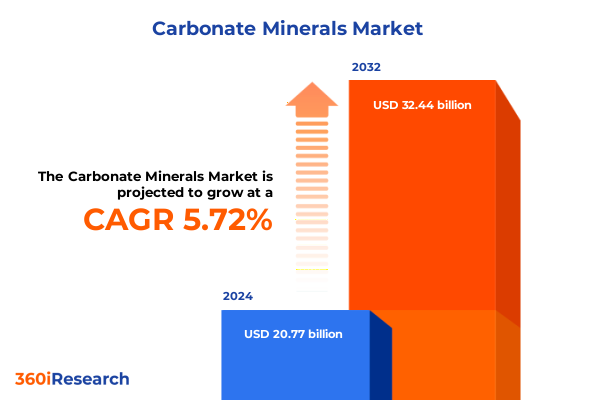

The Carbonate Minerals Market size was estimated at USD 21.99 billion in 2025 and expected to reach USD 23.13 billion in 2026, at a CAGR of 5.71% to reach USD 32.44 billion by 2032.

Overview of Carbonate Minerals: Core Characteristics, Versatile Applications, and Emerging Sustainability Roles

Carbonate minerals, including limestone, dolomite, calcite and aragonite, form the bedrock of a diverse industrial ecosystem and serve as indispensable raw materials across many critical sectors. Composed primarily of calcium and magnesium carbonates, these minerals are renowned for their versatility and functional properties such as pH buffering, whiteness, and structural integrity. Limestone, for instance, underpins cement production and contributes aggregate for concrete and asphalt, roles that underscore its status as a truly versatile commodity within the built environment. Moreover, as global industries increasingly prioritize sustainability, carbonate minerals have emerged as potential enablers of carbon sequestration through enhanced weathering techniques that accelerate the natural conversion of atmospheric CO₂ into solid carbonates.

Against this backdrop, the carbonate minerals landscape has evolved to encompass applications far beyond traditional construction uses. In agriculture, finely milled carbonate minerals serve as soil amendments and animal feed supplements, contributing to improved crop yields and livestock health. Environmental remediation projects leverage limestone’s reactivity to neutralize acidic effluents in flue gas desulfurization systems, where limestone or lime wet-scrubbing removes more than 90% of sulfur dioxide emissions from fossil fuel combustion. Industrial processes such as glass manufacturing, paper and pulp bleaching, and steel production rely on carbonate minerals for fluxing, pH control, and slag formulation. In the pharmaceutical sector, high-purity calcium carbonates form the active ingredients in antacid tablets and dietary supplements, reflecting rigorous quality standards and regulatory compliance. As we embark on this executive summary, it is essential to appreciate how the interplay of material properties, emerging environmental imperatives, and evolving end-use requirements shapes the strategic significance of carbonate minerals on a global stage.

Navigating the Carbonate Minerals Transformation: Sustainability Innovations, Circular Economy Integration, and Digital Disruption

The carbonate minerals industry is experiencing unprecedented transformative shifts driven by the dual imperatives of decarbonization and circularity. Enhanced weathering initiatives, for example, are being piloted to spread finely ground silicate and carbonate minerals across land or ocean surfaces to accelerate atmospheric CO₂ removal, offering a complementary approach to biological sequestration methods. While natural weathering of carbonate rocks has long contributed to global carbon balances, these engineered processes represent a leap toward quantifiable carbon management strategies, integrating mineralogy with climate policy goals.

Simultaneously, the valorization of by-products from flue gas desulfurization units underscores the industry’s embrace of circular economy principles. Power plants equipped with limestone slurry scrubbing systems convert sulfur dioxide emissions into synthetic gypsum, which can be repurposed for wallboard production and agricultural soil conditioners. Innovations in purification and particle size control have enabled synthetic gypsum to consistently meet the stringent quality requirements of gypsum board manufacturers, reducing reliance on natural gypsum quarries and mitigating mining-related environmental impacts.

On the operational front, digital transformation is redefining how carbonate minerals are explored, extracted, and processed. Predictive maintenance platforms powered by artificial intelligence analyze sensor data from quarry equipment to forecast potential failures and optimize repair schedules, driving uptime improvements and cost efficiencies. Autonomous haul trucks and drone-enabled site surveys accelerate material movement and geological mapping, while digital twins of quarry operations allow virtual scenario testing for energy consumption, emissions reduction, and safety enhancements. Industry analyses suggest that AI-driven predictive maintenance and remote monitoring solutions could reduce equipment downtime by up to 25% and lower operational expenditures by nearly 15% in modern mineral operations.

