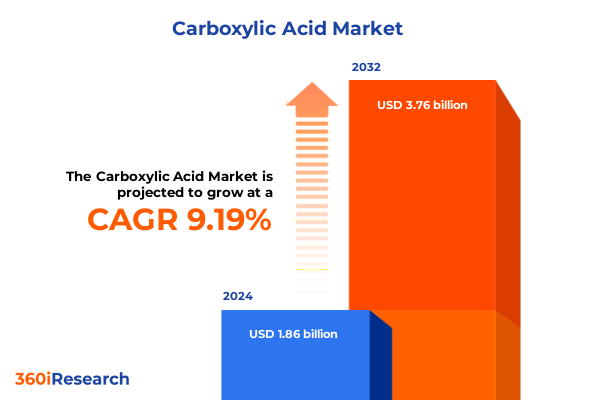

The Carboxylic Acid Market size was estimated at USD 2.00 billion in 2025 and expected to reach USD 2.17 billion in 2026, at a CAGR of 9.36% to reach USD 3.76 billion by 2032.

Comprehensive Exploration of the Carboxylic Acid Market Landscape Uncovering Fundamental Drivers, Emerging Trends, and Strategic Growth Catalysts Across Multiple Sectors

The carboxylic acid sector represents a foundational element within chemical manufacturing, with its compounds serving as building blocks across a multitude of industries. This introductory exploration considers not only the chemical diversity of acetic, formic, citric, butyric, and lactic acids but also their multifaceted roles from industrial intermediates to food-grade ingredients. Beyond molecular structures, we examine how evolving regulatory frameworks, sustainability imperatives, and shifts in end-use dynamics are collectively transforming the sector’s strategic underpinnings.

Moreover, the interplay between upstream feedstock availability and downstream consumption patterns underscores a landscape defined by complex value chain interdependencies. In recent years, heightened scrutiny on environmental compliance and circular economy models has catalyzed innovation in production processes, prompting market players to rethink traditional approaches. By framing these foundational elements, this section establishes the context for a deeper understanding of the carboxylic acid market’s current drivers and latent opportunities.

Evolving Sustainability Imperatives and Technological Innovations Are Redefining Supply Chains and Collaborative Frameworks in Carboxylic Acid Production

Throughout the carboxylic acid domain, transformative shifts have emerged, reshaping both supply dynamics and end-market engagement. Sustainability mandates have prompted a marked transition toward bio-based feedstocks, driving investment in fermentation and biorefinery technologies. As a result, traditional petrochemical pathways are increasingly complemented by green alternatives, reinforcing a dual-supply paradigm that balances cost, scalability, and environmental impact.

Concurrently, digitization across the value chain has accelerated efficiency gains, with real-time data analytics optimizing production yields and predictive maintenance reducing downtime. Cross-sector collaboration has also intensified, as chemical suppliers partner with downstream formulators to co-develop tailored solutions for agriculture, personal care, and pharmaceutical applications. These alliances not only foster innovation but also mitigate risk exposure by integrating sustainability objectives into new product development. As such, the market is evolving into a more transparent, interconnected ecosystem where agility and environmental stewardship define competitive advantage.

Navigating Tariff-Induced Supply Chain Disruptions and Strategic Realignments Shaping the U.S. Carboxylic Acid Market Landscape in 2025

In 2025, the cumulative impact of tariffs imposed by the United States has introduced new complexities across the carboxylic acid supply chain, influencing procurement strategies and regional sourcing decisions. Tariff adjustments have heightened the cost of imports, particularly for feedstocks and intermediate compounds sourced from key exporting nations. This dynamic has incentivized domestic capacity expansions, as manufacturers seek to buffer against external cost shocks and ensure continuity of supply.

At the same time, buyers have diversified their supplier networks to incorporate alternative geographies beyond traditional exporters, mitigating the risk of future duty escalations. Contractual terms have progressively shifted to include tariff pass-through clauses, aligning pricing mechanisms with fluctuating duty rates. Consequently, the downstream sectors-from food and beverage to industrial applications-have adapted by refining their procurement models and inventory management practices. The combined effect underscores a recalibrated marketplace in which tariff-induced headwinds coexist with strategic resilience-building initiatives.

Strategic Dissection of Carboxylic Acid Market Segmentation Illuminating Diverse Product Profiles, Application Demands, and Channel Dynamics

A nuanced understanding of market segmentation reveals how distinct product categories and usage scenarios influence purchasing behaviors and strategic priorities. When analyzed by product type, the landscape spans simple molecules such as acetic acid and formic acid along with larger counterparts including butyric acid, citric acid, and lactic acid, each contributing unique chemical profiles that drive technical properties and value creation across downstream industries.

