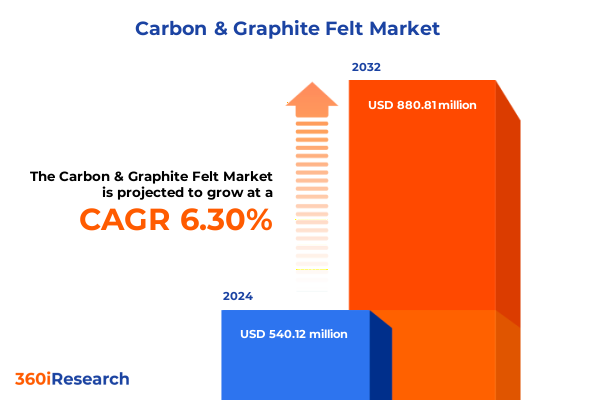

The Carbon & Graphite Felt Market size was estimated at USD 565.17 million in 2025 and expected to reach USD 591.81 million in 2026, at a CAGR of 6.54% to reach USD 880.81 million by 2032.

Exploring the Critical Role of Carbon and Graphite Felt in Modern Industrial Applications and Technological Advancements Across Key Sectors

In an era defined by rapid technological progress and escalating performance demands, carbon and graphite felt has emerged as an indispensable material across a wide variety of industrial applications. Characterized by remarkable thermal stability, exceptional electrical conductivity, and outstanding chemical resistance, these felts form the backbone of high-temperature insulation systems, precision filtration solutions, and advanced electrode assemblies. As global industries increasingly pursue energy efficiency and sustainable manufacturing practices, the relevance of carbon and graphite felt continues to grow, underpinning critical processes from steelmaking to semiconductor fabrication.

At the same time, the material’s inherent versatility has sparked innovation, with manufacturers enhancing purity levels, refining fiber orientation, and integrating proprietary impregnation techniques to meet stringent performance criteria. These advancements are not merely incremental; they represent a transformation in how end users approach thermal management, electrode durability, and filtration efficacy. Consequently, stakeholders across the supply chain-including raw material suppliers, felt manufacturers, equipment providers, and end-use industries-must understand the evolving properties of carbon and graphite felt in order to align their strategies with emerging opportunities.

Moreover, as sustainability takes center stage, the lifecycle impact of felt products is under scrutiny, driving investments in cleaner production methods and recycling protocols. By integrating circularity principles, manufacturers are not only reducing environmental footprints but also enhancing cost efficiency and supply resilience. Against this backdrop, a comprehensive examination of the carbon and graphite felt market is essential for executives tasked with navigating a landscape defined by innovation, regulation, and shifting customer preferences.

Illuminating How Emerging Technologies and Regulatory Trends Are Reshaping the Carbon and Graphite Felt Industry Landscape Globally

Over the last few years, the carbon and graphite felt landscape has undergone a series of transformative shifts, driven by technological breakthroughs and evolving regulatory frameworks. The advent of next-generation semiconductor manufacturing has stimulated demand for ultra-high-purity felts, prompting producers to adopt advanced purification and graphitization processes. Concurrently, the rise of electric vehicle batteries and fuel cell technologies has placed a premium on felt materials capable of withstanding rigorous electrochemical environments, accelerating research into specialized impregnations and composite architectures.

Complementing these market forces, tightening environmental regulations have catalyzed improvements in manufacturing protocols, particularly regarding emissions control and waste management. Felts producers now employ closed-loop systems and solvent-free binders to comply with stringent standards, thereby enhancing product quality while reducing ecological footprints. In parallel, digitalization is reshaping operations; predictive maintenance platforms leverage sensor data from high-temperature insulation modules to optimize service intervals and prevent unplanned outages in power generation and petrochemical plants.

Taken together, these dynamics have not only elevated performance benchmarks but also broadened the material’s application horizon. From novel energy recovery systems to advanced filtration in pharmaceutical production, carbon and graphite felt continues to find new roles. For industry participants, understanding how regulatory pressure, digital innovation, and shifting end-use requirements converge is critical to capturing growth opportunities and maintaining operational excellence in a rapidly evolving environment.

