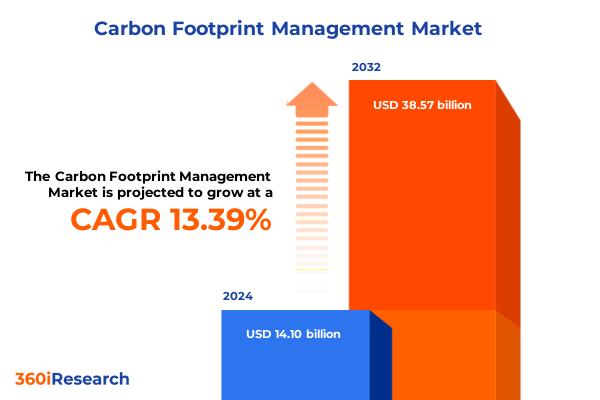

The Carbon Footprint Management Market size was estimated at USD 15.85 billion in 2025 and expected to reach USD 17.88 billion in 2026, at a CAGR of 13.54% to reach USD 38.57 billion by 2032.

Harnessing Strategic Momentum Through Carbon Footprint Management to Drive Sustainable Growth and Decarbonization Across Industries Globally

An intensifying global focus on environmental stewardship is compelling organizations across sectors to embed carbon footprint management into their strategic agendas. As regulatory bodies tighten emissions disclosure requirements and investor expectations for credible net-zero roadmaps escalate, businesses are accelerating the adoption of comprehensive carbon management solutions. This confluence of policy pressure and market demand has elevated carbon footprint management from a compliance exercise to a catalyst for innovation and competitive differentiation.

Leading enterprises recognize that robust carbon accounting and reporting frameworks enable transparent articulations of climate commitments, paving the way for more resilient supply chains and stronger stakeholder trust. Simultaneously, the integration of advanced analytics and digital platforms has unlocked unprecedented capabilities in real-time monitoring and scenario modeling. These capabilities equip decision-makers with the insights needed to prioritize high-impact interventions and optimize resource allocation.

Against this backdrop, the carbon footprint management landscape is undergoing a paradigm shift. Organizations are moving beyond isolated reduction initiatives toward holistic strategies that span carbon capture technologies, offsetting mechanisms, and verification protocols. This transition signifies a maturing market where sustainability objectives and core business imperatives coalesce, forging new pathways for value creation and long-term resilience.

Navigating the Convergence of AI, Regulatory Evolution, and Market Expectations Shaping the Future of Carbon Footprint Management

The evolution of carbon footprint management is defined by converging technological breakthroughs and progressive regulatory frameworks. In the voluntary carbon markets, the Science Based Targets initiative has proposed guidelines that recognize the necessity of carbon removal for residual emissions rather than relying solely on reductions-introducing options for companies to set combined targets for emission cuts and removals. This initiative underscores growing rigor in corporate climate commitments and signals a recalibration of net-zero methodologies that balances practicality with scientific integrity.

Concurrently, the Voluntary Carbon Markets Integrity Initiative has released its Scope 3 Action Code of Practice, offering a structured approach for tackling indirect emissions across value chains. By mandating transparent disclosure of near-term reduction targets and circumscribing offset usage to no more than 25% of Scope 3 emissions, this framework advances accountability and mitigates concerns over credit reliability.

Moreover, the rise of artificial intelligence and machine learning in emissions tracking has accelerated data processing and forecasting accuracy. AI-powered platforms are filling gaps in supplier-level reporting and projecting future emissions trends by integrating global disruptions and market variables. As standardized ESG reporting frameworks gain traction under directives like the EU’s Corporate Sustainability Reporting Directive, companies are embedding carbon accounting into their financial systems-transforming it into a business-critical function with direct implications for profitability and risk management.

Understanding the Broader Ripple Effects of US Trade Tariffs on Clean Technology Adoption and Carbon Management Strategies in 2025

Understanding the broader ripple effects of US trade tariffs on clean technology adoption and carbon management strategies reveals a complex interplay between policy and market dynamics. Major battery manufacturers have already sounded alarms: LG Energy Solution attributes its projected slowdown in EV battery demand to newly imposed US tariffs and the looming end of federal purchase subsidies. This scenario threatens to moderate the pace of zero-emission vehicle rollout and shift investment priorities toward energy storage systems, where domestic manufacturing has found a foothold.

