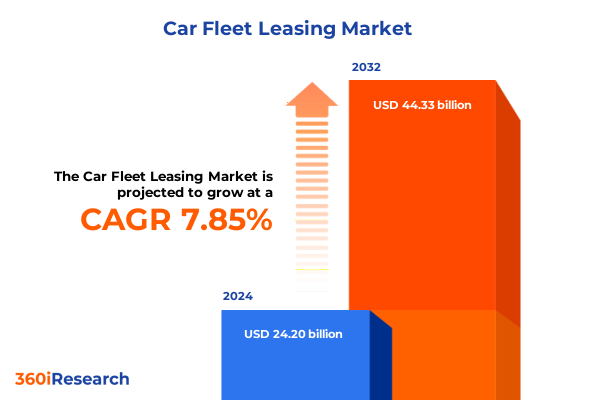

The Car Fleet Leasing Market size was estimated at USD 26.01 billion in 2025 and expected to reach USD 27.98 billion in 2026, at a CAGR of 7.91% to reach USD 44.33 billion by 2032.

Unlocking the Strategic Imperative of Fleet Leasing in an Era of Rapid Technological Innovation and Shifting Mobility Expectations

In recent years, the car fleet leasing industry has undergone a profound evolution driven by shifting corporate priorities, environmental imperatives, and technological breakthroughs. Fleet operators and corporate decision-makers are increasingly seeking solutions that balance cost efficiency with sustainability goals, particularly as stakeholders demand greater accountability for carbon footprints. Against this backdrop, leasing has emerged as a strategic tool, allowing businesses to leverage the latest vehicle technologies while preserving capital for core operations.

Moreover, the proliferation of connected vehicle platforms and telematics has transformed fleet management from a reactive process into a data-driven discipline. Real-time monitoring of vehicle health, driver behavior, and route optimization now underpins cost containment and safety initiatives. As leasing providers enhance their offerings with integrated digital services, customers benefit from seamless access to performance metrics and predictive maintenance alerts. Consequently, the landscape of fleet leasing is not only about vehicles but also about the comprehensive ecosystems of services that drive efficiency and resilience.

Navigating the Pivotal Transformations Driving the Car Fleet Leasing Industry from Digital Connectivity to Electrification and Sustainable Solutions

The car fleet leasing sector is witnessing several converging transformations that are redefining its value proposition and operational paradigms. First, the electrification trend is accelerating as businesses prioritize electric vehicles (EVs) to meet corporate sustainability targets and mitigate exposure to volatile fuel prices. This shift is supported by advances in battery technology, declining total cost of ownership for EVs, and expanding charging infrastructure in urban and suburban markets.

Simultaneously, digitalization is reshaping how lease providers deliver value. Artificial intelligence and machine learning algorithms now power dynamic pricing models, enabling customized lease contracts that reflect utilization patterns, vehicle depreciation, and market fluctuations. Customer portals with self-service capabilities facilitate rapid quote generation and contract adjustments, fostering stronger client engagement. At the same time, regulatory changes-particularly around emissions standards and data privacy-require leasing companies to adapt compliance frameworks and revise contract terms proactively.

Together, these forces are driving a more customer-centric, technology-enabled, and sustainability-oriented industry model. As leasing providers harness these trends, they unlock new opportunities for differentiation through flexible products and value-added services that anticipate the evolving needs of fleet operators.

Assessing the Multifaceted Impact of United States Tariffs in 2025 on Fleet Leasing Economics, Supply Chains, and Operational Cost Structures

Throughout 2025, a series of U.S. trade actions has imposed significant levies on imported automobiles and parts, reshaping the economics of fleet procurement and leasing. In March, a 25 percent tariff on vehicles and key components was enacted under Section 232 of the Trade Expansion Act of 1962, with parts levies commencing in May 2025. These measures applied uniformly to imports outside of United States-Mexico-Canada Agreement (USMCA) content thresholds and introduced substantial cost inflation for lease providers relying on foreign-assembled vehicles.

