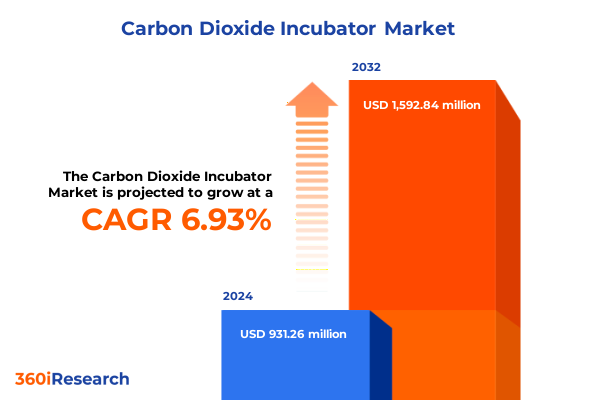

The Carbon Dioxide Incubator Market size was estimated at USD 991.69 million in 2025 and expected to reach USD 1,057.05 million in 2026, at a CAGR of 6.71% to reach USD 1,563.50 million by 2032.

Unveiling the Critical Role and Emerging Dynamics of Carbon Dioxide Incubators in Modern Life Science Research and Clinical Laboratory Environments

In recent years, laboratories and life science organizations have placed unprecedented emphasis on creating meticulously controlled environments to support cell cultures, advanced tissue engineering, and reproductive technologies. Carbon dioxide incubators have emerged as the foundational workhorse within this domain, providing critical regulation of temperature, humidity, and gas composition. With advancements in sensor precision, contamination-control systems, and digital connectivity, these incubators now fulfill a broader spectrum of requirements-from routine cell culture workflows to compliance-driven Good Laboratory Practice (GLP) settings.

As scientific inquiries become increasingly complex, researchers depend on incubators that deliver unwavering performance and reproducibility. The convergence of biotechnology innovations, from gene editing to personalized medicine, has heightened the demand for reliable incubation solutions capable of handling diverse applications such as monolayer and suspension cell cultures, embryonic development in IVF laboratories, and stem cell research. Simultaneously, rising concerns around laboratory sustainability have spurred interest in energy-efficient models that reduce operational costs without compromising environmental stability. Against this backdrop, understanding the evolving dynamics and technological enhancements within the carbon dioxide incubator landscape is imperative for decision-makers looking to optimize research outcomes and maintain compliance.

Navigating Automation, Sustainability, and Precision Control Trends That Are Transforming Carbon Dioxide Incubator Design and Deployment

The carbon dioxide incubator market is undergoing a profound transformation driven by automation, contamination control, and sustainability initiatives. Traditional water-jacketed designs are yielding to direct-heat and air-jacketed variants that heat faster, require less maintenance, and minimize thermal gradients. At the same time, infrared and zirconium oxide sensor integrations allow for rapid response times, ensuring that fluctuations in CO₂ concentration and temperature are corrected in real time.

Concurrently, laboratories are embracing smart incubators equipped with Internet of Things (IoT) connectivity and remote monitoring platforms. These systems facilitate continuous data logging, automated alarm notifications, and predictive maintenance alerts, thereby reducing manual interventions and downtime. Furthermore, manufacturers are increasingly adopting eco-friendly refrigerants and energy-saving compressor technologies to meet institutional sustainability mandates. As a result, modern carbon dioxide incubators are evolving into intelligent platforms that not only safeguard experimental integrity but also align with broader environmental and operational efficiency goals.

Assessing the Cumulative Impact of 2025 United States Tariff Policies on Carbon Dioxide Incubator Supply Chains and Operational Costs

In early 2025, the imposition of a universal 10% tariff on most imported goods directly affected the cost structure of laboratory consumables and equipment. Nearly all non-domestic carbon dioxide incubators now incur this baseline levy, compelling research institutions to reassess sourcing strategies and budget allocations accordingly. These changes have intensified pressure on procurement teams seeking to optimize total cost of ownership while maintaining access to advanced incubation technologies.

