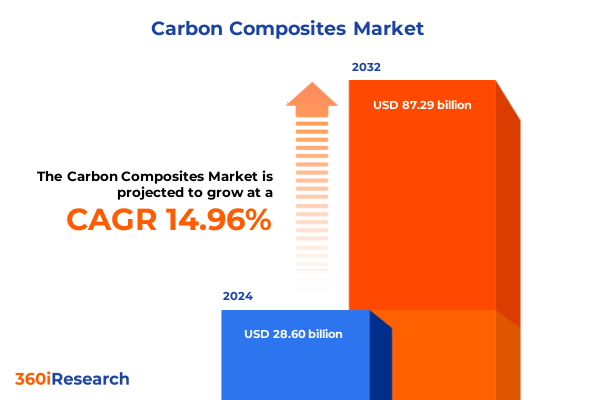

The Carbon Composites Market size was estimated at USD 32.85 billion in 2025 and expected to reach USD 37.29 billion in 2026, at a CAGR of 14.98% to reach USD 87.29 billion by 2032.

Unveiling the Transformative Rise of Carbon Composites and the Critical Factors Driving Growth Across Industries Worldwide

The carbon composite industry stands at a pivotal juncture as advanced materials redefine performance standards across sectors from aerospace to renewable energy. Innovations in fiber architecture, matrix chemistries, and process automation have accelerated the substitution of traditional metals and plastics, unlocking new potential for lightweighting and durability. As global supply chains evolve, manufacturers are navigating a complex landscape of raw material sourcing, capacity expansions, and sustainability mandates. In parallel, end users demand ever more efficient, high-performance solutions, positioning carbon composites as a critical enabler for next-generation products and systems.

Recent industry reports highlight that cost pressures remain an important consideration, particularly as raw carbon fiber prices continue to challenge widespread adoption in high-volume industries. These pricing dynamics are driven by energy-intensive production processes and uneven capacity distribution across geographies, which can influence feedstock availability and lead times. Against this backdrop, strategic collaborations, technology partnerships, and vertical integration models are gaining prominence as manufacturers seek to secure supply continuity and drive down total cost of ownership.

Moving forward, the carbon composite market is expected to hinge on the ability of stakeholders to balance performance gains with economic and environmental imperatives. This report offers a comprehensive examination of the key market forces, technological shifts, and policy drivers shaping the future of carbon composites, setting the stage for informed decision making at every level of the value chain. Transitioning seamlessly into an analysis of transformative shifts, we explore how emerging trends are rewriting the rules of composite manufacturing and application.

Navigating the Paradigm Shifts in Carbon Composite Technologies Redefining Manufacturing Processes and Industrial Applications Globally

The carbon composite landscape is undergoing profound transformation, fueled by breakthroughs in manufacturing and material science. Digital twins and simulation-driven design have converged with automated layup techniques, propelling out-of-autoclave processes into mainstream production. This integration of digital and physical workflows enhances precision, reduces cycle times, and lowers energy consumption, positioning composites for broader adoption in high-volume sectors. Moreover, novel process methods, such as additive manufacturing of preforms, are expanding geometric possibilities, enabling complex, lightweight structures previously unimaginable with conventional composites technology.

In parallel, sustainability imperatives are catalyzing significant shifts in raw material selection and lifecycle management. Regulatory frameworks in key markets are encouraging the development of bio-based resins and circular recycling models, prompting manufacturers to rethink material formulations and end-of-life strategies. A proposed Carbon Border Adjustment Mechanism in major economies underscores the importance of low-carbon production footprints, with emerging policies poised to reshape cost competitiveness and supply chain priorities for carbon composite producers.

These technological and policy shifts are complemented by evolving customer expectations in end-use industries. Aerospace OEMs are specifying higher performance thermoset and thermoplastic prepregs that meet accelerated build rates, while automotive manufacturers explore high-throughput processes to bring composite structural components into mass markets. Sporting goods and wind energy sectors are pushing the envelope on fiber architecture to achieve optimal stiffness-to-weight ratios, driving investment in specialized reinforcement forms and tailored manufacturing platforms. Collectively, these forces are rewriting the rules of composite fabrication, laying the foundation for the next wave of market expansion.

Assessing the Combined Impact of Recent U.S. Tariff Measures on Carbon Composite Supply Chains Costs and Domestic Industry Competitiveness

In March 2025, the U.S. government increased tariffs on imported raw carbon fiber tow from 7.5% to 25% and on prepreg materials from 4.2% to 17.5% as part of an expanded Section 301 initiative targeting advanced manufacturing inputs. These adjustments, implemented with a six-month transition period, immediately reshaped procurement strategies as manufacturers sought to mitigate the added import duty burden. The measures reflect a broader policy emphasis on strengthening domestic supply chains and protecting key industries from perceived unfair trade practices.

