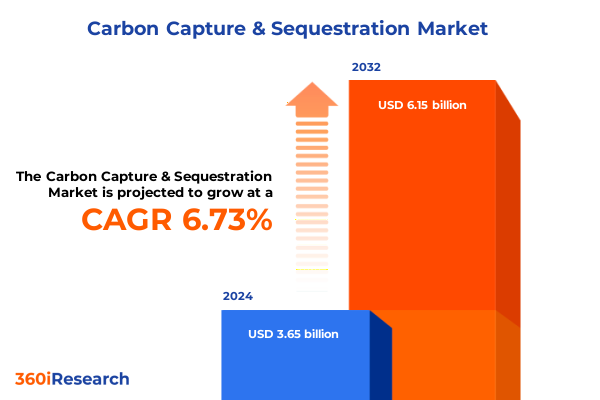

The Carbon Capture & Sequestration Market size was estimated at USD 3.87 billion in 2025 and expected to reach USD 4.11 billion in 2026, at a CAGR of 6.83% to reach USD 6.15 billion by 2032.

Unveiling the Strategic Imperative of Carbon Capture and Sequestration in Decarbonizing Industrial Emissions and Ensuring Sustainable Energy Transitions

The intensifying global commitment to net-zero targets has elevated carbon capture and sequestration from an emerging mitigation concept to a strategic necessity across energy and industrial sectors. With governments worldwide consolidating policy frameworks and regulators tightening emissions standards, the pathway to decarbonization increasingly hinges on the large-scale deployment of technologies capable of capturing carbon dioxide at the point of emission and securing permanent storage underground.

Against this backdrop, carbon capture and sequestration has moved to the forefront of climate action strategies, particularly within heavy industries where combustion and process emissions prove difficult to abate through electrification or fuel switching alone. Industrial facilities that produce cement, steel, chemicals or engage in hydrogen production now view capture capabilities as both a compliance mechanism under evolving regulatory regimes and an opportunity to unlock financial incentives. Simultaneously, power generation and natural gas processing operations are reengineering flue gas treatment and separation processes to align with stricter emissions criteria.

In this dynamic environment, technological innovation converges with policy support-ranging from expanded tax credits to direct public funding-to accelerate project viability and economic competitiveness. The strategic implications for stakeholders span across supply chain integration, project finance structuring, and cross-sector partnerships. As such, decision makers must comprehend not only the technical intricacies of capture methods and storage options but also the shifting regulatory landscape and the incentives designed to catalyze investment and deployment.

Identifying Transformative Shifts Reshaping Carbon Capture and Sequestration Through Emerging Technologies Policy Incentives and Stakeholder Collaboration

Over the past year, several disruptive forces have realigned the carbon capture sector’s trajectory. Advances in solvent chemistry and modular capture unit design are driving down energy penalties associated with post-combustion projects, positioning amine-based absorption systems as more scalable options in both retrofit and greenfield scenarios. Pre-combustion technologies, once confined to large‐scale gasification facilities, are now incorporating membrane-based separation techniques to enhance hydrogen purity while concurrently isolating carbon dioxide streams at lower cost. Meanwhile, oxy-fuel and chemical looping processes, long recognized for their theoretical efficiency advantages, are transitioning from pilot to demonstration phases, with new projects in power and cement sectors leveraging supercritical CO₂ cycles and metal oxide looping to achieve higher capture rates and energy recovery efficiencies.

Concurrently, policy landscapes have shifted markedly. The Inflation Reduction Act’s expansion of Section 45Q tax credits and direct pay provisions has extended financial certainty for projects commencing construction before 2033, spurring a wave of new front-end engineering and design contracts for capture facilities. State-level initiatives, particularly in industrial heartlands, are complementing federal incentives with grants and revolving loan programs aimed at reducing upfront capital requirements. At the international level, emerging carbon border adjustment mechanisms signal that exporters will need to demonstrate low-carbon footprints or face import penalties, fundamentally altering global supply chain economics.

Taken together, these transformative shifts underscore a maturation of the carbon capture ecosystem. Technology providers are converging on standardized, modular solutions that leverage digital twins and predictive analytics. Investors are engaging with policymakers to shape crediting rules and streamline permitting. And industry consortia are co-developing shared infrastructure models that will enable economies of scale in both transport and storage operations.

