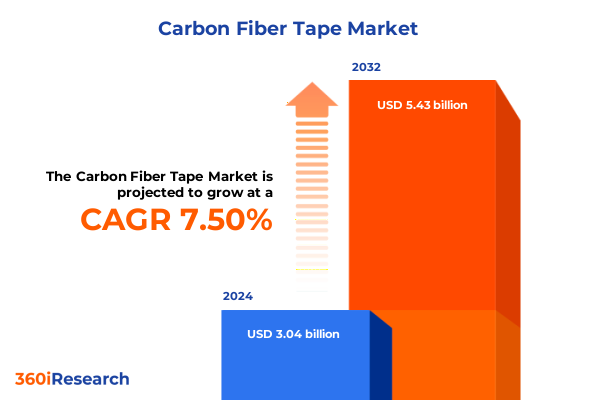

The Carbon Fiber Tape Market size was estimated at USD 3.24 billion in 2025 and expected to reach USD 3.45 billion in 2026, at a CAGR of 7.64% to reach USD 5.43 billion by 2032.

Unveiling the Transformative Potential of Carbon Fiber Tape in Modern Industry Applications and Its Role in Driving Sustainable High-Performance Solutions

Carbon fiber tape, celebrated for its exceptional strength-to-weight ratio and dimensional stability, has become an indispensable material for advanced engineering sectors seeking performance enhancements. Its unique unidirectional fiber architecture enables designers and manufacturers to tailor mechanical properties precisely to specific load requirements, spanning from reinforcing components in aerospace structures to delivering rigidity and durability in sporting goods. As lightweighting and material efficiency gain prominence across industries, carbon fiber tape continues to unlock design possibilities that were once constrained by traditional metallic or polymeric materials.

Recent advancements in fiber treatment processes and resin systems have further elevated performance benchmarks, with novel surface chemistries enhancing fiber-matrix adhesion and enabling higher thermal resistance thresholds. These technical innovations, coupled with streamlined production workflows, have driven broader adoption across both established applications and emerging segments. Moreover, the alignment of carbon fiber tape with circular economy principles-through initiatives in reuse, recycling, and end-of-life recovery-has positioned it as a pivotal contributor to sustainable manufacturing roadmaps. As organizations prioritize decarbonization and regulatory compliance, carbon fiber tape stands out not only for its mechanical prowess but also for its capacity to support greener supply chains and reduce lifecycle environmental impacts.

Exploring the Structural Shifts Redefining the Carbon Fiber Tape Market Landscape Amid Evolving Manufacturing Practices and Sustainability Imperatives

The carbon fiber tape landscape is undergoing a profound metamorphosis, driven by converging forces of sustainability imperatives, digital transformation, and evolving end-user demands. On one front, the integration of advanced manufacturing techniques, such as automated fiber placement and additive deposition, has redefined how tape is applied in complex geometries, reducing material waste while accelerating cycle times. These process innovations are complemented by digital twins and predictive analytics, empowering engineers to simulate structural performance and optimize layup sequences before physical prototyping.

Meanwhile, the emphasis on low-carbon manufacturing has catalyzed a shift toward bio-derived and recyclable resin systems, challenging traditional thermoset formulations. Strategic collaborations between resin producers and fiber manufacturers have given rise to pre-impregnated materials that require less energy during curing and offer streamlined end-of-life processing. This transition not only alleviates environmental burdens but also enhances supply chain transparency, as stakeholders demand traceability from precursor sourcing to final component deployment. Collectively, these transformative shifts have recalibrated competitive dynamics, with agile innovators securing footholds in emergent application arenas and raising the bar for sustainable material performance.

Assessing the Cumulative Ripple Effects of United States Tariff Policies Implemented in 2025 on Carbon Fiber Tape Supply Chains and Cost Structures

The imposition of a new tranche of United States tariffs on select carbon fiber tape imports in early 2025 has reverberated across global supply chains, elevating raw material costs and prompting strategic recalibrations. Import duties applied to key supplier regions have eroded historical pricing advantages, spurring end-users to reexamine sourcing strategies and pursue domestic or allied‐country manufacturing partners. As a result, several tape processors have accelerated localization initiatives, forging partnerships with U.S. resin formulators to mitigate exposure and ensure consistent material availability.