The elevated duties prompted many fabricators to accelerate imports ahead of the effective date while simultaneously exploring alternative sourcing from tariff-exempt regions. However, the shift also spurred renewed investment in local capacity expansions, with domestic producers of carbon fiber and prepreg capitalizing on the policy tailwind. At the same time, supply chain managers initiated multi-tiered strategies to balance cost, quality, and lead-time requirements, engaging both established suppliers and emerging players to secure critical material flows.

Tariff-driven cost increases have had ripple effects across multiple end use industries. Aerospace firms, which rely on high-modulus fiber for secondary structures, encountered upward pressure on program budgets, leading to tighter production schedules and re-evaluated sourcing agreements. In the automotive sector, where cost sensitivity is pronounced, some OEMs adjusted material specifications toward lower-cost thermoplastic composites, while others accelerated collaborative R&D efforts to reduce resin and fiber consumption without compromising performance.

Overall, the 2025 tariff revisions underscore a cumulative impact that extends beyond immediate cost pressures. They have accelerated strategic realignment in the carbon composite ecosystem, driving a wave of innovation in manufacturing processes, domestic capacity investments, and supply chain diversification. These developments will continue to shape competitive dynamics as industry participants navigate a more complex and policy-driven operating environment.

Deep Diving into Carbon Composite Market Segmentation Insights to Uncover Growth Opportunities Across Resin Types Processes Forms and End Use Industries

A nuanced understanding of market segmentation reveals the varied dynamics shaping carbon composite demand. When examining resin technologies, epoxy remains the predominant choice due to its exceptional mechanical properties and thermal stability, while polyester finds favor in cost-constrained applications, and vinyl ester is increasingly selected for marine and corrosion-resistant components. Moving to manufacturing processes, filament winding sustains its leadership in pressure vessel and cylindrical parts, prepreg layup continues to address high-performance aerospace and defense requirements, pultrusion secures a strong position in linear structural products, and resin transfer molding gains traction in lightweight automotive components.

Beyond process variations, the form of reinforcement plays a pivotal role in performance optimization. Braided architectures excel in torsion-resistant structures, non-crimp fabrics deliver high in-plane strength for large wind energy blades, unidirectional tapes remain the benchmark for stiffness-critical aerospace panels, and woven fabrics underpin versatile applications in sporting goods and consumer products. Finally, the diversity of end-use industries-from aerospace & defense through the intricacies of construction & infrastructure, marine vessels, and sporting goods to the burgeoning wind energy sector-drives tailored composite solutions that balance weight, strength, and cost across distinct operating environments.

Each segmentation axis informs strategic priorities for material developers, equipment suppliers, and end users alike. By aligning product portfolios and process investments with specific resin chemistries, manufacturing routes, reinforcement architectures, and application domains, industry participants can capitalize on targeted growth pockets while navigating cost and performance trade-offs inherent to each segment.

This comprehensive research report categorizes the Carbon Composites market into clearly defined segments, providing a detailed analysis of emerging trends and precise revenue forecasts to support strategic decision-making.

- Resin Type

- Manufacturing Process

- Reinforcement Form

- End Use Industry

Uncovering Regional Dynamics Shaping the Carbon Composite Industry Across the Americas EMEA and Asia Pacific Economic Powerhouses

Regional market characteristics highlight how geographic factors influence carbon composite adoption and development strategies. In the Americas, a robust aerospace and automotive base anchors demand, supported by domestic production hubs that have steadily expanded capacity to meet both military and commercial program requirements. Infrastructure modernization projects further bolster interest in composite solutions for bridge rehabilitation and lightweight pedestrian structures, while an expanding energy sector seeks filament-wound gas storage and transportation vessels.

Europe, the Middle East & Africa (EMEA) presents a diverse landscape shaped by stringent environmental regulations and a thriving renewable energy market. Wind turbine manufacturers drive substantial volumes of non-crimp fabrics, and automotive OEMs in Western Europe explore high-throughput composites for both performance and sustainability goals. Meanwhile, the Middle East’s infrastructure and petrochemical industries generate demand for corrosion-resistant vinyl ester composites, and North African ports facilitate growing trade flows of composite components and raw materials.

In the Asia-Pacific region, dynamic growth in electric vehicles and consumer electronics diversifies composite requirements, with key manufacturing centers in Japan, South Korea, and China shaping global fiber and prepreg supply. Strategic investments in gigafactories for battery housing and hydrogen storage tanks leverage filament winding and pultrusion capabilities. Southeast Asian countries are emerging as important hubs for both production and R&D, bridging advanced composite innovations with cost-effective manufacturing solutions for global markets.

