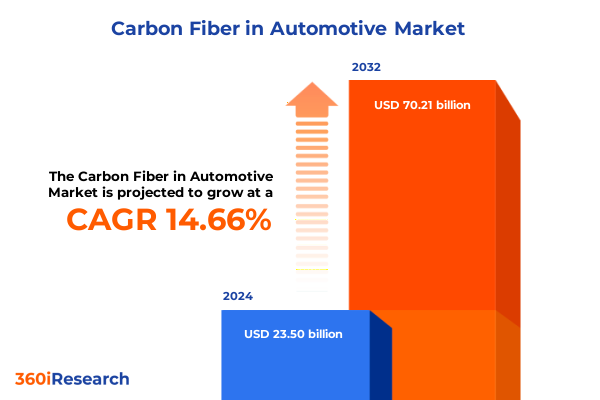

The Carbon Fiber in Automotive Market size was estimated at USD 26.99 billion in 2025 and expected to reach USD 30.65 billion in 2026, at a CAGR of 14.63% to reach USD 70.21 billion by 2032.

Pioneering Carbon Fiber Integration in Automotive Engineering to Drive Performance, Efficiency, and Sustainability Innovations

Carbon fiber has emerged as a cornerstone material in modern automotive engineering, spurring a renaissance in vehicle design and performance. Its exceptional strength-to-weight ratio, combined with enhanced durability and corrosion resistance, positions carbon fiber as a transformative material for the next generation of light, efficient, and high-performing vehicles. As global emissions regulations tighten and consumer demand for electrified and sustainable mobility solutions intensifies, automakers are compelled to integrate advanced composites that deliver both performance gains and environmental benefits.

Amid this evolving landscape, stakeholders across the value chain from material suppliers to OEMs are navigating technological challenges, cost considerations, and supply chain complexities. Early-stage adopters are already witnessing the impact of carbon fiber on vehicle dynamics, energy efficiency, and passenger safety, underscoring the strategic importance of understanding this material’s trajectory. Simultaneously, emerging manufacturing techniques and economies of scale promise to optimize production workflows, reduce per-unit costs, and unlock new application areas.

This executive summary distills critical insights into the automotive carbon fiber landscape, offering a succinct yet comprehensive overview of industry shifts, regulatory influences, segmentation nuances, regional dynamics, and key corporate strategies. Decision-makers will gain clarity on actionable recommendations, methodological rigor, and strategic takeaways to chart a clear path forward. As we embark on this analysis, prepare to uncover the drivers shaping the future of carbon fiber in the automotive domain and the strategic levers available to industry leaders.

Analyzing the Shift Toward Ultra-Lightweight Materials and Advanced Manufacturing Technologies in the Automotive Carbon Fiber Ecosystem

The automotive industry is undergoing a paradigm shift as ultra-lightweight materials take center stage in addressing performance and regulatory objectives. In recent years, carbon fiber has transcended niche sports car applications to become pivotal in mainstream vehicle architectures. Advances in resin systems, automated fiber placement, and out-of-autoclave curing techniques have dramatically reduced cycle times and improved yield rates, making composite parts more cost-competitive and scalable.

Concurrently, digital design tools and simulation platforms empower engineers to optimize fiber orientation and laminate stacking sequences, enhancing crashworthiness and rigidity. These technological strides facilitate the development of complex geometries and multi-material assemblies, enabling automakers to innovate with greater design freedom. Moreover, strategic partnerships between material scientists and OEM R&D teams are accelerating process standardization, from high-volume stamping analogs to rapid prototyping workflows.

As supply chain networks mature, the integration of local and regional carbon fiber precursors, recycled feedstocks, and hybrid composite solutions is reshaping cost structures and sustainability profiles. While production volumes climb and economies of scale kick in, ongoing investments in next-generation raw materials and manufacturing equipment signal a long-term commitment to composites. Looking ahead, the convergence of digitalization, materials science, and collaborative innovation will continue to redefine the automotive carbon fiber ecosystem, delivering tangible value across the mobility landscape.

