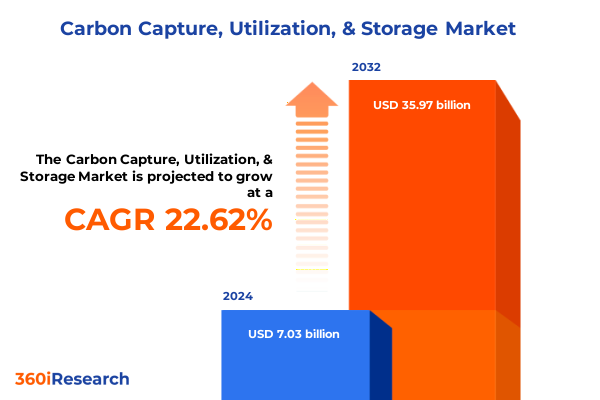

The Carbon Capture, Utilization, & Storage Market size was estimated at USD 8.60 billion in 2025 and expected to reach USD 10.51 billion in 2026, at a CAGR of 22.68% to reach USD 35.97 billion by 2032.

Exploring the Critical Role and Evolution of Carbon Capture, Utilization, and Storage in Mitigating Industrial Emissions at Scale

The global drive to reduce carbon dioxide emissions has positioned carbon capture, utilization, and storage (CCUS) at the forefront of climate mitigation strategies, gaining traction across power generation and heavy industries alike. These technologies capture CO₂ directly from large point sources-such as coal- and gas-fired power plants or cement kilns-and either repurpose it into valuable products or sequester it in deep geological formations. In recent years, the CCUS sector has witnessed a surge in pilot and demonstration projects, yet deployment remains below the levels needed to meet ambitious net-zero targets. According to an analysis by the International Energy Agency, although over 500 CCUS projects are in various stages of development, actual deployment lags significantly behind the trajectory required for a 1.5 °C pathway; policy support and investment must accelerate to close this gap.

Despite its potential to abate emissions in hard-to-decarbonize sectors-such as cement, steel, and petrochemicals-CCUS continues to face challenges related to high capital costs, infrastructure complexity, and concerns about long-term storage safety. A recent investigative report indicates that 45 commercial facilities collectively capture only 50 million metric tons of CO₂ annually, representing less than one percent of global emissions. These figures underline the need for enhanced collaboration between governments, research institutions, and industry players to streamline regulatory frameworks, bolster financing mechanisms, and drive technological innovation.

Unveiling the Disruptive Technological and Policy Developments Reshaping the Carbon Capture, Utilization, and Storage Sector

Over the past two years, transformational shifts have reshaped the CCUS ecosystem, propelled by advances in capture technologies and the emergence of novel utilization pathways. Oxy-fuel combustion, post-combustion, and pre-combustion capture techniques have each achieved incremental improvements in efficiency and cost-effectiveness, enabling more flexible integration with existing industrial plants. Concurrently, synergies between carbon capture and low-carbon hydrogen production have elevated CCUS from a niche solution to an enabler of broader energy transition goals.

Policy landscapes are also evolving; the United States has injected significant capital into demonstration projects under the Infrastructure Investment and Jobs Act, while Europe’s Innovation Fund and Connecting Europe Facility have allocated billions for transport and storage infrastructure. Moreover, novel business models have gained prominence, exemplified by CO₂ transport and storage hubs that pool volumes from multiple emitters, driving economies of scale. At the same time, concerns over lifecycle emissions and storage integrity have prompted heightened scrutiny from environmental watchdogs. As a result, industry stakeholders are prioritizing robust monitoring protocols and community engagement strategies to maintain social acceptance and regulatory compliance.

This confluence of technological breakthroughs and policy momentum has begun to alter the competitive dynamics within the CCUS market, incentivizing new entrants and fostering cross-sector partnerships. Looking ahead, sustained investment in digital monitoring, modular capture units, and CO₂ reuse applications will be essential to convert pilot successes into scalable solutions and to secure the sector’s role in global decarbonization efforts.

