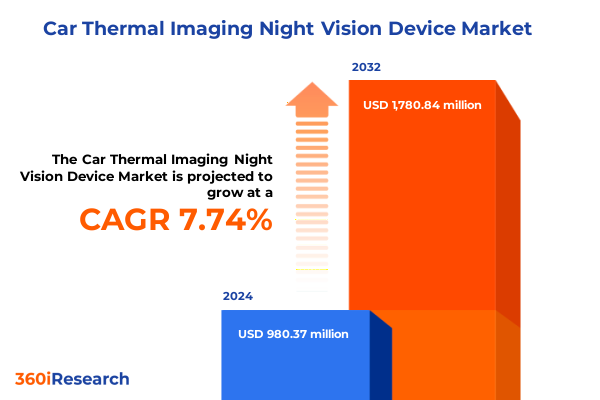

The Car Thermal Imaging Night Vision Device Market size was estimated at USD 1.03 billion in 2025 and expected to reach USD 1.12 billion in 2026, at a CAGR of 8.04% to reach USD 1.78 billion by 2032.

Discovering the Transformative Potential and Strategic Importance of Automotive Thermal Imaging Night Vision Technology Innovations

In recent years, the automotive industry has witnessed a surge of interest in thermal imaging night vision devices as manufacturers seek to address the critical safety challenges associated with low-visibility driving conditions. Traditional camera-based systems often struggle to detect pedestrians, animals, and obstacles in complete darkness or adverse weather, leaving drivers vulnerable. Thermal imaging harnesses the infrared spectrum to reveal heat signatures, providing a stark contrast between living beings or objects and their surroundings, thereby offering a vital supplementary layer of awareness. As a result, deployment of these devices can significantly enhance accident avoidance capabilities, elevating night-time driving safety.

Moreover, regulatory bodies and consumer safety advocates have increasingly emphasized the need for advanced driver assistance systems that go beyond conventional technologies. This evolving regulatory landscape is driving automakers to integrate cutting-edge safety solutions, positioning thermal imaging not merely as a luxury feature but as a strategic imperative. Furthermore, the convergence of sensing hardware and sophisticated software, including artificial intelligence and advanced image processing algorithms, enables real-time threat detection and driver alerts, ensuring that valuable thermal data is both accurate and actionable.

Consequently, stakeholders across the automotive ecosystem-from OEMs to aftermarket specialists-are assessing how thermal imaging night vision can deliver differentiated value. This executive summary distills the pivotal trends shaping the market, examines the impact of recent policy changes, and lays out critical insights to inform strategic decision making in an industry that is rapidly redefining the boundaries of vehicle safety.

Analyzing How Technological Advances And Regulatory Developments Are Reshaping The Automotive Thermal Imaging Night Vision Market

Over the past decade, breakthroughs in sensor miniaturization and cost reduction have revolutionized the feasibility of integrating thermal imaging into passenger and commercial vehicles alike. Innovations in uncooled microbolometer arrays have driven down power consumption and production costs, while advances in cooled detectors, leveraging pulse tube and Stirling engine cooling technologies, have enhanced sensitivity for ultra-long detection ranges. Concurrently, machine learning algorithms are delivering ever more precise object recognition and classification, enabling systems to differentiate between pedestrians, animals, and roadway debris with unprecedented accuracy.

Alongside technological evolution, strategic partnerships between camera sensor suppliers and software firms have accelerated the development of modular, scalable solutions that can be tailored to distinct vehicle platforms. This collaboration has catalyzed transformative ecosystem shifts, enabling automakers to adopt thermal imaging as part of integrated Advanced Driver Assistance Systems (ADAS) suites. As a result, the technology is transitioning from niche luxury segments into mainstream applications, with special purpose, emergency, and military vehicle fleets demonstrating early adoption that is now informing uptake in commercial trucks, buses, and two-wheelers.

Furthermore, an emerging regulatory focus on Vision Enhancement Technologies (VET) is propelling thermal imaging toward broader standardization. As policymakers and safety agencies assess night-vision performance benchmarks, manufacturers are compelled to validate their solutions through rigorous testing and certification processes. This interplay between regulation, technological maturity, and cross-industry collaboration is driving a foundational transformation in how the automotive sector approaches night-time roadway safety.