Examining the Cumulative Impact of United States Tariffs in 2025 on Carbon Capture Equipment Supply Chains Project Costs and Market Dynamics

The cumulative effect of United States trade measures in 2025 is exerting a pronounced influence on carbon capture project economics and supply chain strategies. In May 2024, the Biden administration finalized a four-year review of Section 301 tariffs on imports from China, electing to maintain existing duties and, in some cases, raise rates across critical clean energy inputs. Notably, semiconductor imports face a tariff increase from 25 percent to 50 percent by January 1, 2025, amplifying costs for capture systems that utilize advanced sensors and control electronics. This decision underscores a broader effort to incentivize domestic manufacturing of high-value components, but in the near term it introduces capital expenditure pressures for project developers.

Further compounding cost considerations, U.S. Customs and Border Protection implemented adjustments effective February 4, 2025 that rescind the de minimis duty-free threshold for shipments below $800 and levy an additional 10 percent surcharge on all goods originating from China, atop existing Section 232 and Section 201 duties. Equipment suppliers and engineering firms are reevaluating procurement routes, moving toward localized vendor networks or exploring third-country sourcing to mitigate elevated duties. These strategic responses, while necessary, carry implications for lead times, quality assurance processes and overall project schedules.

Looking ahead, pending legislation such as the Foreign Pollution Fee Act of 2025 proposes to impose import fees calibrated to the carbon intensity of manufacturing processes in exporting countries. If enacted, this policy would introduce a novel cost dimension for capture and storage equipment fabricated abroad, reinforcing the rationale for onshore production of membranes, solvents and specialized pressure vessels. Collectively, the mosaic of trade actions and proposed eco-tariffs is prompting carbon capture stakeholders to craft resilient supply chains that balance cost, risk and regulatory compliance.

Reaping Insights from Multifaceted Segmentation of Carbon Capture Markets Across Applications Technologies Source Industries and Storage Options

A nuanced understanding of carbon capture markets emerges when viewed through multiple segmentation lenses. By application, the spectrum spans hydrogen production facilities refining syngas streams, industrial process emitters in cement kilns or steel plant furnaces, natural gas processing operations removing CO₂ from gas streams, and power generation units retrofitting flue gas treatment; within industrial processes, subgaseous emissions from chemical complexes, oil refineries and cement manufacturing require tailored capture approaches. Likewise, capture technologies themselves diverge from conventional chemical looping combustion systems to oxy-fuel combustion installations, from established post-combustion absorption units to pre-combustion gasification platforms, each presenting distinct energy integration and capital intensity profiles.

Further differentiation arises when markets are surveyed by source industry, with biomass-based energy facilities, large-scale cement plants, coal-fired power stations, gas-fired combined-cycle units and steelmaking sites each posing unique flue gas compositions and operational rhythms. Storage pathways add another layer of complexity: enhanced oil recovery projects utilize captured CO₂ for tertiary extraction, geological storage leverages depleted oil fields or saline aquifers for permanent sequestration, and mineralization processes convert CO₂ into stable carbonate minerals. Navigating this multifaceted segmentation framework is essential for project sponsors and technology providers seeking to align technical capabilities with end-user requirements and storage capacities.

This comprehensive research report categorizes the Carbon Capture & Sequestration market into clearly defined segments, providing a detailed analysis of emerging trends and precise revenue forecasts to support strategic decision-making.

- Capture Technology

- Source Industry

- Storage Option

- Application

Unearthing Regional Dynamics Driving Adoption of Carbon Capture Solutions Across the Americas Europe Middle East Africa and Asia Pacific

Regional dynamics are shaping carbon capture adoption in distinctive patterns across the Americas, Europe Middle East and Africa, and Asia-Pacific. In North America, rich oil and gas infrastructure networks and robust federal and provincial incentives have spurred early cluster development in the Gulf Coast and Canadian prairies; the availability of depleted oil fields for tertiary recovery and saline aquifers for storage underpins major initiatives from Texas through Alberta. In Latin America, nascent policy frameworks in nations like Brazil and Chile are attracting pilot projects that blend industry decarbonization with enhanced oil recovery pilots, albeit on a smaller scale.

