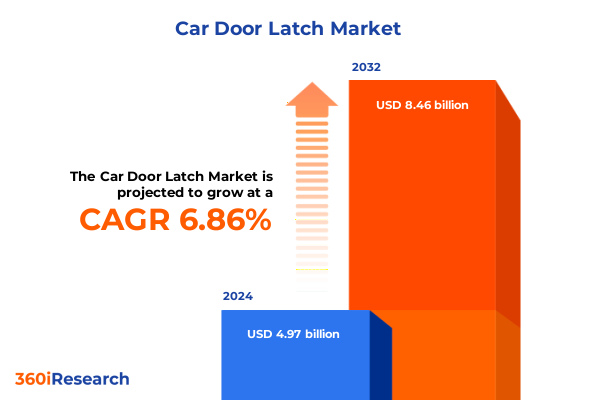

The Car Door Latch Market size was estimated at USD 5.26 billion in 2025 and expected to reach USD 5.57 billion in 2026, at a CAGR of 7.01% to reach USD 8.46 billion by 2032.

Understanding the Evolution and Significance of Modern Car Door Latches in an Era of Advanced Safety and User Convenience Emphasizing Smart Integration

The car door latch has transcended its humble origins as a simple mechanical link, evolving into a pivotal component that intertwines safety, convenience, and smart vehicle integration. Over decades of engineering innovations, an intricate balance of performance, durability, and ergonomics has been achieved, meeting ever-stricter safety mandates while enhancing user experience. As automotive design shifts toward electrification and autonomous operation, the latch’s role has expanded beyond basic function to serve as a seamless interface in connected mobility ecosystems.

This introduction sets the stage for a comprehensive examination of car door latch dynamics, uniting historical context with contemporary imperatives. It highlights the underlying drivers propelling technological transformation, underscores consumer preferences for intuitive access solutions, and frames the emerging challenges facing tier-one suppliers and OEMs alike. By integrating insights from regulatory trends, materials science advances, and shifting market demands, the narrative illuminates why latch systems are critical to both vehicle functionality and brand differentiation.

Exploring the Technological and Regulatory Shifts Reshaping Car Door Latch Innovation from Mechanical Tradition to Electronic and Biometric Solutions

In recent years, the car door latch landscape has undergone transformative shifts fueled by technology breakthroughs and evolving safety regulations. Mechanical latches, long the industry standard, have ceded ground to electronic systems that promise precision actuation, remote diagnostics, and enhanced security through biometric authentication. This transition aligns with overarching trends in vehicle electrification and IoT connectivity, as information-rich latch modules enable predictive maintenance alerts and integration with advanced driver assistance frameworks.

Simultaneously, regulatory bodies worldwide have tightened requirements for occupant safety and pedestrian protection. Crashworthiness standards now mandate sophisticated latch performance under diverse impact scenarios, driving R&D toward materials innovation and multi-axis durability testing. Additionally, cybersecurity considerations have emerged, prompting suppliers to embed secure communication protocols and encryption within latch control units. These converging forces have reshaped product roadmaps, compelled cross-industry collaboration, and elevated the latch from a passive mechanism to a digitally enabled gateway in next-generation mobility solutions.

Analyzing the Compounded Impact of 2025 United States Tariffs on Car Door Latch Manufacturing Costs Supply Chains and Trade Dynamics

The imposition of new United States tariffs in early 2025 has created a cumulative impact reverberating across the car door latch value chain. As steel and aluminum levies intensified manufacturing expenditures, suppliers recalibrated sourcing strategies to mitigate cost pressures. Concurrent Section 301 duties on select electronic components originating from specific markets amplified the financial burden on advanced latch assemblies, prompting a widespread reassessment of supplier diversification and near-shoring possibilities.

Consequently, tier-one manufacturers have pursued more resilient supply chain architectures, securing alternative raw material providers and forging strategic partnerships in tariff-free trade zones. While pass-through pricing has partially alleviated margin erosion, OEM contract negotiations have become more complex, with longer lead times and conditional rebate structures. Altogether, this tariff environment has accelerated the adoption of lightweight composite materials, vertical integration of subassembly processes, and localized production footprints, marking a significant departure from pre-2025 global sourcing practices.

Revealing Comprehensive Segmentation Insights on How Component Types Installation Positions Material Types Distribution Channels and Car Types Influence Market

The market’s granular segmentation reveals diverse trajectories that suppliers must navigate. Based on component type, the landscape bifurcates into electronic latches-comprising biometric activated latch and power door latch variants-and mechanical latches, which include cable operated latch, lever type latch, rod type mechanical latch, and classic rotary latch designs. In electronic latches, the biometric segment is gaining traction in luxury vehicles, while power door latches proliferate across mid-range and premium models seeking seamless user engagement.

