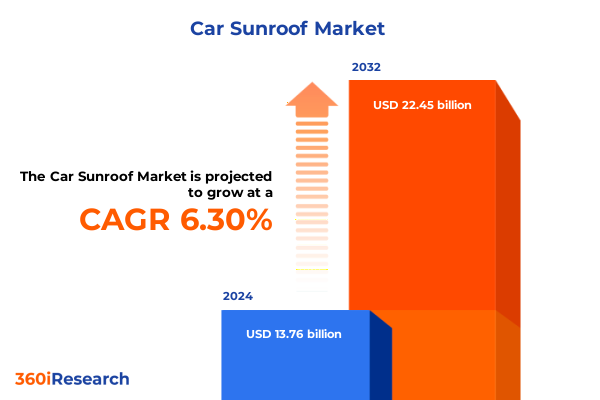

The Car Sunroof Market size was estimated at USD 14.45 billion in 2025 and expected to reach USD 15.18 billion in 2026, at a CAGR of 6.49% to reach USD 22.45 billion by 2032.

Exploring the Role of Sunroof Innovations in Shaping Modern Vehicle Appeal by Embracing Connectivity Comfort and Sustainable Design Trends

The automotive sunroof sector has undergone a remarkable transformation, evolving from basic pop-up panels to integrated panoramic systems that define modern vehicle design. Initially valued primarily for ventilation and natural light, sunroofs now serve as a key differentiator in interior ambiance and passenger experience, enriching comfort with expansive glass roofs that span entire cabin spaces. In parallel, technological breakthroughs such as electrochromatic smart glass have revolutionized control over light and privacy, allowing drivers to dynamically adjust transparency levels at the touch of a button.

As sustainability and connectivity emerge as critical purchase drivers, automakers are integrating solar-generating roofs and app-enabled actuation features into their sunroof portfolios. These innovations not only support vehicle auxiliary systems but also align with consumer demand for greener solutions, reinforcing the sunroof’s role as a convergence point for comfort, efficiency, and environmental responsibility. This introduction sets the stage for a comprehensive examination of market dynamics, technological shifts, tariff implications, and strategic pathways shaping the car sunroof landscape.

Unveiling the Transformative Shifts That Are Redefining the Car Sunroof Market Amid Technological Integration and Evolving Consumer Expectations

The landscape of automotive sunroofs is being reshaped by a surge of technological innovations that transcend traditional glass panels. Smart glass systems featuring electrochromatic technology provide drivers with unparalleled control over tint levels, reducing glare and thermal load while enhancing cabin privacy. Concurrently, the integration of transparent solar cells into panoramic roofs harnesses sunlight to power ventilation systems and auxiliary electronics, advancing energy autonomy and reducing reliance on vehicle batteries.

Beyond functional upgrades, aesthetic and experiential shifts are driving new standards in vehicle design. Automated shading mechanisms respond to sunlight intensity, offering seamless transitions between clear and opaque states without manual intervention. Alongside UV-blocking coatings and lightweight composite materials, these developments reflect a growing emphasis on passenger health, aerodynamic efficiency, and the pursuit of sophisticated styling that resonates with discerning buyers.

Examining the Far Reaching Cumulative Impact of 2025 Tariffs on Car Sunroof Supply Chains Manufacturing and Cost Structures in the United States Market

In March 2025 the U.S. government invoked Section 232 of the Trade Expansion Act to impose a 25% ad valorem tariff on imported automobiles and select parts, including critical sunroof components, effective April 3 for vehicles and May 3 for parts. This policy aims to fortify domestic manufacturing by elevating the cost of foreign-sourced powertrain modules, transmissions, glass assemblies, and other key roof system elements.

The automotive industry has already felt the pressure of these measures, with leading OEMs absorbing significant cost increases rather than passing them to consumers. For example, a major U.S. automaker reported a multibillion-dollar hit to operating income in Q2 2025 directly linked to these tariffs, underscoring the need for supply chain realignment and domestic production investments. As manufacturers accelerate plant expansions and component reshoring, the car sunroof segment faces both cost challenges and opportunities for increased localization.

