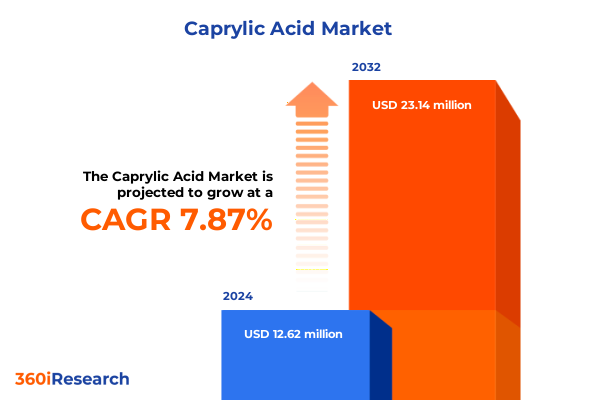

The Caprylic Acid Market size was estimated at USD 13.62 million in 2025 and expected to reach USD 17.07 million in 2026, at a CAGR of 7.85% to reach USD 23.13 million by 2032.

Exploring the Multifaceted Applications of Caprylic Acid Across Key Industries Amid Rising Demand for Sustainable Chemical Solutions

Caprylic acid, also known by its chemical designation octanoic acid, has emerged as a vital medium-chain fatty acid prized for its molecular simplicity and multifunctional properties. Naturally sourced from coconut oil and palm kernel oil, caprylic acid delivers potent antimicrobial and antifungal activity, making it an indispensable ingredient in food preservation processes that extend product shelf life while minimizing reliance on synthetic additives. As a medium-chain triglyceride constituent, it has become a cornerstone of ketogenic and low-carbohydrate dietary supplements, supplying rapid energy and supporting metabolic health thanks to its efficient hepatic processing.

The compound’s attributes have secured its place in diverse industrial and consumer-facing applications. Within the personal care sector, caprylic acid functions as an emollient and skin-conditioning agent, imparting a light, non-greasy feel while delivering anti-inflammatory benefits that resonate with the growing demand for natural, clean-label formulations. In pharmaceutical contexts, its osmotic and preservative qualities bolster the stability and efficacy of drug delivery systems, particularly in antimicrobial preservative roles. The convergence of these performance characteristics with consumer preference for bio-derived ingredients has established caprylic acid at the intersection of innovation and sustainability in specialty chemicals.

Uncovering the Transformative Shifts Redrawing the Global Caprylic Acid Landscape Through Innovative Technologies and Evolving Regulations

Over the past few years, the caprylic acid market landscape has been reshaped by a convergence of technological breakthroughs and evolving regulatory imperatives. Chief among these transformative shifts is the accelerating pivot toward green chemistry paradigms, where enzymatic hydrolysis and supercritical fluid extraction are replacing traditional, energy-intensive processes. Lipase-driven reactions have shortened reaction cycles and reduced solvent waste, while supercritical CO₂ extraction delivers high-purity acid fractions that align with stringent regulatory and consumer expectations for residue-free ingredients.

Simultaneously, the industry has begun to harness the potential of microbial fermentation as a sustainable production vector. Innovative chain-elongation techniques employing Clostridium kluyveri and other specialized microbial strains have demonstrated the capability to produce caprylic acid directly from waste substrates, such as acid whey or lignocellulosic hydrolysates, thereby integrating circular economy principles into medium-chain fatty acid manufacturing. This shift not only reduces dependency on tropical oil feedstocks but also mitigates environmental impact and supply chain volatility linked to commodity price swings.

These advancements coexist with tightening regulations aimed at curbing deforestation and lowering carbon footprints across chemical supply chains. Sustainability taxes, import-duty incentives for eco-friendly processes, and mandatory product disclosure requirements are driving manufacturers to reengineer their value chains. As a result, companies that embrace these technological and regulatory shifts are securing competitive advantage by differentiating their offerings through enhanced environmental credentials and cost efficiencies.

