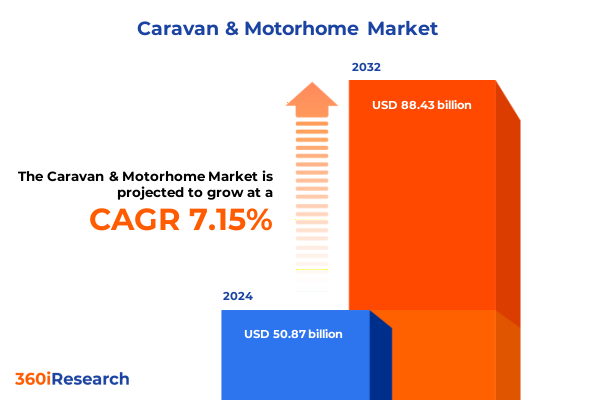

The Caravan & Motorhome Market size was estimated at USD 54.49 billion in 2025 and expected to reach USD 57.86 billion in 2026, at a CAGR of 7.16% to reach USD 88.43 billion by 2032.

Exploring the Evolving Landscape of Caravan and Motorhome Market Dynamics to Equip Decision-Makers with Actionable Insights for Strategic Growth in 2025

The caravan and motorhome landscape has undergone a remarkable evolution as consumer priorities shift toward experiential travel and adaptable living solutions. Once viewed solely as recreational commodities, these vehicles are now recognized as extensions of personal lifestyle, blending mobility with modern conveniences. Against the backdrop of shifting economic conditions and heightened environmental consciousness, stakeholders across the value chain are reorienting strategies to meet demand for sustainability, connectivity, and versatility.

Moreover, the convergence of technology and leisure has redefined expectations, with buyers seeking advanced infotainment, seamless connectivity, and energy-efficient powertrains. As manufacturers refine their offerings, partnerships with technology providers and material innovators are accelerating new product launches. With regulatory frameworks tightening around emissions and safety, the industry must also navigate evolving compliance requirements. This introduction sets the stage for a closer examination of the transformative forces, policy impacts, and market segmentation that will determine the competitive landscape and inform strategic decision-making.

Embracing Industry Transformations from Electrification and Digitalization to Sustainable Materials Revolutionizing How Caravans and Motorhomes Serve Modern Consumers

Over the past few years, the caravan and motorhome sector has entered a phase of profound transformation underpinned by electrification, connectivity enhancements, and sustainable material adoption. Electrified powertrains are no longer niche experiments but strategic pillars for manufacturers seeking to align with emissions targets and eco-conscious traveler preferences. Simultaneously, digitalization has redefined the customer journey, as virtual showrooms and augmented reality pre-purchase experiences reduce friction and expand market reach.

In addition, the integration of lightweight composites and recycled materials is transforming vehicle architecture, contributing to weight reduction and increased range for both towed and self-propelled models. Connectivity platforms now provide real-time diagnostic data, enabling predictive maintenance and personalized travel recommendations. These shifts are reinforced by evolving consumer values: today’s buyers prioritize modular interior layouts, energy self-sufficiency through integrated renewable energy systems, and the ability to customize mobility hubs according to lifestyle needs. Consequently, industry players must embrace agile product development and a culture of continuous innovation to remain relevant in this dynamic landscape.

Evaluating the Compounding Consequences of U.S. Tariff Measures in 2025 on Supply Chains Operational Margins and Global Trade Competitiveness

In 2025, U.S. tariff policies have introduced a new layer of complexity for suppliers and distributors across North America. Higher duties on imported recreational vehicles and key components have prompted many enterprises to reevaluate their sourcing strategies, leading to increased collaboration with domestic chassis and components manufacturers. The ripple effect extends from raw material procurement to final assembly, as cost pressures necessitate a balance between maintaining margin integrity and preserving product quality.

Furthermore, service providers across the value chain-ranging from dealerships to maintenance networks-are recalibrating their pricing models in response to greater operational expenditures. To mitigate these headwinds, several industry leaders have instituted nearshoring initiatives, establishing assembly operations closer to end markets. At the same time, strategic alliances with local vendors help secure preferential treatment under trade agreements and facilitate compliance with evolving tariff schedules. This environment demands a proactive approach to supply chain visibility, dynamic cost modeling, and risk mitigation to safeguard competitiveness while delivering customer value.

Uncovering Core Consumer Preferences and Specialized Market Niches through a Comprehensive Segmentation Framework Spanning Type Price Range and Powertrain

As the market is analyzed across caravan and motorhome categories, one observes the nuanced performance differences between conventional caravans, fifth wheels, and pop-up trailers alongside Class A, Class B, and Class C motorhomes. Throughout these vehicle type variations, manufacturers tailor designs and amenity offerings to specific traveler profiles, driving innovation in both space optimization and towing technology. At the same time, cost sensitivity diverges significantly across economy, mid-range, and luxury price brackets, with value-focused segments emphasizing foundational functionality and premium tiers demanding integrated smart controls and high-end finishes.

