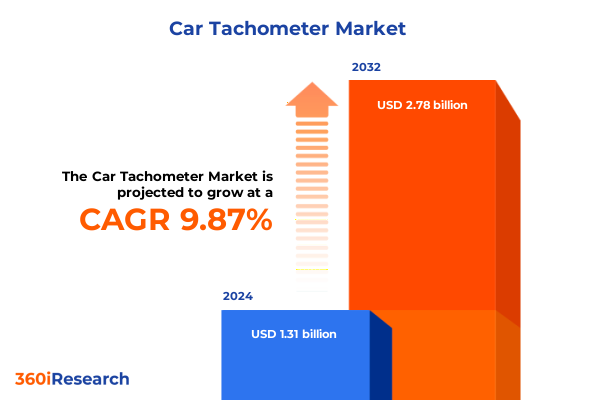

The Car Tachometer Market size was estimated at USD 1.43 billion in 2025 and expected to reach USD 1.57 billion in 2026, at a CAGR of 9.88% to reach USD 2.78 billion by 2032.

Driving Clarity into Vehicle Performance Monitoring Through Comprehensive Insights into Car Tachometer Dynamics and Technological Evolution Shaping Mobility

In the rapidly evolving landscape of vehicle performance monitoring, tachometers stand as a vital instrument for drivers and manufacturers alike. These precision gauges deliver real-time feedback on engine revolutions, enabling safe, efficient operation across diverse driving conditions. Over the past decade, the shift from purely mechanical systems toward electronic and digital interfaces has redefined the capabilities of tachometers, elevating them from simple dial indicators to integrated modules within advanced instrument clusters. This evolution reflects broader trends in automotive design, where connectivity and data analytics have become foundational pillars for performance insights and predictive maintenance.

Moreover, growing consumer expectations around user experience and safety standards have spurred manufacturers to innovate beyond traditional displays. Digital tachometers now often incorporate customizable interfaces, diagnostic warnings, and seamless integration with telematics platforms. As the automotive sector embraces electrification and automated driving technologies, tachometer solutions must adapt to monitor battery systems, electric motor efficiencies, and software-driven power management. This introduction lays the groundwork for a thorough examination of the forces shaping the car tachometer market, highlighting the intersections of technology, regulation, and consumer demand that inform strategic planning and product development in the industry.

Identifying Pivotal Technological and Market Transformations Redefining How Car Tachometer Manufacturers Innovate and Adapt to Evolving Automotive Demands

The car tachometer industry is experiencing a wave of transformative shifts driven by technological breakthroughs and new market imperatives. At the forefront is the acceleration of digitalization within vehicle cockpits, where analog gauges are increasingly replaced by high-resolution, software-configurable displays. This transition not only enhances visibility under varied lighting conditions but also enables dynamic data overlays, providing drivers with performance metrics that adjust according to driving mode, diagnostic status, or user preference. Such versatility reflects a broader move toward highly customizable in-vehicle experiences, influenced by consumer electronics trends and the demand for personalized mobility solutions.

Furthermore, the rise of connected vehicles has introduced telematics-driven insights, allowing tachometers to transmit engine performance data to remote analytics platforms. This connectivity supports predictive maintenance models and fleet management applications, reducing downtime and optimizing operational costs for commercial operators. Simultaneously, the global push towards electric and hybrid propulsion systems has expanded the scope of tachometer functionality. Rather than simply tracking engine revolutions, modern iterations now measure electric motor RPM, battery discharge rates, and regenerative braking performance. These paradigm shifts illustrate how car tachometer manufacturers must navigate an increasingly complex ecosystem, balancing hardware resilience with software innovation to meet evolving automotive demands.

Evaluating the Multifaceted Influence of 2025 United States Tariff Policies on Car Tachometer Supply Chains Pricing Strategies and Competitive Equilibriums

The introduction of new tariff measures in the United States during 2025 has had a substantial cumulative effect on the car tachometer market, reverberating across supply chains, pricing frameworks, and procurement strategies. With duties imposed on key imported components such as precision sensors, microprocessor units, and specialized display panels, manufacturers have faced increased material costs. These escalated expenses have prompted a reassessment of sourcing strategies, with several suppliers exploring nearshoring opportunities in North America to mitigate the impact of cross-border tariffs and ensure continuity of supply. The shift toward regional production hubs underscores the need for agile manufacturing architectures that can absorb cost shocks while maintaining quality standards.