Across Europe, Middle East and Africa, stringent emissions regulations and carbon pricing mechanisms are catalyzing capturе projects in the UK, Netherlands and Middle Eastern oil-dominated economies. Shared infrastructure concepts, such as pan-European CO₂ transport corridors and port clusters configured for offshore storage, illustrate a collaborative approach to minimizing cross-border logistical costs. In Africa, exploration of geological storage potential in North African saline formations and interest from petrostate governments foreshadow emerging opportunities.

In the Asia-Pacific region, medium-term policy targets in Australia, Japan and South Korea are translating into government-backed demonstrations and public-private partnerships. Japan’s steel sector and Australia’s gas processing hubs are evaluating post-combustion and oxy-fuel configurations, while South Korea explores pre-combustion units integrated with hydrogen export plans. Collectively, these regional profiles reveal a tapestry of regulatory drivers, resource endowments and stakeholder alliances that will define the global carbon capture trajectory.

This comprehensive research report examines key regions that drive the evolution of the Carbon Capture & Sequestration market, offering deep insights into regional trends, growth factors, and industry developments that are influencing market performance.

- Americas

- Europe, Middle East & Africa

- Asia-Pacific

Spotlighting Leading Companies Shaping the Carbon Capture and Sequestration Ecosystem Through Innovation Partnerships and Strategic Investments

A constellation of industry leaders is steering technological advancement and commercialization of carbon capture and sequestration. Integrated energy majors are leveraging their subsurface expertise and project execution capabilities to orchestrate large-scale integrated capture, transport and storage projects, while diversified oil and gas companies are repurposing existing pipelines and reservoirs to host new CO₂ hubs. Technology suppliers, spanning global engineering firms to specialized solvent and sorbent developers, are competing to supply modular capture units and proprietary separation media that promise lower energy consumption and footprint.

In parallel, independent engineering procurement and construction contractors are forging alliances with research institutions to refine digital twin models and predictive analytics platforms that optimize capture performance in real time. Emerging pure-play innovators, often spin-outs from university research labs, are pushing the boundaries of membrane separation, solid-sorbent adsorption and mineralization processes, attracting venture capital to scale from pilot to commercial deployment. Across this spectrum, partnerships between project sponsors and technology providers are becoming more collaborative, with shared risk-sharing agreements and milestone-driven contracts facilitating a smoother transition from demonstration to industrial implementation.

This comprehensive research report delivers an in-depth overview of the principal market players in the Carbon Capture & Sequestration market, evaluating their market share, strategic initiatives, and competitive positioning to illuminate the factors shaping the competitive landscape.

- Air Products and Chemicals, Inc.

- Baker Hughes Company

- Chevron Corporation

- Equinor ASA

- Exxon Mobil Corporation

- Halliburton Company

- Linde plc

- Shell plc

- TechnipFMC plc

- TotalEnergies SE

Formulating Actionable Recommendations for Industry Leaders to Accelerate Carbon Capture Deployment Optimize Operations and Navigate Policy Landscapes

To capitalize on the accelerating momentum in carbon capture and sequestration, industry leaders should prioritize strategic investments in modular capture solutions that streamline engineering, procurement and construction timelines. By embracing standardized equipment designs and digitalization tools, organizations can lower the barriers to rapid deployment and ensure consistent performance across diverse host sites.

Moreover, fostering supply chain resilience through nearshore manufacturing partnerships and multi-sourcing strategies will mitigate exposure to evolving tariff landscapes and trade restrictions. Engaging policymakers proactively to shape incentive structures and permitting processes can unlock new funding streams and reduce project development risk, particularly in jurisdictions refining carbon pricing or border adjustment mechanisms.

In addition, establishing cross-sector consortia to develop shared infrastructure-such as CO₂ transport pipelines and regional storage hubs-can deliver economies of scale and accelerate network effects. Concurrently, investing in workforce development programs to cultivate specialized skill sets will position organizations to manage the technical complexity of capture systems and storage operations. Finally, integrating sustainability considerations, including life cycle emissions assessments and community engagement plans, will bolster social license and enhance long-term project viability.

