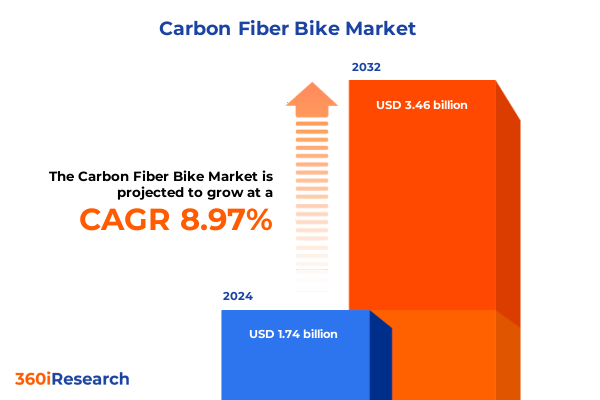

The Carbon Fiber Bike Market size was estimated at USD 1.88 billion in 2025 and expected to reach USD 2.04 billion in 2026, at a CAGR of 9.04% to reach USD 3.46 billion by 2032.

Pioneering the Path of Lightweight Performance with Carbon Fiber Bicycles Driving Unprecedented Efficiency and Rider Experience

The advent of carbon fiber bicycles has reshaped the boundaries of performance, weight optimization, and rider satisfaction, positioning this technology at the forefront of the premium cycling market. These advanced frames leverage the unique properties of carbon fiber composites, including an exceptional strength-to-weight ratio and the ability to fine-tune stiffness characteristics for specific riding disciplines. As a result, athletes and enthusiasts alike are experiencing a new dimension of speed, control, and comfort that outpaces traditional aluminum and steel counterparts.

This introduction delves into the core drivers behind the rapid adoption of carbon fiber bikes, highlighting how material science breakthroughs and precision manufacturing techniques have converged to deliver structural enhancements without compromising responsiveness. The integration of aerodynamic shaping, vibration damping, and customized layup schedules has enabled manufacturers to engineer frames that cater to distinct rider preferences and performance goals. Consequently, the market is witnessing not only an escalation in high-performance offerings but also an expansion in accessibility, with mid-tier brands adopting carbon fiber technology to meet growing consumer demand.

By understanding the technical merits and evolving consumer expectations, industry leaders and stakeholders gain clarity on the factors propelling carbon fiber bikes to the pinnacle of the cycling universe. This introduction sets the stage for an in-depth exploration of transformative trends, regulatory influences, segmentation dynamics, regional nuances, and strategic imperatives shaping the future trajectory of this dynamic sector.

Catalyzing Industry Evolution through Advanced Material Science and Digital Integration Revolutionizing Carbon Fiber Bike Engineering

Significant advances in composite engineering, digital integration, and sustainable manufacturing practices have collectively catalyzed a paradigm shift in the carbon fiber bike landscape. Over the past few years, material scientists have introduced novel fiber architectures and resin systems that enable enhanced fatigue resistance and impact tolerance, addressing longstanding durability concerns. These innovations have been further amplified by automated layup robotic systems and real-time process monitoring, ensuring consistent quality while reducing cycle times and material waste.

Simultaneously, digital technologies-from integrated power meters to connected ride analytics platforms-have become indispensable components of modern bike design. By embedding sensors directly into carbon structures, manufacturers can deliver actionable performance data without compromising the frame’s integrity or adding significant weight. This convergence of hardware and software is elevating the user experience and forging deeper brand loyalty through personalized training insights and seamless data exchange. Furthermore, the increasing emphasis on eco-friendly production has spurred the adoption of recycled fiber composites and bio-based resins, reflecting a broader commitment to circular economy principles.

These transformative shifts underscore the industry’s transition from traditional craftsmanship to a data-driven, sustainability-focused model. As capitalization on these trends intensifies, stakeholders across the value chain-from raw material suppliers to aftermarket service providers-must adapt to new standards of innovation, efficiency, and environmental stewardship to maintain competitive advantage.

Assessing the Far-Reaching Consequences of 2025 United States Tariff Measures on Carbon Fiber Bicycle Value Chains and Cost Structures

In 2025, the United States implemented an expanded tariff regime targeting key composite materials and finished carbon fiber bicycles, aiming to bolster domestic manufacturing and protect strategic industries. The immediate ramifications have rippled across global supply chains, exerting upward pressure on input costs as importers adjust to increased duties. Many frame builders have responded by renegotiating contracts with fiber suppliers, exploring alternative sourcing from non-tariffed regions, and, in some instances, shifting final assembly operations closer to end markets to mitigate duty liabilities.