Assessing The Effects Of New 2025 United States Tariffs On Automotive Thermal Imaging Night Vision Device Supply Chains And Cost Structures

In 2025, the implementation of revised United States tariffs on imported thermal camera modules and related components has introduced new complexities to the automotive thermal imaging supply chain. Specifically, increased duties on certain infrared detector imports have elevated landed costs for module assemblers, prompting many to reevaluate their sourcing strategies. This shift has, in turn, encouraged a more robust emphasis on domestic manufacturing capabilities, as original equipment manufacturers seek to mitigate exposure to tariff-induced price volatility.

The cumulative effect of these tariffs is not limited to direct procurement costs; ripple effects are being felt across the distribution and installation landscape. Aftermarket providers offering accessory modules and retrofit kits have experienced margin compression, leading some to streamline product portfolios and concentrate on higher-value offerings. Meanwhile, OEMs are exploring vertical integration for critical cooled detector subassemblies, leveraging established North American manufacturing clusters to ensure continuity of supply and maintain stringent quality standards.

Consequently, stakeholders must adapt to a market environment where tariff policy significantly influences pricing structures and competitive dynamics. Organizations that proactively adjust their supply networks and invest in localized production will likely secure greater resilience, while those reliant on current import channels may face cost pressures that constrain their ability to invest in ongoing research and development. Such strategic realignments underscore the importance of closely monitoring trade policy developments as an integral component of competitive planning.

Unpacking Critical Market Segmentation Insights To Reveal Performance Drivers Across Applications Technologies Installation Types Price Ranges Detection And Resolution

A comprehensive examination of market segmentation reveals critical insights into performance drivers and adoption patterns across applications, technologies, installation types, price ranges, detection capabilities, and resolution tiers. In terms of application, commercial vehicles-encompassing buses, trucks, and vans-have emerged as early adopters, deploying systems to enhance fleet safety during nocturnal operations, while passenger cars, particularly electric and hybrid models, are increasingly integrating night vision to complement their advanced propulsion platforms. Special purpose vehicles designed for emergency response and defense have historically led technology penetration, and two-wheeler applications including motorcycles and scooters are now demonstrating pilot deployments in regions with challenging nighttime driving conditions.

When analyzing technology preferences, the market is divided between cooled variants-driven by performance demands for ultra-long detection ranges-and uncooled options valued for lower cost and power efficiency. Pulse tube and Stirling engine cooler designs are typically specified for premium or military-grade installations, whereas amorphous silicon and vanadium oxide microbolometer arrays enable broader accessibility through more compact and cost-effective packages. Installation channels further stratify the landscape, with OEM integration dominating new vehicle programs while the aftermarket remains a vital channel for retrofit kits and accessory modules aimed at safety-conscious consumers.

Price considerations influence buyer behavior across high-end luxury implementations down to budget-oriented entry-level products. Within high-end systems, configurations often feature luxury or premium branding, whereas low-end offerings cater to cost-sensitive segments with simplified functionality. Detection range segmentation spans from short-distance urban solutions to medium-range commuter platforms and long-to ultra-long-range systems for highway and defense applications. Finally, resolution grades vary from high-definition arrays such as 1536×1152 to moderate 480×360 options and low-resolution compact sensors, each balancing clarity against price and power demands. Understanding how these segmentation dimensions intersect is crucial for crafting product strategies that resonate with target segments.

This comprehensive research report categorizes the Car Thermal Imaging Night Vision Device market into clearly defined segments, providing a detailed analysis of emerging trends and precise revenue forecasts to support strategic decision-making.

- Technology

- Installation Type

- Detection Range

- Resolution

- Application

Evaluating Regional Dynamics Across The Americas Europe Middle East Africa And Asia-Pacific To Highlight Growth Opportunities And Challenges

Regional dynamics play a pivotal role in shaping how thermal imaging night vision technologies are adopted and deployed. In the Americas, a combination of stringent safety standards, well-established ADAS integration practices, and significant investments in domestic manufacturing infrastructure have fostered an environment where both OEMs and retrofit specialists collaborate to refine system performance. As a result, North American fleets and luxury vehicle lines often serve as testbeds for next-generation sensing solutions.

Across Europe, the Middle East, and Africa, regulatory harmonization around Vision Enhancement Technologies is driving consistent requirements that encourage broad deployment. European automakers leverage regional R&D capabilities to optimize product variants for diverse climates, while Gulf region commercial carriers and African emergency response units pilot specialized configurations tailored to regional operational demands. This confluence of regulation and localized adaptation underscores the importance of flexible system design that addresses varied roadway geometries and environmental conditions.

