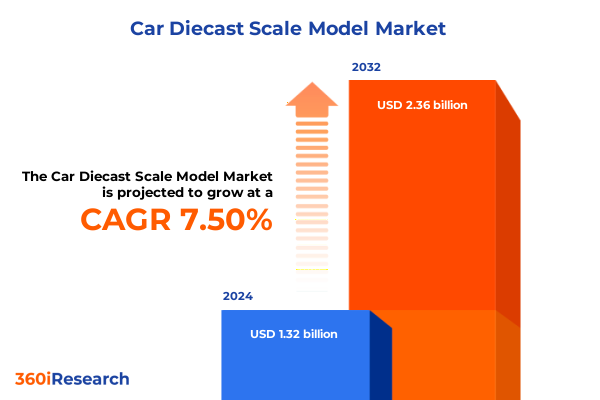

The Car Diecast Scale Model Market size was estimated at USD 1.40 billion in 2025 and expected to reach USD 1.49 billion in 2026, at a CAGR of 7.70% to reach USD 2.36 billion by 2032.

Introduction to the Emerging Dynamics and Fundamental Forces Shaping the Global Car Diecast Scale Model Industry Landscape Worldwide

The car diecast scale model industry continues to thrive as a nexus between nostalgia, advanced manufacturing and collectible culture. Originating from early post-war toy cars, the market has evolved into a sophisticated ecosystem where precision engineering meets licensing partnerships with leading automotive brands. Today’s enthusiasts range from passionate hobbyists assembling dioramas to corporate collectors seeking limited-edition releases, reflecting a diverse consumer base with multifaceted motivations. This introductory section frames the historical evolution of diecast models and underscores their enduring appeal as both decorative art and investment asset.

Recent developments reveal a convergence of traditional craftsmanship with cutting-edge technologies such as 3D printing for prototyping and injection molding for high-precision components. These technological integrations have reduced lead times and improved part consistency, enabling manufacturers to offer intricate detailing at multiple price tiers. Meanwhile, the licensing landscape has expanded beyond automotive OEMs to include entertainment franchises and cultural icons, broadening the scope of collectible series. Consequently, stakeholders must navigate a complex web of intellectual property agreements, production logistics and consumer expectations.

Looking ahead, this industry stands at the intersection of digital transformation and tangible product innovation. E-commerce platforms increasingly serve as primary distribution channels, allowing niche brands to reach global audiences with minimal physical footprint. Concurrently, augmented reality previews and virtual assembly tutorials are enhancing customer engagement, signaling a new era of immersive interaction. This introduction sets the stage for a deeper exploration of the market’s transformative shifts, regulatory impacts and strategic segmentation insights.

How Digital Innovation Sustainability Licensing and Community Engagement Are Driving Transformative Shifts in the Car Diecast Scale Model Ecosystem

The car diecast scale model ecosystem is undergoing a wave of transformation driven by digital innovation and shifting consumer values. E-commerce penetration has accelerated year-on-year as collectors and hobbyists increasingly seek exclusive drops and direct-to-consumer releases. Social media communities are amplifying limited-edition launches, creating rapid sell-out cycles and fueling secondary market activity. Simultaneously, manufacturers are adopting on-demand production models to balance inventory risks and cater to micro-niche audiences.

Sustainability considerations are also reshaping production philosophies. Several leading brands have begun experimenting with recycled metal alloys and bio-based plastics to reduce carbon footprints. These material innovations not only address environmental concerns but also resonate with eco-conscious collectors who value ethical sourcing. Partnerships with certification bodies are emerging to validate eco-credentials, further embedding sustainability into brand narratives.

Licensing strategies and community engagement have converged to foster deeper consumer loyalty. Co-creative campaigns invite enthusiasts to vote on new release designs or provide feedback on prototype concepts. This participatory approach not only drives pre-order commitments but also cultivates long-term brand ambassadors. As a result, industry participants are investing in digital platforms that facilitate interactive storytelling, virtual assembly workshops and immersive unboxing experiences, laying the foundation for the next frontier in collectible automotive miniatures.

Analyzing the Cumulative Impact of the 2025 United States Tariff Measures on Supply Chains Cost Structures and Industry Competitiveness

The introduction of new tariff measures by the United States in 2025 has imposed a multi-tiered layer of duties on imported metals and plastics, directly influencing production costs and supply chain configurations. Manufacturers who historically relied on cost-effective sourcing from Asia have faced recalibrated sourcing strategies, with some opting to relocate final assembly closer to end markets. This shift has prompted a reevaluation of factory footprints and logistics networks, as businesses seek to mitigate elevated duty burdens while maintaining lead time efficiencies.