This comprehensive research report examines key regions that drive the evolution of the Carbon Composites market, offering deep insights into regional trends, growth factors, and industry developments that are influencing market performance.

- Americas

- Europe, Middle East & Africa

- Asia-Pacific

Profiling Leading Carbon Composite Innovators and Strategic Collaborators Driving Technological Advances and Market Expansion in the Industry

Leading industry participants are executing robust strategies to secure technological leadership and scale. Toray Industries has committed significant capital investments across North American and European production sites, expanding regular tow and high-modulus fiber capacity by an estimated 3,000 to 6,000 metric tons annually beginning in 2025 to serve clean energy, aerospace, and defense markets. These expansions reflect Toray’s focus on sustainable growth and alignment with net-zero ambitions under its medium-term Project AP-G 2025 program.

Hexcel Corporation continues to leverage its intellectual property portfolio and manufacturing scale to address core aerospace challenges while driving growth in defense, space, and industrial segments. Despite near-term headwinds in commercial aerospace, Hexcel recorded increased sales in its Defense & Space division in early 2025, complemented by a strategic investment in a carbon fiber recycling leader to enhance its circular economy capabilities and offer full lifecycle solutions for high-performance composites.

The Mitsubishi Chemical Group has deepened its vertical integration by completing a full acquisition of Italy’s CPC group and investing in plant-derived resin technologies certified under ISCC PLUS, underscoring a commitment to bio-based materials and sustainable composite solutions. This move triples CPC’s molding capacity and positions the group to serve hybrid and electric mobility applications with advanced CFRP components across global automotive supply chains.

Collectively, these strategic moves-capacity expansions, innovation partnerships, and sustainability investments-demonstrate how leading companies are reshaping the carbon composite value chain. Their actions set competitive benchmarks and guide market entrants toward collaborative models that can deliver differentiated performance and environmental benefits.

This comprehensive research report delivers an in-depth overview of the principal market players in the Carbon Composites market, evaluating their market share, strategic initiatives, and competitive positioning to illuminate the factors shaping the competitive landscape.

- Carbon Composites, Inc.

- DowAksa Advanced Composites Holdings B.V.

- Gurit Holding AG

- Hexcel Corporation

- Hyosung Advanced Materials Corporation

- Jiangsu Hengshen Co., Ltd.

- Jilin Chemical Fiber Group Co., Ltd.

- Kureha Corporation

- Mitsubishi Chemical Holdings Corporation

- Osaka Gas Chemicals Co., Ltd.

- Royal TenCate

- SGL Carbon SE

- Solvay SA

- Teijin Limited

- Toho Tenax Co., Ltd.

- Toray Industries, Inc.

- UMATEX, Rosatom State Corporation

- Weihai Guangwei Composites Co., Ltd.

- Zhongfu Shenying Carbon Fiber Co., Ltd.

- Zoltek Companies, Inc.

Offering Strategic Recommendations for Industry Leaders to Enhance Supply Chain Resilience Sustainability and Innovation in Carbon Composite Manufacturing

Industry leaders must adopt multifaceted strategies that fortify supply chain resilience while advancing environmental and performance objectives. Central to this is diversifying sourcing footprints by forging partnerships with multiple fiber and resin suppliers across different geographies, thereby mitigating the impact of localized disruptions and policy shifts. Concurrently, organizations should evaluate domestic capacity expansions or joint ventures to balance landed costs against tariff and logistics exposures.

Achieving sustainability goals demands investments in circular economy models, including material recovery and recycling initiatives. Collaborations with specialized recycling firms and the adoption of plant-derived resin solutions can reduce carbon footprints and address tightening regulatory requirements. Digitalization of the supply chain through blockchain-enabled traceability and real-time monitoring will further enhance transparency and facilitate compliance with evolving environmental standards.

On the technology front, accelerated adoption of out-of-autoclave and additive manufacturing processes can lower energy consumption and cycle times while enabling complex geometries. Companies should align their R&D roadmaps with end-user requirements, focusing on lightweight and high-throughput process innovations that unlock new market segments. Engaging in pre-competitive consortia with OEMs, research institutes, and government agencies will expedite standards development and drive broader industry adoption.

Finally, embedding flexible business models-such as pay-per-use service agreements for composite tooling and bolstered aftermarket support-can differentiate offerings and build long-term customer loyalty. By executing these recommendations, industry players will be well-positioned to navigate market volatility and capture growth in the rapidly evolving carbon composite ecosystem.