Meanwhile, Asia-Pacific is witnessing rapid adoption fueled by burgeoning vehicle volumes and government programs promoting advanced safety features as part of smart city initiatives. Leading automotive markets in this region combine high production capacity with growing end-user expectations for enhanced night-time visibility, creating a fertile landscape for both premium and cost-effective thermal imaging solutions. In addition, regional sensor manufacturers are scaling operations to meet global demand, reinforcing Asia-Pacific’s dual role as a consumption and production hub for night vision technologies.

This comprehensive research report examines key regions that drive the evolution of the Car Thermal Imaging Night Vision Device market, offering deep insights into regional trends, growth factors, and industry developments that are influencing market performance.

- Americas

- Europe, Middle East & Africa

- Asia-Pacific

Highlighting Strategic Movements And Competitive Positioning Of Leading Global Players In The Automotive Thermal Imaging Night Vision Sector

Leading global players are advancing the frontier of automotive thermal imaging through strategic investments, partnerships, and continuous product innovations. Prominent sensor manufacturers are expanding their cooled detector lines to offer modular platforms compatible with multiple vehicle architectures, thereby simplifying integration for Tier-1 suppliers and OEMs. At the same time, specialized vision solution providers are forging alliances with artificial intelligence firms to deploy on-edge analytics that enhance object recognition in real time, pushing system latency and accuracy to new thresholds.

Automotive OEMs, recognizing the competitive differentiation afforded by superior night-vision performance, are incorporating thermal imaging as standard or optional features in flagship models. Concurrently, tier-one electronics suppliers are leveraging their existing ADAS portfolios to bundle thermal imaging with radar, LiDAR, and conventional camera sensors, presenting cohesive multisensor solutions that streamline procurement and certification processes. Furthermore, aftermarket technology integrators are introducing retrofit modules that mirror OEM-grade designs, enabling fleet operators and individual vehicle owners to access advanced thermal capabilities without extensive vehicle modification.

These collaborative dynamics have produced a robust ecosystem in which companies at various tiers play complementary roles. As hardware costs continue to decline and software architectures mature, the competitive landscape is shifting toward service and support offerings, including remote diagnostics, over-the-air updates, and tailored maintenance programs, all of which serve to reinforce long-term customer engagement and system uptime.

This comprehensive research report delivers an in-depth overview of the principal market players in the Car Thermal Imaging Night Vision Device market, evaluating their market share, strategic initiatives, and competitive positioning to illuminate the factors shaping the competitive landscape.

- Adasky Ltd.

- Autoliv Inc.

- Continental AG

- Denso Corporation

- Gentex Corporation

- Guide Infrared

- Hella GmbH & Co. KGaA

- Hikmicro Technology Co., Ltd.

- Infineon Technologies AG

- InfiRay Technology Co., Ltd.

- L3Harris Technologies, Inc.

- Magna International Inc.

- North Guangke Technology Co., Ltd.

- OmniVision Technologies, Inc.

- Raytheon Technologies Corporation

- Robert Bosch GmbH

- SATIR Technology Ltd.

- Teledyne Israel Ltd.

- Valeo SA

- Xenics NV

- ZF Friedrichshafen AG

Strategic Recommendations For Automakers And Suppliers To Leverage Thermal Imaging Night Vision Innovations And Enhance Safety Performance

To capitalize on the emerging opportunities in automotive thermal imaging night vision, industry leaders should prioritize a series of strategic initiatives. First, investing in sensor fusion research that integrates thermal data with radar and LiDAR will enhance detection robustness and mitigate false positives under challenging environmental conditions. Moreover, establishing flexible manufacturing partnerships that balance domestic production with regional sourcing resilience can buffer against tariff fluctuations and supply bottlenecks.

In parallel, stakeholders should cultivate close collaboration with regulatory bodies to shape performance standards for night-vision systems, ensuring that new requirements align with practical deployment scenarios and drive meaningful safety improvements. On the product side, adopting modular architectures that accommodate both cooled and uncooled detectors across diverse resolution and price tiers will enable scalable offerings tailored to premium luxury vehicles, budget-focused segments, and specialized fleets. Equally important is the development of aftermarket retrofit solutions that maintain OEM-grade quality, thereby unlocking additional revenue streams and fostering brand loyalty among end users.

Finally, forging alliances with software innovators to refine AI-driven threat detection and implementing over-the-air update frameworks will establish enduring differentiation, bolstering system adaptability as new detection algorithms emerge. By undertaking these concerted measures, automakers and suppliers can position themselves at the forefront of a market that is redefining roadway safety through the lens of thermal sensing.