Evaluating the Far-Reaching Consequences of Recent U.S. Tariffs on Carbon Capture, Utilization, and Storage Supply Chains and Costs

The imposition of U.S. tariffs on specialized equipment and materials critical to CCUS operations has introduced additional complexity to an already capital-intensive sector. Tariffs on membranes, compressors, catalysts, and high-grade alloys have inflated project costs by as much as fifty percent, according to recent industry reports, eroding project economics and delaying final investment decisions. These cost escalations have reverberated through global supply chains, compelling developers to renegotiate vendor contracts and impose contingency clauses to mitigate tariff-related risks.

Geographically, regions with manufacturing capabilities for CCUS components have gained competitive advantage, prompting some U.S.-based companies to accelerate domestic production plans. However, while localization can reduce reliance on imports, it also demands substantial upfront capital and can lead to transient supply shortages during retooling. In parallel, cross-border collaborations with Canada and Mexico, historically vital for CO₂ transport projects, have been strained by shifting trade policies, requiring stakeholders to explore alternative sourcing strategies and to scrutinize regulatory variances along border jurisdictions.

From a business perspective, the specter of sustained trade tensions has spurred a strategic pivot toward modular capture technologies, which offer reduced logistics complexity and better alignment with dynamic tariff regimes. This adaptation, combined with an increased focus on long-term service agreements and local content requirements, is reshaping the CCUS project playbook and influencing where and how capital is deployed in 2025 and beyond.

Decoding Market Nuances through Service, Technology, and End-Use Industry Segmentation to Reveal Strategic Growth Levers

The segmentation of the CCUS market reveals layers of opportunity defined by service offerings, capture technologies, and end-use industries. When viewed through the lens of service specialization, industry players navigate the intricacies of capture modules before transitioning captured CO₂ through dedicated transportation networks toward secure underground reservoirs or utilization facilities. This delineation underscores the importance of integrated service portfolios that can streamline project delivery and reduce interface risks.

In contrast, the technology-based classification highlights three distinct capture pathways-oxy-fuel combustion, where combustion occurs in an oxygen-rich environment to yield a CO₂-rich flue stream; post-combustion capture, which retrofits existing plants with absorption or adsorption units; and pre-combustion capture, which separates CO₂ prior to combustion in gasification or reforming processes. Each technology exhibits unique capital and operational profiles, compelling decision-makers to reconcile performance metrics with site-specific considerations.

Meanwhile, end-use industry segmentation illuminates the varied CCUS adoption curves across cement manufacturing, chemical and petrochemical production, iron and steel operations, oil and gas activities, and power generation. The chemicals sector, including fertilizer and methanol production, has leveraged CCUS to meet stringent product carbon intensity standards. In oil and gas, enhanced oil recovery projects and gas processing facilities have historically constituted the bulk of operational CCUS deployments. Power generation, particularly coal-fired and natural gas plants, is now advancing capture retrofits to comply with regional emissions thresholds and to qualify for tax incentives.

This comprehensive research report categorizes the Carbon Capture, Utilization, & Storage market into clearly defined segments, providing a detailed analysis of emerging trends and precise revenue forecasts to support strategic decision-making.

- Service

- Technology Type

- End-Use Industry

Unraveling Regional Distinctions in Policy Support, Infrastructure Development, and Industrial Adoption across Key Global Markets

Regional dynamics continue to shape the CCUS market’s trajectory, with the Americas, Europe, Middle East & Africa, and Asia-Pacific each charting distinct development paths. In the Americas, robust federal tax credits and state-level incentives have animated a burgeoning pipeline of pilot and commercial-scale projects, spanning from enhanced oil recovery ventures in the Gulf Coast to innovative direct air capture hubs in the Southwest. Canada’s provincial programs further complement these efforts, creating an integrated North American value chain.

Across Europe, the Middle East, and Africa, EU funding instruments and national decarbonization roadmaps underpin several multi-billion-dollar transport and storage consortia, exemplified by cross-border CO₂ hubs in the North Sea. In parallel, Middle Eastern petrochemical complexes are exploring CCUS to safeguard export competitiveness amid tightening global carbon constraints, while South African and North African jurisdictions assess geological storage prospects in saline formations and depleted reservoirs.

In Asia-Pacific, nations including China, Japan, Australia, and South Korea are deploying policy levers-ranging from carbon pricing to direct grants-to accelerate CCUS deployment within heavy industries. Recent MoUs between state-owned oil companies and technology licensors underscore the strategic importance of CCUS in regional energy transition agendas. This convergence of regulatory support and industrial ambition is elevating Asia-Pacific as a critical frontier for large-scale CCUS infrastructure.