Evaluating the Cumulative Impact of 2025 U.S. Tariffs on Automotive Carbon Fiber Supply Chains and Cost Structures

In January 2025, the United States implemented a new tariff schedule targeting composite materials, including carbon fiber precursors and finished components, with the intent of bolstering domestic manufacturing capacity. This policy move introduced an incremental duty on imported prepreg rolls and woven fabrics, creating immediate cost headwinds for OEMs reliant on global supply partnerships. As a result, procurement teams have had to reassess sourcing strategies, negotiate revised supplier contracts, and absorb partial cost pass-throughs.

Over successive quarters, the tariffs have catalyzed investment in local production facilities for epoxy-impregnated fiber and automated layup systems. While these investments mitigate exposure to import duties, they also necessitate significant capital outlays and extended time-to-market considerations. Consequently, automotive manufacturers are reevaluating component design philosophies, shifting toward modular assemblies that can accommodate variations in material origin without compromising structural integrity or performance.

Despite the short-term volatility introduced by tariff-driven cost adjustments, the long-term outlook suggests a more resilient domestic supply chain. Government incentives for advanced manufacturing initiatives, coupled with technology grants for composite research, are attracting new entrants and driving capacity expansions. In turn, this localized ecosystem promises greater supply security, improved lead times, and enhanced collaboration between material innovators and OEMs, setting the stage for sustainable growth in the automotive carbon fiber sector.

Unlocking Comprehensive Segmentation Insights to Guide Strategic Applications of Carbon Fiber Across Diverse Automotive Component Categories

The automotive carbon fiber market is distinguished by a diverse array of application-specific demands. From external body panels such as bumpers, doors, fenders, hoods, and roof panels to interior elements including dashboard panels, seat interiors, and decorative trim components, each segment has unique requirements for strength, finish, and weight optimization. Structural components like chassis sections, crash structures, and seat frames demand rigorous mechanical properties, while underbody parts encompassing floor panels, sills, and underhood components focus on impact resistance and thermal stability under harsh operating conditions.

Vehicle type further nuances these application categories. Commercial vehicles, subdivided into heavy and light segments, prioritize load-bearing capacity and long-term durability, whereas passenger vehicles-spanning coupes, hatchbacks, sedans, and SUVs-seek a balance of lightweight dynamics and consumer-grade cost targets. Two-wheelers, including motorcycles and scooters, require fiber solutions that deliver both crash protection and weight minimization to enhance handling performance.

Material form and fiber grade also play a pivotal role in strategic component design. Raw material choices range from nonwoven mats to prepreg sheets, tow-based build-ups, and woven fabric layups, each offering distinct processing workflows and mechanical trade-offs. Similarly, fiber grade options-high modulus, intermediate modulus, standard modulus, and ultra-high modulus-enable engineers to calibrate stiffness, tensile strength, and cost to the precise demands of each automotive application. By synthesizing these segmentation insights, industry leaders can tailor their product roadmaps to capture targeted performance metrics and operational efficiencies.

This comprehensive research report categorizes the Carbon Fiber in Automotive market into clearly defined segments, providing a detailed analysis of emerging trends and precise revenue forecasts to support strategic decision-making.

- Vehicle Type

- Raw Material

- Fiber Grade

- Application

Deciphering Regional Market Dynamics Driven by Americas, EMEA, and Asia-Pacific Trends in Automotive Carbon Fiber Adoption and Innovation

Regional dynamics in the carbon fiber automotive market reflect differing regulatory frameworks, infrastructure maturity, and consumer preferences. In the Americas, robust government incentives for lightweight materials in North America and a strong aftermarket presence in South America have stimulated early adoption of composite solutions for both legacy OEMs and emerging mobility startups. Supply chain clusters around key automotive hubs are increasingly integrated with local fiber spinning and composite processing capabilities, shortening lead times and reducing logistical overhead.

Meanwhile, Europe, the Middle East, and Africa present a complex mosaic of stringent emissions regulations, localized manufacturing incentives, and cross-border trade flows. European OEMs have pioneered high-performance carbon fiber applications in premium vehicle lines, while several Middle Eastern nations leverage sovereign investment funds to establish composite fabrication plants. Across Africa, partnerships with global material suppliers aim to cultivate regional centers of excellence, bridging infrastructure gaps and upskilling engineering talent.