Tariff escalation extends beyond batteries to encompass critical clean energy components such as solar modules, wind turbine parts, and high-voltage transformers. A recent analysis by the Center for Strategic and International Studies indicates that sweeping reciprocal duties, when combined with existing 25% tariffs on steel and aluminum, will inflate the cost of deploying renewable infrastructure and hinder grid modernization efforts. Such measures could delay maintenance and expansion of the electricity network, jeopardizing reliability at a time when demand is intensifying.

Supply chain shocks are an immediate consequence of these trade measures. Chinese counter-tariffs on rare earth minerals and graphite, along with duties of up to 34% on battery cells, are expected to constrict US manufacturers’ access to essential inputs. In parallel, North American suppliers of steel and aluminum face new burdensome levies, forcing many clean tech producers to explore alternative sourcing strategies or renegotiate supplier agreements to maintain project viability.

Yet, not all impacts are uniformly adverse. Short-term disruptions may catalyze deeper domestic capacity building, especially under the Inflation Reduction Act’s incentives for reshoring clean energy production. While near-term costs are unavoidable, sustained support for manufacturing partnerships and targeted tax credits remains crucial for cushioning the sector against tariff shocks and ensuring continuity of decarbonization efforts.

Uncovering Critical Insights Across Carbon Management Solutions by Component, Organization Size, and End User Dynamics in the Evolving Market

Assessing market dynamics through the lens of component segmentation highlights the nuanced evolution of solution portfolios. Carbon Accounting Software has matured into robust platforms integrating emissions data with financial ledgers, enabling seamless traceability and compliance. Carbon Capture Technology, once nascent, now benefits from modular designs and enhanced sorbents, broadening its applicability across industrial sectors. Carbon Monitoring Software pairs remote sensing with IoT data to offer granular visibility, while Carbon Offsetting Platforms facilitate access to high-integrity credits under emerging standards. Certification & Verification services have expanded in response to demand for third-party assurance, underpinning stakeholder confidence. Meanwhile, consulting firms and education & training providers are delivering bespoke advisory services to guide net-zero roadmaps and workforce upskilling initiatives.

When examining organization size, large enterprises leverage scale to integrate carbon management into enterprise resource planning systems and negotiate supply chain decarbonization commitments. These corporations often secure dedicated carbon teams and invest in custom analytics, driving comprehensive strategies that span Scope 1, 2, and 3 emissions. In contrast, small and medium-sized enterprises focus on scalable software solutions and strategic partnerships to incrementally build carbon capabilities, prioritizing cost-effective reporting and targeted decarbonization projects that align with operational realities.

End-user segmentation further illustrates sector-specific trajectories. The BFSI sector emphasizes transparent reporting frameworks to satisfy investor mandates, incorporating financed emissions into risk assessments. Energy and utilities players are adopting advanced monitoring solutions and exploring carbon capture in power generation. Government entities deploy carbon accounting tools to meet policy objectives, often coupling digital platforms with public procurement guidelines. Healthcare organizations integrate emissions management into facility operations and supply chain auditing, while manufacturing firms embrace carbon capture and offsetting to mitigate process emissions and sustain operational continuity.

This comprehensive research report categorizes the Carbon Footprint Management market into clearly defined segments, providing a detailed analysis of emerging trends and precise revenue forecasts to support strategic decision-making.

- Component

- Organization Size

- End User

- Deployment Model

- Application

Mapping Regional Complexities and Growth Drivers for Carbon Footprint Management Across the Americas, Europe Middle East & Africa, and Asia-Pacific

In the Americas, momentum is fueled by progressive climate policy and substantial private capital flows. The United States continues to refine its regulatory landscape, pairing tariffs and trade measures with invest-oriented incentives under federal programs. Canada advances cross-border collaborations to scale carbon capture deployments and enhance monitoring capabilities across shared infrastructures. Latin American nations pursue renewable energy projects that include robust carbon management plans, driven by both domestic emission targets and demand for off-take in voluntary markets.

Europe, the Middle East, and Africa present a tapestry of contrasting regulatory regimes and market maturity levels. The European Union leads with mandatory disclosures under the CSRD, piloting carbon border adjustment mechanisms to harmonize competitiveness and emissions accountability. In the Gulf region, nascent carbon capture hubs are emerging alongside sovereign wealth fund investments targeting carbon removal technologies. Africa’s carbon market is gaining traction through nature-based projects, community-driven offset programs, and verification services that prioritize both local development and global climate impact.