Installation position segmentation further depicts unique performance criteria for hood latches, rear door latches, side door latches, sliding door latches, tailgate latches, and trunk latches, each requiring tailored actuation force and corrosion resistance parameters. Material type segmentation shows composites emerging alongside traditional metals such as aluminum, steel, and zinc, while plastic grades maintain relevance in cost-sensitive aftermarket channels. Distribution channel divides the market into aftermarket and original equipment manufacturers, with OEMs driving innovation through direct integration and aftermarket players focusing on retrofit and replacement viability. Finally, car type segmentation across convertible, coupe, crossover, hatchback, sedan, and SUV platforms underscores how body architectures and consumer preferences shape latch design priorities across segments.

This comprehensive research report categorizes the Car Door Latch market into clearly defined segments, providing a detailed analysis of emerging trends and precise revenue forecasts to support strategic decision-making.

- Component Type

- Installation Position

- Material Type

- Distribution Channel

- Car Type

Highlighting Key Regional Dynamics in the Americas Europe Middle East Africa and Asia Pacific Underscoring Growth Opportunities and Localization Trends

Regional dynamics in the Americas are characterized by stringent safety regulations and a growing emphasis on lightweight construction aligned with fuel efficiency and electric vehicle mandates. Suppliers in this region concentrate on advanced alloy latches and enhanced corrosion protection to meet severe weather and salt-use conditions, while automotive OEM hubs in North America collaborate closely with local tier-one partners to streamline just-in-time delivery for high-volume assembly lines.

In Europe, Middle East and Africa, demand is driven by luxury and performance markets in Western Europe juxtaposed with emerging volumes in the Middle East and North Africa. Here, emphasis on biometric access solutions and integration with keyless entry platforms is strongest, with suppliers adapting cultural preferences for touchless operation. Asia-Pacific exemplifies rapid adoption across original equipment and aftermarket spheres, spurred by rising vehicle production in China and Southeast Asia, robust EV penetration in markets like South Korea, and an expanding network of regional manufacturing clusters focused on cost-effective, scalable latch assembly processes.

This comprehensive research report examines key regions that drive the evolution of the Car Door Latch market, offering deep insights into regional trends, growth factors, and industry developments that are influencing market performance.

- Americas

- Europe, Middle East & Africa

- Asia-Pacific

Profiling Leading Global Manufacturers and Innovators Shaping the Car Door Latch Sector with Strategic Partnerships and Cutting Edge Technologies

A cohort of leading global players is steering innovation in the car door latch sector. Aptiv leverages its electronics expertise to integrate latch modules with vehicle communication buses, while Magna International pursues partnerships that embed biometric authentication into high-security vehicle segments. Denso focuses on miniaturized power door latches tailored for compact and electric vehicles, and Valeo invests heavily in sensor fusion techniques that enable automated latch diagnostics within connected car architectures.

Meanwhile, Faurecia and Bosch are advancing smart latch prototypes incorporating intrusion detection and remote actuation features, collaborating on cross-industry standards to ensure interoperability and cybersecurity resilience. Collectively, these companies are navigating regulatory compliance mandates and competitive pressures by emphasizing R&D in lightweight materials, modular product platforms, and strategic alliances with OEMs to co-develop bespoke latch solutions that align with evolving consumer expectations and sustainability targets.

This comprehensive research report delivers an in-depth overview of the principal market players in the Car Door Latch market, evaluating their market share, strategic initiatives, and competitive positioning to illuminate the factors shaping the competitive landscape.

- Aisin Corporation

- Alka Enterprises

- Allegion PLC

- Brose Fahrzeugteile SE & Co. KG

- CHINA FINEBLANKING TECHNOLOGY CO., LTD.

- Ci Car International

- Dorman Products, Inc.

- Eberhard Manufacturing Company

- EMKA Beschlagteile GmbH & Co. KG

- Ficosa Internacional SA

- HAPPICH GmbH

- Huf Hülsbeck & Fürst GmbH & Co. KG

- Inteva Products, LLC

- Kiekert AG

- Magna International Inc.

- MinebeaMitsumi Inc.

- Mitsui Kinzoku ACT Corporation

- Sanatan Autoplast Private Limited

- Southco Inc.

- Strattec Security Corporation

- TriMark Corporation

- Trique Mfg

- Valeo SA

- WITTE Automotive

Delivering Strategic Actionable Recommendations to Help Industry Leaders Capitalize on Innovation Supply Chain Resilience and Emerging Market Trends

Industry leaders seeking to capitalize on these trends should prioritize investment in electronic latch development, focusing on biometric authentication and remote diagnostic capabilities that align with vehicle connectivity roadmaps. Equally important is the diversification of supply chains to circumvent tariff-induced cost escalation, achieved through strategic sourcing from tariff-free markets and expansion of regional manufacturing footprints.

