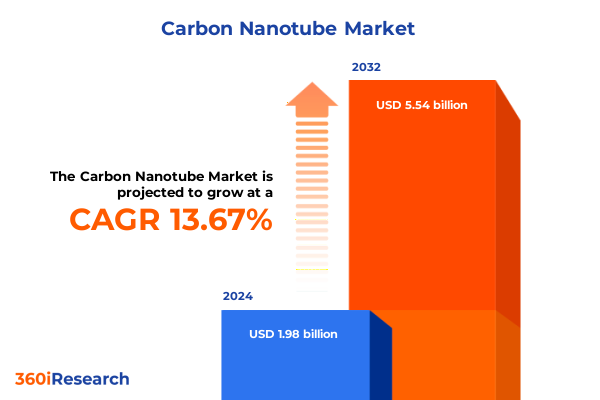

The Carbon Nanotube Market size was estimated at USD 2.24 billion in 2025 and expected to reach USD 2.54 billion in 2026, at a CAGR of 13.76% to reach USD 5.54 billion by 2032.

Unleashing the Potential of Carbon Nanotubes as Revolutionary Nanomaterials Transforming Advanced Industry Applications and Technological Innovation

Since their discovery in the early 1990s, carbon nanotubes (CNTs) have been recognized as one-dimensional hollow tubes of carbon exhibiting exceptional physicochemical properties that far surpass conventional materials in both strength and conductivity. These nanostructures are formed by rolling graphene sheets into seamless cylinders, with single-walled carbon nanotubes consisting of a single graphene layer and multi-walled carbon nanotubes comprising concentric cylinders of multiple graphene sheets. The unique sp² hybridization of carbon atoms endows CNTs with tensile strengths that can exceed steel by orders of magnitude while maintaining ultralow density, and their highly delocalized π-electron systems enable outstanding electrical conductivity and thermal transport properties unmatched by most bulk materials, positioning them at the forefront of advanced materials research and development

Navigating Rapid Advancements in Synthesis Methods and Strategic Partnerships Driving Carbon Nanotube Commercialization at Scale through Global Collaboration

Over the last decade, breakthroughs in synthesis technologies have profoundly accelerated the transition of CNTs from laboratory curiosities to commercially viable materials. Continuous innovations in chemical vapor deposition techniques, including plasma-enhanced and floating catalyst CVD, have enabled greater control over tube diameter, chirality, and purity, while advanced arc discharge and laser ablation methods have begun to yield higher-quality single-walled variants at scale. Concurrently, strategic alliances between material developers and industry leaders are reshaping the commercialization landscape: partnerships to embed CNTs into next-generation battery electrodes, collaborations to integrate CNT-reinforced polymers in aerospace composites, and joint ventures to develop CNT-enabled interconnects for flexible electronics are rapidly proliferating. These converging technological and business shifts are redefining value chains and creating new economies of scale for carbon nanotube production around the globe

Evaluating the Broad Impact of 2025 U.S. Trade Measures on Carbon Nanotube Supply Chains and Cost Structures in Key Industries and Competitive Dynamics

The comprehensive suite of U.S. Section 301 tariffs that took effect in 2024 and 2025 has significantly altered the cost structure for advanced materials integrated with carbon nanotubes. Most notably, semiconductors and related components now face a 50% ad valorem duty on direct imports from China as of January 1, 2025, while solar cells and wafers saw duties rise to 50% in September 2024. Such elevated duty rates on semiconductors and photovoltaic components place upward pressure on input costs for CNT-enhanced FETs, interconnects, and CNT-reinforced solar materials, driving importers to reassess sourcing strategies and supply chain configurations

Uncovering Segmentation Insights Revealing How Carbon Nanotube Types Production Methods and Applications Define Market Opportunities