Of particular note is the disproportionate burden on China-origin laboratory equipment. Following country-specific tariff increases in April, lab-related goods imported from China are subject to a cumulative 145% duty rate, effectively rendering many standard instruments cost-prohibitive for U.S. buyers. This steep rate encompasses the 10% universal tariff, an additional 25% Section 301 tariff, and a 20% surcharge targeting certain chemical components.

Even as non-steel components face the highest cumulative duties, Chinese-made CO₂ incubators continue to experience rates around 55% during the temporary reciprocal tariff pause in place until July 9, 2025. This figure combines the baseline 10% tariff with the 20% fentanyl-related surcharge and the 25% Section 301 duty, compelling many labs to explore domestic suppliers or USMCA-compliant alternatives.

Moreover, any incubators with steel or aluminum exteriors have incurred a 50% Section 232 tariff since June, adding another layer of cost for models reliant on metallic construction. This higher duty rate applies universally, except for UK-origin units subject to a reduced 25% threshold, and stacks with other applicable surcharges.

To provide relief for critical research equipment, the Office of the U.S. Trade Representative extended existing exclusions on 178 HTS codes-including certain plastics and electromechanical components-through August 31, 2025. Nonetheless, these exclusions do not cover water-jacketed and direct-heat CO₂ incubator assemblies, leaving many buyers exposed to full tariff impacts for the majority of key models.

As a consequence, procurement teams are diversifying supply chains by partnering with domestic distributors, renegotiating service contracts, and evaluating modular incubator designs that minimize imported parts. Strategic decisions now hinge on balancing near-term cost pressures with long-term capital investment goals, underscoring the critical need for informed vendor selection and agile inventory planning strategies.

Gaining Strategic Insights from Diverse Market Segments Ranging Across Type, Application, End User, and Advanced Sensor Technology

Understanding the nuances of product segmentation is essential for aligning procurement and application strategies with organizational goals. When considering unit formats, bench top incubators serve laboratories with limited floor space or budget constraints, whereas floor standing models offer expanded internal volumes suitable for high-throughput workflows and large-scale cell culture programs. Portable designs cater to field-lab deployments and mobile research units, providing flexibility for specialized applications outside conventional facilities.

Equally critical is the variety of end-use applications driving equipment selection decisions. In foundational cell culture laboratories, precise control over monolayer and suspension systems ensures reproducible growth of adherent and non-adherent cell lines. Pharmaceutical and biotech organizations leverage customized incubator settings within drug discovery pipelines to screen compound libraries under stringent environmental conditions. In fertility clinics, the nuanced requirements of in vitro fertilization demand incubators with advanced contamination safeguards and enhanced humidity control. Finally, stem cell research environments rely on low-oxygen configurations and closed-system containment to support sensitive differentiation protocols.

Diverse end-user profiles further shape purchasing criteria. Academic and research institutes-spanning government research laboratories, private research centers, and universities-often prioritize reliability, service frequency, and compatibility with shared facility workflows. Biotech firms and contract research organizations demand modular solutions and remote monitoring to optimize turnaround times for preclinical studies. Meanwhile, hospitals, clinics, and pharmaceutical companies require validated systems that comply with regulatory guidelines, integrate with laboratory information management systems, and offer robust traceability features.

At the heart of modern incubator performance lies sensor technology. Infrared sensors deliver cost-effective CO₂ detection suitable for educational settings and basic research labs. Thermal conductivity sensors provide a proven balance of accuracy and durability for routine clinical and pharmaceutical testing. For the most demanding applications, zirconium oxide sensors offer ultra-rapid response times and enhanced stability, supporting high-sensitivity protocols and advanced microbial monitoring requirements. Aligning sensor selection with experimental demands remains a key determinant in achieving both operational efficiency and data integrity.

