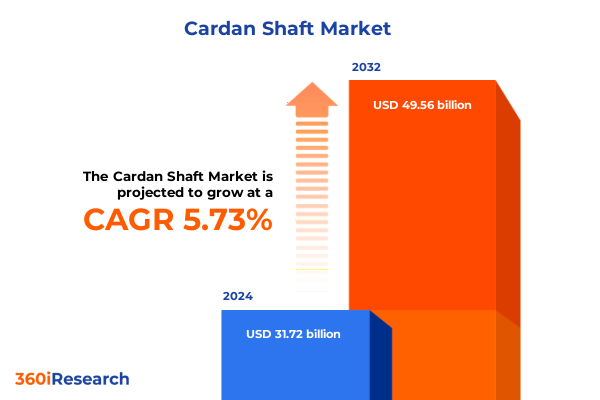

The Cardan Shaft Market size was estimated at USD 33.44 billion in 2025 and expected to reach USD 35.25 billion in 2026, at a CAGR of 5.77% to reach USD 49.56 billion by 2032.

Understanding the Core Principles and Strategic Importance of Cardan Shafts in Vehicle Dynamics and High-Performance Engineering Applications

Cardan shafts serve as pivotal mechanisms that transmit torque between non-collinear shafts, enabling seamless power transfer in systems where angular misalignment is inevitable. These mechanical linkages, characterized by their universal joints, accommodate dynamic motion while maintaining rotational continuity, making them indispensable across automotive drivetrains, heavy machinery, and aerospace propulsion systems. As industries demand ever-greater precision and reliability, the fundamental principles governing cardan shaft operation-involving angular displacement compensation and vibration dampening-have become central to engineering discourse and product development strategies.

Over time, the evolution of materials science and manufacturing processes has elevated cardan shafts from purely functional components to strategic performance differentiators. High-strength steel alloys laid the groundwork for early industrial applications, while recent advancements in carbon fiber composites and high-grade aluminum have enabled significant weight reduction without sacrificing durability. Consequently, organizations leverage refined design methodologies and simulation-driven optimization to tailor cardan shafts that meet the exacting demands of modern powertrains and heavy-duty equipment. This fusion of core mechanical principles and cutting-edge technology underpins the sector’s ongoing quest for enhanced efficiency, resilience to operational stresses, and improved lifecycle economics.

Exploring How Rapid Technological Advancements Regulatory Changes and Supply Chain Realignments Are Redefining Cardan Shaft Innovation and Procurement

Recent years have witnessed seismic changes reshaping the cardan shaft landscape, as technological breakthroughs, shifting regulatory frameworks, and economic realignments converge. The advent of lightweight composite materials, notably carbon fiber-reinforced polymers, has catalyzed a trend toward slender, high-torque shafts that meet the imperatives of fuel efficiency and reduced emissions in automotive and aerospace sectors. At the same time, the integration of smart sensor arrays within universal joints is transitioning cardan shafts from passive power transmitters to active monitoring platforms, offering real-time diagnostics on load distribution, vibration, and wear patterns. This digital transformation is further accentuated by the proliferation of predictive maintenance algorithms, which leverage sensor-derived data to forestall unexpected failures and optimize service intervals.

Meanwhile, global supply chains have undergone profound reevaluation, driven by geopolitical tensions and shifting trade policies. Manufacturers are increasingly diversifying supplier networks and nearshoring critical component production to mitigate disruptions, while advanced manufacturing technologies-such as additive manufacturing and precision forging-are enabling more localized, responsive production models. Regulatory bodies are concurrently tightening emissions and safety standards, prompting designers to refine joint geometries and material compositions to comply with stricter noise, vibration, and harshness (NVH) criteria, as well as environmental compliance mandates. In concert, these developments are redefining how cardan shafts are conceptualized, engineered, and procured, ushering in a new era of agility and resilience for original equipment manufacturers and suppliers alike.