Type segmentation reveals a dominant share held by multi-walled carbon nanotubes, prized for their mechanical robustness, scalable production, and cost-effectiveness, while single-walled variants continue emerging more rapidly owing to their unparalleled electrical and thermal conductivities that enable high-precision applications. From a production-method perspective, chemical vapor deposition remains the workhorse technique, delivering consistent yields and tunable wall structures, even as arc discharge, high-pressure carbon monoxide, and laser ablation methods evolve to address purity and structural uniformity challenges. Across applications, aerospace and defense sectors leverage CNT composites for weight-saving structural components, automotive manufacturers pursue CNT-infused polymer parts for enhanced durability, and electronics companies integrate CNT-based field-effect transistors and interconnect fillers to push miniaturization limits. In parallel, energy and power markets are adopting CNTs in fuel cell catalysts and solar cell enhancements, while healthcare and pharmaceutical innovators deploy CNTs in diagnostics imaging probes, targeted drug delivery vectors, and tissue engineering scaffolds, underscoring the material’s multifaceted impact on modern industries

This comprehensive research report categorizes the Carbon Nanotube market into clearly defined segments, providing a detailed analysis of emerging trends and precise revenue forecasts to support strategic decision-making.

- Type

- Production Methods

- Application

Exploring Regional Variations and Growth Drivers Shaping the Carbon Nanotube Market across Americas Europe Middle East Africa and Asia Pacific

In the Americas, robust research ecosystems in the United States and Canada are driving CNT adoption through joint programs between national laboratories and technology firms, focused on electronics miniaturization, advanced composites, and additive-manufacturing applications. Europe, the Middle East, and Africa benefit from sustained government funding via Horizon Europe and national initiatives in Germany and France, where aerospace, renewable energy, and sustainable manufacturing programs are integrating CNTs into next-generation products. In Asia-Pacific, China, Japan, and South Korea dominate global production capacity, supported by “Made in China 2025” mandates, significant R&D investments, and rapid deployment of CNT applications across consumer electronics, electric vehicles, and industrial energy storage, cementing the region’s position as the world leader in both production and catalytic innovation of carbon nanotubes

This comprehensive research report examines key regions that drive the evolution of the Carbon Nanotube market, offering deep insights into regional trends, growth factors, and industry developments that are influencing market performance.

- Americas

- Europe, Middle East & Africa

- Asia-Pacific

Analyzing Leading Carbon Nanotube Industry Players and Their Strategic Advances in Production Partnerships and Technology Development

Leading the industrial landscape, OCSiAl has expanded its single-walled nanotube output with a new large-scale facility in Luxembourg, underscoring a strategy focused on affordability and high-purity production for semiconductor and battery sectors. Cnano Technology has tripled multi-walled production capacity in Jiangsu Province, while leveraging AI-driven quality control to meet stringent purity requirements in electronics. Mitsubishi Chemical Corporation’s collaboration with a major Japanese battery producer on CNT-enhanced anodes signals deep vertical integration in energy storage materials. In China, Timesnano continues low-cost, high-volume manufacturing, reinforcing its domestic dominance. Nanocyl’s launch of 3D-printing-optimized CNT masterbatches exemplifies innovation in additive manufacturing, aligning product development with emerging engineering needs. These strategic initiatives highlight a trend of capacity expansions, technology partnerships, and domain-specific product portfolios among top players in the carbon nanotube sector

This comprehensive research report delivers an in-depth overview of the principal market players in the Carbon Nanotube market, evaluating their market share, strategic initiatives, and competitive positioning to illuminate the factors shaping the competitive landscape.

- Alfa Chemistry

- Arkema S.A.

- Beijing Dk Nano Technology Co., Ltd.

- Cabot Corporation

- Canatu Oy

- Carbon Solutions, Inc.

- CD Bioparticles

- CHASM Advanced Materials, Inc.

- Cheap Tubes, Inc.

- Dazhan Nanomaterials Co., Ltd

- Denso Corporation

- Huntsman Corporation

- Jiangsu Cnano Technology Limited

- Klean Industries Inc.

- LG Chem Ltd

- Nano-C, Inc.

- NanoIntegris Inc.

- Nanolab Inc.

- Nanoshel LLC

- OCSiAl

- Raymor Industries Inc.

- Resonac Holdings Corporation

- Shenzhen Dynanonic Co., Ltd.

- Sumitomo Electric Industries, Ltd.

- Thomas Swan & Co. Ltd.

- Toray Industries, Inc.

