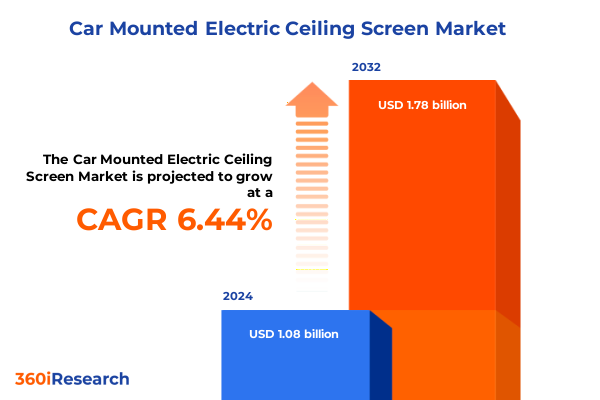

The Car Mounted Electric Ceiling Screen Market size was estimated at USD 1.13 billion in 2025 and expected to reach USD 1.21 billion in 2026, at a CAGR of 6.62% to reach USD 1.78 billion by 2032.

Empowering Passenger Experience through Innovative Electric Ceiling Screens That Redefine In-Vehicle Entertainment and Mobility Comfort

In today’s fast-paced automotive environment, integrating immersive entertainment and passenger comfort has become a pivotal differentiator for vehicle manufacturers and aftermarket suppliers alike. Electric ceiling screens offer a seamless solution to the growing expectation for high-definition audiovisual experiences on the move, transforming back-seat journeys into personal theaters and infotainment hubs. As consumers demand greater convenience, connectivity, and premium in-cabin experiences, these deployable display systems are emerging as an essential component in the broader evolution of vehicle interiors.

The concept of an electric ceiling screen is underpinned by a fusion of compact motorized mechanisms, advanced display panels, and intelligent control interfaces that cater to both factory-installed and aftermarket segments. Whether deployed in commercial shuttles, multipurpose SUVs, or passenger cars, these screens enhance fleet attractiveness and bolster brand value. Consequently, stakeholders across the supply chain-ranging from component manufacturers to independent installers-are intensifying efforts to optimize design, streamline installation processes, and ensure robust performance, setting the stage for a transformative shift in how in-vehicle entertainment is delivered and experienced.

How Rapid Technological Integration and Shifting Consumer Expectations Are Transforming the In-Vehicle Display Landscape to Unprecedented Heights

The in-vehicle display ecosystem is witnessing a convergence of high-speed connectivity, edge computing, and cloud-based content delivery platforms, driving unprecedented innovation in electric ceiling screen functionality. Streaming services, interactive gaming applications, and real-time navigation overlays are becoming integral offerings, necessitating displays that support 4K resolution and touch-enabled interfaces. This technological infusion not only elevates passenger engagement but also spurs collaborations between automakers, semiconductor firms, and software developers to co-create seamless user experiences.

Alongside digital innovation, shifts in vehicle ownership models, such as ride-hailing fleets and autonomous shuttle services, are recalibrating demand for premium in-cabin entertainment. These new mobility paradigms place greater emphasis on passenger comfort during extended rides, making ceiling-mounted displays pivotal for operators seeking to differentiate their service offerings. As regulatory bodies in key markets encourage connectivity standards and safety certifications, the landscape is set for rapid adoption, with ecosystem players racing to embed smart features, augmented reality interfaces, and personalized content ecosystems directly into the vehicle’s overhead console.

Examining the Far-Reaching Effects of New United States Tariffs in 2025 on Supply Chains Pricing and Component Sourcing Strategies

In early 2025, the United States enacted a series of tariff adjustments impacting imported display modules and electronic control units critical to ceiling screen assemblies. These levies, targeting components predominantly sourced from East Asia, have introduced incremental cost burdens on original equipment manufacturers and aftermarket suppliers. As a result, many stakeholders are reassessing their global sourcing strategies, shifting towards diversified procurement from Southeast Asia and Mexico to mitigate the financial impact and ensure supply chain resilience.