In Asia-Pacific, rapid industrialization and evolving ESG mandates are reshaping corporate sustainability agendas. Japan and South Korea integrate stringent emissions trading system pathways with carbon capture pilot programs, while China advances domestic carbon markets and invests heavily in monitoring infrastructure. Southeast Asian economies leverage offsetting platforms to monetize forestry and agricultural mitigation projects, and Australia focuses on regulatory clarity to harness emerging carbon capture and storage capacities. Across the region, collaboration between public and private entities accelerates technology adoption and cross-border data standardization.

This comprehensive research report examines key regions that drive the evolution of the Carbon Footprint Management market, offering deep insights into regional trends, growth factors, and industry developments that are influencing market performance.

- Americas

- Europe, Middle East & Africa

- Asia-Pacific

Profiling Leading Innovators and Strategic Partnerships Shaping the Competitive Landscape of Carbon Footprint Management Solutions

Leading vendors in the carbon footprint management space are forging strategic partnerships and innovation pipelines to expand their influence. Software giants have embedded carbon modules within enterprise suites, enabling end-to-end emissions management and real-time reporting capabilities. Specialized platform providers continue to refine user interfaces and API integrations, facilitating seamless data exchange with energy management systems and supply chain platforms.

Collaboration between technology vendors and consulting firms has intensified, unlocking joint service offerings that bundle carbon accounting software with bespoke advisory support. Meanwhile, certification and verification bodies are partnering with blockchain innovators to enhance transparency in offset transactions, establishing immutable ledgers for credit issuance and retirement.

Emerging disruptors, including AI-driven analytics startups, are attracting investment to push the boundaries of predictive emissions modeling. These firms are working with hardware manufacturers to integrate sensor-based monitoring within industrial facilities, offering turnkey analytics solutions that identify high-value decarbonization opportunities. As corporate demand for end-to-end carbon management escalates, ecosystem players are consolidating, forming alliances that promise integrated platforms underpinned by robust service networks.

This comprehensive research report delivers an in-depth overview of the principal market players in the Carbon Footprint Management market, evaluating their market share, strategic initiatives, and competitive positioning to illuminate the factors shaping the competitive landscape.

- AMCS Group

- Avarni Pty Ltd

- Carbon Footprint Ltd.

- Carbon Reform, Inc.

- CarbonEES

- Climeworks AG

- Concrete4Change Ltd.

- CoolPlanet Ltd

- Cority Software Inc.

- Dakota Software Corporation

- Diligent Corporation

- EnergyCAP, LLC

- Engie SA

- International Business Machines Corporation

- iPoint-systems GmBH

- IsoMetrix Software

- Locus Technologies

- Mapistry, Inc.

- Microsoft Corporation

- Native Energy, Inc.

- Normative AB

- Persefoni AI

- Salesforce, Inc.

- SAP SE

- SCS Global Services

- SINAI Technologies, Inc.

- Singularity Energy, Inc.

- Sphera Solutions, Inc.

- Sweep SAS

- Trinity Consultants, Inc.

- Vela Software International Inc.

- VelocityEHS Holdings Inc.

- Verdafero, Inc.

- WatchWire LLC by Tango Analytics LLC

- WattCarbon, Inc.

- Wolters Kluwer N.V.

- Yokogawa Electric Corporation

Empowering Industry Leaders with Practical Strategies to Enhance Carbon Footprint Management and Drive Sustainable Business Transformation

Industry leaders should prioritize the development of cohesive carbon management frameworks that align with broader enterprise objectives. By embedding emissions KPIs into executive dashboards, organizations can drive accountability at all levels and ensure that sustainability targets are interwoven with financial and operational goals. Cultivating cross-functional teams that include sustainability, finance, and operations will enable more efficient deployment of decarbonization initiatives.

Adoption of advanced analytics and AI-powered forecasting tools is essential for proactive carbon reduction planning. Organizations should evaluate machine learning platforms that integrate external data sources, such as commodity price indices and regulatory developments, to anticipate future emission hotspots and calibrate mitigation strategies accordingly. Investing in remote monitoring and IoT sensor networks will further enhance data fidelity and support continuous improvement cycles.

Strengthening supplier engagement through collaborative decarbonization programs can amplify impact across value chains. Industry leaders are encouraged to co-invest in emission reduction projects with key vendors, providing technical guidance and shared incentives to drive collective progress. Establishing transparent communication channels and standardized reporting templates ensures that supplier performance is tracked rigorously and fosters resilient partnerships.