Actionable Strategies for Industry Leaders to Navigate Supply Chain Risks and Capitalize on Emerging Carbon Nanotube Market Trends

To mitigate supply chain disruptions and tariff-related cost escalations, industry leaders should prioritize diversification of raw material sources by establishing alternative supply lines in regions exempt from onerous duties. Investing in domestic or near-shoring production capabilities for CNTs and CNT-based components can reduce exposure to trade-policy volatility. Form strategic R&D partnerships with academic institutions and key end-user industries to co-develop application-specific formulations that maximize material performance while addressing cost constraints. Focus on refining chemical vapor deposition and arc discharge processes to improve yield and purity, thereby lowering per-unit production costs. Establish an ongoing dialogue with trade policymakers to advocate for targeted duty exclusions for critical CNT applications, and implement dynamic pricing models to absorb input cost fluctuations without compressing innovation budgets

Detailing a Robust Research Methodology Integrating Secondary Analyses Expert Interviews and Data Triangulation for Accurate Market Insights

This analysis integrates secondary research from government sources, legal and trade advisories, and peer-reviewed literature alongside primary interviews with CNT producers, materials scientists, and strategic supply-chain executives. Market dynamics and segmentation data were triangulated by cross-referencing tariff schedules, company disclosures, and academic studies on CNT properties. Expert validation was conducted through a review panel of industry veterans and policy analysts to ensure accuracy. Qualitative insights draw on policy memoranda, Section 301 Federal Register notices, and strategic announcements, while quantitative observations leverage production capacity disclosures and published synthesis yield data. Confidential interviews provided forward-looking projections on capacity expansions and technology roadmaps, culminating in robust, actionable market insights.

This section provides a structured overview of the report, outlining key chapters and topics covered for easy reference in our Carbon Nanotube market comprehensive research report.

- Preface

- Research Methodology

- Executive Summary

- Market Overview

- Market Insights

- Cumulative Impact of United States Tariffs 2025

- Cumulative Impact of Artificial Intelligence 2025

- Carbon Nanotube Market, by Type

- Carbon Nanotube Market, by Production Methods

- Carbon Nanotube Market, by Application

- Carbon Nanotube Market, by Region

- Carbon Nanotube Market, by Group

- Carbon Nanotube Market, by Country

- United States Carbon Nanotube Market

- China Carbon Nanotube Market

- Competitive Landscape

- List of Figures [Total: 15]

- List of Tables [Total: 1113 ]

Concluding Insights Highlighting Carbon Nanotube Market Evolution Key Challenges and Opportunities for Future Innovation

Carbon nanotubes have evolved from a laboratory curiosity into a transformative material underpinning breakthroughs across electronics, energy storage, aerospace, and healthcare. Technological innovations in synthesis and functionalization have expanded their commercial viability, while trade policies and Section 301 tariffs have reshaped global supply chains and cost structures. Segmentation insights underscore distinct growth vectors in multi-walled versus single-walled variants, production techniques, and end-use applications spanning FETs, fuel cells, and biomedicine. Regional analysis highlights Asia-Pacific’s manufacturing scale, Europe’s policy-driven R&D, and North America’s innovation ecosystems. Strategic case studies of leading companies reveal a trajectory of capacity expansions, domain-specific partnerships, and product specialization. These converging factors illustrate a dynamic carbon nanotube market poised for accelerated adoption amid evolving trade landscapes and technological frontiers

Engage with Ketan Rohom to Secure Comprehensive Carbon Nanotube Insights and Unlock Actionable Intelligence for Strategic Decision Making

To explore our comprehensive market research report and gain real-world intelligence on the evolving carbon nanotube landscape, reach out directly to Ketan Rohom, Associate Director of Sales & Marketing. His expertise will guide you through tailored insights and strategic data points that can drive your organization’s success. Connect with Ketan to discuss how our findings can be applied to your business objectives and to secure immediate access to the full report, unlocking the actionable intelligence you need for informed decision making.

- How big is the Carbon Nanotube Market?

- What is the Carbon Nanotube Market growth?

- When do I get the report?

- In what format does this report get delivered to me?

- How long has 360iResearch been around?

- What if I have a question about your reports?

- Can I share this report with my team?

- Can I use your research in my presentation?