Cost pass-through to consumers has varied based on brand positioning and product tier. Premium series with highly detailed diecast metal components have seen moderate price adjustments to preserve margin structures, whereas entry-level plastic-heavy offerings have absorbed a larger portion of duty increases to remain accessible. These pricing strategies have influenced purchase behaviors, with a segment of price-sensitive collectors trading down to mixed-material lines or delaying acquisitions until promotional cycles align with tariff exemptions.

Beyond pricing, the tariff environment has accelerated negotiations between manufacturers and local foundries for aluminum and zinc alloy casting, stimulating domestic capacity expansions. Concurrently, cross-border partnerships and tariff consultancy services have become integral to ensuring compliance with harmonized tariff subheadings. As the dust settles on the latest duty regimen, industry players are poised to adopt hybrid sourcing models that blend regional production hubs with targeted import volumes, balancing cost optimization with regulatory resilience.

Unveiling Critical Segmentation Insights by Vehicle Types and Material Compositions Illuminating Opportunities in Car Diecast Scale Modeling

A granular examination of industry segmentation reveals that vehicle type remains a foundational lens through which product portfolios are tailored. Sedans continue to command steady interest, offering collectors iconic models from executive saloons to luxury cruisers. The sports car segment, bifurcated into high-end and mid-range categories, exhibits contrasting dynamics: high-end variants emphasize master-class detailing and limited runs, whereas mid-range counterparts balance aspirational designs with broader price accessibility. SUVs and trucks, drawing inspiration from both heritage off-roaders and modern utility vehicles, have gained traction as lifestyle symbols among collectors seeking robust and contemporary model selections.

Material composition constitutes a second axis of market differentiation. Diecast metal offerings, crafted from aluminum or zinc alloy, attract purists who prioritize heft, finish quality and structural resilience. In contrast, mixed materials products combine metal chassis elements with plastic components to optimize production flexibility and cost efficiency. Fully plastic constructions, while lighter, maintain appeal through innovative molding techniques and paint applications that replicate metal aesthetics at entry-level price points. As manufacturers refine material blends, they strategically position new launches to capture evolving consumer preferences and leverage cost structures that align with tariff pressures.

Integrating these segmentation perspectives enables a holistic view of portfolio management. By overlaying vehicle type preferences with material choices, firms can forecast demand clusters-such as high-end sports cars in zinc alloy for seasoned collectors or plastic SUVs for casual enthusiasts-thus informing targeted design, pricing and promotional initiatives. This dual segmentation framework supports more accurate inventory planning and fosters the development of complementary accessories and display solutions that enhance collector engagement.

This comprehensive research report categorizes the Car Diecast Scale Model market into clearly defined segments, providing a detailed analysis of emerging trends and precise revenue forecasts to support strategic decision-making.

- Material

- Scale

- End User

- Distribution Channel

Deciphering Regional Dynamics Across the Americas Europe Middle East Africa and Asia Pacific to Drive Strategic Decisions in Car Diecast Scale Models

Regional dynamics in the car diecast scale model industry illustrate how cultural preferences, licensing infrastructures and distribution frameworks converge to shape global demand patterns. In the Americas, the collector community is buoyed by a deep-seated automotive heritage and a robust network of hobby conventions. Iconic muscle cars and classic roadsters resonate strongly, driving collaborations with heritage auto clubs and live restoration events. Retailers in this region have embraced experiential pop-ups and subscription box models, enabling enthusiasts to discover curated assortments aligned with regional nostalgia.

The Europe, Middle East & Africa region presents a mosaic of licensing partnerships tied to both continental automakers and niche boutique brands. European collectors exhibit an affinity for limited-run models that reflect local motorsport heritage and bespoke coach-built designs. In the Middle East, high-performance supercars command premium pricing, and exclusive distributor agreements facilitate pre-order cycles that coincide with regional auto shows. Meanwhile, select markets in Africa are emerging as growth corridors for entry-level plastic lines, supported by online marketplaces that bridge logistical gaps.

In Asia-Pacific, manufacturing excellence and scale economies underpin the region’s dual role as a production hub and a burgeoning consumer base. China and Southeast Asian nations host advanced foundries for both aluminum and zinc alloy casting, while domestic demand for commemorative releases and anime-inspired crossovers surges. E-commerce giants facilitate rapid distribution, often bundling collectibles with localized content and promotional tie-ins. As these regional forces continue to evolve, stakeholders can leverage localized strategies to optimize product assortments, licensing collaborations and go-to-market models.