In parallel, original equipment manufacturers have navigated higher input costs by renegotiating contracts, adopting cost-sharing mechanisms, and in some cases, redesigning product architectures to utilize more tariff-exempt materials. The redistribution of expenses between suppliers and OEMs has led to divergent pricing strategies: some providers have opted to absorb marginal cost increases to preserve market share, while others have passed a portion of these costs to end customers through incremental unit price adjustments. Looking ahead, the durability of these adaptations will depend on the evolution of trade policies and the ability of industry players to strategically diversify their component portfolios, balancing compliance with long-term profitability.

Uncovering Segment Specific Demand Drivers Spanning Vehicle Types Tachometer Technologies Fuel Preferences and Distribution Channels

Understanding demand drivers across vehicle categories reveals distinct trajectories in tachometer adoption and feature requirements. Within the heavy commercial vehicle segment, robustness and durability take precedence, prompting suppliers to engineer analog and digital tachometers that withstand high-vibration environments and extreme temperature fluctuations. On the other hand, light commercial vehicles demand greater emphasis on cost efficiency and ease of maintenance, leading manufacturers to optimize digital module designs for reduced assembly complexity and streamlined calibration processes. Meanwhile, passenger vehicles represent the largest canvas for tachometer innovation, combining aesthetics with advanced functionality through seamless integration into digital instrument clusters.

Tachometer type also plays a pivotal role in market segmentation. Analog variants continue to appeal to cost-sensitive segments and markets that prioritize proven mechanical reliability, whereas digital tachometers have surged in popularity due to their capacity for customization, compatibility with telematics systems, and advanced diagnostic capabilities. The underlying fuel type further influences feature sets: diesel-powered vehicles require tachometers capable of accurately tracking high torque ranges, electric vehicles necessitate modules that measure motor RPM and battery discharge cycles, hybrids blend functionalities to monitor dual propulsion systems, and petrol engines lean on tachometer interfaces to enhance driving feedback with sport-oriented performance metrics.

Finally, the distribution channel determines strategic outreach. OEM supply agreements focus on long-term partnerships and just-in-time delivery models, fostering tight integration between tachometer design and vehicle platform specifications. In contrast, the aftermarket segment demands broader compatibility and plug-and-play solutions, driving the development of universal interfaces and modular hardware that can retrofit diverse vehicle platforms. Together, these segmentation insights provide a nuanced perspective on how manufacturers tailor their product portfolios to align with varied operational, technological, and economic considerations.

This comprehensive research report categorizes the Car Tachometer market into clearly defined segments, providing a detailed analysis of emerging trends and precise revenue forecasts to support strategic decision-making.

- Vehicle Type

- Tachometer Type

- Vehicle Fuel Type

- Sales Channel

Analyzing Regional Market Nuances in North and South Americas Europe Middle East Africa and Asia Pacific for Car Tachometer Adoption and Growth Prospects

Regional dynamics in the Americas are characterized by a mix of mature automotive hubs and emerging markets. In North America, stringent regulatory standards and a high rate of technological adoption foster demand for digital tachometers with advanced diagnostic features. Fleet operators across the region have embraced telematics integration, driving a preference for modules that can seamlessly feed data into centralized management platforms. In South America, infrastructure development and rising vehicle ownership are creating new growth corridors, particularly in markets where affordability and local assembly are critical. Here, analog tachometers retain significant market share, though digital alternatives are slowly gaining traction as manufacturing capabilities and aftermarket networks expand.

The Europe, Middle East, and Africa region exhibits diverse market profiles. Western Europe is a hotbed for innovation, with luxury and performance vehicle manufacturers pushing the boundaries of tachometer design through customizable digital interfaces and immersive graphics. Regulations around emissions and safety further encourage the integration of performance monitoring systems that support fuel efficiency and predictive maintenance. Meanwhile, the Middle East presents opportunities driven by high commercial vehicle usage and investment in logistics infrastructure, favoring rugged tachometer solutions suited to heavy-haul applications. In Africa, growing demand for reliable aftermarket parts has led to a reliance on analog tachometers imported via regional trade corridors, creating potential for localized digital module manufacturing.

In Asia-Pacific, the market is propelled by a blend of established automotive powerhouses and rapidly growing economies. China and Japan, with their advanced manufacturing ecosystems, are at the forefront of digital tachometer innovation, leveraging domestic supply chain strengths and government incentives for electric vehicle development. In contrast, Southeast Asian and South Asian markets balance cost considerations with burgeoning adoption of hybrid and electric vehicles, calling for tachometers that can deliver hybrid instrumentation capabilities at competitive price points. Australia and New Zealand, with high standards for vehicle safety and performance, also show strong demand for digital modules capable of integrating with over-the-air update platforms and connected vehicle architectures.