Analyzing the Far-Reaching Operational Disruptions Cost Pressures and Strategic Material Substitutions Resulting From the 2025 Expansion of Steel and Aluminum Tariffs

The imposition of expanded Section 232 tariffs on steel and aluminum imports in early 2025 has reverberated across the cardan shaft manufacturing continuum, triggering cost and sourcing challenges that transcend singular input categories. Steel, forming the backbone of traditional cardan shaft production, became subject to a 25% levy on imports from key trading partners, while aluminum inputs faced similar escalations. According to a recent industry analysis, these measures are projected to increase costs for steel-based components by upward of $22.4 billion annually and compound price pressures on derivative products, including driveline assemblies that incorporate universal joints and flange couplings. At the same time, domestic producers have tightened capacity, elevating spot prices and prompting OEMs to explore alternative alloys and composite reinforcements to offset raw material inflation.

Furthermore, survey data from a leading organization representing vehicle suppliers indicates that nearly 80% of driveline component manufacturers are reporting significant operational disruptions due to abrupt expiration of tariff exclusions and the erosion of established North American trade arrangements. These dynamics have fueled a reevaluation of production footprints, with some stakeholders accelerating investments in modular forging lines and automated machining centers within tariff-exempt zones. Moreover, heightened price volatility on global exchanges has driven many companies to hedge procurement contracts and recalibrate inventory strategies, ensuring continuity of supply while containing working capital exposure. As a result, the cumulative impact of the 2025 tariffs has not only elevated per-unit costs but also spurred a wave of process and material innovation across the cardan shaft value chain.

Uncovering the Multifaceted Segmentation Landscape That Defines Product Variants Material Preferences and Application-Specific Requirements Across Cardan Shaft Markets

Delineating the cardan shaft arena through multidimensional segmentation illuminates distinct vectors of demand and application specificity. The product type dimension contrasts constant velocity joints, prized for smooth rotary motion under misalignment, with cross-type universal joints and specialized double cardan configurations that deliver high-torque capacity in robust applications. Meanwhile, design paradigms span from compact single joint shafts to intricate triple joint assemblies, encompassing telescopic and flange variants engineered for adaptability across drive lengths and service environments. Material selection further differentiates market positioning, pitting traditional carbon steel and forged steel constructions against aluminum alloy and emerging composite alternatives that prioritize weight savings and corrosion resistance.

Torque capacity criteria introduce another layer of segmentation, segregating high-capacity shafts exceeding 2,000 Nm from medium-range variants in the 500–2,000 Nm band and low-torque shafts below 500 Nm, each aligned to applications from heavy-duty industrial machinery down to precision robotics. Shaft length considerations likewise bifurcate opportunities into short spans below 500 mm, medium runs up to 3,000 mm, and long-distance configurations exceeding 3,000 mm. Finally, end-use industry analysis underscores the breadth of cardan shaft utility, from aerospace platforms-spanning commercial and military aircraft-to diversified automotive sectors, including commercial vehicles, electric drivetrains, and conventional passenger cars. Energy applications chart demand in oil & gas exploration and power generation turbines, while industrial sectors deploy these shafts in construction machinery, manufacturing equipment, and mining apparatus, each segment imposing unique performance and durability requisites.

This comprehensive research report categorizes the Cardan Shaft market into clearly defined segments, providing a detailed analysis of emerging trends and precise revenue forecasts to support strategic decision-making.

- Product Type

- Product Design

- Material Type

- Torque Capacity

- Shaft length

- End-Use Industry

Examining How Diverse Regional Dynamics in the Americas Europe Middle East Africa and Asia-Pacific Shape Material Choices Manufacturing Strategies and Customer Demands