Leveraging Rigorous Qualitative and Quantitative Research Techniques to Deliver Comprehensive Carbon Footprint Management Insights

Our analysis employs an integrated research methodology combining primary and secondary approaches to deliver comprehensive insights. Secondary research encompassed a thorough review of regulatory filings, corporate sustainability reports, policy frameworks, and academic literature to map evolving standards and best practices. We conducted extensive data triangulation to validate technology trends and adoption rates.

Primary research involved in-depth interviews with C-level executives, sustainability directors, and technical leads across multiple industries. These conversations provided context on strategic priorities, implementation challenges, and real-world performance metrics of carbon management solutions. Additionally, we surveyed end users to gauge satisfaction levels and identify gaps in existing platforms.

Quantitative analysis leveraged emissions databases, survey data, and financial records to assess solution efficacy and market adoption patterns. Our qualitative approach incorporated case studies of leading deployments, highlighting success factors and lessons learned. The combination of these methodologies ensures balanced, data-driven insights that can inform decision-making and strategic planning for carbon footprint management initiatives.

This section provides a structured overview of the report, outlining key chapters and topics covered for easy reference in our Carbon Footprint Management market comprehensive research report.

- Preface

- Research Methodology

- Executive Summary

- Market Overview

- Market Insights

- Cumulative Impact of United States Tariffs 2025

- Cumulative Impact of Artificial Intelligence 2025

- Carbon Footprint Management Market, by Component

- Carbon Footprint Management Market, by Organization Size

- Carbon Footprint Management Market, by End User

- Carbon Footprint Management Market, by Deployment Model

- Carbon Footprint Management Market, by Application

- Carbon Footprint Management Market, by Region

- Carbon Footprint Management Market, by Group

- Carbon Footprint Management Market, by Country

- United States Carbon Footprint Management Market

- China Carbon Footprint Management Market

- Competitive Landscape

- List of Figures [Total: 17]

- List of Tables [Total: 1272 ]

Solidifying the Path to Net-Zero Through Integrated Carbon Management Practices and Collaborative Stakeholder Engagement for Long-Term Impact

The imperative to decarbonize has reached a critical juncture, requiring integrated carbon management practices that span technology adoption, regulatory compliance, and cross-sector collaboration. Organizations that align their sustainability agendas with robust carbon accounting, capture innovations, and offsetting strategies will enhance resilience and competitive positioning.

Emerging frameworks and advanced analytics tools are equipping businesses with the transparency and foresight needed to navigate evolving policy landscapes and investor expectations. By institutionalizing carbon management into core operations, companies can accelerate progress toward net-zero targets and mitigate climate-related risks across their value chains.

Looking forward, the convergence of AI-driven monitoring, nature-based solutions, and rigorous certification standards will redefine best practices in carbon footprint management. Stakeholders who embrace these dynamic shifts and foster collaborative ecosystems will drive meaningful progress, catalyzing long-term sustainable growth and enduring environmental impact.

Connect with Ketan Rohom for Expert Guidance and Secure the Definitive Carbon Footprint Management Report to Propel Your Sustainability Agenda

We invite you to engage directly with Ketan Rohom, our Associate Director of Sales & Marketing, to secure the definitive Carbon Footprint Management report. By leveraging this comprehensive analysis, you can empower your organization to navigate evolving regulatory landscapes and capitalize on emerging decarbonization technologies. Ketan’s expertise in translating complex research into actionable strategies ensures you’ll receive tailored guidance that aligns with your sustainability objectives and growth ambitions.

Reach out to connect with Ketan and gain unparalleled insight into carbon accounting solutions, carbon capture advancements, monitoring platforms, and offsetting methodologies. His knowledge of the competitive environment, regional nuances, and key market drivers equips you to make informed decisions with confidence. Don’t miss this opportunity to elevate your carbon management initiatives and secure a competitive edge-partner with Ketan Rohom today to acquire the essential market intelligence you need to propel your sustainability agenda forward

- How big is the Carbon Footprint Management Market?

- What is the Carbon Footprint Management Market growth?

- When do I get the report?

- In what format does this report get delivered to me?

- How long has 360iResearch been around?

- What if I have a question about your reports?

- Can I share this report with my team?

- Can I use your research in my presentation?