This comprehensive research report examines key regions that drive the evolution of the Carbon Capture, Utilization, & Storage market, offering deep insights into regional trends, growth factors, and industry developments that are influencing market performance.

- Americas

- Europe, Middle East & Africa

- Asia-Pacific

Profiling the Diverse Cohorts of Energy Majors, Technology Innovators, and Niche Specialists Driving Advances in Carbon Capture and Storage

The competitive landscape of CCUS is shaped by both legacy energy majors and technology innovators, each carving out specialized niches and forging strategic partnerships. Integrated oil and gas corporations have leveraged their subsurface expertise to pursue large-scale storage ventures, exemplified by joint ventures in Norway’s Longship Northern Lights project, which now anticipates its first CO₂ deliveries in 2025 and a phased expansion to inject up to 5 million tons annually. These endeavors build on decades of reservoir management and pipeline operation, offering valuable lessons in scaling geological storage solutions.

Equipment manufacturers and engineering firms have also emerged as critical enablers, supplying modular capture units, high-efficiency compressors, and digital monitoring platforms. Their agility in refining sorbents and membranes has driven incremental cost reductions, while alliances with academia have fostered breakthroughs in solvent regeneration and process intensification.

Meanwhile, specialized service providers are differentiating through full-cycle offerings-from site assessment and permitting support to long-term storage monitoring-catering to developers seeking turnkey solutions. Beyond traditional players, newcomers focused on direct air capture and CO₂-to-chemicals are disrupting established industry hierarchies, attracting venture capital to pilot scalable utilization pathways and novel sequestration methods. This evolving mosaic of incumbents and challengers underscores the multifaceted nature of competition within the CCUS ecosystem.

This comprehensive research report delivers an in-depth overview of the principal market players in the Carbon Capture, Utilization, & Storage market, evaluating their market share, strategic initiatives, and competitive positioning to illuminate the factors shaping the competitive landscape.

- Aker Solutions ASA

- Atlas Copco AB

- Baker Hughes Company

- Bechtel Corporation

- Carbon Clean Solutions Limited

- Carbon Engineering Ltd.

- Chevron Corporation

- COWI A/S

- Eaton Corporation PLC

- Exxon Mobil Corporation

- Fluor Corporation

- General Electric Company

- Halliburton Company

- Honeywell International Inc.

- Linde PLC

- MAN Energy Solutions SE

- McDermott International, Ltd.

- Mitsubishi Heavy Industries, Ltd.

- National Grid PLC

- NOV Inc.

- PAO NOVATEK

- SABIC Group

- Saudi Arabian Oil Company

- Schlumberger Limited

- Shell PLC

- Siemens AG

- Svante Inc.

- TotalEnergies SE

Strategic Playbook for Accelerating Deployment, Strengthening Partnerships, and Optimizing Performance in Carbon Capture Initiatives

To navigate the evolving CCUS terrain, industry leaders must adopt multifaceted strategies that balance technical rigor with economic pragmatism. First, prioritizing modular pilot deployments can de-risk full-scale investments by validating capture and transport interfaces under real-world conditions, thereby shortening development timelines and informing capital allocation.

Second, forging cross-sector partnerships-linking emitters, utilities, technology providers, and financing institutions-can unlock synergies and aggregate CO₂ volumes to achieve economies of scale. Collaborative frameworks should extend to joint infrastructure development, enabling shared transport pipelines and storage facilities to reduce per-unit costs.

Third, engaging proactively with policymakers to advocate for stable tax regimes, direct incentives, and streamlined permitting processes is essential to maintain project viability. Industry associations and consortiums can amplify these efforts, ensuring that regulations reflect operational realities and that credit mechanisms are adjusted for inflation to preserve long-term investment certainty.

Lastly, integrating digital monitoring and predictive analytics into CCUS operations can enhance performance tracking, mitigate risk, and foster stakeholder confidence. By leveraging data-driven insights, operators can optimize capture rates, detect anomalies in storage integrity, and rapidly address technical challenges.

