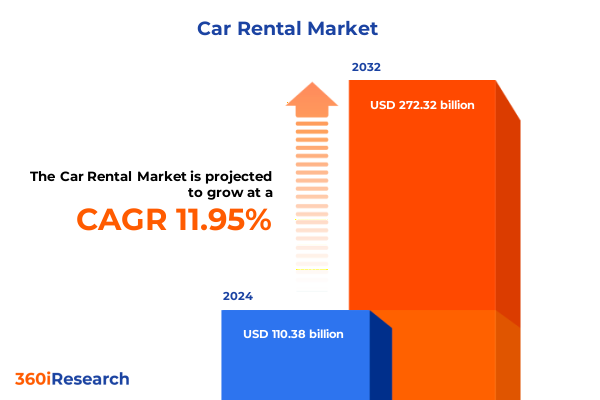

The Car Rental Market size was estimated at USD 121.54 billion in 2025 and expected to reach USD 133.83 billion in 2026, at a CAGR of 12.21% to reach USD 272.32 billion by 2032.

Setting the Stage for an Innovative and Resilient Car Rental Ecosystem Amid Evolving Customer Expectations and Technological Advancements

The car rental industry today stands at the crossroads of evolving customer expectations and rapid technological advancement. As urban mobility patterns shift and digitization drives new service models, traditional rental providers are redefining their value propositions to remain competitive. Consumers now demand seamless booking experiences, integrated digital services, and transparent pricing, catalyzing a fundamental transformation in how rental businesses operate.

Against this backdrop, sustainability considerations and environmental commitments have taken center stage. The increasing adoption of electric and hybrid vehicles signals a shift toward greener fleets, while digital platforms empower customers to customize rental options more precisely than ever before. Concurrently, partnerships with ride-hailing services and facility operators are reshaping distribution channels, creating novel collaboration opportunities that extend beyond conventional airport and city-center outlets.

In this dynamic environment, stakeholders must balance operational excellence with innovative service delivery. This introduction lays the groundwork for understanding the strategic imperatives that define the current landscape and sets the stage for a deeper exploration of the drivers and challenges that will shape the future of car rental.

Witnessing a Revolution in Mobility Services Driven by Shared Economy Forces and Data-Driven Operational Excellence

Over the past few years, the car rental landscape has undergone transformative shifts driven by evolving mobility preferences and accelerating digitalization. On one hand, the emergence of shared mobility platforms has intensified competition, encouraging traditional rental companies to integrate on-demand solutions and real-time fleet management tools. This trend has fundamentally redefined customer engagement, as users increasingly expect flexible pick-up and drop-off options combined with intuitive mobile interfaces.

Simultaneously, the transition to electric and hybrid vehicles has gained significant momentum, propelled by regulatory incentives and growing environmental awareness. Rental providers are investing in charging infrastructure and forging partnerships with energy companies to facilitate smooth operations. This environmental pivot not only addresses sustainability objectives but also resonates with eco-conscious travelers seeking low-emission travel solutions.

Furthermore, data analytics and artificial intelligence are revolutionizing revenue management and predictive maintenance strategies. By harnessing customer behavior data and vehicle telematics, firms can optimize pricing models and reduce downtime, thereby enhancing profitability and service quality. These technological and market-driven shifts underscore the imperative for agility and continuous innovation in an increasingly competitive arena.

Assessing How Recent Trade Measures Have Reshaped Procurement Strategies and Accelerated Localized Fleet Electrification Initiatives

In 2025, the United States implemented a series of tariffs that reverberated across the automotive supply chain and car rental ecosystem. Affected components ranged from imported spare parts and tires to electronic systems critical for fleet telematics. These measures introduced cost pressures that rippled through maintenance budgets, fleet acquisition strategies, and service pricing frameworks.

Rental operators reacted by reassessing procurement channels, exploring domestic sourcing alternatives, and recalibrating rental rates to offset increased overheads. In parallel, some companies accelerated fleet electrification to capitalize on domestic incentives for locally assembled electric vehicles, thereby mitigating dependency on tariff-exposed imports. This strategic pivot not only reduced exposure to international trade volatility but also aligned with broader sustainability goals.

Amid these adjustments, collaborative agreements with local manufacturers and service providers gained prominence. By pooling demand and negotiating volume-based discounts, rental firms were able to soften the impact of higher input costs. Ultimately, the 2025 tariff landscape reinforced the importance of supply chain resilience, cost flexibility, and strategic partnerships as critical levers for maintaining profitability and customer satisfaction under shifting trade policies.