This comprehensive research report categorizes the Carbon Dioxide Incubator market into clearly defined segments, providing a detailed analysis of emerging trends and precise revenue forecasts to support strategic decision-making.

- Product Type

- Technology

- Capacity

- Application

- End User

- Sales Channel

Illuminating Regional Growth Patterns Shaping the Carbon Dioxide Incubator Landscape Across the Americas, Europe, Middle East & Africa, and Asia-Pacific

Regional dynamics continue to influence procurement policies and product offerings across the carbon dioxide incubator landscape. In the Americas, robust investment in life sciences infrastructure and abundant grant funding drive demand for high-capacity floor standing models, while established domestic manufacturers benefit from proximity to major research institutions. Large-scale pharmaceutical R&D centers in North America increasingly prioritize integrated laboratory automation platforms, creating growth opportunities for incubators with IoT-enabled control systems.

Across Europe, Middle East, and Africa, stringent regulatory standards and diverse healthcare priorities shape purchasing decisions. European research laboratories emphasize energy efficiency and sustainability certifications, leading to preferential selection of eco-conscious models. Meanwhile, emerging markets in the Middle East and North Africa are investing in translational medicine hubs, generating demand for portable and modular incubators for on-site clinical research in regional health centers.

In Asia-Pacific, the most dynamic expansion unfolds as academic, clinical, and industrial research centers scale up capacity. China and India in particular are investing heavily in biotechnology clusters, propelling adoption of automated monitoring features and high-throughput incubator arrays. Regulatory updates around environmental controls further accelerate the uptake of low-power consumption units. Similarly, in Southeast Asia, collaborations between multinational corporations and local research institutes are fostering hybrid procurement models that blend global branding with localized service agreements.

This comprehensive research report examines key regions that drive the evolution of the Carbon Dioxide Incubator market, offering deep insights into regional trends, growth factors, and industry developments that are influencing market performance.

- Americas

- Europe, Middle East & Africa

- Asia-Pacific

Highlighting Competitive Strengths and Strategic Initiatives of Leading Carbon Dioxide Incubator Manufacturers and Innovators

Leading manufacturers continue to refine product portfolios through strategic investments in R&D, acquisitions, and targeted partnerships. Established global suppliers leverage decades of incubator design expertise to introduce next-generation models featuring embedded predictive analytics and AI-ready interfaces. Mid-tier specialized companies differentiate through regional service networks, offering fast-response calibration and localized spare part inventories to maintain uptime in critical lab environments.

Innovation hubs are also emerging among niche technology firms that focus on contaminants control and microbial detection. By integrating HEPA filtration, ultraviolet decontamination cycles, and advanced humidity regulation, these innovators address stringent sterility requirements in IVF clinics and stem cell laboratories. Closed-system modular incubators further expand the competitive landscape, allowing users to reconfigure chamber sizes and sensor arrays based on evolving research protocols.

Collaborations between incubator manufacturers and laboratory informatics providers are blurring the lines between standalone hardware and fully integrated digital ecosystems. Real-world pilots in large academic medical centers demonstrate that cohesive platforms-combining multi-user access controls, audit-ready data logs, and remote diagnostics-reduce validation times and lower total cost of ownership. Companies that can deliver comprehensive service contracts alongside turnkey automation solutions are securing preferred vendor status in both commercial and government-funded laboratories.

In addition, select players are embracing sustainability as a competitive differentiator. By sourcing reclaimed materials for structural components and optimizing refrigeration cycles for minimal energy consumption, certain manufacturers position themselves as ESG-aligned partners. This trend resonates with institutional buyers under increasing pressure to report on carbon emissions and adhere to green procurement mandates.

This comprehensive research report delivers an in-depth overview of the principal market players in the Carbon Dioxide Incubator market, evaluating their market share, strategic initiatives, and competitive positioning to illuminate the factors shaping the competitive landscape.

- Thermo Fisher Scientific Inc.