Understanding the Combined Effects of U.S. Trade Policies on Carbonate Minerals Supply Chains and Cost Structures in 2025

In 2025, the United States embarked on a multifaceted trade policy agenda that has cumulatively influenced the carbonate minerals supply chain. The White House fact sheet issued on April 15 initiated a Section 232 investigation into processed critical minerals under the Trade Expansion Act, with the potential to extend reciprocal tariff measures to a broad array of industrial raw materials. Although the resulting executive order included exemptions for minerals deemed critical by the U.S. Geological Survey, carbonate minerals were not listed among those protected categories, leaving limestone and dolomite subject to the general reciprocal tariff framework.

Further compounding cross-border supply dynamics, the administration announced on January 31 that a 25% tariff on imports from Canada and Mexico would take effect on February 1. The Essential Minerals Association warned of significant cost increases that could ripple through downstream industries as U.S. off-takers faced higher prices for Canadian carbonate imports valued at $47 billion in 2023. Given Canada’s position as the largest supplier of U.S. mineral imports, these tariffs threaten to create procurement challenges for cement kilns, soil treatment facilities and chemical processors reliant on high-quality carbonate feedstocks.

Legislative proposals such as the Foreign Pollution Fee Act of 2025 have also introduced the prospect of pollution-adjusted tariffs on carbon-intensive goods, including cement, glass and fertilizer products. The act would impose baseline duties of 15% on imports whose embedded emissions exceed U.S. production benchmarks, incentivizing cleaner practices abroad but raising costs for American manufacturers that utilize imported carbonate derivatives in their processes.

Collectively, these measures are prompting supply chain realignments, fostering nearshoring of quarry operations and accelerating investments in domestic processing capacity. However, short-term procurement disruptions and elevated material costs are likely, underscoring the need for strategic sourcing, inventory management and engagement with policymakers to mitigate unintended economic impacts.

Delving into the Multifaceted Market Segments That Define Carbonate Minerals Demand and Product Differentiation

The carbonate minerals market can be dissected through several critical lenses that reveal nuanced demand patterns and strategic priorities. Application-based segmentation illustrates how agricultural stakeholders utilize animal feed and soil treatment grades to enhance livestock health and correct soil pH, while construction materials producers calibrate feedstocks for cement production, decorative stone blocks and engineered road base products. Environmental remediation sectors leverage specialized carbonate chemistries in flue gas desulfurization units, soil stabilization projects and wastewater treatment plants to comply with stringent emission and discharge regulations. In heavy industry, glass manufacturers, paper and pulp mills and steel producers depend on tailored carbonate inputs for flux control, filler applications and slag conditioning. Meanwhile, pharmaceutical companies adhere to rigorous purity standards for antacid tablets and dietary supplements, reflecting the critical role of pharmaceutical-grade calcium carbonate in consumer healthcare formulations.

Parallel insights emerge when considering mineral type, product form, purity grade and particle size. Aragonite, calcite, dolomite and limestone each offer distinct crystallographic and compositional characteristics that influence reactivity, brightness and mechanical performance. Coating materials excel in paper and plastics applications, while granules, lumps and chips deliver bulk handling advantages in agricultural and industrial use cases. Powdered carbonate forms, finely milled to medium or fine particle sizes, enhance reactivity in chemical processes and dissolution rates in soil amendments. Purity grades ranging from technical to agricultural, food and pharmaceutical standards dictate permissible impurity levels and drive price differentials. For instance, USP and FCC specifications require calcium carbonate assays between 98% and 100.5%, with stringent limits on lead, arsenic and heavy metals to ensure consumer safety and regulatory compliance.

This comprehensive research report categorizes the Carbonate Minerals market into clearly defined segments, providing a detailed analysis of emerging trends and precise revenue forecasts to support strategic decision-making.

- Mineral Type

- Product Form

- Purity Grade

- Particle Size

- Application

Exploring Regional Nuances in Carbonate Mineral Consumption Patterns Driven by Trade Dynamics, Policy Shifts, and Infrastructure Investments

Across the Americas, carbonate minerals markets are heavily influenced by established quarry networks in the United States and Canada, where abundant limestone deposits support local cement, aggregate and environmental remediation industries. In Canada, proximity to high-purity carbonate sources has traditionally underpinned robust export flows to U.S. off-takers, reinforcing cross-border operations under the North American Free Trade Agreement and its successor frameworks. Regional infrastructure renewals and agricultural modernization programs continue to sustain demand for animal feed supplements and soil pH conditioners, even as trade policy shifts introduce cost considerations that prompt supply chain adjustments.

Europe, Middle East and Africa (EMEA) markets are increasingly shaped by carbon pricing instruments and regulatory mechanisms such as the European Union’s Carbon Border Adjustment Mechanism, which will require importers of cement, aluminium and other high-carbon goods to purchase emissions certificates beginning in 2026. Nations within the EMEA region are also prioritizing circular economy initiatives, driving investments in synthetic gypsum production from flue gas desulfurization waste and promoting the reuse of carbonate by-products in agricultural lime and construction composites.