Outlining Comprehensive Research Methodology Leveraging Primary Interviews Secondary Analysis and Data Triangulation for Robust Carbon Composite Market Insights

This comprehensive market analysis leverages a hybrid research framework combining primary and secondary data sources. Primary insights were gathered through in-depth interviews with senior executives, R&D leaders, and procurement specialists representing composite material producers, OEM integrators, and tier-one suppliers. These qualitative inputs provided context on emerging trends, technological priorities, and strategic imperatives.

Secondary research encompassed detailed review of industry publications, patent filings, corporate press releases, and government trade statistics. Harmonized Tariff Schedule data and policy documents guided our analysis of trade barriers, while sustainability certifications and environmental regulations informed assessments of material innovations and compliance strategies.

Quantitative market segmentation was validated using a triangulation approach, cross-referencing multiple datasets to ensure consistency and accuracy. Wherever possible, we aligned findings with publicly available company financial disclosures, capacity announcements, and expert forecasts. Analytical rigor was maintained through iterative validation workshops with subject matter experts, ensuring that conclusions reflect the latest industry developments and stakeholder perspectives.

This methodology underpins the actionable insights presented throughout the report, offering a robust foundation for decision-makers seeking to navigate the complexities of the carbon composite market with confidence and clarity.

This section provides a structured overview of the report, outlining key chapters and topics covered for easy reference in our Carbon Composites market comprehensive research report.

- Preface

- Research Methodology

- Executive Summary

- Market Overview

- Market Insights

- Cumulative Impact of United States Tariffs 2025

- Cumulative Impact of Artificial Intelligence 2025

- Carbon Composites Market, by Resin Type

- Carbon Composites Market, by Manufacturing Process

- Carbon Composites Market, by Reinforcement Form

- Carbon Composites Market, by End Use Industry

- Carbon Composites Market, by Region

- Carbon Composites Market, by Group

- Carbon Composites Market, by Country

- United States Carbon Composites Market

- China Carbon Composites Market

- Competitive Landscape

- List of Figures [Total: 16]

- List of Tables [Total: 795 ]

Drawing Key Conclusions on the Future Trajectory of Carbon Composite Industries in Light of Technological Trends Policy Shifts and Global Market Dynamics

The carbon composite industry is poised for dynamic evolution, shaped by technological breakthroughs, regulatory imperatives, and global competitive forces. As manufacturers deploy advanced processes and materials, market participants must balance the pursuit of performance gains with cost and sustainability objectives. Trends such as out-of-autoclave manufacturing, digital simulation, and circular economy models are converging to redefine what is possible in composite design and application.

Policy shifts, including the recent adjustment of U.S. import duties and proposed carbon import levies, will continue to influence strategic sourcing decisions and drive investment in domestic capabilities. Segmentation analysis highlights distinct growth opportunities across resin chemistries, manufacturing routes, reinforcement architectures, and end-use industries, underscoring the need for targeted product and process innovation.

Regional market dynamics vary widely, from aerospace-driven demand in the Americas to renewable energy and sustainability mandates in EMEA, and rapid electrification initiatives in Asia-Pacific. Leading companies are responding with capacity expansions, R&D partnerships, and sustainability investments-setting benchmarks for the broader industry to emulate.

By adopting the recommended strategies and leveraging the detailed insights contained in this report, stakeholders at every level can position themselves to thrive in an increasingly competitive and policy-driven environment. The future of carbon composites will be defined by collaboration, digitalization, and a relentless focus on value creation.

Connect with the Expert to Secure Advanced Carbon Composite Market Intelligence and Propel Strategic Decision Making Across Emerging Opportunity Frontiers

Are you ready to empower your strategic initiatives with unparalleled market intelligence and stay ahead of the curve in the rapidly evolving carbon composite industry? Reach out today to Ketan Rohom, Associate Director of Sales & Marketing, to explore a tailored briefing on detailed market trends, segmentation analyses, and actionable insights crafted to inform high-impact decisions.

By engaging with Ketan’s expert guidance, you’ll unlock exclusive access to our comprehensive carbon composite market research report, featuring in-depth coverage of technological advancements, supply chain dynamics, and competitive landscapes. This collaboration will ensure that your organization leverages the latest industry data to optimize investments, mitigate risks, and capitalize on emerging growth opportunities.

Contact Ketan now to secure your competitive advantage and drive sustainable, long-term value in your carbon composite strategies. Your next market-defining move starts with a conversation.

- How big is the Carbon Composites Market?

- What is the Carbon Composites Market growth?

- When do I get the report?

- In what format does this report get delivered to me?

- How long has 360iResearch been around?

- What if I have a question about your reports?

- Can I share this report with my team?

- Can I use your research in my presentation?