While these measures have achieved their policy objectives of spurring local capacity development, they have also introduced complexities around lead times and inventory management. Original equipment manufacturers (OEMs) are balancing the benefits of localized production-such as reduced shipping distances and enhanced quality control-against the challenges of scaling specialized facilities and retaining access to advanced fiber formulations. In parallel, retailers and distributors have reassessed margin structures to accommodate the pass-through of elevated costs, leading to strategic price recalibrations that may influence consumer adoption patterns.

Looking ahead, the tariff environment is likely to remain a pivotal consideration for decision-makers evaluating investment and partnership opportunities. Companies that proactively diversify their supplier base, invest in domestic fiber development projects, and leverage lean manufacturing principles will be best positioned to navigate the evolving regulatory landscape. Understanding these cumulative impacts is essential for charting a resilient growth path amid ongoing geopolitical and trade policy shifts.

Unveiling Segment-Specific Trends Shaping Carbon Fiber Bike Adoption across Types Fiber Varieties Customer Profiles and Distribution Channels

Analyzing market adoption through the lens of product type reveals a pronounced preference for mountain bike variants-particularly cross country, trail, and downhill configurations-driven by their robust demand among off-road enthusiasts seeking lightweight yet durable frames. Road bike applications, spanning aero, endurance, and racing designs, continue to command attention from cyclists focused on speed optimization and biomechanical efficiency. Hybrid and triathlon or time trial models, while capturing a smaller slice of consumer interest, exhibit growth as manufacturers innovate with aerodynamic shaping and integrated componentry to meet diverse riding conditions.

Considering fiber composition, high modulus materials have emerged as the premium choice for performance-centric riders who prioritize stiffness-to-weight ratios, whereas intermediate modulus fibers offer a balanced combination of responsiveness and cost efficiency. Standard modulus options remain prevalent in entry-level and mid-tier segments, where affordability and resilience are key purchasing drivers. Customer segmentation underscores a dichotomy between professional athletes and recreational cyclists; professionals demand bespoke frame geometries and advanced layup schedules, while recreational users seek reliable, versatile bikes that deliver a premium riding experience without specialized customization.

Distribution patterns further illustrate evolving consumer behaviors. Offline channels, including department stores, local bicycle shops, and specialty retailers, continue to serve as critical touchpoints for product trials and service-based relationships. Conversely, online direct-to-consumer models and third-party e-commerce platforms are gaining traction by offering streamlined purchasing, configurator tools, and enhanced delivery options. Together, these distribution formats paint a nuanced portrait of how market participants engage with carbon fiber bikes at every stage of the purchase journey.

This comprehensive research report categorizes the Carbon Fiber Bike market into clearly defined segments, providing a detailed analysis of emerging trends and precise revenue forecasts to support strategic decision-making.

- Type

- Fiber Type

- Customer

- Distribution Channel

Delineating Regional Dynamics Influencing Carbon Fiber Bike Popularity and Innovation Drivers across the Americas EMEA and Asia-Pacific

The Americas region remains a cornerstone for carbon fiber bicycle innovation and consumption, fueled by a robust cycling culture that spans urban commuting to elite-level competition. North American markets exhibit a growing appetite for integrated e-bike solutions and gravel-specific carbon frames, reflecting an increasing emphasis on versatility and performance. In South America, rising disposable incomes and expanding cycling tourism networks are catalyzing interest in high-end carbon models, albeit from a smaller installed base.

Within Europe, the Middle East, and Africa, established cycling traditions and rigorous competitive circuits have sustained demand for both road and mountain carbon bikes. European manufacturers lead in process innovation and craftsmanship, frequently collaborating with professional racing teams to refine material attributes and aerodynamic profiles. Meanwhile, emerging markets in the Middle East and Africa are showing nascent growth, supported by government infrastructure investments and a cultural shift toward recreational cycling as a lifestyle choice.