Understanding the Comprehensive Impact of 2025 United States Tariffs on Carbon and Graphite Felt Supply Chains and Cost Structures

In 2025, the United States implemented a revised tariff structure targeting carbon and graphite felt imports, significantly altering cost dynamics and supply chain strategies for domestic manufacturers. While the stated objective was to encourage local production and safeguard critical industries, the result has been a complex interplay of higher input costs, shifted trade flows, and accelerated vendor diversification. Manufacturers with established domestic capabilities have benefited from reduced competitive pressure, yet many processors still rely on specialized imports-particularly those offering premium performance grades-not yet produced at scale in North America.

Consequently, procurement teams have had to reconceptualize sourcing frameworks. Some have turned to nearshoring partners in Europe, Middle East & Africa and Asia-Pacific regions where integrated logistics networks can mitigate transit delays and tariff burdens. Others have invested in inventory buffers to hedge against price volatility and supply disruptions. At the same time, increased landed costs have spurred end users to explore alternative materials or hybrid solutions involving ceramic felts or advanced polymer composites for lower-temperature applications.

Looking ahead, companies that proactively establish integrated supply chain visibility and engage in tariff mitigation tactics-such as tariff engineering, bonded warehousing, and collaborative vendor agreements-will be better positioned to sustain profitability. Furthermore, domestic felt manufacturers with the capacity to expand production of graphitized and non-graphitized grades stand to capture market share by offering stable pricing and guaranteed lead times. Ultimately, the 2025 U.S. tariff revisions have introduced both challenges and strategic inflection points for the carbon and graphite felt value chain.

Delivering Strategic Insights into Carbon and Graphite Felt Market Segmentation by Type Form Application End-Use Industry and Sales Channel Dynamics

A nuanced understanding of product segmentation reveals how distinct felt varieties and configurations cater to divergent performance requirements. Based on type, the market distinguishes between graphitized felt-renowned for its purity and superior thermal conductivity-and non-graphitized felt, which balances cost efficiency with robust insulation properties. Alongside material composition, form-driven classification emphasizes impregnated felts, which incorporate resin or metal impregnants to boost mechanical strength; laminated felts, where multiple layers are bonded for enhanced thickness and densification; and plain felts, valued for their customizability and ease of integration into bespoke thermal systems.

Application-driven analysis further underscores the material’s versatility. In electric heating modules, felt acts as a uniform thermal interface, whereas in electrodes, its porosity and electrical conductivity are critical. Filtration scenarios leverage the felt’s precise pore structure to capture particulates in harsh chemical environments, while thermal insulation applications depend on low thermal conductivity and minimal shrinkage at extreme temperatures. Equally important is the end-use industry segmentation, where chemical plants require corrosion-resistant versions, electronics manufacturers demand ultra-clean production-grade felts, metallurgy operations focus on wear-resistant types, and power generation facilities prioritize high-temperature stability and extended service life.

Finally, differences in sales channel dynamics shape market outreach and customer engagement. Direct sales models facilitate tailored solutions and technical support for major industrial accounts, distributor sales extend geographic reach and logistics efficiency, and e-commerce platforms cater to smaller-scale buyers seeking rapid fulfillment. By weaving together these segmentation dimensions, stakeholders can identify white spaces for innovation, optimize product portfolios, and craft targeted marketing strategies that align with specific performance and operational imperatives.

This comprehensive research report categorizes the Carbon & Graphite Felt market into clearly defined segments, providing a detailed analysis of emerging trends and precise revenue forecasts to support strategic decision-making.

- Type

- Form

- Application

- End-Use Industry

- Sales Channel

Analyzing Regional Variations in Carbon and Graphite Felt Demand Technology Adoption and Growth Opportunities across Major Global Regions

Regional demand patterns for carbon and graphite felt are shaped by distinctive economic, technological, and regulatory factors across global markets. In the Americas, robust energy infrastructure investments and a revitalized domestic manufacturing agenda have elevated demand for high-performance insulation and electrode materials, with regional producers striving to meet quality and lead-time expectations. Over in Europe, Middle East & Africa, stringent emissions standards and a strong petrochemical sector drive adoption of advanced felt solutions, while industrial modernization initiatives in the Middle East catalyze projects that rely on reliable thermal barriers and filtration technologies.

Within the Asia-Pacific region, the convergence of booming electronics fabrication, rapid metallurgical expansion, and large-scale power generation projects has positioned it as a consumption hot spot. Nations leading in battery manufacturing and semiconductor construction have sparked surging requirements for ultra-pure, specialty felts, compelling global players to deepen local partnerships and invest in capacity expansions. Moreover, the emphasis on circular economy practices in developed economies is prompting manufacturers to explore recycling protocols and end-of-life repurposing schemes, further influencing regional supply dynamics.