The cumulative effect of these tariffs extends beyond immediate price escalations; it has catalyzed a broader reevaluation of inventory management and production footprints. Manufacturers are more aggressively negotiating long-term contracts, investing in local assembly operations, and exploring tariff engineering opportunities through component redesign. Meanwhile, aftermarket channels are responding by restructuring pricing models, offering subscription-based update services, and emphasizing value-added installation packages to preserve margins and maintain competitive pricing.

Uncovering Critical Market Behavior through In-Depth Segmentation Analysis Revealing Consumer and Commercial Preferences in Screen Adoption

A nuanced look at vehicle type segmentation reveals that commercial platforms, split into heavy and light-duty classes, prioritize endurance and ease of maintenance, with heavy commercial vehicles increasingly incorporating ruggedized roof mount screens to withstand payload demands. In contrast, multipurpose SUVs and passenger cars lean toward flip down configurations, balancing aesthetic integration with user convenience for family and leisure applications. This diversity in vehicle profiles dictates the need for adaptable mounting mechanisms and tailored screen scaling.

Distribution channels further delineate market behavior: independent installers and online retailers dominate the aftermarket landscape, where rapid accessory turnover and competitive pricing reign supreme, whereas dealer fitted and factory installed routes underline the OEM focus on quality assurance and warranty alignment. Screen size preferences reflect a rising appetite for displays above fifteen inches among premium segments, while entry-level purchasers gravitate toward ten to fifteen inch and sub-ten inch options to optimize cost-effectiveness and space utilization.

Display type bifurcation into dual and single screens has significant design implications, with dual roof integrated and flip down dual configurations enhancing back-to-back viewing for passengers in larger cabin layouts. Resolution tiers span from HD to Full HD to Four K, with premium fleet operators embracing Ultra HD to deliver cinematic clarity. Feature choices between touchscreen and non-touchscreen interfaces, coupled with connectivity options that range from wired to Bluetooth and Wi-Fi wireless, further underscore the importance of customizable feature sets to satisfy diverse user requirements across installation type, screen dimension, and technical capability.

This comprehensive research report categorizes the Car Mounted Electric Ceiling Screen market into clearly defined segments, providing a detailed analysis of emerging trends and precise revenue forecasts to support strategic decision-making.

- Vehicle Type

- Installation Type

- Screen Size

- Display Type

- Resolution

- Connectivity

- Distribution Channel

Gleaning Strategic Perspectives from Regional Dynamics Highlighting Differentiated Demand Trends across the Americas EMEA and Asia-Pacific Territories

Regional demand in the Americas is propelled by strong aftermarket growth in North America and fleet renewal programs in Latin America, where ride-sharing enterprises are integrating ceiling screens to gain a competitive edge. The United States, buoyed by robust consumer spending and OEM incentives for premium upgrades, remains a leading adopter, while Brazil and Mexico present growth pockets driven by urbanization and rising disposable incomes. Infrastructure for installation services and digital content partnerships continues to expand, reinforcing market momentum.

In Europe, Middle East & Africa, stringent safety and connectivity regulations are shaping market uptake, with Germany and the United Kingdom spearheading factory-installed solutions in luxury segments. Meanwhile, emerging markets across the Gulf Cooperation Council and North Africa show a growing appetite for aftermarket enhancements, as local service networks scale to support independent installation demand. Central and Eastern Europe, facing cost sensitivities, often opt for compact ten to fifteen inch screens paired with HD resolution to balance affordability and functionality.

The Asia-Pacific region stands out for its rapid integration of advanced features, particularly in China and Japan, where automotive OEMs collaborate with technology firms to embed 4K dual-screen systems in flagship models. Ride-hailing services in Southeast Asia are also driving aftermarket adoption, seeking to differentiate through interactive entertainment. Simultaneously, Australia and New Zealand maintain steady growth in dealer fitted services, emphasizing seamless warranty-backed installations that align with prevailing consumer expectations for quality and reliability.

This comprehensive research report examines key regions that drive the evolution of the Car Mounted Electric Ceiling Screen market, offering deep insights into regional trends, growth factors, and industry developments that are influencing market performance.