These tariff-induced cost pressures have also shifted investment priorities, with companies reallocating capital toward vertical integration of prepreg production and in-house tape winding capabilities. By insulating operations from external duty fluctuations, organizations gain greater control over quality specifications and delivery timelines. Concurrently, the heightened cost environment has underscored the importance of design efficiency; aerospace and automotive OEMs are increasingly leveraging simulation-based optimization to minimize tape usage without compromising structural integrity. While short-term margins have tightened, the long-term outcome promises a more resilient and diversified North American supply ecosystem, capable of adapting to evolving trade policies and raw material availability constraints.

Uncovering Detailed Segmentation Perspectives Revealing Product Formats Resin Variants and Industry Usage Scenarios Driving Carbon Fiber Tape Adoption

A granular segmentation analysis reveals critical nuances in product form performance, resin chemistry, industry application and end-use demands that shape strategic positioning in the carbon fiber tape market. In terms of product form, Dry Tape remains a versatile option for manual layup and consolidating at lower-temperature processes, whereas Prepreg Tape stands at the forefront of high-performance applications due to its one-step fiber and resin integration. Within the prepreg category, epoxy-based systems deliver robust bonding and thermal stability, while thermoplastic-based variants offer rapid consolidation and recyclability advantages.

Examining resin type segmentation, Epoxy Resin systems-drawn from either high-temperature or standard formulations-serve industries requiring extended thermal endurance, notably aerospace and industrial equipment. Thermoplastic Resin alternatives, exemplified by PEKK and PPS matrices, are gaining traction for their melt-fusion capabilities and simplified recycling streams. Meanwhile, end-use industries manifest distinct adoption trajectories; aerospace & defense and wind energy offshore segments prioritize fatigue resistance and corrosion mitigation, while automotive applications-split between commercial and passenger vehicles-demand cost efficiency and crash performance. Consumer electronics manufacturers leverage both housings and thermal management substrates, and industrial sectors utilize civil engineering and pressure vessel reinforcements. Marine applications, spanning commercial vessels and recreational boats, and sporting goods markets for bicycles and racquet sports each apply tape according to unique performance criteria. Across applications, reinforcement remains the primary use case, complemented by repairs & maintenance activities in both automotive and industrial arenas, as well as the manufacture of structural components that require precision and consistency. This comprehensive segmentation informs targeted value propositions, enabling suppliers to align product development and channel strategies with the specific performance and processing preferences of each end-use cohort.

This comprehensive research report categorizes the Carbon Fiber Tape market into clearly defined segments, providing a detailed analysis of emerging trends and precise revenue forecasts to support strategic decision-making.

- Product Form

- Resin Type

- End Use Industry

- Application

Highlighting the Strategic Regional Dynamics Shaping Carbon Fiber Tape Market Growth Patterns Across Americas EMEA and Asia Pacific Territories

Regional dynamics play a pivotal role in determining the competitive landscape and innovation trajectories for carbon fiber tape providers. In the Americas, the confluence of established aerospace hubs, burgeoning wind energy farms, and a resurgent domestic automotive sector has fostered a robust demand pipeline. Industry stakeholders here prioritize geographic proximity to OEMs and the ability to comply with stringent certification protocols, reinforcing the importance of localized production and rapid technical support.

Across Europe, the Middle East & Africa, advanced research institutes and defense applications have long anchored demand, but recent commitments to renewable energy deployment and lightweight automotive initiatives are fueling incremental growth. European markets, in particular, place a premium on eco-friendly manufacturing and closed-loop recycling, driving resin suppliers to innovate bio-based chemistries and reclaim fiber from end-of-life composites. Meanwhile, in the Asia-Pacific region, aggressive expansion of electric vehicle platforms, consumer electronics fabrication, and offshore wind farms is unlocking substantial tape usage. Manufacturers here excel in scaling production capacity, leveraging lower labor costs and integrated supply chains to meet surging regional demand. Together, these regional profiles underscore the necessity for flexible manufacturing footprints, differentiated service models, and strategic alliances tailored to the regulatory frameworks and application priorities unique to each geography.