Assessing the Cumulative Financial, Strategic, and Supply Chain Impact of New 2025 United States Section 301 Tariffs on Essential Caprylic Acid Imports

Under the U.S. Harmonized Tariff Schedule, caprylic acid imported into the United States is classified under subheading 2915.90.1050, which encompasses saturated acyclic monocarboxylic acids and their derivatives, and carries a base tariff rate of 5 percent ad valorem. This foundational duty applies uniformly to imports from most trading partners, reflecting long-standing tariff commitments under the World Trade Organization framework.

However, the imposition of Section 301 tariffs by the Office of the United States Trade Representative has layered significant additional cost burdens on caprylic acid shipments originating from China. Following the statutory four-year review process concluded in late 2024, an extra 25 percent ad valorem duty came into effect on January 1, 2025, targeting a broad array of specialty chemicals, including medium-chain fatty acids. Consequently, Chinese-origin caprylic acid now faces a combined tariff of 30 percent, amplifying supply chain complexities and raising landed costs for U.S. consumers.

These tariff measures, combined with reciprocal actions taken by trading partners and the extension of certain exclusions only through mid-2025, have introduced pronounced price volatility and sourcing challenges. Procurement teams are navigating a delicate balance between cost containment and supply security, prompting a reassessment of regional sourcing strategies and an urgent exploration of domestic or non-Chinese supply alternatives.

Delivering Unique Strategic Insights into Key Caprylic Acid Market Segmentation Unveiling End Use Industry, Source Origins, and Production Method Nuances

Caprylic acid’s market segmentation reveals nuanced demand drivers across distinct end-use industries. In animal nutrition, the acid’s potent antimicrobial feed additive properties are deployed to enhance livestock health, while its pellet binding capacity contributes to feed integrity and nutrient delivery efficiencies. Feed supplements enriched with caprylic acid are also valued for their digestibility and potential to bolster gut microbiota balance.

Turning to food and beverage applications, caprylic acid serves as a natural preservative in bakery products, beverages, confectioneries, and dairy items, effectively inhibiting microbial spoilage and extending shelf life in clean-label formulations. Industrial usage underscores its role in biolubricants, detergents, and plasticizer production, where its medium-chain structure delivers favorable viscosity profiles and biodegradability characteristics. Within personal care, its incorporation as an antiseptic, cleanser, or emollient enables multifunctional skincare solutions, while in pharmaceuticals, its osmotic agent attributes aid controlled-release formulations and its capsule lubricant capabilities optimize solid-dose manufacturing.

Examining the market through the lens of source material, caprylic acid is procured from animal fats such as lard and tallow, derived synthetically via chemical synthesis and biosynthesis routes, or extracted from vegetable oils like coconut and palm kernel oil. Meanwhile, production methodologies span traditional chemical synthesis-leveraging distillation and esterification pathways-innovative fermentation processes including enzymatic and microbial chain-elongation, and physical fractionation techniques such as membrane and solvent separation. Each production avenue carries distinct cost, purity, and sustainability trade-offs that inform strategic supply chain decisions.

This comprehensive research report categorizes the Caprylic Acid market into clearly defined segments, providing a detailed analysis of emerging trends and precise revenue forecasts to support strategic decision-making.

- Source

- Production Method

- End Use Industry

Exploring the Critical Regional Insights Redefining Caprylic Acid Market Trajectories Across the Americas, EMEA Dynamics, and the Asia-Pacific Surge

In the Americas, the United States leads global consumption of caprylic acid, driven by a robust dietary supplement market, mature food and beverage manufacturing infrastructure, and a strong personal care sector. Domestic producers and processors benefit from advanced logistical networks and proximity to major end-use customers, yet they are contending with tariff-induced cost pressures that have prompted increased valuation of near-shoring and domestic synthesis investments.

Europe, the Middle East, and Africa exhibit a diverse regulatory landscape, with the European Union’s stringent clean-label mandates and eco-design directives fueling demand for sustainably sourced caprylic acid in cosmetics and pharmaceutical applications. In this region, companies are actively pursuing circular-economy certifications and leveraging regional oleochemical clusters in Northwest Europe to secure stable supply chains and mitigate feedstock risk.