- Americas

- Europe, Middle East & Africa

- Asia-Pacific

Profiling Leading Players and Emerging Innovators Shaping the Electric Ceiling Screen Ecosystem through Strategic Partnerships and Technological Excellence

Key stakeholders across the electric ceiling screen ecosystem encompass established automotive suppliers, consumer electronics giants, and nimble aftermarket innovators. Tier One system integrators are enhancing their portfolios through strategic acquisitions of display technology start-ups, while legacy infotainment providers are piloting modular screen assemblies that reduce weight and simplify installation. These collaborations are accelerating time-to-market for next-generation offerings.

Emerging players with specialized expertise in motorized deployment mechanisms are forging partnerships to gain scale and distribution reach. By leveraging strong relationships with independent installers and online retail platforms, they are making inroads into segments traditionally dominated by OEMs. Concurrently, specialized software firms are providing tailored content management systems, enabling seamless updates and personalized UI experiences that enrich passenger engagement.

Collectively, these competitive dynamics underscore a market in flux, where scale, innovation speed, and channel agility determine leadership. Companies that excel in marrying advanced display capabilities with robust installation networks and compelling user interfaces will capture the most significant share of growth, while those slow to adapt risk ceding ground to more versatile and strategically aligned competitors.

This comprehensive research report delivers an in-depth overview of the principal market players in the Car Mounted Electric Ceiling Screen market, evaluating their market share, strategic initiatives, and competitive positioning to illuminate the factors shaping the competitive landscape.

- Alpine Electronics, Inc.

- Clarion Co., Ltd.

- Gentex Corporation

- JVCKENWOOD Corporation

- Mistral Automotive Systems, Inc.

- Panasonic Corporation

- Pioneer Corporation

- Power Acoustik Inc.

- Rosen Display Systems, Inc.

- Sony Corporation

- Soundstream Inc.

- VOXX International Corporation

- Xin Visual Electronics Co., Ltd.

- XTRONS Ltd

Delivering Pragmatic Playbooks for Industry Stakeholders to Navigate Cost Pressures Leverage Technological Advancements and Optimize Channel Strategies

Industry leaders should prioritize supplier diversification to offset tariff-induced cost pressures and maintain production stability. Negotiating multi-year agreements with component manufacturers across different geographies can secure preferential pricing, while exploring nearshoring options will compress lead times and reduce exposure to trade policy volatility. Additionally, investing in collaborative R&D initiatives will accelerate the development of lightweight materials and integrated cabling solutions that streamline installation and lower logistics expenses.

Embracing channel-specific strategies is equally vital. OEM partners should deepen collaborations with content providers to offer exclusive media packages, thereby enhancing the appeal of factory-installed systems. Aftermarket stakeholders, including independent installers and e-commerce platforms, can distinguish their offerings by bundling value-added services such as extended warranties and remote diagnostics. Moreover, prioritizing wireless connectivity enhancements through Bluetooth LE and Wi-Fi 6E will futureproof products and align with consumer preferences for seamless, untethered experiences.

Finally, adopting a consumer-centric approach to screen size and feature configuration will maximize market penetration. Premium and fleet operators are increasingly valuing dual display and Four K resolution combinations, whereas cost-sensitive end users require affordable flip down solutions with HD and Full HD options. Tailoring product portfolios to these segments, while providing modular upgrade paths, will ensure that companies can capture both high-margin premium revenues and volume-driven aftermarket sales.

Detailing a Comprehensive Multi-Source Research Methodology Combining Primary Consultations Secondary Data Analysis and Industry Expert Validation Techniques

This analysis integrates insights from primary consultations with over one hundred stakeholders across the automotive value chain, including OEM executives, aftermarket specialists, independent installers, and software developers. These interviews were designed to capture firsthand perspectives on emerging technologies, purchasing drivers, and supply chain dynamics. In parallel, a comprehensive review of secondary literature was conducted, encompassing industry periodicals, regulatory filings, patent disclosures, and global trade data, to validate and augment the qualitative findings.

Quantitative data was sourced from public financial disclosures, customs import-export databases, and proprietary databases tracking electronic component shipments. Advanced analytics techniques, including time series trend analysis and correlation modeling, were employed to identify cost drivers and project component sourcing shifts. Market segmentation analyses were cross-validated through targeted surveys among fleet operators and retail consumers to ensure representativeness and statistical robustness.