Detailing The Rigorous Research Approach And Validation Techniques Underpinning The Analysis Of Automotive Thermal Imaging Night Vision Trends

This analysis is grounded in a rigorous multi-stage research process designed to deliver comprehensive and reliable insights. Initially, an extensive review of patent filings, technical whitepapers, and academic journals was conducted to map the evolution of infrared detector technologies, sensor calibration procedures, and signal processing architectures. To validate these findings, subject matter expert interviews were carried out with engineers from vehicle OEMs, Tier-one component suppliers, and leading universities engaged in optical sciences research.

Subsequently, a structured primary research phase encompassed in-depth discussions with fleet operators, retrofit installers, and aftermarket distributors to capture real-world performance feedback and identify key pain points. This qualitative input was synthesized with secondary desk research, including publicly available regulatory documents, industry symposium proceedings, and safety agency reports, to cross-reference observed trends against emerging policy frameworks.

Finally, data triangulation techniques were employed to ensure consistency across disparate information sources, followed by a peer review conducted by independent automotive safety analysts. This methodological rigor underpins the validity of the strategic insights and recommendations presented throughout this summary, providing stakeholders with an authoritative foundation for navigating the evolving landscape of automotive thermal imaging night vision.

This section provides a structured overview of the report, outlining key chapters and topics covered for easy reference in our Car Thermal Imaging Night Vision Device market comprehensive research report.

- Preface

- Research Methodology

- Executive Summary

- Market Overview

- Market Insights

- Cumulative Impact of United States Tariffs 2025

- Cumulative Impact of Artificial Intelligence 2025

- Car Thermal Imaging Night Vision Device Market, by Technology

- Car Thermal Imaging Night Vision Device Market, by Installation Type

- Car Thermal Imaging Night Vision Device Market, by Detection Range

- Car Thermal Imaging Night Vision Device Market, by Resolution

- Car Thermal Imaging Night Vision Device Market, by Application

- Car Thermal Imaging Night Vision Device Market, by Region

- Car Thermal Imaging Night Vision Device Market, by Group

- Car Thermal Imaging Night Vision Device Market, by Country

- United States Car Thermal Imaging Night Vision Device Market

- China Car Thermal Imaging Night Vision Device Market

- Competitive Landscape

- List of Figures [Total: 17]

- List of Tables [Total: 2385 ]

Synthesizing Core Findings To Emphasize The Future Trajectory And Strategic Imperatives For Automotive Thermal Imaging Night Vision Adoption

In synthesis, automotive thermal imaging night vision technology stands at the cusp of transforming vehicle safety by delivering unparalleled visibility in low-light and adverse conditions. Technological advancements in cooled and uncooled detectors, combined with AI-driven analytics, are enabling solutions that meet the diverse needs of commercial fleets, passenger vehicles, and specialized emergency platforms. The 2025 tariff landscape underscores the significance of adaptive supply chain strategies, while segmentation and regional insights reveal where tailored offerings can achieve maximum impact.

Moreover, the competitive environment is defined by strategic collaborations that merge hardware expertise with software innovation, paving the way for integrated multisensor ADAS suites. As industry leaders embark on next-generation product development, emphasis on modular designs, robust regulatory engagement, and scalable aftermarket pathways will serve as critical differentiators. Looking ahead, continuous investment in sensor fusion, localized manufacturing, and over-the-air software support will shape the trajectory of night-vision adoption and solidify its role within the broader ecosystem of vehicle safety technologies.

Ultimately, organizations that leverage these insights to refine their strategic roadmaps will be best positioned to harness the full potential of thermal imaging night vision, driving meaningful reductions in nighttime collision risks and elevating the overall safety profile of the vehicles they bring to market.

Encouraging Stakeholder Engagement With Ketan Rohom To Secure Comprehensive Market Insights And Drive Informed Decision-Making

Thank you for exploring this executive summary on automotive thermal imaging night vision technology. To gain comprehensive insights, tailored analysis, and strategic recommendations that empower your organization to make informed decisions, please connect with Ketan Rohom, Associate Director of Sales & Marketing. By engaging directly with Ketan, you will receive personalized guidance on how this research can address your specific objectives, unlock market opportunities, and enhance your competitive positioning. Reach out today to secure your full report and collaborate with an expert who can help transform these insights into actionable strategies that drive tangible results.

- How big is the Car Thermal Imaging Night Vision Device Market?

- What is the Car Thermal Imaging Night Vision Device Market growth?

- When do I get the report?

- In what format does this report get delivered to me?

- How long has 360iResearch been around?

- What if I have a question about your reports?

- Can I share this report with my team?

- Can I use your research in my presentation?