Overall, while each region exhibits its own set of priorities-ranging from energy transition imperatives to industrial growth schemes-the opportunities lie in customizing product offerings and forging strategic alliances that account for local regulations, infrastructure projects, and sustainability mandates.

This comprehensive research report examines key regions that drive the evolution of the Carbon & Graphite Felt market, offering deep insights into regional trends, growth factors, and industry developments that are influencing market performance.

- Americas

- Europe, Middle East & Africa

- Asia-Pacific

Highlighting Market Leadership and Innovative Capabilities of Key Players Driving Advancements in Carbon and Graphite Felt Solutions Worldwide

A handful of specialized manufacturers command significant influence through a combination of technological expertise, production capacity, and global distribution networks. These firms have achieved market prominence by pioneering high-temperature graphitization techniques, developing proprietary binders for enhanced mechanical resilience, and deploying digital platforms for customer support. Their strategic focus on research and development has yielded next-generation felt variants with ultralow impurity levels, enabling critical applications such as semiconductor vacuum furnaces and lithium-ion battery electrode support.

Collaboration between felt producers and end users has become increasingly common, with co-development agreements aimed at fine-tuning material characteristics for specific process parameters. For instance, partnerships with metallurgy customers have led to felts engineered for higher compressive strength and abrasion resistance, reducing maintenance cycles in ladle and furnace linings. Similarly, alliances with filtration system integrators have produced felts with graded pore structures optimized for microfiltration and gas dedusting.

In parallel, leading organizations are enhancing their supply chain resilience by establishing regional manufacturing hubs and forging strategic alliances with raw material providers. This trend not only mitigates geopolitical risk but also shortens order-to-delivery timelines, a critical factor in fast-moving sectors such as automotive and energy. By leveraging these competitive strengths, key players continue to solidify their leadership positions, setting performance benchmarks and shaping the innovation trajectory of the carbon and graphite felt ecosystem.

This comprehensive research report delivers an in-depth overview of the principal market players in the Carbon & Graphite Felt market, evaluating their market share, strategic initiatives, and competitive positioning to illuminate the factors shaping the competitive landscape.

- Beijing Great Wall Co., Ltd.

- Carbon Composites, Inc.

- CeraMaterials

- CFCCARBON Co., Ltd.

- CGT Carbon GmbH

- Chemshine Carbon Co., Ltd.

- Fiber Materials Inc.

- Kureha Corporation

- Mersen

- Morgan Advanced Materials plc

- Nippon Carbon Co., Ltd.

- Olmec Advanced Materials

- SGL Carbon

- Sinotek Materials Co., Ltd.

- Toray Industries Inc.

Proposing Actionable Strategies for Industry Leaders to Navigate Market Challenges and Capitalize on Emerging Opportunities in Carbon and Graphite Felt Sector

To navigate the evolving carbon and graphite felt landscape, industry leaders should adopt a multi-faceted strategic agenda that emphasizes innovation, resilience, and sustainability. First, companies must accelerate material research programs focused on next-generation graphitization and alternative fiber sources to meet burgeoning purity requirements and reduce reliance on critical supply chains. By integrating advanced analytics into product development, manufacturers can optimize formulation parameters, shortening time to market for high-value felt variants.

Second, executives should reinforce supply chain robustness through diversification strategies that include nearshoring and the establishment of regional production facilities. This approach will mitigate tariff impacts and logistical disruptions while ensuring consistent quality control. At the same time, forging closer partnerships with end-use customers-through co-development agreements and technical training initiatives-can deepen market insights and drive tailored solutions for specialized applications.

Third, embedding sustainability into core operations is imperative. Companies should invest in closed-loop manufacturing processes and recycling schemes for end-of-life felts, reducing waste and meeting increasingly stringent environmental regulations. Concurrently, digital platforms for predictive maintenance and lifecycle analytics can deliver actionable data that enhances service performance and reinforces client relationships.

By implementing these recommendations, organizations will be well-positioned to capitalize on emerging market trends, differentiate their offerings, and secure long-term competitive advantage in a sector defined by rapid technological progress and dynamic regulatory landscapes.