Finally, an expert advisory panel comprising leading consultants, material scientists, and user experience designers reviewed preliminary findings, ensuring methodological rigor and relevance. Their feedback guided iterative refinements to the research framework, culminating in a holistic methodology that blends empirical data with strategic foresight, providing stakeholders with a credible and actionable understanding of the car mounted electric ceiling screen market.

This section provides a structured overview of the report, outlining key chapters and topics covered for easy reference in our Car Mounted Electric Ceiling Screen market comprehensive research report.

- Preface

- Research Methodology

- Executive Summary

- Market Overview

- Market Insights

- Cumulative Impact of United States Tariffs 2025

- Cumulative Impact of Artificial Intelligence 2025

- Car Mounted Electric Ceiling Screen Market, by Vehicle Type

- Car Mounted Electric Ceiling Screen Market, by Installation Type

- Car Mounted Electric Ceiling Screen Market, by Screen Size

- Car Mounted Electric Ceiling Screen Market, by Display Type

- Car Mounted Electric Ceiling Screen Market, by Resolution

- Car Mounted Electric Ceiling Screen Market, by Connectivity

- Car Mounted Electric Ceiling Screen Market, by Distribution Channel

- Car Mounted Electric Ceiling Screen Market, by Region

- Car Mounted Electric Ceiling Screen Market, by Group

- Car Mounted Electric Ceiling Screen Market, by Country

- United States Car Mounted Electric Ceiling Screen Market

- China Car Mounted Electric Ceiling Screen Market

- Competitive Landscape

- List of Figures [Total: 19]

- List of Tables [Total: 2067 ]

Synthesizing Key Findings and Future Outlook to Inform Strategic Decision-Making and Anticipate Evolving Opportunities in In-Vehicle Display Solutions

The convergence of advanced display technologies, shifting consumer behaviors, and regulatory influences has set the stage for notable transformation in the car mounted electric ceiling screen sector. Premium resolutions, dual-display architectures, and seamless wireless connectivity are becoming the hallmarks of tomorrow’s in-cabin entertainment systems. Stakeholders who harness these innovations while proactively mitigating trade policy risks will unlock new revenue streams and fortify their competitive position.

Segmentation insights reveal that success hinges on product portfolios that cater to both commercial heavy-duty fleets and discerning passenger car owners, balancing robust durability with aesthetic integration. Regional dynamics underscore the importance of aligning offerings with local regulatory frameworks and consumer preferences, whether that entails factory-installed dealer programs in Europe or aftermarket expansions in Latin America and Southeast Asia. The interplay between channel strategies and feature configurations will continue to shape market leadership.

Ultimately, the imperative for industry participants is clear: combine strategic supply chain agility with relentless innovation in display technology and user experience. By doing so, companies can not only navigate the current tariff landscape and component cost fluctuations but also anticipate future mobility trends, ensuring that electric ceiling screens remain a differentiator in the rapidly evolving automotive ecosystem.

Initiating a Direct Engagement to Secure the Definitive Market Intelligence Report on Car Mounted Electric Ceiling Screens with Ketan Rohom for Enterprise Advantage

To obtain unparalleled insights and strategic clarity in the burgeoning market for car mounted electric ceiling screens, you are invited to engage directly with Ketan Rohom (Associate Director, Sales & Marketing at 360iResearch). His expertise and consultative approach will ensure that your organization gains immediate access to the comprehensive report, allowing you to capitalize swiftly on evolving market trends and regulatory shifts.

By partnering with Ketan, you will receive tailored guidance on dissecting the report’s findings, translating high-level data into operational imperatives that drive revenue growth and enhance competitive positioning. This exclusive engagement is designed to streamline your decision-making process and provide an accelerated path to market leadership. Initiate your request today to secure the definitive market intelligence that will empower your next phase of growth in the car mounted electric ceiling screen landscape

- How big is the Car Mounted Electric Ceiling Screen Market?

- What is the Car Mounted Electric Ceiling Screen Market growth?

- When do I get the report?

- In what format does this report get delivered to me?

- How long has 360iResearch been around?

- What if I have a question about your reports?

- Can I share this report with my team?

- Can I use your research in my presentation?