By late April, the administration issued amendments to streamline the provision of tariff offsets for domestic assembly. Automakers with U.S. production between April 3, 2025 and April 30, 2026 could claim a 3.75 percent import adjustment offset on parts, tapering to 2.5 percent thereafter, to incentivize domestic assembly and mitigate cost spikes. This dual approach aims to reinforce national security by bolstering local manufacturing while tempering immediate inflationary pressures on fleet leasing costs.

Collectively, the cumulative impact of these tariffs and offset programs has elevated procurement costs, triggered renegotiations of long-term lease agreements, and fueled a strategic pivot toward domestically assembled or USMCA-compliant vehicles. Lease providers are recalibrating portfolios to minimize exposure to high-tariff import segments, investing in local supply chain partnerships, and adjusting residual value assumptions to uphold margin integrity.

Unveiling Crucial Segmentation Perspectives to Drive Strategic Decision Making Across Lease Types, Use Cases, Fuel Options, and End User Profiles

The market for car fleet leasing can be understood more deeply by examining how different leasing and usage models align with customer expectations. When considering lease type, finance leases offer lessees the advantages of long-term capital deployment and potential ownership, whereas operating leases emphasize flexibility and off-balance-sheet treatment for companies seeking to maintain liquidity. This contrast shapes how providers structure their offerings and manage risk.

Further differentiation emerges in lease purpose. Commercial users typically demand large, varied vehicle pools to support delivery and logistics operations, while corporate users focus on executive and employee mobility solutions that highlight brand image and comfort. Personal use leases, meanwhile, cater to individuals through tailored terms, mileage allowances, and maintenance agreements designed to appeal to private hirers.

Fuel type constitutes another critical axis, as fleet operators balance cost, environmental objectives, and technological readiness. Diesel remains prevalent for high-utilization vehicles engaged in heavy-duty tasks, whereas electric and hybrid options attract organizations aiming to reduce emissions and benefit from incentive programs. Petrol vehicles continue to play a transitional role, offering widespread refueling infrastructure and stable supply chains.

End-user segmentation further refines the market dynamic. Large enterprises leverage scale to negotiate preferential rates, while small and medium enterprises seek agile leasing solutions that align with lean budget constraints. Federal, state, and local government fleets adhere to procurement regulations and sustainability mandates, driving demand for compliant offerings. Within the individual category, corporate executives expect premium vehicles with concierge services, whereas private lessees prioritize flexibility and cost transparency. Together, these segmentation lenses reveal nuanced demand patterns and inform how leasing providers tailor product suites for maximum market resonance.

This comprehensive research report categorizes the Car Fleet Leasing market into clearly defined segments, providing a detailed analysis of emerging trends and precise revenue forecasts to support strategic decision-making.

- Lease Type

- Vehicle Type

- Fuel Type

- Contract Tenure

- Fleet Size

- Applications

- End-user

- Distribution Channel

Highlighting Distinct Regional Dynamics Shaping Car Fleet Leasing Opportunities Across the Americas, Europe Middle East & Africa, and Asia Pacific Markets

The Americas continue to dominate the car fleet leasing arena, driven by the United States’ mature leasing infrastructure, robust credit markets, and economies of scale achieved through nationwide networks of dealerships and service centers. In this region, providers are investing heavily in telematics and connected services to refine route planning and reduce idle time. Latin American markets are marked by accelerating adoption of shorter-term leases as businesses seek agility in response to economic volatility.

Meanwhile, Europe, the Middle East, and Africa (EMEA) exhibit diverse regulatory landscapes and fleet requirements. Western European nations lead in electrification, thanks to aggressive emissions regulations and generous purchase incentives. In contrast, Middle Eastern countries focus on premium, luxury fleets for corporate and government use, supported by strong oil revenues. Africa’s leasing market remains nascent, with growth driven by infrastructure investments and the entry of global providers forging local partnerships.

In the Asia-Pacific region, dynamic growth is propelled by rapid urbanization, expanding e-commerce penetration, and government policies promoting green mobility. China’s push for new energy vehicles and India’s emerging corporate leasing segment underscore the strategic importance of localized solutions. Providers in the Asia-Pacific are forging alliances with technology vendors to deploy integrated charging and maintenance networks, catering to complex regulatory requirements and high customer expectations.

This comprehensive research report examines key regions that drive the evolution of the Car Fleet Leasing market, offering deep insights into regional trends, growth factors, and industry developments that are influencing market performance.