Detailing Rigorous Research Methodology Providing Transparency and Reliability in Carbon and Graphite Felt Market Analysis and Data Collection Practices

A rigorous, transparent research methodology underpins this analysis, combining comprehensive primary and secondary data sources with systematic validation techniques. Primary insights were gathered through in-depth interviews with industry veterans, including felt manufacturers, end-use customers, and technical experts from major application sectors. These qualitative inputs provided firsthand perspectives on performance requirements, innovation roadmaps, and supply chain dynamics.

Secondary research encompassed a wide range of reputable government publications, trade association reports, patent filings, and academic journals. This multifaceted approach ensured balanced coverage of technological advancements, regulatory changes, and market drivers. To enhance data reliability, we employed a triangulation process, cross-referencing findings from various sources and resolving discrepancies through follow-up consultations with subject matter authorities.

Quantitative data on production capabilities, raw material availability, and import-export flows were validated using both bottom-up and top-down estimation methods. This dual approach provided consistency checks and fortified the analytical framework. Additionally, a series of workshops with industry stakeholders was convened to test preliminary findings, refine key assumptions, and validate segmentation logic. The result is a robust, data-driven narrative that captures the current state of the carbon and graphite felt market and anticipates future evolution with a high degree of confidence.

This section provides a structured overview of the report, outlining key chapters and topics covered for easy reference in our Carbon & Graphite Felt market comprehensive research report.

- Preface

- Research Methodology

- Executive Summary

- Market Overview

- Market Insights

- Cumulative Impact of United States Tariffs 2025

- Cumulative Impact of Artificial Intelligence 2025

- Carbon & Graphite Felt Market, by Type

- Carbon & Graphite Felt Market, by Form

- Carbon & Graphite Felt Market, by Application

- Carbon & Graphite Felt Market, by End-Use Industry

- Carbon & Graphite Felt Market, by Sales Channel

- Carbon & Graphite Felt Market, by Region

- Carbon & Graphite Felt Market, by Group

- Carbon & Graphite Felt Market, by Country

- United States Carbon & Graphite Felt Market

- China Carbon & Graphite Felt Market

- Competitive Landscape

- List of Figures [Total: 17]

- List of Tables [Total: 954 ]

Synthesizing Core Findings to Deliver a Cohesive Perspective on the Future Trajectory of the Carbon and Graphite Felt Market Landscape

In synthesizing the insights across technological innovations, geopolitical developments, and segmentation trends, a cohesive vision of the carbon and graphite felt market emerges. The material’s versatile properties continue to unlock new application frontiers, from advanced filtration in pharmaceutical and chemical processing to precision heater elements in renewable energy systems. Meanwhile, the 2025 U.S. tariff adjustments have introduced fresh complexities, underscoring the need for adaptive supply chain and sourcing strategies.

Segmentation analysis reveals differentiated growth vectors: high-purity graphitized felts serve niche, high-value applications; impregnated and laminated forms address rigorous mechanical demands; and a spectrum of sales channels ensures market penetration across diverse customer profiles. Regionally, while the Americas and Europe, Middle East & Africa emphasize performance optimization and regulatory compliance, the Asia-Pacific region drives volume consumption through its expansive industrial base and cutting-edge electronics fabrication capacity.

Looking forward, industry leaders equipped with tailored strategic roadmaps, sustainable manufacturing practices, and data-backed insights will be poised to thrive. The convergence of digitalization, environmental stewardship, and material science advancements will dictate the competitive contours of the market, making agility and innovation essential to long-term success.

Empowering Stakeholders with Direct Access to Expert Market Intelligence through a Personalized Consultation to Purchase the Comprehensive Carbon and Graphite Felt Report

If you’re ready to gain unparalleled insights into the dynamics shaping the carbon and graphite felt industry, reach out to our Associate Director, Sales & Marketing, Ketan Rohom at 360iResearch. He will personally guide you through the data-rich findings, answer your questions, and ensure you have the strategic intelligence required to drive informed decisions. Unlock the comprehensive market research report today and position your organization to capitalize on key trends, overcome emerging challenges, and secure a competitive advantage in this rapidly evolving sector.

- How big is the Carbon & Graphite Felt Market?

- What is the Carbon & Graphite Felt Market growth?

- When do I get the report?

- In what format does this report get delivered to me?

- How long has 360iResearch been around?

- What if I have a question about your reports?

- Can I share this report with my team?

- Can I use your research in my presentation?