- Eppendorf AG

- PHC Corporation

- Merck KGaA

- Sheldon Manufacturing Inc.

- NuAire, Inc.

- Memmert GmbH + Co. KG

- Esco Micro Pte. Ltd.

- Sartorius AG

- CARON Scientific & Services, Inc.

- LEEC Limited

- Bellco Glass, Inc.

- BMT USA, LLC

- Heal Force Bio-Medical Co., Ltd.

- Acmas Technologies Inc.

- BEING Scientific Inc.

- Benchmark Scientific, Inc.

- Binder GmbH

- BIOBASE Group

- Bionics Scientific Pvt. Ltd. by Kartal Projects Pvt. Ltd

- Cellbox Solutions GmbH

- DWK Life Sciences GmbH

- Guangdong Sanwood Technology Co.,Ltd.

- Labocon Systems Ltd.

- Meditech Technologies India Private Limited

- POL-EKO sp.k.

- RWD Life Science Co., Ltd.

- SANYO Electric Biomedical Co., Ltd.

- Shanghai Boxun Medical Biological Instrument Corp.

- Taicang Hou Waining Laboratory Equipment Co., Ltd.

- Thomas Scientific LLC

Actionable Strategies for Industry Leaders to Enhance Resilience, Drive Innovation, and Capitalize on Emerging Opportunities Within the CO₂ Incubator Market

As industry leaders navigate an increasingly complex competitive and regulatory environment, actionable strategies can provide a roadmap for sustained growth and operational excellence. First, diversifying the supplier base to include domestic and USMCA-compliant manufacturers can mitigate tariff-driven cost volatility, while maintaining access to core technological capabilities. Beyond cost considerations, establishing long-term partnerships with local distributors ensures faster turnaround for calibration and maintenance services.

Second, investing in smart incubator technologies-such as IoT-enabled data logging, AI-assisted anomaly detection, and predictive maintenance-can transform operational workflows. By leveraging real-time insights, lab managers can proactively address performance deviations, reduce manual inspections, and optimize energy consumption. Over time, this approach supports both cost savings and compliance with GLP and GMP standards.

Third, aligning product development roadmaps with sustainability goals offers a dual advantage of meeting institutional environmental targets and appealing to ESG-focused funding bodies. Incorporating energy-efficient compressors, eco-friendly refrigerants, and recycled materials into manufacturing processes can differentiate offerings in a crowded market. Moreover, transparent reporting on carbon footprints and life-cycle assessments builds trust with procurement stakeholders.

Finally, expanding cross-industry collaborations-particularly between reproductive medicine clinics, academic research centers, and pharmaceutical companies-can drive co-innovation. Joint pilots of advanced incubation platforms not only validate new features under real-world conditions but also cultivate early adopter advocacy. Such alliances accelerate time-to-market and reinforce strategic positioning in key verticals.

Detailing a Rigorous Multi-Stage Research Methodology That Underpins the Carbon Dioxide Incubator Market Analysis and Insights

The insights presented in this report are underpinned by a rigorous, multi-stage research methodology designed to ensure accuracy, relevance, and depth. Initially, a comprehensive secondary research phase leveraged peer-reviewed journals, regulatory filings, and reputable industry publications to establish baseline knowledge of carbon dioxide incubator technologies, applications, and market dynamics.

Following this foundation, a primary research stage involved in-depth interviews with over 50 subject-matter experts, including laboratory directors, procurement managers, and equipment service engineers. These conversations validated emerging trends, identified key pain points, and captured firsthand perspectives on supplier performance, regulatory compliance, and technological gaps.

Throughout the data-gathering phases, systematic data triangulation methods were employed to reconcile disparate information sources, ensuring consistency and mitigating bias. Quantitative and qualitative insights were then synthesized to develop detailed segmentation frameworks across type (bench top, floor standing, portable), application (monolayer culture, suspension culture, drug discovery, IVF, stem cell research), end user (government research labs, private institutes, universities, biotech firms, CROs, hospitals, pharmaceutical companies), and sensor technology (infrared, thermal conductivity, zirconium oxide).