The Asia-Pacific region emerges as the fastest-growing market, buoyed by expanding food and beverage industries, rising consumer health awareness, and the ready availability of coconut and palm kernel oils in Malaysia, Indonesia, and the Philippines. Government incentives aimed at fostering green chemistry and value-added processing are accelerating local fermentation-based production initiatives, positioning Asia-Pacific producers to capture a larger share of both domestic and export markets.

This comprehensive research report examines key regions that drive the evolution of the Caprylic Acid market, offering deep insights into regional trends, growth factors, and industry developments that are influencing market performance.

- Americas

- Europe, Middle East & Africa

- Asia-Pacific

Analyzing Key Competitive Landscapes, Strategic Partnerships, and Innovation Drivers Guiding Top Companies in the Caprylic Acid Industry

The competitive landscape of the caprylic acid market is anchored by established oleochemical and specialty chemical companies that command scale and distribution networks. Wilmar International, KLK OLEO, Musim Mas Group, Oleon NV, and Emery Oleochemicals are recognized for their integrated operations spanning feedstock sourcing, production, and global sales channels. These players leverage multi-feedstock flexibility and strategic partnerships to navigate raw material price fluctuations and tariff exposures.

Recent strategic developments underscore a wave of capacity expansions and product portfolio enhancements. In March 2025, Stepan announced the expansion of its Illinois production facility to meet growing demand for MCT-based ingredients, including caprylic acid derivatives, underscoring the emphasis on domestic manufacturing resilience. Similarly, VVF Ltd. introduced a range of caprylic-based emulsifiers catering to clean-label skincare brands, illustrating how product innovation is driving differentiation in saturated markets.

Emerging biotechnology firms are also making inroads with fermentation-based production platforms. Companies harnessing engineered microbial strains to convert waste streams into caprylic acid are attracting investor interest, offering prospects of a lower-carbon footprint supply and novel feedstock diversification. This confluence of traditional oleochemical strength and biotech innovation is shaping a more dynamic and opportunity-rich competitive environment.

This comprehensive research report delivers an in-depth overview of the principal market players in the Caprylic Acid market, evaluating their market share, strategic initiatives, and competitive positioning to illuminate the factors shaping the competitive landscape.

- Acme-Hardesty by Jacob Stern & Sons, Inc.

- BariteWorld

- Central Drug House (P) Ltd.

- Chemical Associate India

- Croda International Plc

- Emery Oleochemicals GmbH

- Excellentia International

- IOI Oleochemical

- Kao Corporation

- KLK EMMERICH GmbH

- Mosselman S.A.

- Musim Mas Group

- Oleocomm Global SDN BHD

- Oleon NV

- Otto Chemie Pvt. Ltd.

- OXEA GmbH

- Permata group

- Procter & Gamble Chemicals

- PT Bakrie Sumatera Plantations Tbk

- The Merck Group

- Thermo Fisher Scientific Inc.

- Vigon International, LLC

- Vizag Chemicals

- VVF LLC

- Wilmar International Limited

Implementing Actionable Strategies, Investment Roadmaps, and Forward-Looking Recommendations to Enhance Caprylic Acid Market Leadership and Supply Chain Resilience

Industry leaders should prioritize the diversification of feedstock sources to mitigate tariff-related cost fluctuations and supply disruptions, exploring regional coconut and palm kernel oil alternatives alongside synthetic and fermentation-derived streams. Strategic alliances with biotech startups can accelerate access to novel microbial production processes, enhancing sustainability credentials and reducing environmental impact.

Investment in advanced processing technologies-such as enzymatic hydrolysis and supercritical fluid extraction-can strengthen product purity and address emerging regulatory requirements. Equally, deploying real-time analytics and automation across manufacturing operations will improve yield consistency and lower per-unit production costs.

Engagement with trade authorities and participation in tariff exclusion review processes can yield favorable policy outcomes. Companies should maintain proactive dialogues with government stakeholders to shape exclusion criteria and monitor shifting trade landscapes.