The Asia-Pacific landscape is characterized by rapid urbanization and infrastructure development across China, India and Southeast Asia, fueling sustained demand for construction-grade carbonates in cement kilns, road base materials and decorative aggregates. Governments are channeling billions of dollars into smart city projects and sustainable building programs, with a growing emphasis on low-carbon construction materials. At the same time, environmental regulations targeting industrial effluents and agriculture-sector runoff have elevated the role of carbonate minerals in flue gas desulfurization, soil stabilization and wastewater treatment applications.

This comprehensive research report examines key regions that drive the evolution of the Carbonate Minerals market, offering deep insights into regional trends, growth factors, and industry developments that are influencing market performance.

- Americas

- Europe, Middle East & Africa

- Asia-Pacific

Profiling the Key Global and Regional Players Steering Production, Innovation, and Sustainability in the Carbonate Minerals Market

The carbonate minerals industry is anchored by a blend of global multinationals and regional specialists whose strategies shape supply capacities, innovation trajectories and sustainability commitments. Among the most prominent global players are Omya, Imerys, Sibelco and Carmeuse, known for their extensive quarry networks, diverse product portfolios and R&D investments. Omya’s focus on specialty additives for paper, plastics and coatings has been complemented by digitalization efforts that optimize mine planning and logistics using advanced analytics. Imerys has pursued strategic partnerships to expand its precipitation capabilities for high-purity calcium carbonates used in pharmaceutical and food applications.

Carmeuse has reinforced its market leadership through targeted acquisitions, such as the purchase of Cal Arco Iris in Brazil, enhancing its production base for high-calcium and dolomitic lime products across Latin America. The company’s comprehensive CO₂ roadmap further underscores its commitment to carbon neutrality by 2050, focusing on energy efficiency improvements, alternative energy conversion and carbon capture technologies. Meanwhile, Huber Engineered Materials has concentrated on broadening its precipitated calcium carbonate capacity and developing specialty grades that cater to technical, food and pharmaceutical sectors.

Regional producers, including Blue Mountain Minerals, Jay Minerals and Midwest Calcium Carbonates, leverage localized resource endowments to serve niche markets in the United States, Europe and Asia-Pacific. These companies often collaborate with technology providers to refine milling processes, reduce energy consumption and meet evolving regulatory standards. Collectively, these players are navigating a landscape where operational excellence, sustainability credentials and product innovation are critical determinants of competitive differentiation.

This comprehensive research report delivers an in-depth overview of the principal market players in the Carbonate Minerals market, evaluating their market share, strategic initiatives, and competitive positioning to illuminate the factors shaping the competitive landscape.

- ASCOM Group

- Calcinor Corporación

- Calcit d.o.o.

- Carmeuse Group

- Columbia River Carbonates

- Fimatec Ltd.

- Franzefoss Minerals AS

- GLC Minerals, LLC

- Graymont Limited

- Imerys S.A.

- Lhoist Group

- Magnesia GmbH

- Minerals Technologies Inc.

- Mississippi Lime Company

- Nordkalk Corporation

- Omya AG

- SCR-Sibelco N.V.

Strategic Imperatives for Carbonate Minerals Industry Leaders: Supply Resilience, Digital Innovation, Sustainability Alignment, and Collaborative R&D

Industry leaders must adopt a multipronged approach to thrive amid evolving market, regulatory and technological landscapes. First, securing supply chain resilience through diversification of sourcing strategies is paramount. This entails forging partnerships with quarry operators across the Americas, Europe and Asia-Pacific to mitigate exposure to unilateral trade measures and policy shifts. Companies can also evaluate strategic stakes in upstream assets to enhance control over material quality and availability.

Second, embracing digital transformation across the value chain will unlock efficiency gains and cost savings. Implementing AI-driven predictive maintenance and remote monitoring platforms can reduce equipment downtime, while digital twins of quarry operations enable scenario modeling for energy consumption, emissions reduction and workforce planning. Concurrently, investments in advanced milling technologies and formulation analytics will support the development of high-performance specialty grades for environmental remediation, pharmaceuticals and industrial applications.

Third, aligning product portfolios with sustainability imperatives and regulatory frameworks is critical. Organizations should prioritize the commercialization of enhanced weathering solutions, circular economy initiatives for synthetic gypsum valorization and low-carbon lime products. Engaging proactively with policymakers on emerging tariff proposals, carbon border adjustment mechanisms and pollution fee legislation can help shape equitable policy outcomes while safeguarding access to key export markets.