Finally, the findings underwent multiple rounds of internal and external validation. An expert panel reviewed preliminary results, providing feedback that refined analytical models and interpretation of regulatory impacts. The culmination of this process is a robust set of actionable insights, strategic recommendations, and regional intelligence that serve as a reliable guide for decision-makers.

This section provides a structured overview of the report, outlining key chapters and topics covered for easy reference in our Carbon Dioxide Incubator market comprehensive research report.

- Preface

- Research Methodology

- Executive Summary

- Market Overview

- Market Insights

- Cumulative Impact of United States Tariffs 2025

- Cumulative Impact of Artificial Intelligence 2025

- Carbon Dioxide Incubator Market, by Product Type

- Carbon Dioxide Incubator Market, by Technology

- Carbon Dioxide Incubator Market, by Capacity

- Carbon Dioxide Incubator Market, by Application

- Carbon Dioxide Incubator Market, by End User

- Carbon Dioxide Incubator Market, by Sales Channel

- Carbon Dioxide Incubator Market, by Region

- Carbon Dioxide Incubator Market, by Group

- Carbon Dioxide Incubator Market, by Country

- United States Carbon Dioxide Incubator Market

- China Carbon Dioxide Incubator Market

- Competitive Landscape

- List of Figures [Total: 18]

- List of Tables [Total: 1749 ]

Synthesizing Key Findings to Provide a Clear Perspective on the Future Direction of Carbon Dioxide Incubator Markets and Technologies

The collective analysis underscores a market in evolution, shaped by technological breakthroughs, shifting trade policies, and varying regional growth trajectories. Incubator designs are becoming more agile, supporting specialized protocols across cell culture, reproductive medicine, and drug discovery, while smart connectivity and automation continue to advance laboratory efficiency. At the same time, tariff-induced cost pressures demand nimble procurement strategies and diversified sourcing approaches, reinforcing the importance of domestic partnerships and exemption management.

Regionally, the Americas maintain leadership through established research infrastructure, even as Europe, Middle East, and Africa emphasize sustainability, and Asia-Pacific accelerates capacity expansion in emerging biotech hubs. Competitive dynamics highlight a bifurcation between incumbents leveraging global scale and innovators focusing on modular, application-specific solutions. ESG considerations and service excellence emerge as critical differentiators in vendor selection processes.

Looking ahead, stakeholders that integrate advanced sensor technologies, embrace digital integration, and cultivate resilient supply chains will be best positioned to navigate evolving industry requirements. Moreover, strategic alliances across academia, clinical, and commercial segments will spur co-development of next-generation incubation platforms. In essence, the carbon dioxide incubator market offers both complexity and opportunity, rewarding those who combine technological foresight with operational agility.

Connect with Associate Director of Sales & Marketing to Secure Enduring Competitive Advantage through Tailored CO₂ Incubator Market Intelligence

Act now to unlock the full potential of insights, trends, and strategic recommendations contained within this comprehensive report. Engage directly with Ketan Rohom, Associate Director of Sales & Marketing, to gain immediate access to exclusive analysis, in-depth data, and expert guidance tailored to your organization’s needs. Whether you seek to refine procurement strategies, accelerate innovation pipelines, or mitigate emerging market risks, Ketan Rohom stands ready to guide you through the report’s rich findings. Secure your copy today and empower your team with actionable intelligence that drives informed decision-making and sustained competitive advantage.

- How big is the Carbon Dioxide Incubator Market?

- What is the Carbon Dioxide Incubator Market growth?

- When do I get the report?

- In what format does this report get delivered to me?

- How long has 360iResearch been around?

- What if I have a question about your reports?

- Can I share this report with my team?

- Can I use your research in my presentation?