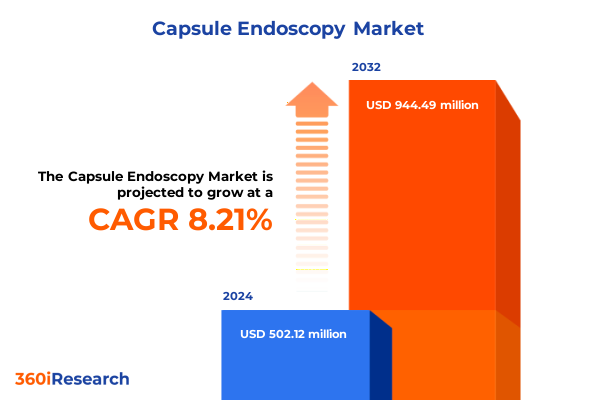

The Capsule Endoscopy Market size was estimated at USD 541.09 million in 2025 and expected to reach USD 583.89 million in 2026, at a CAGR of 8.28% to reach USD 944.49 million by 2032.

Understanding the Rising Importance of Capsule Endoscopy as a Minimally Invasive Diagnostic Innovation Transforming Gastrointestinal Healthcare Delivery

The realm of gastrointestinal diagnostics has been profoundly transformed by the advent of capsule endoscopy, offering a minimally invasive alternative to traditional endoscopic techniques. As healthcare systems worldwide emphasize patient comfort and procedural efficiency, capsule endoscopy stands at the intersection of innovation and clinical necessity. Early detection of gastrointestinal disorders relies heavily on the ability to visualize mucosal linings in the small intestine and beyond, areas historically challenging to access via conventional endoscopy. By encapsulating high-resolution imaging within a swallowable device, clinicians gain unprecedented visibility into obscure bleeding sources, mucosal inflammation, and tumor development, all while enhancing the patient experience.

In parallel, the integration of advanced imaging sensors and extended battery lives has elevated diagnostic yield and procedural reliability, reinforcing the modality’s role in routine clinical workflows. Reimbursement frameworks in key markets have evolved to accommodate this technology, further catalyzing its adoption across ambulatory surgical centers, diagnostic facilities, and hospitals. Consequently, capsule endoscopy is no longer a niche diagnostic tool but has become an integral component of comprehensive gastrointestinal care. This introduction sets the stage for a deeper exploration into the paradigm shifts, economic influences, segmentation dynamics, and strategic imperatives that define the current landscape of capsule endoscopy technologies.

Revolutionary Technological and Clinical Advancements Reshaping the Dynamics and Accessibility of Capsule Endoscopy Procedures Across Global Healthcare Systems

Over the past several years, the capsule endoscopy arena has witnessed a convergence of technological breakthroughs and clinical practice enhancements that have redefined diagnostic capabilities. Artificial intelligence–driven image analysis has moved from pilot studies to clinical integration, enabling real-time lesion detection and pattern recognition that significantly reduce false negatives. Concurrent advancements in telemedicine infrastructure support remote monitoring of capsule transit and automated data transmission, facilitating prompt clinical interventions and reducing patient follow-up burdens.

Meanwhile, the development of specialized capsules tailored to distinct gastrointestinal segments-ranging from esophageal to colon applications-has diversified clinical utility, allowing physicians to target diagnostic procedures with greater precision. Material science innovations have introduced biocompatible coatings that minimize foreign body discomfort and battery chemistries that extend operational lifespans beyond eight hours. These developments, coupled with evolving reimbursement frameworks that recognize the modality’s cost-effectiveness, have collectively accelerated the transition of capsule endoscopy from specialized centers to mainstream diagnostic protocols. As such, transformative shifts in technology, clinical acceptance, and healthcare policy are converging to establish capsule endoscopy as a cornerstone in the continuum of gastrointestinal diagnostics.