This comprehensive research report examines key regions that drive the evolution of the Car Diecast Scale Model market, offering deep insights into regional trends, growth factors, and industry developments that are influencing market performance.

- Americas

- Europe, Middle East & Africa

- Asia-Pacific

Profiling Leading Companies Pioneering Innovation Quality and Licensing Partnerships in the Competitive Car Diecast Scale Model Market

Leading firms in the car diecast scale model arena have distinguished themselves through differentiated licensing portfolios, proprietary manufacturing techniques and targeted marketing ecosystems. Notably, certain global players maintain official partnerships with premium automakers, granting exclusive rights to replicate newly unveiled supercars and special edition vehicles in miniature form. These alliances not only bolster brand equity but also facilitate co-branded promotional events at major auto expos.

Innovation in production processes has also become a key competitive lever. Some companies have developed in-house tooling advancements that enable ultra-fine mold cavities, resulting in sharper panel lines and authentic badge reproductions. Others have implemented automated paint-shop robotics and laser-etched detailing to achieve uniform finishes across high-volume runs. These technological investments allow premium lines to achieve gallery-grade aesthetics while controlling per-unit costs.

On the marketing front, direct-to-consumer platforms and collector club memberships have emerged as vital avenues for sustained engagement. By offering tiered loyalty programs, exclusive early-access pledges and limited-edition subscriber kits, companies drive recurring revenue streams and foster community allegiance. Furthermore, strategic collaborations with influencers and restoration workshops deliver content that bridges the gap between product attributes and hands-on enthusiast experiences, reinforcing brand advocacy in an increasingly crowded marketplace.

This comprehensive research report delivers an in-depth overview of the principal market players in the Car Diecast Scale Model market, evaluating their market share, strategic initiatives, and competitive positioning to illuminate the factors shaping the competitive landscape.

- Amalgam Collection Ltd.

- Auto World

- AutoArt Model Car Corp.

- CMC Modelcars GmbH

- Diecast Masters

- Dinky Toys Ltd.

- Greenlight Collectibles, LLC

- Hornby PLC

- IXO Models

- Jada Toys, Inc.

- Kyosho Corporation

- Lagardère SCA

- Majorette SAS

- Mattel, Inc.

- May Cheong Group Limited

- Nürnberger Zinkdruckguss‑Modelle GmbH

- Paul’s Model Art GmbH

- Schuco Modell GmbH & Co. KG

- Sieper Lüdenscheid GmbH & Co. KG

- Solido SA

- Spark Model

- Sun Star Co., Ltd.

- Sun Star Diecast Limited

- Sun Star Models Development Ltd.

- TOMY Company, Ltd.

- Welly Die Casting Factory Limited

Actionable Strategic Recommendations to Enhance Operational Efficiency Market Penetration and Sustainable Growth for Car Diecast Scale Model Industry Leaders

Industry leaders can seize growth opportunities by aligning product development with emerging consumer segments and operational best practices. First, elevating customization capabilities through modular design platforms will allow businesses to introduce limited-run offerings with rapid turnaround times, catering to collectors seeking unique or personalized models. This approach can be supplemented by digital configurators that engage users in the design journey, driving pre-order commitments and reducing inventory risk.

Second, optimizing supply chains through regional manufacturing partnerships will mitigate the volatility introduced by trade policies and material cost fluctuations. Leveraging foundries within key markets can shorten lead times and lower duty burdens, while maintaining centralized quality control protocols. Coupling these partnerships with flexible logistics frameworks-such as multi-modal transport planning and vendor-managed inventory models-can further enhance responsiveness to demand spikes.

Third, deepening consumer engagement via content-driven campaigns and immersive experiences will reinforce brand loyalty. Hosting virtual assembly tutorials, partnering with automotive museums for exclusive series and integrating augmented reality previews into e-commerce platforms will position companies at the forefront of experiential retail. By executing these strategic imperatives in concert, industry players can fortify competitive positioning, drive sustainable margin improvement and unlock new channels for revenue diversification.

Comprehensive Research Methodology Integrating Primary Stakeholder Interviews Secondary Data Analysis and Multilevel Validation Techniques for Robust Insights

This study adopts a hybrid research methodology designed to deliver robust, triangulated insights into the car diecast scale model sector. The primary research phase comprised in-depth interviews with executives spanning OEM licensors, contract manufacturers and leading collectors, providing qualitative depth on licensing negotiations, production constraints and consumer motivations. These dialogues were augmented by focus panels that evaluated prototype samples, yielding direct feedback on product attributes such as paint fidelity, assembly complexity and tactile feel.