In the Asia-Pacific region, competitive labor costs and rapidly evolving EV ecosystems drive aggressive carbon fiber usage. Japan and South Korea lead in material science R&D, whereas China’s domestic market expansion and government-led advanced manufacturing initiatives are scaling precursor and composite production at unprecedented rates. Southeast Asian nations are also emerging as strategic export hubs, leveraging port infrastructure to serve global automotive supply chains. Collectively, these regional insights underscore the importance of geo-specific strategies for material sourcing, production footprint, and market entry in the evolving automotive carbon fiber landscape.

This comprehensive research report examines key regions that drive the evolution of the Carbon Fiber in Automotive market, offering deep insights into regional trends, growth factors, and industry developments that are influencing market performance.

- Americas

- Europe, Middle East & Africa

- Asia-Pacific

Revealing Key Corporate Players Driving Innovation and Collaboration in the Automotive Carbon Fiber Value Chain Landscape

A cadre of leading corporations is shaping the automotive carbon fiber ecosystem through strategic investments, partnerships, and technological breakthroughs. Industry incumbents with vertically integrated operations-spanning precursor production, fiber spinning, and composite part manufacturing-have leveraged scale to optimize cost structures and establish robust quality control regimes. Meanwhile, specialized technology providers are pushing the envelope on resin formulations, automated deposition systems, and recycling protocols.

Collaboration between OEMs and composite specialists has accelerated the development of modular carbon fiber subassemblies, integrating seamlessly into traditional manufacturing lines. Joint ventures focused on next-generation tow and nonwoven processing techniques are scaling pilot facilities into commercial operations, enabling tier-one suppliers to deliver ready-to-install components. Parallel initiatives among material producers, equipment OEMs, and research institutes are expanding the knowledge base for high-speed curing processes and in-line inspection technologies.

Furthermore, emerging players are carving niche positions by targeting aftermarket performance upgrades and bespoke composite solutions for low-volume specialty vehicles. These agile entrants benefit from digital marketing platforms and rapid prototyping services, allowing them to respond to customer trends with unprecedented speed. Collectively, these corporate strategies highlight a dynamic interplay between scale-driven incumbents and innovation-focused challengers, driving continuous evolution across the automotive carbon fiber value chain.

This comprehensive research report delivers an in-depth overview of the principal market players in the Carbon Fiber in Automotive market, evaluating their market share, strategic initiatives, and competitive positioning to illuminate the factors shaping the competitive landscape.

- Carbon Revolution Limited

- Clearvise AG

- DowAksa Advanced Composites Holdings B.V.

- Formosa Plastics Corporation

- Gurit Holding AG

- Hexcel Corporation

- Hyosung Advanced Materials

- Mitsubishi Chemical Group Corporation

- Mitsubishi Chemical Holdings Corporation

- Mubea Carbo Tech GmbH

- Plasan Carbon Composites

- Rock West Composites

- SGL Carbon SE

- Solvay SA

- Teijin Limited

- Toray Industries, Inc.

- Zoltek Corporation

Formulating Actionable Strategies to Accelerate Carbon Fiber Adoption and Optimize Automotive Manufacturing Operations

Industry leaders should prioritize end-to-end value chain integration by fostering deeper partnerships with precursor manufacturers, equipment OEMs, and research institutions. This collaborative approach will streamline material qualification processes and accelerate the adoption of next-generation resin and fiber technologies. In parallel, investing in advanced process monitoring and digital twins can enhance quality assurance, minimize defects, and reduce rework costs, translating into faster time-to-market for composite parts.

Moreover, executives should explore hybrid material architectures that combine carbon fiber composites with metallic or polymeric substructures to balance cost sensitivity with performance requirements. Piloting these hybrid assemblies in select vehicle programs will generate empirical data on manufacturability and life-cycle impacts, guiding broader implementation strategies. Simultaneously, scaling local precursor production and recycling operations can mitigate tariff exposures, enhance supply security, and support sustainability goals aligned with evolving regulatory mandates.

Finally, leadership teams need to cultivate a culture of continuous learning by upskilling engineering workforces on composite design principles and additive manufacturing techniques. Establishing centers of excellence for automated fiber placement and out-of-autoclave curing will position organizations to capitalize on emerging advancements. By executing these actionable strategies, companies can solidify their competitive posture, deliver differentiated products, and drive long-term value in the automotive carbon fiber market.