- Americas

- Europe, Middle East & Africa

- Asia-Pacific

Profiling Leading Players and Innovative Entrants Steering the Future of Car Fleet Leasing Through Strategic Collaborations and Technological Advancements

A constellation of global and regional players has emerged to define the current competitive landscape of car fleet leasing. Major financial institutions leverage their capital strength and credit rating to offer comprehensive full-service leasing programs, bundling maintenance, insurance, and telematics into single-point solutions. At the same time, specialized leasing vendors differentiate through vertical focus, serving industry segments such as logistics, ride-hailing, or healthcare with tailored contractual frameworks and dedicated account management.

Innovative technology companies and mobility-as-a-service (MaaS) startups are also disrupting traditional models. By integrating AI-driven fleet optimization tools and user-friendly digital interfaces, these new entrants have elevated expectations around transparency, cost predictability, and service responsiveness. Collaborations between established leasing providers and telematics platforms are further accelerating the rollout of value-added services, such as predictive maintenance scheduling and usage-based billing.

In parallel, automotive OEMs have deepened their involvement through captive leasing arms, granting them direct insight into lifetime vehicle performance and customer behavior. These in-house leasing divisions use proprietary data to refine residual value accuracy, reducing risk and enabling competitive pricing. The interplay between these various company archetypes underscores the importance of strategic partnerships, data integration, and agile innovation in shaping the next generation of fleet leasing offerings.

This comprehensive research report delivers an in-depth overview of the principal market players in the Car Fleet Leasing market, evaluating their market share, strategic initiatives, and competitive positioning to illuminate the factors shaping the competitive landscape.

- ALD Automotive Limited

- Arval UK Limited

- Athene Holding Ltd.

- AutoFlex AFV Inc.

- Element Fleet Management Corp

- EMKAY, Inc.

- Ewald Automotive Group

- ExpatRide International

- Glesby Marks

- Global Auto Leasing LLC

- Infinite Auto Leasing

- Jim Pattison Lease

- LP Group B.V.

- Merchants Fleet

- Moneyshake.com Limited

- ORIX Corporation

- Pro Leasing Services, Inc.

- Sixt Leasing SE

- Sumitomo Mitsui Auto Service Company Limited

- Uber Technologies Inc.

- United Leasing, Inc.

- Velcor Leasing Corporation

- Wilmar, Inc.

- World Fine Cars

- Xclusive Auto Leasing NYC

Driving Competitive Advantage Through Actionable Recommendations That Align Fleet Leasing Strategies With Emerging Market Trends and Regulatory Realities

Leaders in the fleet leasing sector should prioritize the integration of electrified vehicles and scalable charging infrastructure within their core offerings. By forging alliances with charging network operators and leveraging incentive programs, providers can offer end-to-end electrification roadmaps that address both upfront acquisition costs and long-term operational savings. Furthermore, embedding advanced analytics capabilities into lease management platforms will enable dynamic pricing, predictive maintenance, and improved asset utilization.

To enhance customer retention and attract new segments, firms must develop flexible contract structures that adapt to evolving usage patterns. Short-term and hybrid lease models can capture demand from gig economy participants and project-based industrial clients, while mileage-based billing aligns costs with actual utilization. In addition, establishing robust compliance frameworks to navigate shifting emissions regulations and trade policies will reduce risk and build trust with corporate and government stakeholders.

Finally, investing in talent development and cross-functional teams will be crucial. Organizations should cultivate expertise in data science, regulatory affairs, and renewable energy integration to stay ahead of market disruptions. By executing on these strategic imperatives, industry leaders will reinforce competitive positioning, accelerate growth, and deliver differentiated value to an increasingly sophisticated client base.

Ensuring Rigorous and Transparent Research Methodology Integrating Multisource Data Collection, Expert Validation, and Robust Analytical Frameworks

This research employed a mixed-methods approach to ensure depth and rigor. Secondary data sources included regulatory filings, trade publications, and government reports on Section 232 and related tariff actions, providing a legal and economic context for cost impact assessments. Market participant information was gathered through company annual reports, press releases, and industry association briefings to map competitive positioning and service portfolios.