This comprehensive research report examines key regions that drive the evolution of the Carbon Fiber Tape market, offering deep insights into regional trends, growth factors, and industry developments that are influencing market performance.

- Americas

- Europe, Middle East & Africa

- Asia-Pacific

Revealing Competitive Intelligence on Leading Carbon Fiber Tape Manufacturers Illuminating Their Strategic Initiatives and Market Positioning

Leading manufacturers in the carbon fiber tape arena are distinguished by their technological roadmaps, partnership ecosystems and targeted go-to-market approaches. Global fiber producers have increasingly invested in vertical integration, spanning precursor synthesis through to tape conversion, to secure consistent quality control and margin stability. Strategic collaborations with resin formulators and equipment suppliers have enabled the co-development of tailored prepreg offerings, optimized for processes such as automated fiber placement or compression molding.

At the same time, several specialized converters have carved out niches by offering rapid prototyping services, just-in-time inventory management and custom resin impregnation capabilities. These differentiated value propositions, supported by certificate-of-conformance documentation and streamlined order management platforms, are resonating with OEMs seeking agility in development cycles. Companies with established aftermarket service networks are further leveraging their maintenance and repair competencies to provide turnkey solutions for end-users, from automotive collision centers to industrial equipment fabricators. The competitive interplay between integrated global players and agile regional specialists continues to drive innovation, foster competitive pricing, and expand the breadth of material options available to diverse end-use segments.

This comprehensive research report delivers an in-depth overview of the principal market players in the Carbon Fiber Tape market, evaluating their market share, strategic initiatives, and competitive positioning to illuminate the factors shaping the competitive landscape.

- Celanese Corporation

- Dow Inc.

- Gurit Holding AG

- Hexcel Corporation

- Hyosung Corporation

- Koninklijke DSM N.V.

- Mitsubishi Chemical Corporation

- Royal Ten Cate nv

- SGL Carbon SE

- Solvay S.A.

- Teijin Limited

- Toray Industries, Inc.

- Victrex plc

Actionable Insights to Empower Industry Leaders in Accelerating Carbon Fiber Tape Adoption While Streamlining Supply Chains and Enhancing Sustainability

To capitalize on evolving market conditions and fortify competitive positioning, companies should prioritize strategic initiatives that bridge technological innovation with operational resilience. First, investing in advanced prepreg solutions that combine tailored resin chemistries with automated deposition compatibility will enable rapid scale-up for high-volume applications while reducing cycle times and material waste. Concurrently, diversifying resin portfolios to include both thermoset and thermoplastic matrices can unlock access to new recycling pathways and address customer preferences for reworkable materials.

Optimizing supply chains through nearshoring or strategic alliances with downstream processors will help mitigate tariff volatility and enhance delivery reliability. Integrating digital traceability tools to monitor batch quality and environmental performance can strengthen sustainability credentials and meet increasingly stringent regulatory audits. Furthermore, cultivating closer collaboration with end-use industry leaders-through joint development agreements and embedded engineering support-will accelerate the translation of emerging carbon fiber tape capabilities into application-specific performance gains. By aligning these actionable priorities with a clear roadmap, organizations can navigate trade uncertainties, capitalize on segmentation opportunities, and drive sustainable growth in the carbon fiber tape domain.

Outlining Rigorous Research Methodology Combining Primary Interviews Secondary Data Analysis and Advanced Validation Techniques for Carbon Fiber Tape Insights

This research employs a multi-tiered methodology designed to capture a holistic view of the carbon fiber tape market. Primary data collection entailed structured interviews with executives across major fiber producers, tape converters, resin formulators and OEMs, enabling firsthand validation of emerging trends, technological challenges and purchase drivers. Secondary data sources, including industry journals, patent databases and public financial disclosures, were systematically reviewed to quantify competitive landscapes, identify innovation hotspots and map corporate partnerships.