Assessing the Comprehensive Economic and Operational Effects of Newly Implemented United States Tariffs on Capsule Endoscopy Devices and Supply Chains

The introduction of new tariff regulations in the United States during 2025 has generated a complex set of challenges and opportunities for stakeholders in the capsule endoscopy supply chain. Increased import duties on electronic components and specialized imaging sensors have elevated production costs for manufacturers relying on globalized sourcing networks. As a result, cost pressures have prompted device producers to reevaluate procurement strategies, spurring a shift toward nearshoring electronic assembly and exploring strategic partnerships with domestic suppliers to preserve margin stability.

Concurrently, distributors and healthcare providers have experienced adjustments in pricing structures, leading to renegotiated service agreements and reimbursement discussions with payers. In response, several leading manufacturers have absorbed portions of the tariff increases through optimized manufacturing efficiencies and volume-based discounts, aiming to mitigate patient-level cost escalation. Although some organizations report temporary logistical slowdowns as new customs procedures are implemented, the cumulative impact has galvanized investment in supply chain resilience, including redundant supplier networks and advanced inventory management systems. Ultimately, these shifts are shaping a more robust and agile ecosystem capable of withstanding future trade policy fluctuations.

Insightful Analysis of Capsule Endoscopy Market Segmentation Revealing Diverse Applications Patient Demographics and Mode Preferences Driving Clinical Adoption

Distilling the capsule endoscopy market through varied lenses illuminates critical differentiation points that influence clinical preference and adoption rates. When examining product type, one must consider the distinct diagnostic roles of Colon Capsule Endoscopy, Esophageal Capsule Endoscopy, and Small Bowel Capsule Endoscopy, each optimized for specific anatomical challenges. The choice between Reusable Capsules and Single Use Capsules hinges on procedural volumes and sterilization protocols, with reusable devices often favored in high-throughput centers and disposables preferred where cross-contamination risks are paramount.

Age group segmentation underscores unique clinical needs across Adult, Geriatric, and Pediatric populations, driving design considerations such as capsule size and transit duration. Application-based distinctions further deepen this complexity, as indications ranging from Celiac Disease to Colon Cancer Screening, Crohn’s Disease to Gastroesophageal Reflux Disease, Obscure Gastrointestinal Bleeding to Small Intestine Tumors and Ulcer Detection require tailored imaging resolutions and data analysis workflows. Distribution channels, encompassing Offline and Online pathways, determine procurement agility and technical support availability, particularly in remote or emerging markets. Finally, end user environments such as Ambulatory Surgical Centers, Diagnostic Centers, Hospitals, and Research Institutes impose divergent demands on device compatibility, data integration, and throughput capacity. Collectively, these segmentation insights reveal a nuanced landscape where product configuration, patient demographics, clinical indication, and operational context converge to shape strategic decision-making.

This comprehensive research report categorizes the Capsule Endoscopy market into clearly defined segments, providing a detailed analysis of emerging trends and precise revenue forecasts to support strategic decision-making.

- Product Type

- Endoscopy Mode

- Age Group

- Application

- Distribution Channel

- End User

Critical Regional Perspectives Unveiling Distinct Market Drivers Regulatory Environments and Adoption Trends in Americas Europe Middle East Africa and Asia-Pacific

A granular assessment of regional dynamics reveals differentiated momentum in the uptake and integration of capsule endoscopy technologies. In the Americas, robust reimbursement policies and extensive healthcare infrastructure have fueled widespread adoption, with leading centers pioneering advanced clinical protocols and publishing outcome data that validate real-world efficacy. North America continues to set benchmarks in procedural standardization and payor collaboration, while Latin American markets are showing promising interest as access programs and localized training initiatives expand.

Europe, the Middle East & Africa region presents a mosaic of regulatory frameworks and healthcare priorities. Western European nations benefit from coordinated regulatory pathways and established endoscopy networks, amplifying clinical research partnerships and technology sharing. In contrast, emerging markets within the Middle East and Africa are gradually integrating capsule endoscopy through selective public-private partnerships, leveraging mobile health units and telemedicine to bridge gaps in specialist availability.

Asia-Pacific stands out for its rapid technological adoption and large patient pools. Governments across the region are investing in digital health strategies that align with capsule endoscopy’s strengths in non-invasive diagnostics. Strategic collaborations between local medical device firms and global technology providers have accelerated product localization and aftermarket service infrastructure, propelling the region toward becoming a global innovation hub for next-generation endoscopic modalities.