Primary research comprised in-depth interviews with senior executives from leasing providers, fleet managers across multiple sectors, and technology solution vendors. These discussions illuminated evolving customer priorities, service innovation trajectories, and operational challenges encountered in a post-tariff environment. Expert validation workshops were conducted to test preliminary findings and refine strategic recommendations, ensuring alignment with real-world practices.

Quantitative analysis leveraged industry databases to track transaction volumes, vehicle mix shifts across fuel types, and residual value movements. Advanced statistical techniques and scenario modeling were applied to evaluate tariff impacts and fleet electrification paths under differing regulatory scenarios. Finally, synthesis of insights was achieved through iterative peer review, culminating in a robust framework that underpins the recommendations and conclusion presented herein.

This section provides a structured overview of the report, outlining key chapters and topics covered for easy reference in our Car Fleet Leasing market comprehensive research report.

- Preface

- Research Methodology

- Executive Summary

- Market Overview

- Market Insights

- Cumulative Impact of United States Tariffs 2025

- Cumulative Impact of Artificial Intelligence 2025

- Car Fleet Leasing Market, by Lease Type

- Car Fleet Leasing Market, by Vehicle Type

- Car Fleet Leasing Market, by Fuel Type

- Car Fleet Leasing Market, by Contract Tenure

- Car Fleet Leasing Market, by Fleet Size

- Car Fleet Leasing Market, by Applications

- Car Fleet Leasing Market, by End-user

- Car Fleet Leasing Market, by Distribution Channel

- Car Fleet Leasing Market, by Region

- Car Fleet Leasing Market, by Group

- Car Fleet Leasing Market, by Country

- United States Car Fleet Leasing Market

- China Car Fleet Leasing Market

- Competitive Landscape

- List of Figures [Total: 20]

- List of Tables [Total: 2067 ]

Synthesizing Key Insights From Fleet Leasing Trends and Market Dynamics to Illuminate Strategic Imperatives for Industry Stakeholders

Throughout this analysis, several overarching themes have emerged that define the current and future trajectory of car fleet leasing. First, sustainability and electrification are no longer peripheral considerations but core drivers of product development and customer engagement. As total cost of ownership for electric and hybrid vehicles becomes increasingly competitive, leasing providers must accelerate portfolio transitions and forge partnerships to support charging infrastructure deployment.

Second, technological integration-spanning telematics, AI-driven analytics, and digital customer interfaces-is fundamental to enhancing operational efficiency and client satisfaction. Real-time visibility into vehicle performance and utilization not only reduces downtime but also creates new revenue streams through value-added services.

Lastly, the regulatory and trade environment, characterized by recent tariff impositions and offset programs, has underscored the importance of flexible pricing models and supply chain diversification. Providers that can swiftly adapt to these external pressures while maintaining consistent service levels will distinguish themselves in a crowded market.

Together, these insights illuminate strategic imperatives for stakeholders seeking to navigate complexity, drive innovation, and secure a competitive edge in the evolving landscape of car fleet leasing.

Reach Out to Ketan Rohom to Secure Comprehensive Car Fleet Leasing Intelligence and Propel Your Organization Ahead of Competitive Market Curves

If your organization seeks to outpace competitors and capitalize on the latest developments in car fleet leasing, now is the time to act. Engaging directly with Ketan Rohom, Associate Director of Sales & Marketing, will ensure you gain privileged access to the full breadth of market intelligence, granular analysis, and strategic insights necessary to make informed decisions. With Ketan’s guidance, you will secure a comprehensive report that addresses your unique challenges and objectives, empowering your teams to optimize fleet operations, negotiate favorable lease agreements, and integrate emerging technologies with confidence. Reach out today to initiate a tailored consultation and propel your organization ahead of evolving market demands. Partner with an industry expert to transform data into actionable strategy and ensure your fleet leasing program drives sustainable growth and competitive advantage.

- How big is the Car Fleet Leasing Market?

- What is the Car Fleet Leasing Market growth?

- When do I get the report?

- In what format does this report get delivered to me?

- How long has 360iResearch been around?

- What if I have a question about your reports?

- Can I share this report with my team?

- Can I use your research in my presentation?