From an application standpoint, carboxylic acid serves critical functions in agriculture as soil conditioners, in food and beverage as acidulants, flavoring agents, and preservatives, in industrial processes as chemical intermediates, cleaning agents, and solvents, and in personal care and pharmaceutical formulations where purity and consistency are paramount. In assessing grade requirements, the market differentiates between food grade, industrial grade, and pharmaceutical grade variants, each aligning to stringent quality thresholds and regulatory standards.

Form factor considerations further segment the landscape into liquid and solid configurations, impacting handling requirements, storage protocols, and transportation logistics. Distribution channels bifurcate into traditional offline mechanisms-encompassing direct sales, bulk shipments, and distributor networks-and emerging online platforms that offer streamlined procurement and digital traceability. These segmentation insights form the foundation for targeted strategy development, enabling stakeholders to align portfolio offerings with distinct market niches.

This comprehensive research report categorizes the Carboxylic Acid market into clearly defined segments, providing a detailed analysis of emerging trends and precise revenue forecasts to support strategic decision-making.

- Product Type

- Form

- Purity Grade

- Distribution Channel

- Application

Unearthing Distinct Regional Market Dynamics and Policy-Driven Drivers Across Americas, Europe Middle East Africa, and Asia-Pacific Carboxylic Acid Hubs

Regional nuances play a pivotal role in shaping competitive dynamics and investment priorities across the Americas, Europe, Middle East & Africa, and Asia-Pacific. In the Americas, robust industrial infrastructure and established agricultural sectors drive sustained demand for carboxylic acid derivatives, supported by policy incentives for renewable feedstock integration. Meanwhile, supply chain optimization and localized production have emerged as critical priorities to counterbalance global trade uncertainties.

Across Europe, the Middle East, and Africa, regulatory frameworks centered on chemical safety and environmental protection have spurred innovation in green manufacturing practices, with particular emphasis on reducing greenhouse gas emissions. Strategic collaborations between public and private entities have produced pilot projects that demonstrate scalable biobased production, reinforcing the region’s leadership in sustainable chemistry.

In the Asia-Pacific, rapid industrialization and expanding food processing industries underpin a significant consumption base for both commodity-grade and specialty carboxylic acids. Investments in capacity expansion, particularly in emerging economies, are complemented by technology transfers and joint ventures that accelerate knowledge exchange. This regional perspective underscores the importance of tailored market entry strategies and risk assessments that account for diverse regulatory landscapes and infrastructure capabilities.

This comprehensive research report examines key regions that drive the evolution of the Carboxylic Acid market, offering deep insights into regional trends, growth factors, and industry developments that are influencing market performance.

- Americas

- Europe, Middle East & Africa

- Asia-Pacific

Analyzing Strategic Initiatives and Innovation Pathways Among Leading Carboxylic Acid Manufacturers to Drive Operational Excellence and Market Competitiveness

A close examination of key corporate players reveals varied strategic approaches to value creation and market positioning. Leading specialty chemical firms are leveraging proprietary catalysts and process intensification techniques to lower production costs while enhancing product purity, directly addressing the evolving specifications of pharmaceutical and food applications.

Integration strategies, including targeted mergers and acquisitions, have enabled companies to secure feedstock supply and expand their geographic footprints. Meanwhile, alliances with research institutions are accelerating the development of novel bioconversion pathways, supporting the shift toward bio-derived carboxylic acids. These partnerships not only diversify innovation pipelines but also de-risk capital investments in early-stage technologies.

Furthermore, market leaders are differentiating through service offerings such as digital supply chain platforms that provide real-time visibility into inventory and quality metrics. By embracing circular economy principles, they are exploring models for waste valorization and feedstock recycling, reinforcing both environmental credentials and operational efficiencies. Collectively, these insights highlight how strategic agility and technological prowess are reshaping competition in the carboxylic acid industry.

This comprehensive research report delivers an in-depth overview of the principal market players in the Carboxylic Acid market, evaluating their market share, strategic initiatives, and competitive positioning to illuminate the factors shaping the competitive landscape.

- abcr GmbH

- Alfa Aesar by Thermo Fisher Scientific Inc.

- ALPHA CHEMIKA

- Ascentus Organics Pvt. Ltd.

- Ashok Alco - chem Limited

- BASF SE

- Celanese Corporation

- Eastman Chemical Company

- Ebrator Biochemicals

- Finar Limited by Actylis

- Finetech Industry Limited

- Hibrett Puratex

- Kakdiya Chemicals

- Kanto Chemical Co., Inc.

- LyondellBasell Industries N.V.

- Merck KGaA

- Mitsui Chemicals, Inc.

- Noah Chemicals

- OQ Chemicals GmbH

- Petroliam Nasional Berhad

- ProChem, Inc.

- Redox Industries Limited

- The Dow Chemical Company

- Thirumalai Chemicals Ltd.

- Tokyo Chemical Industry Co., Ltd.

- VanDeMark Chemical, Inc.