Revealing Key Segmentation Insights That Define Varied Car Sunroof Preferences Based on Type Material Operation Propulsion and Distribution Channels

Segmentation analysis reveals distinct consumer and OEM behaviors across sunroof configurations. Types range from compact inbuilt designs to expansive panoramic roofs, each delivering unique value propositions in terms of spatial openness and structural integration. Pop-up and spoiler sunroofs continue to serve entry-level and performance niches, respectively, reflecting diverse aesthetic and functional priorities. Material choices-glass versus metal-further differentiate offerings, balancing transparency and durability against weight and thermal performance.

Operation modes span from manual crank systems to fully automatic slide-and-tilt platforms, catering to varying levels of user convenience and cost sensitivity. Distinctions between electric and internal combustion vehicle platforms shape design requirements, influencing factors such as energy harvesting and structural support. Consumer preferences also vary by vehicle type, with convertibles prioritizing full-open flexibility and SUVs and sedans favoring large fixed glass panels. Finally, the distribution channel dimension contrasts OEM integration with aftermarket enhancements, illuminating opportunities to expand service networks and accessory portfolios.

This comprehensive research report categorizes the Car Sunroof market into clearly defined segments, providing a detailed analysis of emerging trends and precise revenue forecasts to support strategic decision-making.

- Type

- Material

- Operation

- Propulsion Type

- Vehicle Type

- Distribution Channel

Analyzing Regional Dynamics That Drive Sunroof Adoption Across Americas Europe Middle East Africa and Asia Pacific Automotive Sectors

Regional dynamics play a pivotal role in sunroof adoption patterns across global markets. In the Americas, robust SUV and pickup demand drives preference for larger fixed and panoramic glass modules that deliver both a commanding view and enhanced cabin ambiance. Meanwhile, OEMs leverage modular roof assemblies to streamline production across North and South American manufacturing hubs, balancing cost and scale.

Europe Middle East and Africa markets benefit from a legacy of strong automotive engineering and premium brand heritage, where high-end electrochromic and UV-protective sunroof options are often standard on luxury sedans and crossovers. In the Asia Pacific region, rapid EV adoption and government incentives for green mobility fuel demand for solar-integrated and lightweight panoramic roofs, prompting local players to invest in expanded production capacity to meet both OEM and aftermarket needs.

This comprehensive research report examines key regions that drive the evolution of the Car Sunroof market, offering deep insights into regional trends, growth factors, and industry developments that are influencing market performance.

- Americas

- Europe, Middle East & Africa

- Asia-Pacific

Highlighting Strategic Positions and Innovations of Leading Car Sunroof Suppliers Transforming the Global Automotive Landscape with Advanced Roof Systems

Leading Tier 1 suppliers are driving innovation and market expansion through strategic investments and technology partnerships. Webasto Group has introduced ambient LED-enabled panoramic systems and eco-friendly roof substrates that reduce lifecycle emissions, showcasing its commitment to sustainability and user experience enhancement. Inalfa Roof Systems has debuted smart-tint panoramic sunroofs with real-time sensor integration, further blurring the line between comfort and convenience.

Glass manufacturers like AGC Inc. and NSG Group are collaborating with automakers to embed HUD capabilities and advanced UV-blocking coatings directly into sunroof panels, elevating the role of roof glass within the connected car ecosystem. Aisin Seiki and Magna International continue to enhance modular roof structures through lightweight composites and adaptive shading technologies, while also expanding localized production footprints to mitigate tariff disruptions and meet evolving regional requirements.

This comprehensive research report delivers an in-depth overview of the principal market players in the Car Sunroof market, evaluating their market share, strategic initiatives, and competitive positioning to illuminate the factors shaping the competitive landscape.

- AISIN CORPORATION

- American Sunroof Corp.

- Automotive Sunroof-Customcraft (ASC) Inc.

- BOS GmbH & Co. KG

- CIE AUTOMOTIVE S.A.

- Compagnie de Saint-Gobain S.A.

- Fuyao Glass Industry Group Co., Ltd

- Glavista Autoglas GmbH

- Hyundai Mobis

- Inalfa Roof Systems Group B.V.

- Johnan Manufacturing Inc.

- Magna International Inc.

- Matrix Car Décor

- Minda Corporation

- Shyu Fuu Industrial Co., Ltd.

- Webasto SE

- Wuxi Ming Fang AutoMobile Parts Industry Co., Ltd.

- Xinyi Glass Holdings Limited.

- Yachiyo Industry Co., Ltd.