Secondary research components included a systematic review of trade publications, regulatory filings and patent databases to map technological advancements and tariff classifications. Data validation was achieved through cross-referencing publicly disclosed corporate disclosures with proprietary shipment records and customs databases, ensuring the accuracy of material sourcing and regional trade flow assessments. A structured data model facilitated the categorization of manufacturers by production capacity, material specialization and licensing scope.

To ensure methodological rigor, findings underwent multi-level verification by an internal panel of industry analysts and an external advisory board comprised of veteran hobbyists and retail channel executives. This iterative validation process refined analytical frameworks and tested scenario-based forecasts against real-world operational case studies. The result is a comprehensive, evidence-based narrative that combines qualitative richness with quantitative precision, equipping stakeholders with actionable intelligence and strategic clarity.

This section provides a structured overview of the report, outlining key chapters and topics covered for easy reference in our Car Diecast Scale Model market comprehensive research report.

- Preface

- Research Methodology

- Executive Summary

- Market Overview

- Market Insights

- Cumulative Impact of United States Tariffs 2025

- Cumulative Impact of Artificial Intelligence 2025

- Car Diecast Scale Model Market, by Material

- Car Diecast Scale Model Market, by Scale

- Car Diecast Scale Model Market, by End User

- Car Diecast Scale Model Market, by Distribution Channel

- Car Diecast Scale Model Market, by Region

- Car Diecast Scale Model Market, by Group

- Car Diecast Scale Model Market, by Country

- United States Car Diecast Scale Model Market

- China Car Diecast Scale Model Market

- Competitive Landscape

- List of Figures [Total: 16]

- List of Tables [Total: 1431 ]

Synthesizing Core Findings and Strategic Imperatives Highlighting the Road Ahead for Stakeholders in the Car Diecast Scale Model Domain

The confluence of digital innovation, evolving consumer segments and regulatory implications underscores a period of pivotal transformation for the car diecast scale model market. Throughout this report, we have examined how emerging e-commerce paradigms and sustainability considerations are redefining production and distribution strategies. We have also analyzed the ramifications of recent trade policies on cost structures and supply chain resilience, highlighting the imperative for adaptive sourcing models.

Segmentation insights reveal nuanced demand clusters across vehicle types and material compositions, enabling companies to calibrate portfolios that align with collector preferences. Regional analysis further illuminates distinctive market dynamics in the Americas, Europe, Middle East & Africa and Asia-Pacific, offering a geographic blueprint for targeted go-to-market executions. Company profiles demonstrate that strategic licensing collaborations and manufacturing innovations serve as critical differentiators in an increasingly crowded landscape.

In synthesizing these findings, it is evident that success will hinge on the ability to integrate customer co-creation, operational agility and data-driven decision-making into core business models. As the industry advances, stakeholders equipped with the insights contained in this report will be well positioned to anticipate shifting consumer trends, navigate regulatory headwinds and capitalize on untapped growth opportunities. The road ahead demands both strategic vision and tactical execution to thrive in this dynamic collectible sector.

Contact Ketan Rohom to Access the In-Depth Car Diecast Scale Model Market Research Report and Unlock Exclusive Strategic Intelligence for Business Professionals

To gain a comprehensive understanding of the nuanced competitive dynamics licensing frameworks and regional demand drivers that will shape the car diecast scale model industry, we invite you to reach out directly to Ketan Rohom, Associate Director, Sales & Marketing at 360iResearch. Engaging with Ketan will provide you with an opportunity to discuss tailored data packages, explore exclusive intelligence modules, and secure access to the full research report that delves deeper into manufacturer strategies, consumer sentiment analyses, and supply chain optimizations. His expertise will ensure you receive a bespoke consultation aligned with your organizational priorities and decision-making timelines.

By partnering with Ketan Rohom, you will unlock strategic frameworks designed to enhance product portfolio positioning, navigate evolving trade regulations, and identify high-value distribution channels across key regions. This collaboration will equip your leadership team with actionable metrics, scenario planning tools, and risk mitigation roadmaps essential for sustaining competitive advantage in a rapidly transforming marketplace. Don’t miss this chance to leverage our latest findings and collaborate on innovative growth strategies tailored to your needs.

- How big is the Car Diecast Scale Model Market?

- What is the Car Diecast Scale Model Market growth?

- When do I get the report?

- In what format does this report get delivered to me?

- How long has 360iResearch been around?

- What if I have a question about your reports?

- Can I share this report with my team?

- Can I use your research in my presentation?