market

- Competitive Landscape

- List of Figures [Total: 16]

- List of Tables [Total: 954 ]

Synthesizing Critical Findings to Illuminate Future Trajectories and Strategic Imperatives for Capnography Equipment Stakeholders in Healthcare

In summary, the capnography equipment market is undergoing a dynamic transformation, driven by technological innovations, evolving clinical guidelines, and complex trade environments. The intersection of advanced sensor modalities, integrated monitoring platforms, and regulatory imperatives positions capnography as a pivotal tool for enhancing patient safety across diverse care settings.

Looking ahead, resilience in supply chain design, strategic alliances with technology partners, and investment in data-driven monitoring solutions will define market leaders. As healthcare providers continue to prioritize real-time respiratory monitoring, manufacturers equipped to navigate tariff landscapes and deliver interoperable, AI-enhanced devices are poised to seize growth opportunities and shape the next generation of patient care.

Partner with Ketan Rohom to Secure Exclusive Insights and Acquire the Definitive Capnography Equipment Market Research Report Today with Expert Guidance

To access the full depth of market intelligence, detailed analysis, and executive insights on the capnography equipment landscape, we invite you to connect with Ketan Rohom, Associate Director of Sales & Marketing. Secure your organization’s strategic advantage by purchasing the comprehensive market research report and unlocking actionable data tailored to your needs.

- How big is the Capnography Equipment Market?

- What is the Capnography Equipment Market growth?

- When do I get the report?

- In what format does this report get delivered to me?

- How long has 360iResearch been around?

- What if I have a question about your reports?

- Can I share this report with my team?

- Can I use your research in my presentation?