- Vigon International, LLC

- Vizag chemical

- Volu-Sol

- VVF LLC

Implementing Resilient Supply Chain, Bioinnovation, and Digital Transformation Strategies to Navigate Tariff Pressure and Sustainability Imperatives

Industry decision-makers must prioritize investments that bolster supply chain resilience and foster collaborative innovation. First, strengthening partnerships with domestic and alternative international suppliers can mitigate the impact of fluctuating trade policies. By embedding flexible contractual terms that account for tariff adjustments, companies can maintain cost transparency and reduce margin volatility.

Second, expanding capabilities in bio-based production through pilot programs and joint ventures with research institutions will position organizations at the forefront of sustainability trends. Aligning R&D efforts with end-user requirements-particularly in high-purity applications-ensures that product development remains responsive to evolving regulatory and consumer expectations.

Third, adopting digital tools for end-to-end supply chain visibility will streamline procurement, quality assurance, and logistics. Real-time analytics can inform proactive decision-making, enabling swift responses to potential disruptions. Finally, embedding circular economy principles into process design, such as by valorizing by-products and implementing closed-loop systems, will reinforce operational efficiencies and enhance corporate social responsibility credentials. These strategic imperatives collectively offer a roadmap for sustained competitive advantage.

Employing a Rigorous Hybrid Research Design Integrating Primary Stakeholder Interviews, Secondary Data Corroboration, and Scenario-Based Analysis

This study employs a rigorous, multi-faceted research methodology combining primary interviews, secondary data validation, and cross-industry benchmarking. Primary insights were gathered through structured interviews with key stakeholders across manufacturing, end-use industries, and regulatory bodies to capture nuanced perspectives on supply chain dynamics and innovation priorities.

Secondary research encompassed a comprehensive review of regulatory publications, patent filings, and technical journals to validate process advancements and sustainability initiatives. Additionally, market intelligence was synthesized from trade association reports, company disclosures, and academic case studies to triangulate findings and ensure robust contextual analysis.

Quantitative information was corroborated through cross-validation with industry experts and refined through scenario analysis to explore potential market responses to regulatory shifts and technological breakthroughs. This integrated approach assures a balanced, fact-based assessment of the carboxylic acid market’s evolving landscape, supporting strategic decision-making for stakeholders.

This section provides a structured overview of the report, outlining key chapters and topics covered for easy reference in our Carboxylic Acid market comprehensive research report.

- Preface

- Research Methodology

- Executive Summary

- Market Overview

- Market Insights

- Cumulative Impact of United States Tariffs 2025

- Cumulative Impact of Artificial Intelligence 2025

- Carboxylic Acid Market, by Product Type

- Carboxylic Acid Market, by Form

- Carboxylic Acid Market, by Purity Grade

- Carboxylic Acid Market, by Distribution Channel

- Carboxylic Acid Market, by Application

- Carboxylic Acid Market, by Region

- Carboxylic Acid Market, by Group

- Carboxylic Acid Market, by Country

- United States Carboxylic Acid Market

- China Carboxylic Acid Market

- Competitive Landscape

- List of Figures [Total: 17]

- List of Tables [Total: 1272 ]

Synthesis of Market Drivers, Regional Dynamics, and Strategic Imperatives Highlighting Pathways to Sustainable Growth in Carboxylic Acid Industry

In conclusion, the carboxylic acid market is undergoing a profound transformation driven by sustainability mandates, technological innovation, and evolving regulatory landscapes. The shift toward bio-based production and the integration of digital supply chain solutions are redefining traditional value chains, while tariff dynamics underscore the importance of resilience and flexibility in procurement strategies.

Through targeted segmentation insights, regional analyses, and an examination of leading corporate initiatives, stakeholders can identify high-impact opportunities across diverse end-use markets. By adopting the recommended strategic imperatives, companies will be well-positioned to navigate complexity, drive innovation, and achieve sustained growth.

Ultimately, success in this dynamic environment will hinge on a balanced approach that harmonizes operational agility, environmental stewardship, and collaborative innovation, ensuring that the carboxylic acid industry continues to evolve as a cornerstone of modern chemical manufacturing.

Unlock Critical Market Insights and Propel Strategic Growth in Carboxylic Acid by Partnering Directly with Our Senior Sales and Marketing Executive

To gain unparalleled strategic clarity and drive competitive advantage within the carboxylic acid market, we invite you to connect with Ketan Rohom, Associate Director of Sales & Marketing, to secure your comprehensive copy of the latest market research report. This indispensable resource is tailored to equip decision-makers with actionable intelligence, enabling you to anticipate disruptive shifts, optimize supply chain resilience, and align innovation roadmaps with emerging customer demands. Reach out today to embark on a data-driven journey that will fortify your market positioning and power sustained growth.

- How big is the Carboxylic Acid Market?

- What is the Carboxylic Acid Market growth?

- When do I get the report?

- In what format does this report get delivered to me?

- How long has 360iResearch been around?

- What if I have a question about your reports?

- Can I share this report with my team?

- Can I use your research in my presentation?