When evaluating vehicle dimensions, models shorter than five meters capture the interest of urban adventurers prioritizing ease of maneuverability, whereas offerings between five and seven meters deliver a balanced combination of living space and drivability. In contrast, units exceeding seven meters serve sizable families or extended expeditioners requiring expansive interiors and enhanced storage. Powertrain segmentation further differentiates market adoption, as diesel powertrains uphold legacy preferences for long-haul efficiency, gasoline platforms benefit from extensive service infrastructure, and electric drivetrains emerge as the vanguard for sustainability advocates. End users-from commercial fleets to leisure enthusiasts and rental operators-each impose distinct durability and configurability requirements. Meanwhile, distribution channels ranging from traditional dealerships to direct factory sales and online platforms redefine the purchase journey, and sleeping capacity options spanning two-person through six-plus arrangements shape vehicle interior optimization. Finally, chassis constructions, whether integrated motorhome shells, semi-integrated coachbuilt designs, or versatile van conversions, underscore how structural frameworks intersect with consumer priorities and operational use cases.

This comprehensive research report categorizes the Caravan & Motorhome market into clearly defined segments, providing a detailed analysis of emerging trends and precise revenue forecasts to support strategic decision-making.

- Length

- Powertrain

- Chassis Type

- Vehicle Type

- End User

Highlighting Strategic Variations in Consumer Demand Infrastructure Developments and Regulatory Frameworks across the Americas EMEA and Asia-Pacific Regions

Regional landscapes present contrasting growth trajectories and operational considerations for market participants. In the Americas, a deeply established dealership infrastructure and strong recreational culture underpin stable demand patterns. Consumers demonstrate a preference for rugged diesel platforms and expansive motorhome configurations, supported by extensive highway networks and a mature service ecosystem. Moreover, collaboration between OEMs and outdoor lifestyle brands has enhanced accessory offerings, reinforcing product differentiation.

Across Europe, the Middle East, and Africa, regulatory emphasis on emissions and vehicle weight drives material innovation and alternative energy integration, especially in densely populated regions with stringent environmental standards. Classic caravan traditions coexist with rising interest in compact, urban-friendly designs. Meanwhile, dealer and rental networks across these territories leverage established tourism corridors to amplify utilization rates. In the Asia-Pacific sphere, rapid infrastructure development and growing disposable incomes are unlocking new opportunities, particularly in markets receptive to electric powertrain adoption and flexible rental business models. However, import reliance and variable regulatory frameworks call for agile market entry strategies, local manufacturing partnerships, and tailored financial offerings to capture emerging demand pockets.

This comprehensive research report examines key regions that drive the evolution of the Caravan & Motorhome market, offering deep insights into regional trends, growth factors, and industry developments that are influencing market performance.

- Americas

- Europe, Middle East & Africa

- Asia-Pacific

Spotlighting Leading Industry Players Strategic Alliances and Innovation Pathways Shaping the Caravan and Motorhome Landscape with Competitive Differentiation

Leading companies have adopted distinct pathways to secure competitive advantages, ranging from product innovation to strategic collaborations. Major OEMs known for volume leadership are increasingly investing in modular platforms to accelerate time to market and accommodate diverse chassis and accommodation configurations. At the same time, premium segment specialists are forging partnerships with luxury interior designers and technology firms to elevate the customer experience through bespoke finishes and integrated smart home controls.

Collaboration models extend into the supply chain, where alliances with battery and power electronics suppliers enable the rollout of electric motorhome prototypes. In parallel, several firms have pursued joint ventures in regions affected by tariff changes to streamline production and achieve regulatory compliance. Aftermarket service providers are embracing connected vehicle data insights to deliver predictive maintenance programs and subscription-based support offerings. These strategic initiatives highlight how a combination of agility, cross-sector partnerships, and customer-centric innovation defines leadership in today’s caravan and motorhome industry.

This comprehensive research report delivers an in-depth overview of the principal market players in the Caravan & Motorhome market, evaluating their market share, strategic initiatives, and competitive positioning to illuminate the factors shaping the competitive landscape.

- Adria Mobil, d.o.o.

- Bürstner GmbH & Co. KG

- Dethleffs GmbH & Co. KG

- Elddis Ltd

- Forest River, Inc.

- Giottiline S.r.l.

- Hymer AG

- Knaus Tabbert AG

- Laika S.p.A.

- LMC Caravan GmbH & Co. KG

- Newmar Corporation

- Nexus RV, LLC

- Niesmann+Bischoff GmbH & Co. KG

- Northwood Manufacturing, LLC

- Swift Group Limited

- Thor Industries, Inc.

- Tiffin Motorhomes, Inc.

- Trigano S.A.

- Triple E Recreational Vehicles, Inc.

- Winnebago Industries, Inc.