Data triangulation ensured consistency across divergent inputs, with proprietary validation techniques applied to reconcile discrepancies between reported capacities and observed shipments. An expert panel comprising materials scientists, process engineers and sustainability consultants provided iterative feedback on draft findings, refining the analytical framework and underpinning key insights. Throughout, the research adhered to established ethical standards for data integrity, ensuring confidentiality and transparency in stakeholder engagement. This rigorous approach delivers credible, actionable intelligence tailored to the strategic decision-making needs of market participants.

This section provides a structured overview of the report, outlining key chapters and topics covered for easy reference in our Carbon Fiber Tape market comprehensive research report.

- Preface

- Research Methodology

- Executive Summary

- Market Overview

- Market Insights

- Cumulative Impact of United States Tariffs 2025

- Cumulative Impact of Artificial Intelligence 2025

- Carbon Fiber Tape Market, by Product Form

- Carbon Fiber Tape Market, by Resin Type

- Carbon Fiber Tape Market, by End Use Industry

- Carbon Fiber Tape Market, by Application

- Carbon Fiber Tape Market, by Region

- Carbon Fiber Tape Market, by Group

- Carbon Fiber Tape Market, by Country

- United States Carbon Fiber Tape Market

- China Carbon Fiber Tape Market

- Competitive Landscape

- List of Figures [Total: 16]

- List of Tables [Total: 2385 ]

Synthesizing Core Insights and Strategic Imperatives to Provide a Cohesive Understanding of Carbon Fiber Tape Market Evolution and Future Pathways

The evolution of the carbon fiber tape market reflects a convergence of technological innovation, sustainability mandates and dynamic end-use requirements. From the advent of advanced prepreg formulations to the implications of new tariff regimes, stakeholders are navigating an increasingly complex ecosystem that rewards agility and strategic foresight. Segmentation analysis underscores the importance of aligning product offerings to distinct form factors, resin chemistries and application use cases, while regional insights highlight the necessity of tailored manufacturing footprints and compliance models.

Competitive differentiation is now driven by integrated value chains, digital traceability and service-oriented partnerships, reinforcing the shift from commodity supply toward solution-centric engagement. As organizations embrace design-led optimization and nearshoring initiatives, the market is poised for greater resilience and streamlined workflows. Looking ahead, sustained investment in bio-based resins, automated processing capabilities and closed-loop recycling will determine the leaders of tomorrow. By synthesizing these core imperatives, companies can chart a clear path forward, balancing performance excellence with environmental stewardship and securing enduring advantage in the carbon fiber tape domain.

Connect with Ketan Rohom in Sales & Marketing to Access Your Tailored Carbon Fiber Tape Market Research Report Designed for Strategic Growth

Harnessing the extensive analysis presented throughout this report, industry leaders are invited to take decisive action in strengthening their competitive positioning and capitalizing on emerging opportunities in the carbon fiber tape landscape. Engaging directly with our tailored research offering provides unparalleled access to nuanced market intelligence, validated supplier insights, and strategic guidance calibrated to your organization’s specific objectives. Reach out without delay to align your product development roadmaps and procurement strategies with the latest technological advancements, regulatory considerations, and end-use industry dynamics shaping the future of carbon fiber tape.

Empower your team with the clarity and confidence needed to navigate shifting supply chains, evolving tariff regimes, and intensifying sustainability requirements. By connecting with Ketan Rohom, you will secure a bespoke market research solution that distills complex data into actionable strategies for reinforcing core capabilities, expanding into adjacent segments, and driving long-term growth. Act now to transform market uncertainty into strategic advantage and fortify your leadership in the next wave of high-performance composite materials.

- How big is the Carbon Fiber Tape Market?

- What is the Carbon Fiber Tape Market growth?

- When do I get the report?

- In what format does this report get delivered to me?

- How long has 360iResearch been around?

- What if I have a question about your reports?

- Can I share this report with my team?

- Can I use your research in my presentation?