Exploring Diverse Customer Demand Profiles Across Rental Duration Fuel Preferences and Booking Channels for Deeper Operational Clarity

An in-depth segmentation perspective reveals intricate variations in customer demand and service design. When examining rental duration, long term arrangements spotlight the importance of subscription-style models for business travelers, while short term rentals emphasize convenience and spontaneity for leisure users. Fuel type segmentation underscores the rapid embrace of electric vehicles alongside traditional petrol and diesel options, with hybrids bridging the transition and showcasing consumer appetite for low-emission solutions. Service feature analysis delineates a clear divide between self-driving experiences that prioritize flexibility and chauffeur-led journeys built for premium convenience. User type splits illustrate divergent needs: corporate accounts driven by large enterprises demand robust corporate billing and centralized fleet oversight, while small enterprises and individual consumers seek customizable packages and on-demand support. Car type preferences range widely, from the allure of convertibles that cater to vacationers seeking style to practical hatchbacks favored by urban commuters, the ubiquitous sedan serving business segments, and the expanding SUV category capturing both family and adventure markets. Finally, booking methodology insights reveal that walk-in and call center channels remain vital for certain demographics, but mobile app and website platforms dominate digital-first adopters, signifying the criticality of omnichannel integration for seamless customer journeys.

This comprehensive research report categorizes the Car Rental market into clearly defined segments, providing a detailed analysis of emerging trends and precise revenue forecasts to support strategic decision-making.

- Rental Duration

- Fuel Type

- Service Features

- User Type

- Car Type

- Booking Method

Comparing How Regulatory Incentives and Consumer Behavior Drive Tailored Fleet Strategies Across Key Global Regions

Regional perspectives highlight distinct market dynamics in the Americas, Europe, Middle East and Africa, and Asia-Pacific regions. In the Americas, maturity in on-demand services and rideshare partnerships drives innovation, while regulatory frameworks increasingly favor electric vehicle deployments, prompting fleet renewals and infrastructure investments. Across Europe, Middle East and Africa, varied regulatory regimes and urban density patterns shape fleet composition, with Western Europe emphasizing emission-free mobility in city centers, the Middle Eastern market prioritizing luxury and full-service experiences, and African markets emerging with infrastructure-driven growth opportunities. In the Asia-Pacific arena, rapid urbanization and burgeoning middle-class travel budgets are fueling short term rental demand, complemented by government-backed incentives for electrification in key economies. Each region’s interplay of regulatory directives, consumer behaviors, and infrastructural readiness underscores the necessity for tailored strategies that resonate locally while leveraging global best practices.

This comprehensive research report examines key regions that drive the evolution of the Car Rental market, offering deep insights into regional trends, growth factors, and industry developments that are influencing market performance.

- Americas

- Europe, Middle East & Africa

- Asia-Pacific

Unveiling Competitive Strategies and Collaborative Ventures That Are Setting Industry Leaders Apart in a Rapidly Evolving Mobility Market

Leading industry participants are forging new paths with differentiated initiatives. Major multinational rental corporations are leveraging strategic alliances with technology firms to develop integrated mobility platforms and advanced telematics capabilities. Meanwhile, regional specialists are focusing on niche offerings, from premium chauffeur services to subscription-based access models that attract specific customer cohorts. In the electric mobility space, visionaries are establishing charging partnerships and co-investing in renewable energy projects to ensure reliable charging networks and transparent green credentials. Innovators in dynamic pricing are harnessing AI-driven algorithms to fine-tune rates in real time, capturing incremental revenue opportunities while maintaining competitive positioning. Collaborative joint ventures between rental providers and automotive manufacturers are emerging as powerful mechanisms for securing fleet stability and advanced vehicle feature sets, reinforcing the value of cross-industry cooperation in addressing evolving market demands.

This comprehensive research report delivers an in-depth overview of the principal market players in the Car Rental market, evaluating their market share, strategic initiatives, and competitive positioning to illuminate the factors shaping the competitive landscape.

- Asianventure Tours

- Avis Rent A Car System, LLC

- Booking Group Corporation Ltd.

- Budget Rent A Car System, Inc.

- Car N Coach Rentals

- Enterprise Holdings, Inc.

- Expedia, Inc.

- KAYAK by Booking Holdings Inc.