This comprehensive research report examines key regions that drive the evolution of the Capsule Endoscopy market, offering deep insights into regional trends, growth factors, and industry developments that are influencing market performance.

- Americas

- Europe, Middle East & Africa

- Asia-Pacific

In-Depth Examination of Leading Capsule Endoscopy Manufacturers Highlighting Strategic Collaborations Technological Innovations and Competitive Positioning

The competitive landscape of capsule endoscopy is characterized by the presence of established medtech corporations alongside nimble specialist firms. Leading manufacturers distinguish themselves through continuous innovation in imaging resolution, battery performance, and AI-powered diagnostic software. Strategic collaborations with academic research centers have catalyzed the development of next-generation capsules featuring multispectral imaging and real-time data analytics.

Mid-sized companies are leveraging focused R&D investments to differentiate their offerings, often targeting niche applications such as ultra-thin capsules for pediatric use or specialized coatings to enhance mucosal contrast. Partnerships with cloud computing providers and telehealth platforms are enabling end-to-end service bundles that integrate data management, image interpretation, and patient reporting. In parallel, several entrants have prioritized regulatory approvals in emerging markets to capitalize on first-mover advantages, establishing local assembly and training hubs to streamline deployment.

Furthermore, strategic acquisitions and licensing agreements continue to reshape market positions, as firms seek to complement their portfolios with additive diagnostic technologies and software capabilities. Collectively, these corporate maneuvers underscore a trend toward convergence of hardware excellence and digital health services, laying the foundation for more comprehensive gastrointestinal diagnostic ecosystems.

This comprehensive research report delivers an in-depth overview of the principal market players in the Capsule Endoscopy market, evaluating their market share, strategic initiatives, and competitive positioning to illuminate the factors shaping the competitive landscape.

- Advin Health Care

- Anx Robotica Corp.

- Beijing Richen-Force Science & Technology Co.,Ltd

- Biocam Sp. z o.o.

- CapsoVision, Inc.

- Covestro AG

- Duomed Group

- Fujifilm Holding Corporation

- Intromedic co., Ltd

- JINSHAN Science & Technology (Group) Co., Ltd.

- Medtronic PLC

- MU Ltd.

- Olympus Corporation

- RF Systems Lab

- Shangxian Minimal Invasive Inc

- STERIS

- SynMed Ltd.

Strategic Imperatives and Actionable Steps for Industry Leaders to Navigate Market Complexities Capitalize on Innovation and Strengthen Competitive Advantage

Industry leaders must adopt a multifaceted strategy to harness emerging opportunities and navigate evolving challenges within the capsule endoscopy sector. Firstly, investing in advanced AI and machine learning capabilities will be paramount to reduce diagnostic turnaround times and enhance lesion detection accuracy. Developing modular software platforms that integrate seamlessly with existing hospital IT infrastructures can accelerate adoption curves and foster stickier customer relationships.

Secondly, strengthening supply chain resilience through geographic diversification and strategic nearshoring initiatives can mitigate the impacts of trade policy fluctuations, ensuring consistent device availability. Establishing localized manufacturing or assembly operations in key markets will not only offset tariff risks but also improve responsiveness to regional regulatory requirements.

Furthermore, forging deeper partnerships with payors and healthcare networks to co-design value-based reimbursement models will be critical in demonstrating cost-effectiveness and driving broader market penetration. Companies should also explore strategic alliances with telehealth providers and patient engagement platforms to deliver holistic diagnostic care pathways. Lastly, dedicating resources to targeted clinical studies across diverse patient demographics and indications will validate the utility of capsule endoscopy in new therapeutic areas, expanding its clinical footprint and building stronger evidence for payor coverage.

