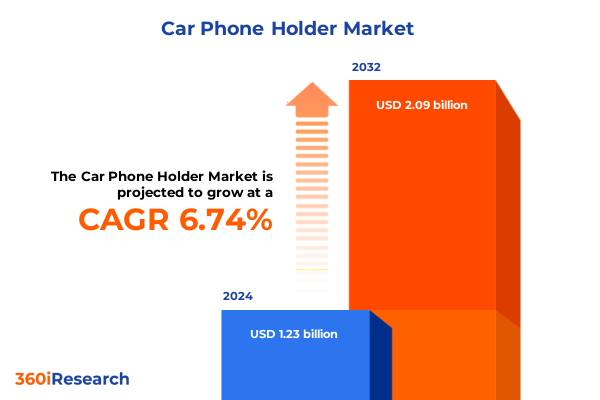

The Car Phone Holder Market size was estimated at USD 1.32 billion in 2025 and expected to reach USD 1.40 billion in 2026, at a CAGR of 6.72% to reach USD 2.09 billion by 2032.

Unveiling the Foundational Forces and Emerging Trends Driving Growth and Innovation in the Global Car Phone Holder Sector Amid Evolving Consumer Preferences and Technological Advancements

The global car phone holder market has evolved from a mere accessory to an integral component of modern in-vehicle technology ecosystems. As smartphones ascend to indispensability in daily life, consumers are increasingly seeking safe, convenient, and aesthetically pleasing solutions to secure their devices during transit. This surge in demand has spurred manufacturers to innovate across multiple dimensions, from ergonomic design elements to integrated charging capabilities and compatibility with advanced infotainment systems. Consequently, the market is witnessing a fusion of consumer electronics principles with automotive-grade engineering standards.

Moreover, regulatory pressures around distracted driving and heightened consumer awareness of safety guidelines have propelled the adoption of more sophisticated mounting solutions. In parallel, the rise of autonomous driving prototypes has triggered early explorations of seamless device integration, blurring the lines between peripherals and core vehicle functionalities. Against this backdrop, the car phone holder segment has become a dynamic arena where technological advancement, regulatory compliance, and shifting user expectations converge to define the competitive trajectory.

Analyzing the Paradigm-Shifting Technological, Regulatory, and Consumer Behavior Transformations Redefining the Car Phone Holder Market Landscape Worldwide

The market for car phone holders is undergoing transformative shifts driven by breakthroughs in materials engineering, connectivity standards, and consumer behavior patterns. Notably, the integration of wireless charging modules has propelled magnetic mounting solutions into the mainstream, enabling seamless power delivery without compromising device security. This capability resonates with tech-savvy consumers who expect their peripherals to mirror the convenience of their wireless charging pads at home and in the office.

Simultaneously, collaborations between automotive OEMs and accessory manufacturers are gaining traction as original equipment manufacturers integrate universal mounting interfaces into dashboard layouts. This trend has been further amplified by regulatory bodies advocating for standardized mounting positions to minimize driver distraction. Moreover, the proliferation of 5G networks and voice-assistant platforms has prompted holders to support unobstructed microphone and antenna performance, ensuring that voice commands and data-intensive applications remain unhindered. These converging forces illustrate a landscape where innovation cycles are accelerating and the definitions of “mobile accessory” and “vehicle component” are becoming increasingly intertwined.

Assessing the Comprehensive Economic and Operational Impact of 2025 United States Tariffs on Automotive Accessories and Car Phone Holder Supply Chains

The cumulative impact of recent United States tariff measures has introduced significant cost considerations for stakeholders across the car phone holder value chain. In March 2025, an Executive Order under Section 232 imposed a 25% ad valorem tariff on imported passenger vehicles and light trucks, with parallel duties of the same rate on key automobile parts, effective April 3 for finished vehicles and May 3 for components. Although these provisions primarily target core automotive categories, ancillary accessories-such as phone holders constructed from automotive-grade metals-have experienced cost pressures due to overlapping steel and aluminum tariffs implemented earlier in 2025 under Section 232.

Furthermore, Section 301 tariffs on imports from China, originally instituted in 2018 and recently maintained by the current administration, continue to levy up to 25% on a broad range of electronics and consumer hardware components. This enduring duty burden affects plastic injection–molded and metal phone holder variants alike, as both rely on components sourced or manufactured in China. Although certain exclusions have been extended through mid-2025, the majority expired on May 31, amplifying landed costs. To mitigate these headwinds, manufacturers are exploring regional production realignment, alternative material sourcing, and negotiating tiered duty reductions announced in late April 2025 that adjust automobile parts tariffs to 15% in the first year and 10% in the second year. These dynamic policy shifts underscore the importance of agile supply chain strategies for maintaining competitive pricing and protecting margins.