- Lotte Corporation

- NHIEUXE.VN

- RentalCarGroup

- Sixt Rent a Car, LLC

- Skyscanner Ltd

- The Hertz Corporation.

- TraveliGo

- Traveloka

- Vietnam Airlines JSC

- Vietnamdrive

- VIPCars.com

- VN Car Rentals

- Zipcar, Inc.

- Zoomcar Ltd.

Charting a Forward-Looking Blueprint for Building Agile Innovation Pipelines and Electrified Mobility Ecosystems to Secure Market Leadership

Industry leaders should prioritize building robust digital ecosystems that seamlessly integrate booking, vehicle access, and post-rental service support. By investing in scalable platform architectures and open APIs, organizations can foster partnerships with third-party mobility providers and enrich customer touchpoints. Equally critical is the acceleration of electrification strategies through targeted infrastructure investments and collaboration with energy stakeholders to guarantee reliable charging availability and transparent carbon reporting. Operators must also refine dynamic pricing frameworks, leveraging real-time data insights to optimize revenue without compromising customer value perceptions. Finally, embedding agility within organizational culture-through cross-functional squads and rapid prototyping methodologies-will enable quick adaptation to regulatory shifts and emerging consumer trends, ensuring sustained competitive advantage in a fluid market environment.

Detailing a Multi-Method Research Design That Integrates Executive Interviews Secondary Analysis and Customer Surveys for Robust Insights

This research framework combined qualitative and quantitative approaches to ensure comprehensive coverage of market dynamics. Primary interviews with senior executives, fleet managers, and technology partners provided firsthand perspectives on operational challenges and strategic priorities. These insights were complemented by a robust analysis of secondary sources, including industry white papers, regulatory filings, and transportation authority data, to validate emerging trends and benchmark best practices. Case studies of successful digital transformation and electrification initiatives offered practical lessons, while supply chain audits highlighted vulnerabilities and resilience strategies. Cross-sectional surveys of end users enriched the narrative with authentic customer sentiment, ensuring that recommendations align with real-world needs. Rigorous triangulation of these diverse inputs underpins the credibility of findings and ensures actionable guidance for stakeholders.

This section provides a structured overview of the report, outlining key chapters and topics covered for easy reference in our Car Rental market comprehensive research report.

- Preface

- Research Methodology

- Executive Summary

- Market Overview

- Market Insights

- Cumulative Impact of United States Tariffs 2025

- Cumulative Impact of Artificial Intelligence 2025

- Car Rental Market, by Rental Duration

- Car Rental Market, by Fuel Type

- Car Rental Market, by Service Features

- Car Rental Market, by User Type

- Car Rental Market, by Car Type

- Car Rental Market, by Booking Method

- Car Rental Market, by Region

- Car Rental Market, by Group

- Car Rental Market, by Country

- United States Car Rental Market

- China Car Rental Market

- Competitive Landscape

- List of Figures [Total: 18]

- List of Tables [Total: 1590 ]

Reflecting on How Integrated Mobility Ecosystems and Strategic Agility Will Define the Future Trajectory of Car Rental Services

The current confluence of digital innovation, electrification momentum, and evolving customer expectations signals a pivotal era for the car rental industry. Providers who embrace seamless digital platforms, cultivate sustainable fleets, and strengthen supply chain flexibility will be best positioned to thrive. Meanwhile, collaborative ventures and strategic partnerships will serve as catalysts for expanded service portfolios and enhanced value propositions. By aligning operational excellence with forward-thinking strategies, industry stakeholders can navigate tariff-induced headwinds and regulatory shifts while delivering compelling mobility experiences. This synthesis reaffirms the imperative for proactive adaptability and underscores the transformative potential of integrated mobility ecosystems in driving future growth.

Unlock Exclusive Access to Comprehensive Car Rental Market Insights by Connecting with Our Expert in Sales and Marketing for Personalized Guidance

To access in-depth strategic analysis and comprehensive insights tailored to your organizational needs, connect directly with Ketan Rohom, Associate Director of Sales and Marketing. His expertise in automotive sector dynamics and client-focused guidance will ensure you receive the full value of this research. Reach out today to secure your copy of the complete car rental market report and accelerate your roadmap to growth.

- How big is the Car Rental Market?

- What is the Car Rental Market growth?

- When do I get the report?

- In what format does this report get delivered to me?

- How long has 360iResearch been around?

- What if I have a question about your reports?

- Can I share this report with my team?

- Can I use your research in my presentation?