Regional dynamics exert a profound influence on cardan shaft development, procurement strategies, and innovation pathways. In the Americas, a mature automotive industry coexists with expanding energy and aerospace activities, fostering demand for both standardized driveline components and customized high-performance shafts. Localized content requirements and regional sourcing incentives have encouraged a shift toward North American forging and precision machining hubs, particularly in response to tariff-driven supply realignments and demand for shorter lead times. Conversely, Europe, the Middle East & Africa collectively leverage advanced manufacturing clusters in Germany and Italy, where an emphasis on sustainability and stringent NVH regulations has accelerated adoption of composite cardan shafts and sensor-integrated driveline systems. Market participants in this region also benefit from coordinated research consortia and cross-border engineering collaborations. Meanwhile, the Asia-Pacific region remains a prolific production and consumption center, driven by rapid infrastructure build-outs in China and India and a robust automotive OEM presence in Japan and South Korea. Here, the confluence of high-volume demand and evolving electrification mandates is catalyzing the scale-up of lightweight material processes and the refinement of torque management technologies tailored to regional power density requirements.

This comprehensive research report examines key regions that drive the evolution of the Cardan Shaft market, offering deep insights into regional trends, growth factors, and industry developments that are influencing market performance.

- Americas

- Europe, Middle East & Africa

- Asia-Pacific

Revealing the Strategic Alliances Technological Showcases and Modular Manufacturing Tactics That Define Leading Cardan Shaft Providers’ Competitive Edge

The competitive landscape of cardan shaft providers is characterized by strategic innovation, vertical integration efforts, and collaborative partnerships. Leading global players have invested heavily in research and development to secure first-mover advantages in next-generation materials and integrated monitoring solutions. For example, one major driveline specialist showcased its latest torque management disconnect systems at a premier powertrain symposium, emphasizing modular architectures optimized for electrified vehicle platforms and streamlined assembly processes. Similarly, industry frontrunners presented advanced asymmetric limited-slip differential and sustainable driveshaft designs at international congresses, underscoring the imperative of balancing efficiency gains with durability benchmarks.

Beyond pure product innovation, top-tier firms are forging partnerships with OEMs to co-develop bespoke driveline modules, embedding smart sensors and leveraging digital twins for predictive maintenance capabilities. Efforts to localize production through joint ventures in emerging economies aim to mitigate tariff exposure and align with customer requirements for rapid responsiveness. Additionally, the integration of modular propshaft concepts, underpinned by patented interface technologies, exemplifies how established suppliers are refining cost structures and assembly efficiency to win large-volume contracts in commercial vehicle segments.

This comprehensive research report delivers an in-depth overview of the principal market players in the Cardan Shaft market, evaluating their market share, strategic initiatives, and competitive positioning to illuminate the factors shaping the competitive landscape.

- Altra Industrial Motion Corp by Regal Rexnord Corporation

- American Axle & Manufacturing, Inc.

- Belden Inc.

- Chongqing Manke Transmissions Co., Ltd

- Dana Incorporated

- Eugen Klein GmbH

- Gelenkwellenwerk Stadtilm GmbH

- GKN Ltd. Hindustan Hardy Ltd

- JTEKT Corporation

- KTR Kupplungstechnik GmbH

- MAINA Organi di Trasmissione S.P.A.

- Meritor, Inc. by Cummins Inc.

- Misumi Corporation

- Neapco Holdings LLC

- NTN Corporation

- Schaeffler AG

- SKF GmbH

- Voith GmbH & Co

- Wahan Engineering Corporation

- Wanxiang Qianchao Group

- Welte Cardan-Service GmbH

- Wuxi Weicheng Cardan Shaft Co.,Ltd

- Wärtsilä Corporation

- ZF Friedrichshafen AG

Implementing Strategic Innovations and Supply Chain Resilience Measures to Enhance Product Performance and Mitigate Policy-Driven Disruptions

To navigate the complex cardan shaft environment, industry leaders should pursue targeted actions across product innovation, supply chain strategy, and market engagement. Embracing advanced material platforms-such as hybrid composites and high-strength aluminum alloys-can offset raw material inflation and deliver weight savings that align with global efficiency mandates. Concurrently, infusing universal joints with embedded sensing elements and adopting data analytics frameworks will enhance uptime through predictive maintenance and differentiate service offerings.