Strategic Actionable Recommendations for Industry Leaders to Capitalize on Emerging Sunroof Technologies and Navigate Market Shifts with Confidence

To thrive in the shifting sunroof market, industry leaders should accelerate the integration of smart glass and solar harvesting technologies to deliver multifunctional roof systems that resonate with eco-conscious consumers. Cultivating partnerships with electric vehicle manufacturers will ensure seamless alignment between propulsion architectures and roof system energy requirements. Additionally, diversifying production footprints and forging alliances with regional suppliers can mitigate the impacts of fluctuating trade policies and logistics constraints.

Investment in cutting-edge materials research is vital for achieving weight reduction without compromising safety or durability. Companies should prioritize scalable manufacturing processes capable of accommodating both OEM and aftermarket demand. Finally, elevating the customer experience through intuitive app-based controls and customizable ambient features will distinguish premium offerings and foster brand loyalty in an increasingly competitive environment.

Detailing the Rigorous Research Methodology Applied to Analyze Car Sunroof Market Segmentation Trends and Regional Patterns with Precision and Depth

Our methodology combined extensive secondary research with in-depth primary interviews across the automotive ecosystem. Industry experts from OEMs, Tier 1 suppliers, and aftermarket specialists contributed insights on technological adoption, material selection, and production strategies. We reviewed government policy documents, patent filings, and trade data to assess tariff structures and regulatory impacts. This approach enabled robust triangulation of quantitative and qualitative inputs.

Segmentation analysis followed a structured framework that categorized the market by sunroof type, material composition, operation mechanism, propulsion compatibility, vehicle class, and distribution channel. Regional assessments incorporated macroeconomic indicators, regional policy landscapes, and consumer preference studies. Insights were validated through cross-reference with supplier announcements and product launch timelines, ensuring a comprehensive and reliable view of the global car sunroof market.

This section provides a structured overview of the report, outlining key chapters and topics covered for easy reference in our Car Sunroof market comprehensive research report.

- Preface

- Research Methodology

- Executive Summary

- Market Overview

- Market Insights

- Cumulative Impact of United States Tariffs 2025

- Cumulative Impact of Artificial Intelligence 2025

- Car Sunroof Market, by Type

- Car Sunroof Market, by Material

- Car Sunroof Market, by Operation

- Car Sunroof Market, by Propulsion Type

- Car Sunroof Market, by Vehicle Type

- Car Sunroof Market, by Distribution Channel

- Car Sunroof Market, by Region

- Car Sunroof Market, by Group

- Car Sunroof Market, by Country

- United States Car Sunroof Market

- China Car Sunroof Market

- Competitive Landscape

- List of Figures [Total: 18]

- List of Tables [Total: 1113 ]

Concluding Reflections on the Car Sunroof Market Outlook Emphasizing Strategic Imperatives and Future Growth Trajectories for Stakeholders

The car sunroof market stands at the intersection of design innovation, sustainability imperatives, and shifting consumer expectations. Technological advancements-from electrochromic glass to solar-powered modules-are redefining what a roof system can deliver, both functionally and aesthetically. Regulatory developments, particularly import tariffs, underscore the importance of agile supply chain strategies and localized manufacturing investments.

As automakers and suppliers navigate these complexities, strategic focus on integrated product differentiation, material innovation, and regional alignment will determine market leadership. The insights presented herein offer a roadmap for stakeholders to leverage emerging opportunities, address cost challenges, and shape the future trajectory of automotive sunroof systems.

Empowering Strategic Decisions Through Market Intelligence Connect with Ketan Rohom Associate Director Sales Marketing to Secure Your Sunroof Market Report Today

To transform insights into action and secure a competitive advantage, engage directly with Ketan Rohom, Associate Director of Sales & Marketing. By connecting with Ketan Rohom you will gain personalized guidance on how to navigate the evolving sunroof landscape and access exclusive data-driven perspectives tailored to your needs. This strategic partnership will enable your organization to capitalize on emerging opportunities, mitigate risks from regulatory changes, and unlock new revenue streams. Reach out today to procure the definitive car sunroof market report and empower your team with the intelligence required to lead with confidence and precision.

- How big is the Car Sunroof Market?

- What is the Car Sunroof Market growth?

- When do I get the report?

- In what format does this report get delivered to me?

- How long has 360iResearch been around?

- What if I have a question about your reports?

- Can I share this report with my team?

- Can I use your research in my presentation?