Detailing Robust Research Methodology Combining Primary Interviews Secondary Data Qualitative and Quantitative Analyses and Expert Validation

The research underpinning this executive summary draws upon a rigorous, multi-stage methodology designed to ensure data integrity and analytical depth. Primary research included in-depth interviews with C-level executives, technology providers, project developers and regulatory authorities across key regions. These qualitative insights were complemented by structured surveys targeting captive audiences in heavy industry, power generation and gas processing sectors to validate technology preferences and investment criteria.

Secondary research encompassed comprehensive desk studies of industry reports, academic publications, patent filings and legislative documents, enabling a thorough mapping of technology maturity levels and policy frameworks. Data triangulation techniques reconciled divergent sources, while scenario analysis provided a sensitivity lens on trade policies and incentive regimes. Findings were subsequently vetted through an expert panel review, bringing together thought leaders in carbon capture, subsurface geology and environmental policy to refine assumptions and interpretations.

This blended approach, integrating quantitative and qualitative dimensions, supports a holistic understanding of market drivers, technological trajectories and regulatory influences, thereby equipping decision makers with robust, actionable insights for strategic planning.

This section provides a structured overview of the report, outlining key chapters and topics covered for easy reference in our Carbon Capture & Sequestration market comprehensive research report.

- Preface

- Research Methodology

- Executive Summary

- Market Overview

- Market Insights

- Cumulative Impact of United States Tariffs 2025

- Cumulative Impact of Artificial Intelligence 2025

- Carbon Capture & Sequestration Market, by Capture Technology

- Carbon Capture & Sequestration Market, by Source Industry

- Carbon Capture & Sequestration Market, by Storage Option

- Carbon Capture & Sequestration Market, by Application

- Carbon Capture & Sequestration Market, by Region

- Carbon Capture & Sequestration Market, by Group

- Carbon Capture & Sequestration Market, by Country

- United States Carbon Capture & Sequestration Market

- China Carbon Capture & Sequestration Market

- Competitive Landscape

- List of Figures [Total: 16]

- List of Tables [Total: 1113 ]

Summarizing Key Takeaways on the Critical Role of Carbon Capture and Sequestration in Achieving Climate Goals and Energy Security

As jurisdictions worldwide intensify their climate commitments and enact more stringent emissions regulations, carbon capture and sequestration has ascended as a cornerstone of decarbonization strategies in hard-to-abate industries. The convergence of technological advancements, policy incentives and collaborative infrastructure models has fostered a fertile landscape for deployment, even as trade measures and regulatory proposals introduce new dimensions of complexity.

Market participants that adeptly navigate the evolving tariff environment, leverage advanced capture technologies and forge strategic partnerships will unlock the greatest potential in this nascent industry. The multifaceted segmentation of applications, technologies, source industries and storage options underscores the need for tailored approaches that align technical capabilities with site-specific emissions profiles and regulatory frameworks.

Taken together, the evidence indicates that the next wave of carbon capture growth will be driven by players who combine operational excellence with policy engagement and supply chain resilience. The imperative for accelerated deployment is clear: to meet global climate targets, carbon management solutions must scale rapidly, efficiently and sustainably across diverse geographies and industrial sectors.

Empowering Decision Makers with Exclusive Insights and Direct Engagement to Acquire Comprehensive Carbon Capture Market Research Reports

Are you prepared to lead your organization through the next chapter of carbon capture innovation? Engage directly with Ketan Rohom (Associate Director, Sales & Marketing at 360iResearch) to secure access to the full, authoritative market research report that will equip you with the granular insights, strategic analyses, and competitive intelligence required to navigate policy shifts, optimize investment decisions, and accelerate your decarbonization initiatives. Reach out today to capitalize on this opportunity to future-proof your operations and gain a decisive edge in the evolving carbon capture and sequestration landscape.

- How big is the Carbon Capture & Sequestration Market?

- What is the Carbon Capture & Sequestration Market growth?

- When do I get the report?

- In what format does this report get delivered to me?

- How long has 360iResearch been around?

- What if I have a question about your reports?

- Can I share this report with my team?

- Can I use your research in my presentation?