Finally, fostering collaborative research and development partnerships will accelerate innovation. Joint ventures with academic institutions, technology providers and end-user industries can drive breakthroughs in carbon capture mineralization, high-purity nanocarbonate applications and bio-based processing. Such alliances not only amplify R&D capacity but also position companies to capitalize on next-generation markets for sustainable minerals solutions.

Comprehensive Research Framework Integrating Secondary Analysis, Primary Interviews, Data Triangulation, and Robust Validation Procedures

This study employed a rigorous, multi-stage methodology designed to ensure comprehensive coverage and analytical robustness. Secondary research formed the foundation of our insights, encompassing reviews of government publications, industry association reports, trade press, academic literature and regulatory databases. Primary research involved in-depth interviews with senior executives, technical experts and policy stakeholders across major producing and consuming regions, enabling qualitative validation of market dynamics and emergent trends.

Data triangulation was achieved through comparative analysis of multiple sources, cross-referencing production statistics, trade flows and company disclosures to reconcile discrepancies and refine our findings. Market segmentation insights were derived by mapping application areas, mineral types, product forms, purity grades and particle sizes against end-use requirements and regulatory contexts. Regional and company profiles were developed using proprietary databases, supplemented by financial reports and press releases, to capture strategic developments and capacity changes.

Throughout the research process, adherence to ethical and confidentiality standards was maintained, with sensitive information handled under non-disclosure agreements. Quantitative data was subjected to quality checks, outlier analysis and consistency validations to ensure accuracy. The resulting analysis offers a clear view of industry structures, competitive landscapes and growth levers, equipping decision-makers with actionable intelligence for strategic planning.

This section provides a structured overview of the report, outlining key chapters and topics covered for easy reference in our Carbonate Minerals market comprehensive research report.

- Preface

- Research Methodology

- Executive Summary

- Market Overview

- Market Insights

- Cumulative Impact of United States Tariffs 2025

- Cumulative Impact of Artificial Intelligence 2025

- Carbonate Minerals Market, by Mineral Type

- Carbonate Minerals Market, by Product Form

- Carbonate Minerals Market, by Purity Grade

- Carbonate Minerals Market, by Particle Size

- Carbonate Minerals Market, by Application

- Carbonate Minerals Market, by Region

- Carbonate Minerals Market, by Group

- Carbonate Minerals Market, by Country

- United States Carbonate Minerals Market

- China Carbonate Minerals Market

- Competitive Landscape

- List of Figures [Total: 17]

- List of Tables [Total: 1749 ]

Consolidating Strategic Insights as Carbonate Minerals Navigate a New Era of Sustainability, Policy Complexity, and Technological Evolution

The carbonate minerals industry stands at a pivotal juncture shaped by sustainability mandates, trade policy recalibrations and technological disruption. From the proven reliability of limestone in cement kilns and flue gas desulfurization units to pioneering enhanced weathering strategies for carbon dioxide removal, these minerals continue to underpin foundational industrial and environmental functions. Yet the landscape is being reshaped by circular economy practices, digitalization imperatives and evolving regulatory architectures that demand agile responses.

Amid this dynamic environment, opportunities abound for forward-looking organizations that can leverage segmentation insights, nurture supply chain agility and harness innovation to create differentiated value propositions. Companies that align operations with low-carbon pathways, cultivate strategic partnerships and harness data-driven technologies will not only navigate tariff uncertainties and policy shifts but also position themselves for long-term growth in specialty and sustainability-focused markets.

As the industry evolves, the interplay of material science breakthroughs, regulatory frameworks and market demands will continue to redefine the role of carbonate minerals. Stakeholders who proactively integrate sustainability, digital excellence and collaborative innovation into their strategic agendas will be best placed to shape the future trajectory of this vital sector.

Connect with Ketan Rohom to Acquire the Definitive Carbonate Minerals Market Research Report and Elevate Your Strategic Decision Making

For readers poised to gain a strategic advantage in the carbonate minerals arena, securing comprehensive insights and actionable intelligence has never been more critical. Ketan Rohom, Associate Director of Sales & Marketing, is available to guide you through the features and benefits of the full market research report. Reach out to learn how this in-depth analysis can inform your investment decisions, support your product development strategies, and strengthen your competitive positioning in a rapidly evolving landscape. Partner with Ketan to obtain tailored solutions, schedule a personalized briefing, and ensure that your organization is equipped with the data and foresight needed to navigate the opportunities and challenges of the carbonate minerals market.

- How big is the Carbonate Minerals Market?

- What is the Carbonate Minerals Market growth?

- When do I get the report?

- In what format does this report get delivered to me?

- How long has 360iResearch been around?

- What if I have a question about your reports?

- Can I share this report with my team?

- Can I use your research in my presentation?