Comprehensive Research Framework Combining Qualitative and Quantitative Methodologies to Ensure Rigorous Analysis and Reliable Insights in Capsule Endoscopy Studies

This report’s findings are grounded in a comprehensive research framework that synthesizes both qualitative and quantitative methodologies. Primary research activities included in-depth discussions with key opinion leaders, gastroenterologists, supply chain experts, and regulatory authorities to capture nuanced perspectives on clinical practice patterns and policy impacts. Meanwhile, a structured survey of endoscopy centers across multiple regions provided empirical data on device utilization trends and service delivery models.

Secondary research encompassed the systematic review of peer-reviewed journals, regulatory filings, health technology assessments, and clinical trial registries. This robust foundation was complemented by continuous monitoring of trade policies, patent filings, and corporate press releases to ensure currency of insights. Data triangulation techniques were employed to validate assumptions and reconcile conflicting information, thereby enhancing the reliability of conclusions. Finally, expert panel workshops facilitated iterative refinement of key segmentation frameworks and regional analyses, ensuring that the report aligns closely with real-world market dynamics.

This section provides a structured overview of the report, outlining key chapters and topics covered for easy reference in our Capsule Endoscopy market comprehensive research report.

- Preface

- Research Methodology

- Executive Summary

- Market Overview

- Market Insights

- Cumulative Impact of United States Tariffs 2025

- Cumulative Impact of Artificial Intelligence 2025

- Capsule Endoscopy Market, by Product Type

- Capsule Endoscopy Market, by Endoscopy Mode

- Capsule Endoscopy Market, by Age Group

- Capsule Endoscopy Market, by Application

- Capsule Endoscopy Market, by Distribution Channel

- Capsule Endoscopy Market, by End User

- Capsule Endoscopy Market, by Region

- Capsule Endoscopy Market, by Group

- Capsule Endoscopy Market, by Country

- United States Capsule Endoscopy Market

- China Capsule Endoscopy Market

- Competitive Landscape

- List of Figures [Total: 18]

- List of Tables [Total: 1113 ]

Synthesizing Key Findings to Illuminate Future Pathways for the Capsule Endoscopy Sector Emphasizing Emerging Opportunities and Strategic Considerations

In summary, capsule endoscopy has evolved into a cornerstone of non-invasive gastrointestinal diagnostics, driven by technological refinements, expanding clinical applications, and conducive policy landscapes. Transformative shifts such as AI integration, specialized capsule variants, and telemedicine enablement are redefining diagnostic paradigms. Meanwhile, external factors including trade policies are influencing supply chain strategies and cost structures, prompting stakeholders to adapt through nearshoring and strategic partnerships.

The detailed segmentation analyses underscore the importance of tailoring product attributes and service models to specific anatomical, demographic, and clinical needs. Regional insights highlight diverse adoption trajectories shaped by reimbursement environments and healthcare infrastructure maturity. Against this backdrop, leading manufacturers are forging collaborative networks and digital health alliances to maintain competitive positioning.

As healthcare systems prioritize patient-centric and cost-effective solutions, capsule endoscopy is poised to capture an ever-larger role in screening, diagnosis, and disease management pathways. By embracing data-driven innovation, robust operational planning, and strategic engagement with key stakeholders, industry players can unlock the full potential of this transformative technology.

Drive Informed Decisions and Secure Competitive Growth by Acquiring the Comprehensive Capsule Endoscopy Market Report Through Direct Engagement with the Associate Director

Elevate your strategic decision-making by engaging directly with Ketan Rohom, Associate Director of Sales & Marketing, to acquire the definitive capsule endoscopy market research report. This opportunity delivers unparalleled access to comprehensive insights, enabling you to optimize your product development roadmap, refine go-to-market strategies, and anticipate emerging regulatory shifts. A personalized consultation with Ketan ensures that you obtain tailored guidance on interpreting the report’s findings for maximum competitive impact. Secure your organization’s strategic advantage today by connecting with Ketan Rohom to initiate the acquisition process and unlock the full value of this critical market intelligence.

- How big is the Capsule Endoscopy Market?

- What is the Capsule Endoscopy Market growth?

- When do I get the report?

- In what format does this report get delivered to me?

- How long has 360iResearch been around?

- What if I have a question about your reports?

- Can I share this report with my team?

- Can I use your research in my presentation?