Employing a Rigorous Mixed-Methods Approach Integrating Secondary Intelligence, Executive Interviews, and Data Triangulation

This market analysis is grounded in a structured research methodology combining secondary and primary data sources to ensure analytical rigor and industry relevance. Secondary research involved a comprehensive review of government publications, peer-reviewed journals, think-tank reports, and regulatory filings to compile baseline data on CCUS projects, policy frameworks, and technology performance benchmarks. Secondary sources spanned recent International Energy Agency publications, U.S. Department of Energy reports, and reputable industry news outlets.

Primary research encompassed in-depth interviews with senior executives from capture technology vendors, host-site operators, pipeline developers, and storage asset managers. These engagements provided qualitative insights into project decision drivers, cost sensitivities, and emerging innovations. Data triangulation methods were employed to reconcile discrepancies between reported capacities, investment figures, and operational metrics, ensuring the highest level of accuracy.

Quantitative analyses leveraged proprietary databases tracking CCUS installations and deployment timelines, supplemented by scenario modeling to assess tariff impacts and infrastructure bottlenecks. All data points were cross-verified through follow-up consultations to validate assumptions and to refine segmentation definitions. The resulting insights offer a robust foundation for strategic decision-making across the CCUS value chain.

This section provides a structured overview of the report, outlining key chapters and topics covered for easy reference in our Carbon Capture, Utilization, & Storage market comprehensive research report.

- Preface

- Research Methodology

- Executive Summary

- Market Overview

- Market Insights

- Cumulative Impact of United States Tariffs 2025

- Cumulative Impact of Artificial Intelligence 2025

- Carbon Capture, Utilization, & Storage Market, by Service

- Carbon Capture, Utilization, & Storage Market, by Technology Type

- Carbon Capture, Utilization, & Storage Market, by End-Use Industry

- Carbon Capture, Utilization, & Storage Market, by Region

- Carbon Capture, Utilization, & Storage Market, by Group

- Carbon Capture, Utilization, & Storage Market, by Country

- United States Carbon Capture, Utilization, & Storage Market

- China Carbon Capture, Utilization, & Storage Market

- Competitive Landscape

- List of Figures [Total: 15]

- List of Tables [Total: 1113 ]

Synthesizing Trends, Challenges, and Strategic Imperatives to Propel Carbon Capture, Utilization, and Storage toward Scalable Impact in the Energy Transition

CCUS is at a pivotal juncture, transitioning from demonstration projects to the cusp of large-scale deployment that can materially influence global emission pathways. While technological advancements and policy incentives have catalyzed momentum, challenges related to cost, supply chain resilience, and regulatory harmonization persist. The cumulative impact of U.S. tariffs and inflationary pressures underscores the need for adaptive strategies that emphasize modular innovation and localized supply chain resilience.

Segmentation insights reveal that tailoring service and technology portfolios to specific industry needs will be essential to unlock demand, while regional analyses highlight the critical role of coordinated policy frameworks in scaling infrastructure. Key players, from integrated energy giants to specialized technology firms, are collectively shaping the sector’s evolution, yet sustained collaboration and transparent performance tracking remain imperative.

Looking forward, actionable recommendations spanning pilot deployment, partnership ecosystems, policy engagement, and digital integration will enable stakeholders to overcome barriers and to realize the substantial potential of CCUS in the global decarbonization agenda. Continued research and real-time data sharing will further enhance industry resilience and accelerate progress toward net-zero ambitions.

Unlock Comprehensive CCUS Market Insights by Connecting with Our Expert Sales Leader for Tailored Research Support

To explore the comprehensive details of the CCUS market and empower your organization with strategic foresight, reach out to Ketan Rohom, Associate Director of Sales & Marketing at 360iResearch. Ketan can guide you through tailored solutions and data-driven insights, ensuring you obtain the most relevant information to support your decarbonization and investment initiatives. Engage directly with Ketan to secure your copy of the full market research report and begin harnessing the competitive advantages that advanced CCUS intelligence offers.

- How big is the Carbon Capture, Utilization, & Storage Market?

- What is the Carbon Capture, Utilization, & Storage Market growth?

- When do I get the report?

- In what format does this report get delivered to me?

- How long has 360iResearch been around?

- What if I have a question about your reports?

- Can I share this report with my team?

- Can I use your research in my presentation?