Additionally, embracing advanced composite materials can offset raw material price volatility, while collaborative alliances with select OEMs accelerate time-to-market for next-generation latch systems. Implementing digital twin simulations for durability and performance testing can streamline validation cycles, and launching targeted aftermarket retrofit programs will capture residual demand as legacy vehicles undergo technological upgrades. These actionable strategies will fortify market positioning and ensure resilience amid evolving regulatory and competitive landscapes.

Outlining the Rigorous Research Methodology Including Primary Expert Interviews and Secondary Data Triangulation Procedures Ensuring Data Reliability

The research methodology underpinning this analysis combines primary and secondary data collection techniques designed to maximize reliability. Primary insights were gathered through in-depth interviews with over thirty executives from tier-one suppliers and major OEM procurement teams, supplemented by structured surveys among aftermarket distributors. Secondary research encompassed review of regulatory publications, corporate financial disclosures, and trade policy documentation to contextualize tariff impacts and material supply fluctuations.

Data triangulation protocols were rigorously applied, cross-referencing company press releases, third-party industry journals, and customs import-export databases to validate qualitative narratives and ensure coherence with observed market behaviors. Analytical models integrated thematic analysis of interview transcripts with trend extrapolation, enabling nuanced interpretation of technological adoption cycles and regional growth differentials. Peer review and expert validation processes further enhanced the credibility and applicability of the findings.

This section provides a structured overview of the report, outlining key chapters and topics covered for easy reference in our Car Door Latch market comprehensive research report.

- Preface

- Research Methodology

- Executive Summary

- Market Overview

- Market Insights

- Cumulative Impact of United States Tariffs 2025

- Cumulative Impact of Artificial Intelligence 2025

- Car Door Latch Market, by Component Type

- Car Door Latch Market, by Installation Position

- Car Door Latch Market, by Material Type

- Car Door Latch Market, by Distribution Channel

- Car Door Latch Market, by Car Type

- Car Door Latch Market, by Region

- Car Door Latch Market, by Group

- Car Door Latch Market, by Country

- United States Car Door Latch Market

- China Car Door Latch Market

- Competitive Landscape

- List of Figures [Total: 17]

- List of Tables [Total: 1431 ]

Summarizing Key Findings and Strategic Implications to Provide Decision Makers with a Clear Path Forward in the Evolving Car Door Latch Landscape

The evolving car door latch market is characterized by a decisive shift from mechanical simplicity towards electronically enabled, user-centric solutions underpinned by stringent safety and cybersecurity mandates. Emerging tariff structures have catalyzed strategic supply chain realignments, while segmentation analysis reveals differentiated growth paths across component type, installation position, material selection, distribution channel, and vehicle category. Regional landscapes offer distinct challenges and opportunities, from the Americas’ regulatory rigor to Europe, Middle East and Africa’s demand for luxury integration, and Asia-Pacific’s mass-production agility.

Leading manufacturers and innovators are responding with targeted R&D investments, strategic partnerships, and modular product architectures designed for rapid customization. For decision makers, recognizing these multifaceted dynamics is essential to inform product roadmaps, sourcing strategies, and go-to-market plans. Ultimately, the capacity to navigate technological transitions, regulatory shifts, and geopolitical influences will determine competitive success in the next chapter of car door latch evolution.

Take the Next Step in Gaining a Competitive Edge with an In Depth Car Door Latch Market Research Report Tailored to Your Strategic Objectives

To accelerate your strategic journey in the competitive car door latch arena, engage with Ketan Rohom, Associate Director, Sales & Marketing, to acquire an in-depth market research report tailored to your objectives. This bespoke analysis delves into technological, regulatory, and regional dynamics, furnishing you with actionable insights that can inform product roadmaps, supply chain strategies, and partnership approaches. By partnering with a dedicated expert, you will gain direct access to the latest data, executive interviews, and proprietary analysis, ensuring you remain ahead of emerging trends and disruptive forces in the automotive components landscape.

Reach out to elevate your decision-making process with a comprehensive, customized study that aligns with your organization’s growth ambitions and innovation goals. Secure your copy today to empower your next phase of strategic planning and capitalize on opportunities in the evolving global car door latch market.

- How big is the Car Door Latch Market?

- What is the Car Door Latch Market growth?

- When do I get the report?

- In what format does this report get delivered to me?

- How long has 360iResearch been around?

- What if I have a question about your reports?

- Can I share this report with my team?

- Can I use your research in my presentation?