Asia-Pacific presents a dual narrative: Westernized economies such as Australia and Japan drive premium segment sales, leveraging seasoned retail channels and high per-capita expenditure on cycling pursuits, while rapidly developing markets in China, India, and Southeast Asia are experiencing accelerating adoption rates, particularly in entry-level and mid-tier categories. Local fiber production capabilities and a burgeoning network of e-commerce platforms are enhancing market accessibility, positioning the region as a dynamic growth frontier for carbon fiber bike stakeholders.

This comprehensive research report examines key regions that drive the evolution of the Carbon Fiber Bike market, offering deep insights into regional trends, growth factors, and industry developments that are influencing market performance.

- Americas

- Europe, Middle East & Africa

- Asia-Pacific

Exploring Strategic Approaches of Leading Brands Steering R&D Market Expansion and Sustainable Practices in Carbon Fiber Bicycle Manufacturing

Leading bicycle manufacturers and specialized frame builders are executing multifaceted strategies to strengthen their foothold in the carbon fiber segment. Premium brands collaborate with material science institutes to co-develop proprietary high modulus fibers and resin formulations, enabling incremental gains in stiffness and impact resistance. In parallel, several players have invested in vertically integrated production models that encompass fiber spinning, composite layup, and final assembly, thereby safeguarding intellectual property and elevating quality control.

Competitive pressures have fostered an environment of rapid product refresh cycles, with companies unveiling aerodynamic enhancements, vibration damping technologies, and multi-material frame assemblies to differentiate their offerings. Strategic partnerships with advanced component suppliers, including groupsets and wheelset specialists, have become commonplace, allowing brands to present fully integrated performance packages. Moreover, a handful of ambitious entrants are pursuing disruptive go-to-market tactics-such as factory direct sales and community-centric subscription services-to challenge traditional retail paradigms and accelerate customer acquisition.

As environmental concerns ascend, leading firms are also embedding circular economy principles into their operational playbooks. By launching fiber reclamation initiatives and exploring bio-based resin alternatives, these companies demonstrate a commitment to long-term sustainability that resonates with environmentally conscious consumers. Consequently, strategic innovation, operational excellence, and environmental stewardship have emerged as the defining pillars of success for top-tier participants in the carbon fiber bicycle ecosystem.

This comprehensive research report delivers an in-depth overview of the principal market players in the Carbon Fiber Bike market, evaluating their market share, strategic initiatives, and competitive positioning to illuminate the factors shaping the competitive landscape.

- Alchemy Bikes

- BMC Switzerland AG

- Canyon Bicycles USA, Inc.

- Colnago Erneso E C. Srl

- Cube Bikes

- DAHON North America, Inc.

- De Rosa Ugo & Figli Srl

- Ellsworth Bikes

- Giant Manufacturing Co. Ltd.

- ICAN Cycling

- Kestrel Bicycles

- KROSS S.A.

- LOOK Cycle International SAS

- Merida Industry Co., Ltd.

- PIERER Mobility AG

- Rinasclta Bicycle Components

- Santa Cruz Bicycles, Inc.

- Storck Bicycle GmbH

- SwiftCarbon

- Tianjin Fuji-ta Group Co., Ltd.

- Trek Bicycle Corporation

- Tyrell Bike

- XDS Bikes

Formulating High-Impact Strategic Initiatives to Strengthen Supply Chains Innovate Materials and Enhance Customer Engagement in Carbon Fiber Bikes

Industry leaders seeking to outperform in the competitive carbon fiber bicycle arena should prioritize the diversification of fiber sourcing and assembly footprints to fortify their supply chain resilience. Establishing strategic partnerships with alternative fiber producers in tariff-exempt jurisdictions can help stabilize raw material procurement while incremental investments in domestic manufacturing hubs will reduce exposure to import duties and logistics disruptions.

Concurrently, accelerating the adoption of emerging fiber technologies-such as nano-enhanced composites and hybrid multi-material laminates-can unlock new performance thresholds and capture the attention of professional and recreational segments alike. To complement material innovation, companies should integrate predictive analytics and IoT-enabled monitoring systems into their production lines, enabling real-time quality assurance and agile responsiveness to design iterations.

On the customer engagement front, expanding direct-to-consumer channels and digital configurators will cultivate deeper brand loyalty and data-driven personalization, while a curated service ecosystem-including virtual fitting, tune-up subscriptions, and performance coaching-can differentiate offerings beyond the hardgoods themselves. Finally, embedding sustainability into every facet of the value chain-from eco-friendly packaging to end-of-life fiber recycling-will not only address regulatory pressures but also resonate with the growing cohort of environmentally attuned cyclists, ensuring long-term brand affinity.