Deriving Strategic Insights from Market Segmentation Across Mounting Type, Holder Type, Material Composition, Sales Channels, and End-User Dynamics

Insights derived from careful segmentation analysis reveal the nuanced preferences and purchasing patterns that define each consumer cohort. In examining mounting type, demand for vent slot attachments has risen sharply, aided by integrated air vent cooling solutions, while dashboard and windshield mounts have sustained appeal among luxury buyers seeking premium finishes. Cradle designs remain preferred for secure fit and aesthetics, though magnetic holders are rapidly gaining ground due to their minimalist form factor and quick-release convenience.

Material composition also plays a pivotal role, as ABS plastic variants dominate value-conscious segments, whereas aluminum constructions find favor among users desiring durability and a premium tactile experience. The sales channel segmentation further delineates consumer pathways: online platforms offer unparalleled product variety and price transparency, whereas automotive accessories stores, convenience outlets, and large-format supermarkets and hypermarkets cater to impulse buyers and those prioritizing immediate availability. End-user analysis highlights that individual consumers drive volume sales in urban centers, whereas commercial vehicle operators-particularly logistics, delivery fleets, taxi, and transport services-prioritize ruggedized designs and long-term reliability.

Collectively, these segmentation insights enable stakeholders to refine target propositions, optimize channel investments, and align product portfolios with the distinct expectations of each market segment.

This comprehensive research report categorizes the Car Phone Holder market into clearly defined segments, providing a detailed analysis of emerging trends and precise revenue forecasts to support strategic decision-making.

- Mounting Type

- Holder Type

- Material

- Sales Channel

- End User

Illuminating Regional Market Nuances and Growth Opportunities Across the Americas, Europe Middle East Africa, and Asia-Pacific in the Car Phone Holder Industry

Regional dynamics within the car phone holder market exhibit distinct characteristics shaped by socio-economic factors, automotive fleet composition, and digital infrastructure maturity. In the Americas, widespread smartphone penetration and mature e-commerce ecosystems have accelerated demand for feature-rich holders, including those with integrated wireless charging and app-based personalization capabilities. Meanwhile, distribution strength in brick-and-mortar automotive accessory outlets remains a key differentiator, particularly in locations where impulse purchases and aftermarket upgrades dominate.

Across Europe, the Middle East, and Africa, regulatory emphasis on in-vehicle safety and emerging standards for head-up display compatibility are driving innovation in low-profile, non-obstructive mounting systems. This region’s heterogeneous automotive landscape necessitates flexible design parameters to accommodate varying vehicle models and regulatory frameworks. Conversely, Asia-Pacific’s rapid urbanization and diverse income profiles have fueled a bifurcated market: premium holders with advanced ergonomics flourish in developed markets like Japan and South Korea, whereas cost-effective ABS plastic solutions maintain traction in high-volume markets such as India and Southeast Asia.

Understanding these regional idiosyncrasies is vital for devising market entry strategies, prioritizing R&D investments, and tailoring localized marketing campaigns that resonate with the priorities of each global region.

This comprehensive research report examines key regions that drive the evolution of the Car Phone Holder market, offering deep insights into regional trends, growth factors, and industry developments that are influencing market performance.

- Americas

- Europe, Middle East & Africa

- Asia-Pacific

Highlighting Competitive Benchmarking and Strategic Initiatives from Leading Global Car Phone Holder Manufacturers and Technology Innovators

Major players in the car phone holder segment continue to reinforce their market positions through product innovation, strategic partnerships, and channel expansion. Industry frontrunners have unveiled modular mounting systems that integrate magnetic alignment, wireless power transfer, and automated clamping mechanisms compatible with a wide range of device dimensions. Simultaneously, several manufacturers have entered co-development agreements with automotive OEMs to embed mounting interfaces directly into new vehicle models, thereby elevating aftermarket accessories to factory-installed amenities.

Additionally, acquisitions among specialized accessory makers have consolidated niche capabilities in materials science and wireless charging technologies, enabling mid-tier firms to compete with established brands on both price and feature set. Parallel to these movements, select companies are enhancing their online-to-offline capabilities by piloting augmented reality–enabled shopping experiences that allow consumers to virtually position holders in their vehicles before purchase. Through these collective initiatives, leading enterprises are setting benchmarks for user experience, reliability, and seamless integration, thus shaping the prevailing competitive landscape.

This comprehensive research report delivers an in-depth overview of the principal market players in the Car Phone Holder market, evaluating their market share, strategic initiatives, and competitive positioning to illuminate the factors shaping the competitive landscape.

- Amkette Analytics Limited

- Anker Innovations Inc.

- Arkon Resources, Inc.

- Aukey International Co. Ltd

- Baseus Technology Co., Ltd

- Belkin International, Inc.

- Bestrix Ltd.

- Brodit AB

- iOttie, Inc.

- Joyroom Technology Co., Ltd

- Kenu, Inc.

- Lamicall Co., Ltd

- Mpow Innovations Ltd.

- National Products, Inc.

- Nite Ize, Inc.