This comprehensive research report examines key regions that drive the evolution of the Car Tachometer market, offering deep insights into regional trends, growth factors, and industry developments that are influencing market performance.

- Americas

- Europe, Middle East & Africa

- Asia-Pacific

Profiling Industry Leading Companies Driving Innovation Competitive Differentiation and Strategic Partnerships in the Car Tachometer Ecosystem

Leading players in the car tachometer ecosystem are leveraging a combination of technological innovation, strategic partnerships, and global production footprints to maintain competitive differentiation. Companies with a strong heritage in automotive instrumentation are focusing on expanding their digital product lines, investing in next-generation display technologies such as OLED and e-paper to enhance readability and power efficiency. These suppliers also collaborate closely with semiconductor manufacturers to co-develop high-precision microprocessors and sensor arrays optimized for rapid data acquisition and real-time performance analytics.

In parallel, emerging technology firms are entering the fray by offering modular tachometer platforms with open APIs, enabling third-party developers to build specialized applications and user interfaces. This trend is particularly evident in partnerships between instrument cluster specialists and telematics providers, where integrated solutions streamline data flow from vehicle systems to cloud-based analytics services. Some forward-thinking companies are also experimenting with augmented reality overlays and head-up display integrations, extending tachometer functionality beyond the dashboard.

At the strategic level, mergers and acquisitions have reshaped the competitive landscape, as larger automotive component manufacturers absorb niche instrumentation firms to broaden their solution portfolios. These consolidation moves create economies of scale in R&D and manufacturing, allowing combined entities to offer end-to-end cockpit systems that integrate tachometers with speedometers, infotainment screens, and driver assistance modules. As market consolidation progresses, the ability to deliver cohesive, customizable instrument clusters becomes a key differentiator among the top-tier companies shaping the future of car tachometers.

This comprehensive research report delivers an in-depth overview of the principal market players in the Car Tachometer market, evaluating their market share, strategic initiatives, and competitive positioning to illuminate the factors shaping the competitive landscape.

- Actia Group S.A.

- Atech Automotive Co. Ltd.

- Bosch Automotive Aftermarket

- Cruzpro Limited

- Datcon Instrument Company

- Denso Corporation

- Dixson Inc.

- Faria Instruments

- Intellitronix Corporation

- Jegs Automotive Inc.

- Koso North America Inc.

- Marshall Instruments

- Mitsubishi Electric Corporation

- New South Performance

- Nippon Seiki Co. Ltd.

- Nordskog Performance Products

- Smiths Industries plc

- Speedhut LLC

- Vetus B.V.

- Veyron Technologies

- Yazaki Corporation

Translating Market Intelligence into Actionable Strategies for Tachometer Manufacturers Suppliers and Automotive Stakeholders to Maintain Market Advantage

To thrive in an environment marked by rapid technological progress and shifting trade policies, industry leaders must adopt a proactive, data-driven approach. Manufacturers should prioritize the development of adaptable platform architectures for tachometers that can seamlessly support both analog and digital interfaces. This flexibility enables rapid customization for different vehicle types, fuel technologies, and regional requirements, minimizing time to market and reducing design complexity. Simultaneously, suppliers should deepen collaborations with semiconductor and display technology partners to co-create high-performance modules that anticipate the next wave of automotive standards and connectivity protocols.

Strengthening supply chain resilience is also critical. Companies should conduct thorough risk assessments of tariff exposure and diversify sourcing across multiple geographic zones. Investing in nearshore production facilities and long-term supplier contracts can mitigate cost fluctuations and ensure a stable flow of precision components. At the same time, implementing advanced inventory management systems and predictive demand analytics will help align production volumes with real-time market trends, reducing excess inventory and optimizing working capital.

Finally, forging strategic alliances within the automotive ecosystem can unlock new revenue streams. By partnering with telematics providers, fleet management platforms, and OEMs focused on electric mobility, tachometer suppliers can embed their solutions into broader digital service offerings. Crafting joint go-to-market strategies that emphasize integrated performance monitoring and predictive maintenance capabilities will position companies as indispensable enablers of modern vehicle operations, driving both top-line growth and enduring competitive advantage.

Detailing Rigorous Methodological Approaches Combining Primary Expert Engagement Comprehensive Secondary Research and Robust Data Validation Protocols

This study combines rigorous primary research with expansive secondary analysis to ensure robust, reliable insights. The primary phase involved in-depth interviews with key executives, engineering leaders, and product managers at major OEMs, tier 1 tachometer suppliers, and specialist telematics firms. These conversations provided firsthand perspectives on emerging requirements, technological roadmaps, and strategic responses to tariff measures. Additionally, targeted workshops with fleet operators and maintenance professionals enriched the qualitative understanding of usage patterns, feature preferences, and pain points across different vehicle categories.