Detailing a Rigorous Mixed-Method Research Methodology Underpinning In-Depth Insights into Automotive Carbon Fiber Market Dynamics

The research underpinning this analysis employed a mixed-method approach, combining qualitative interviews with material scientists, OEM engineers, and tier-one supply chain executives, alongside quantitative process assessments of production workflows. Primary data collection included virtual workshops with cross-functional teams to map composite material flows, identify cost drivers, and evaluate lead-time constraints under varying tariff scenarios. Secondary research involved a systematic review of technical patents, scholarly journals, and regulatory filings to triangulate technology maturity and market readiness.

To ensure comprehensive coverage, the methodology integrated comparative case studies of vehicle programs that have successfully implemented carbon fiber body panels, interiors, structural components, and underbody modules. These case studies highlighted best practices in design optimization, supply chain localization, and automated fabrication. Furthermore, sensitivity analyses were conducted to assess the impact of raw material grade and form variations on mechanical performance, thermal behavior, and manufacturability across diverse automotive segments.

Throughout the process, rigorous data validation protocols were applied, including cross-referencing interview insights with third-party industry reports and in-field production audits. This multifaceted approach provided both strategic context and granular operational clarity, ensuring that the insights presented in this report are robust, actionable, and reflective of real-world industry dynamics.

This section provides a structured overview of the report, outlining key chapters and topics covered for easy reference in our Carbon Fiber in Automotive market comprehensive research report.

- Preface

- Research Methodology

- Executive Summary

- Market Overview

- Market Insights

- Cumulative Impact of United States Tariffs 2025

- Cumulative Impact of Artificial Intelligence 2025

- Carbon Fiber in Automotive Market, by Vehicle Type

- Carbon Fiber in Automotive Market, by Raw Material

- Carbon Fiber in Automotive Market, by Fiber Grade

- Carbon Fiber in Automotive Market, by Application

- Carbon Fiber in Automotive Market, by Region

- Carbon Fiber in Automotive Market, by Group

- Carbon Fiber in Automotive Market, by Country

- United States Carbon Fiber in Automotive Market

- China Carbon Fiber in Automotive Market

- Competitive Landscape

- List of Figures [Total: 16]

- List of Tables [Total: 1908 ]

Summarizing Critical Insights and Strategic Takeaways from the Comprehensive Automotive Carbon Fiber Analysis and Industry Outlook

This executive summary has distilled the essential trends, regulatory influences, regional dynamics, and corporate strategies shaping the automotive carbon fiber landscape. Key takeaways underscore the critical importance of advanced manufacturing technologies, strategic supply chain localization, and targeted material segmentation in driving both performance gains and cost efficiencies. By evaluating the ripple effects of 2025 U.S. tariffs, decision-makers can anticipate shifts in sourcing paradigms and capitalize on domestic capacity expansions.

Furthermore, the segmentation and regional analyses illuminate the multi-dimensional nature of carbon fiber applications, from external body panels and interiors to structural and underbody components across passenger, commercial, and two-wheeler platforms. Corporate insights reveal the interplay between scale-driven incumbents and agile challengers, while the methodological rigor ensures that recommendations are grounded in empirical evidence and industry best practices.

As the automotive sector continues to embrace electrification, autonomous capabilities, and sustainability imperatives, carbon fiber is poised to play an increasingly central role. Stakeholders equipped with the actionable strategies and insights outlined here will be well positioned to navigate evolving market conditions, drive innovation, and secure competitive advantage in this dynamic material ecosystem.

Take Immediate Ownership of the Definitive Automotive Carbon Fiber Market Intelligence and Propel Strategic Decisions with an Expert-Led Research Report

By partnering directly with Ketan Rohom, Associate Director, Sales & Marketing, you gain personalized guidance tailored to your strategic imperatives in automotive innovation. His expert insights into emerging carbon fiber applications and critical decision-making criteria will ensure your organization invests with confidence and foresight. Reach out today to secure your copy of the definitive market intelligence report and begin translating in-depth analysis into measurable competitive advantage.

- How big is the Carbon Fiber in Automotive Market?

- What is the Carbon Fiber in Automotive Market growth?

- When do I get the report?

- In what format does this report get delivered to me?

- How long has 360iResearch been around?

- What if I have a question about your reports?

- Can I share this report with my team?

- Can I use your research in my presentation?