Charting a Strategic Roadmap of Actionable Initiatives to Enhance Operational Efficiency Drive Innovation and Strengthen Market Positioning Amidst Industry Disruption

Industry leaders are encouraged to prioritize the development of electrified vehicle platforms alongside scalable charging infrastructure partnerships to meet rising sustainability demands and regulatory mandates. Concurrently, investing in digital sales ecosystems-such as virtual configurators and immersive online showrooms-can significantly enhance consumer engagement and reduce purchase cycle times. Integrating advanced telematics across product lines will not only support predictive maintenance services but also open revenue streams through subscription-based connectivity offerings.

Furthermore, companies should evaluate the feasibility of nearshoring critical assembly and component operations to mitigate tariff pressures and logistics disruptions. Establishing flexible manufacturing cells capable of switching between diesel, gasoline, and electric powertrain configurations will bolster resilience against supply chain volatility. Expanding alliances with rental and lifestyle service providers can also drive higher asset utilization rates and generate data-driven insights for iterative product improvements. Finally, fostering partnerships with regulatory bodies and industry associations will ensure proactive alignment with evolving standards, safeguarding market access and long-term growth prospects.

Outlining a Robust Mixed Research Methodology Integrating Primary Stakeholder Engagement Benchmarking and Secondary Data Analysis for Comprehensive Market Intelligence

This research employs a rigorous mixed-methods framework that integrates primary stakeholder engagement, quantitative benchmarking, and in-depth secondary data analysis to deliver holistic market insights. Primary research comprised structured interviews and consultations with senior executives from vehicle manufacturers, component suppliers, distribution networks, and end-user organizations. These dialogues provided first-hand perspectives on emerging trends, strategic priorities, and operational challenges across key regions.

Secondary research involved systematic reviews of industry publications, regulatory filings, and trade association reports, as well as an examination of technological white papers and sustainability guidelines. Data points were cross-validated through triangulation to ensure consistency and reliability. Benchmarking exercises compared product portfolios, pricing strategies, and service models to distill best practices. Throughout the process, an emphasis on impartiality and methodological transparency guided data collection and analysis, culminating in actionable intelligence that addresses both macro trends and granular market dynamics.

This section provides a structured overview of the report, outlining key chapters and topics covered for easy reference in our Caravan & Motorhome market comprehensive research report.

- Preface

- Research Methodology

- Executive Summary

- Market Overview

- Market Insights

- Cumulative Impact of United States Tariffs 2025

- Cumulative Impact of Artificial Intelligence 2025

- Caravan & Motorhome Market, by Length

- Caravan & Motorhome Market, by Powertrain

- Caravan & Motorhome Market, by Chassis Type

- Caravan & Motorhome Market, by Vehicle Type

- Caravan & Motorhome Market, by End User

- Caravan & Motorhome Market, by Region

- Caravan & Motorhome Market, by Group

- Caravan & Motorhome Market, by Country

- United States Caravan & Motorhome Market

- China Caravan & Motorhome Market

- Competitive Landscape

- List of Figures [Total: 17]

- List of Tables [Total: 1272 ]

Summarizing Pivotal Insights and Strategic Imperatives to Navigate Disruption Foster Resilience and Sustain Competitive Advantage in the Caravan and Motorhome Sector

The caravan and motorhome industry stands at a pivotal juncture where technological innovation, regulatory evolution, and shifting consumer expectations intersect. As electrified powertrains gain momentum and digital customer experiences become baseline requisites, companies must cultivate organizational agility to pivot in response to tariff fluctuations and regional market nuances. Strategic segmentation insights underscore the importance of tailored product programs that resonate with distinct user profiles, whether urban explorers seeking compact motorhomes or luxury travelers desiring expansive living quarters.

Looking ahead, the ability to forge synergistic partnerships-across technology providers, supply chain allies, and regional stakeholders-will separate market leaders from followers. By adhering to the outlined recommendations, firms can enhance operational resilience, unlock new revenue streams, and deliver differentiated value propositions. This executive summary thus serves as a strategic compass, guiding stakeholders through the complexities of a dynamic marketplace and towards sustained competitive advantage.

Connect with Ketan Rohom to Secure Exclusive Access to the Comprehensive Caravan and Motorhome Market Research Report and Unlock Strategic Growth Opportunities

I invite you to connect with Ketan Rohom, Associate Director of Sales & Marketing, to explore how this comprehensive research can catalyze your strategic initiatives in the caravan and motorhome industry. Through a personalized briefing, Ketan will walk you through tailored insights on product innovation, supply chain resilience, and market entry opportunities that align with your growth objectives. By securing this report, you gain not only a detailed analysis of transformative trends and tariff impacts, but also access to an actionable roadmap designed to strengthen your competitive positioning. Reach out today to schedule your exclusive consultation, uncover untapped market potential, and chart a path toward sustained success in an ever-evolving environment. Together, let’s turn data into winning strategies and drive your business forward with confidence.

- How big is the Caravan & Motorhome Market?

- What is the Caravan & Motorhome Market growth?

- When do I get the report?

- In what format does this report get delivered to me?

- How long has 360iResearch been around?

- What if I have a question about your reports?

- Can I share this report with my team?

- Can I use your research in my presentation?