Outlining a Robust Mixed-Methods Research Framework Integrating Industry Expertise Empirical Data and Stakeholder Validation for Comprehensive Insights

Our research framework embraces a mixed-methods approach that synthesizes quantitative data analysis with qualitative insights from industry veterans. Secondary data collection involved the systematic review of technical literature, patent filings, and regulatory filings to establish a foundational understanding of composite material developments and trade policy dynamics.

Simultaneously, in-depth interviews and roundtables with material scientists, OEM executives, and supply chain specialists provided nuanced perspectives on emerging manufacturing methodologies, distribution models, and consumer preferences. These conversations were complemented by site visits to leading production facilities, allowing direct observation of automated layup processes, materials handling protocols, and quality assurance systems.

To ensure the integrity and reliability of our findings, all data points were triangulated through cross-validation among multiple sources, with discrepancies resolved via follow-up consultations and expert adjudication. The integration of statistical trend analysis, thematic coding, and scenario modeling further enriched the analytical rigor, enabling the distillation of actionable insights. This robust methodology underpins the comprehensive intelligence presented in this report and ensures that recommendations are grounded in empirical evidence and industry best practices.

This section provides a structured overview of the report, outlining key chapters and topics covered for easy reference in our Carbon Fiber Bike market comprehensive research report.

- Preface

- Research Methodology

- Executive Summary

- Market Overview

- Market Insights

- Cumulative Impact of United States Tariffs 2025

- Cumulative Impact of Artificial Intelligence 2025

- Carbon Fiber Bike Market, by Type

- Carbon Fiber Bike Market, by Fiber Type

- Carbon Fiber Bike Market, by Customer

- Carbon Fiber Bike Market, by Distribution Channel

- Carbon Fiber Bike Market, by Region

- Carbon Fiber Bike Market, by Group

- Carbon Fiber Bike Market, by Country

- United States Carbon Fiber Bike Market

- China Carbon Fiber Bike Market

- Competitive Landscape

- List of Figures [Total: 16]

- List of Tables [Total: 1431 ]

Synthesizing Key Findings to Illuminate Future Pathways and Critical Considerations for Stakeholders in the Carbon Fiber Bicycle Sector

The synthesis of technological, regulatory, and market-oriented factors paints a clear picture: carbon fiber bicycles stand at a pivotal juncture, propelled by material innovations, digital integration, and evolving consumer expectations. Tariff-induced realignments in supply chains have underscored the strategic value of localized production and diversified sourcing, while segmentation insights reveal differentiated growth drivers across type, fiber composition, customer profile, and distribution channel.

Regional analyses confirm that established markets in the Americas and EMEA continue to drive premium demand, even as Asia-Pacific emerges as a vibrant frontier for both entry-level expansion and high-end innovation. Leading companies are capitalizing on this momentum through vertical integration, strategic partnerships, and sustainability initiatives that align with the sector’s environmental imperatives.

Looking forward, stakeholders who embrace agile manufacturing, invest in next-generation composites, and deepen direct engagement with end users will be best positioned to capture value. The convergence of performance, personalization, and purpose-driven narratives will define the winners in this dynamic landscape, setting the stage for sustained growth and differentiation.

Empowering Decision-Makers with Exclusive Access to In-Depth Carbon Fiber Bike Market Intelligence through a Direct Engagement Opportunity

To uncover untapped opportunities and gain a competitive edge in the evolving carbon fiber bike landscape, secure immediate access to the comprehensive intelligence you need to drive growth. Connect directly with Ketan Rohom, Associate Director of Sales & Marketing, who will guide you through tailored insights and customized deliverables designed to empower your strategic initiatives. Don’t miss the chance to elevate your decision-making with exclusive market research that translates complex data into actionable imperatives. Reach out to Ketan and transform your understanding of the carbon fiber bicycle sector through a personalized consultation and secure the definitive report that will inform your next bold move.

- How big is the Carbon Fiber Bike Market?

- What is the Carbon Fiber Bike Market growth?

- When do I get the report?

- In what format does this report get delivered to me?

- How long has 360iResearch been around?

- What if I have a question about your reports?

- Can I share this report with my team?

- Can I use your research in my presentation?