Finally, expanding product applications in fast-growing segments such as gut-health supplements, clean-label cosmetics, and eco-friendly industrial formulations will unlock new revenue streams. Tailoring R&D roadmaps to address these end-use pockets, while leveraging the antimicrobial and functional benefits of caprylic acid, will reinforce market leadership and drive long-term growth.

Unveiling a Robust Research Methodology Blending Primary Interviews, Secondary Data, and Rigorous Analytical Frameworks for Caprylic Acid Study

This analysis integrates both primary and secondary research methodologies to ensure comprehensive coverage of the caprylic acid market. Primary research included in-depth interviews with industry executives, feedstock suppliers, technology providers, and tariff specialists, yielding qualitative insights into evolving production practices, regulatory shifts, and strategic priorities.

Secondary research leveraged reputable trade publications, government tariff databases, and peer-reviewed journals to validate market trends, technological advancements, and regional dynamics. Key sources included alignment with HTSUS classifications for tariff impact assessment, as well as industry reports detailing production methods and competitive landscapes.

Data synthesis was conducted through a rigorous analytical framework encompassing segmentation analysis, SWOT assessments, and PESTEL considerations. Cross-validation between quantitative trade statistics and qualitative expert perspectives ensured the robustness of strategic conclusions and actionable recommendations.

This section provides a structured overview of the report, outlining key chapters and topics covered for easy reference in our Caprylic Acid market comprehensive research report.

- Preface

- Research Methodology

- Executive Summary

- Market Overview

- Market Insights

- Cumulative Impact of United States Tariffs 2025

- Cumulative Impact of Artificial Intelligence 2025

- Caprylic Acid Market, by Source

- Caprylic Acid Market, by Production Method

- Caprylic Acid Market, by End Use Industry

- Caprylic Acid Market, by Region

- Caprylic Acid Market, by Group

- Caprylic Acid Market, by Country

- United States Caprylic Acid Market

- China Caprylic Acid Market

- Competitive Landscape

- List of Figures [Total: 15]

- List of Tables [Total: 2385 ]

Concluding Perspectives Highlighting the Strategic Importance of Caprylic Acid Amidst Emerging Market Trends and Regulatory Dynamics and Offering a Future Outlook

The strategic importance of caprylic acid lies in its distinctive combination of antimicrobial efficacy, functional versatility, and alignment with clean-label and sustainability imperatives. Technological advancements in green extraction, enzymatic processing, and microbial fermentation are redefining cost structures and environmental footprints, creating a new competitive frontier for producers and end-use manufacturers alike.

Simultaneously, tariff landscapes driven by Section 301 measures and reciprocal trade actions have underscored the criticality of supply chain resilience and regional diversification. Companies that adapt through flexible sourcing, policy engagement, and process innovation will emerge as market leaders.

Looking ahead, the convergence of consumer preference for natural, sustainable ingredients with regulatory momentum toward circular economy principles presents a compelling growth trajectory for caprylic acid. Stakeholders that harness these dual drivers through strategic investments and collaborative partnerships will be best positioned to capture emerging opportunities and deliver value across the entire value chain, and Offering a Future Outlook

Connect with Ketan Rohom to Secure Comprehensive Caprylic Acid Market Research Insights and Elevate Your Strategic Decisions

To arrange your access to the comprehensive Caprylic Acid market research report and unlock tailored strategic insights, we encourage you to connect directly with Ketan Rohom, Associate Director of Sales & Marketing. Drawing on deep expertise in specialty chemicals and an intimate understanding of evolving market dynamics, Ketan can guide you through the report’s detailed analyses and help identify the most relevant data for your business objectives. Reach out to Ketan Rohom to secure the full report, explore customized subscription options, and accelerate your decision-making with authoritative intelligence on caprylic acid.

- How big is the Caprylic Acid Market?

- What is the Caprylic Acid Market growth?

- When do I get the report?

- In what format does this report get delivered to me?

- How long has 360iResearch been around?

- What if I have a question about your reports?

- Can I share this report with my team?

- Can I use your research in my presentation?