On the secondary side, the research team conducted exhaustive reviews of industry white papers, technical patents, and regulatory filings to map the evolution of tachometer technologies and certification standards. Company annual reports, investor presentations, and press releases were analyzed to track strategic partnerships, mergers, and acquisitions shaping the competitive landscape. Trade journals and automotive engineering publications supplemented this data, ensuring a comprehensive view of market dynamics.

All collected data underwent meticulous validation through triangulation, comparing primary inputs with secondary sources to identify inconsistencies and refine findings. Statistical techniques were employed to categorize qualitative insights and align them with market segmentation schematics. This methodological rigor guarantees that the analysis reflects current realities and delivers actionable intelligence for stakeholders examining car tachometer trends and opportunities.

This section provides a structured overview of the report, outlining key chapters and topics covered for easy reference in our Car Tachometer market comprehensive research report.

- Preface

- Research Methodology

- Executive Summary

- Market Overview

- Market Insights

- Cumulative Impact of United States Tariffs 2025

- Cumulative Impact of Artificial Intelligence 2025

- Car Tachometer Market, by Vehicle Type

- Car Tachometer Market, by Tachometer Type

- Car Tachometer Market, by Vehicle Fuel Type

- Car Tachometer Market, by Sales Channel

- Car Tachometer Market, by Region

- Car Tachometer Market, by Group

- Car Tachometer Market, by Country

- United States Car Tachometer Market

- China Car Tachometer Market

- Competitive Landscape

- List of Figures [Total: 16]

- List of Tables [Total: 795 ]

Summarizing Insights and Implications from Car Tachometer Industry Dynamics to Guide Decision Makers Towards Strategic Foresight and Mobility Investments

The car tachometer sector stands at the intersection of traditional automotive instrumentation and cutting-edge digital innovation. As manufacturers navigate the implications of new tariff regimes, evolving consumer expectations, and the shift toward electrified powertrains, the capacity to deliver versatile, high-performance tachometer solutions becomes paramount. Insights into segment-specific requirements highlight the necessity for modular designs that cater to heavy commercial, light commercial, and passenger vehicles alike, while also addressing the distinct needs of analog and digital preferences across diverse fuel types and sales channels.

Regional analyses underscore the importance of aligning product strategies with local regulations and market maturity, whether in the technologically advanced landscapes of North America and Western Europe or the cost-sensitive markets of South America and parts of Asia-Pacific. Similarly, understanding competitive maneuvers-ranging from joint ventures in advanced display development to mergers aimed at integrated cockpit solutions-helps industry players anticipate future market shifts and position themselves advantageously.

Ultimately, the convergence of methodological rigor, strategic planning, and technological partnership will determine which organizations lead the trajectory of car tachometer evolution. By applying the actionable recommendations outlined in this report, stakeholders can fortify their innovation pipelines, optimize operational resilience, and capitalize on emerging growth avenues in the dynamic world of vehicle performance monitoring.

Empowering Industry Stakeholders with Critical Car Tachometer Market Research Insights and Direct Engagement Opportunities with Sales Leadership

To gain a comprehensive understanding of car tachometer trends and power impactful decision-making, engage directly with our sales leadership. Ketan Rohom, Associate Director of Sales & Marketing, brings extensive industry knowledge and can guide you through tailored research offerings designed to address specific strategic needs. By connecting with Ketan Rohom, you unlock an opportunity to explore in-depth analyses, clarify technical queries, and align research insights with your organizational objectives. Proactive engagement ensures you receive personalized support, fast access to critical data, and specialized recommendations aimed at enhancing your competitive positioning in the tachometer market.

Take the next step toward informed investment and technology adoption by reaching out to Ketan Rohom for a detailed consultation. This direct collaboration bridges the gap between market intelligence and practical implementation, enabling your team to anticipate industry shifts and capitalize on emerging opportunities. Whether you seek a deep dive into segment dynamics, guidance on tariff impacts, or a collaborative discussion on innovation strategies, Ketan Rohom is poised to deliver the strategic insights you need to advance your initiatives.

Secure your path to futureproofing your operations in the dynamic car tachometer sector by contacting Ketan Rohom today. Empower your organization with the most pertinent market research report and translate intelligence into action.

- How big is the Car Tachometer Market?

- What is the Car Tachometer Market growth?

- When do I get the report?

- In what format does this report get delivered to me?

- How long has 360iResearch been around?

- What if I have a question about your reports?

- Can I share this report with my team?

- Can I use your research in my presentation?