- Olixar

- Portronics Digital Private Limited

- Scosche Industries, Inc.

- Spigen Inc.

- TechMatte Inc.

Formulating Actionable Strategies for Industry Leaders to Navigate Supply Chain Challenges, Capitalize on Emerging Technologies, and Enhance Market Positioning

To thrive amid rapid technological evolution and complex trade environments, industry leaders should prioritize supply chain diversification by establishing manufacturing partnerships in regions unaffected by Section 301 and Section 232 tariffs. Embracing dual-sourcing strategies for key components can mitigate geopolitical risks and stabilize production costs. In parallel, forging alliances with automotive OEMs to develop genuine factory-installed mounting solutions will strengthen brand credibility and generate recurring revenue streams through licensing and co-branded offerings.

Moreover, integrating advanced features such as Qi-enabled wireless charging, voice-assistant compatibility, and IoT connectivity will differentiate products in an increasingly crowded market. Investment in digitally enabled customer experiences-such as AR-based fitment visualization and post-sale support applications-will foster deeper engagement and drive higher conversion rates. Finally, aligning product roadmaps with emerging safety and infotainment standards will position companies as forward-thinking partners, ready to address both regulatory mandates and consumer demands. Collectively, these actions will enable stakeholders to capture growth opportunities and maintain resilient operations in the face of evolving market dynamics.

Detailing the Rigorous Research Framework Employing Primary Interviews, Authoritative Secondary Sources, and Robust Data Triangulation Methodology

The research employs a rigorous, multi-tiered methodology to ensure data integrity and comprehensive coverage. Primary insights were gathered through structured interviews with supply chain executives, product development leads, and procurement managers across key geographic markets. Concurrently, a targeted survey of end users provided detailed feedback on feature preferences, purchase drivers, and satisfaction benchmarks.

Secondary research encompassed the systematic review of regulatory filings, trade publications, and public disclosures from leading accessory manufacturers and automotive OEMs. Proprietary databases were leveraged to extract historical import and export volumes, tariff data, and material cost indices, facilitating an analysis of policy impacts on landed costs. Data triangulation techniques were applied to cross-validate findings from multiple sources, while a robust quality assurance process ensured consistency across market segmentations. This multi-faceted approach underpins the report’s actionable insights and strategic recommendations.

This section provides a structured overview of the report, outlining key chapters and topics covered for easy reference in our Car Phone Holder market comprehensive research report.

- Preface

- Research Methodology

- Executive Summary

- Market Overview

- Market Insights

- Cumulative Impact of United States Tariffs 2025

- Cumulative Impact of Artificial Intelligence 2025

- Car Phone Holder Market, by Mounting Type

- Car Phone Holder Market, by Holder Type

- Car Phone Holder Market, by Material

- Car Phone Holder Market, by Sales Channel

- Car Phone Holder Market, by End User

- Car Phone Holder Market, by Region

- Car Phone Holder Market, by Group

- Car Phone Holder Market, by Country

- United States Car Phone Holder Market

- China Car Phone Holder Market

- Competitive Landscape

- List of Figures [Total: 17]

- List of Tables [Total: 1272 ]

Concluding Reflections on Market Dynamics, Innovation Imperatives, and Strategic Priorities Driving the Future Evolution of the Car Phone Holder Market

The car phone holder market stands at the intersection of consumer electronics and automotive innovation, driven by converging demands for safety, connectivity, and convenience. As mobile devices continue to evolve, holders must adapt to support new form factors, power delivery technologies, and in-vehicle communication standards. At the same time, ongoing tariff fluctuations and regulatory shifts underscore the need for flexible supply chain architectures and localized manufacturing alliances.

Looking ahead, the stakeholders who proactively embrace strategic partnerships, invest in modular design platforms, and align with emerging safety and connectivity protocols will be best positioned to capture incremental value. By leveraging the segmentation and regional insights outlined herein, companies can tailor their offerings to specific user needs and regional dynamics. Ultimately, sustained success in this market will hinge upon the ability to innovate rapidly, maintain operational resilience, and anticipate the next wave of consumer and regulatory imperatives.

Engaging with Associate Director Ketan Rohom to Secure Comprehensive Market Analysis and Drive Informed Strategic Decision-Making Today

To unlock comprehensive intelligence that will empower your strategic planning and help you stay ahead of market shifts, reach out directly to Ketan Rohom, Associate Director of Sales & Marketing. With his expertise, you can secure tailored insights, explore customized data segments, and gain access to the full scope of research findings that will drive actionable decisions. Engage with Ketan Rohom today to acquire the definitive market research report and transform the way you approach opportunities and challenges in the car phone holder market.

- How big is the Car Phone Holder Market?

- What is the Car Phone Holder Market growth?

- When do I get the report?

- In what format does this report get delivered to me?

- How long has 360iResearch been around?

- What if I have a question about your reports?

- Can I share this report with my team?

- Can I use your research in my presentation?