From a supply chain perspective, diversifying sourcing across tariff-exempt jurisdictions and investing in nearshore machining and forging capacities will bolster resilience against trade policy volatility. Strategic partnerships with logistics providers can further streamline procurement and inventory management, mitigating lead-time risks. In parallel, cultivating close collaboration with key OEMs to co-engineer tailored shaft assemblies will secure design lock-ins and foster long-term contract stability. Finally, amplifying sustainability credentials-through recyclable material initiatives and energy-efficient production lines-will reinforce brand positioning amid tightening environmental regulations.

Outlining a Comprehensive Mixed-Methods Research Approach Integrating Expert Interviews Patent Analyses and Regulatory Data Triangulation

The foundation of this analysis rests on a rigorous research methodology combining primary and secondary intelligence gathering. Primary insights were obtained through structured interviews with engineering leaders, supply chain executives, and product managers across automotive, aerospace, and industrial equipment segments. These discussions provided firsthand perspectives on material preferences, design trade-offs, and procurement challenges under evolving trade regimes.

Complementing this, extensive secondary research encompassed technical whitepapers, patent filings, and academic journals focused on materials science and power transmission technologies. Regulatory databases and tariff schedules were analyzed to quantify policy impacts, while market reports from independent think tanks and governmental agencies informed regional production and consumption patterns. Data triangulation and cross-validation with industry benchmarks ensured the robustness of conclusions, and qualitative findings were subjected to expert panel review to refine strategic recommendations.

This section provides a structured overview of the report, outlining key chapters and topics covered for easy reference in our Cardan Shaft market comprehensive research report.

- Preface

- Research Methodology

- Executive Summary

- Market Overview

- Market Insights

- Cumulative Impact of United States Tariffs 2025

- Cumulative Impact of Artificial Intelligence 2025

- Cardan Shaft Market, by Product Type

- Cardan Shaft Market, by Product Design

- Cardan Shaft Market, by Material Type

- Cardan Shaft Market, by Torque Capacity

- Cardan Shaft Market, by Shaft length

- Cardan Shaft Market, by End-Use Industry

- Cardan Shaft Market, by Region

- Cardan Shaft Market, by Group

- Cardan Shaft Market, by Country

- United States Cardan Shaft Market

- China Cardan Shaft Market

- Competitive Landscape

- List of Figures [Total: 18]

- List of Tables [Total: 1749 ]

Synthesizing the Essential Trends Strategic Responses and Competitive Differentiators Shaping the Future of Cardan Shaft Technologies

The cardan shaft domain stands at the nexus of enduring mechanical principles and rapid technological evolution. As materials innovation, digital integration, and fluctuating trade policies reshape the landscape, stakeholders are impelled to adopt agile strategies that balance cost pressures with performance imperatives. Multifaceted segmentation highlights the nuanced requirements across product types, torque classes, and end-use sectors, while regional insights underscore the importance of localized manufacturing and regulatory alignment. The key players identified herein exemplify how strategic partnerships, modular manufacturing, and forward-looking R&D can yield competitive differentiation.

Looking ahead, the convergence of lightweight composites, sensor-infused diagnostics, and sustainable production practices will define the next wave of cardan shaft advancement. Organizations that proactively embed these dimensions into their design, supply chain, and market engagement frameworks will be best positioned to thrive in a dynamic global environment. This synthesis of core principles and emergent trends provides a roadmap for decision makers seeking to harness the full potential of cardan shaft technologies and secure long-term success.

Empower Your Decision-Making With Personalized Insights and Strategic Guidance From Our Associate Director of Sales & Marketing

To explore how your organization can harness these insights and secure a competitive edge in the evolving cardan shaft market, reach out to Ketan Rohom, Associate Director for Sales & Marketing. Ketan brings deep expertise in power transmission research and can guide you through tailored solutions aligned with your strategic objectives. Connect with Ketan to unlock detailed market assessments, customized data analysis, and exclusive briefings that empower decisive action. Take the next step toward optimizing your driveline strategies and capitalizing on emerging opportunities by contacting Ketan to acquire the comprehensive market research report today

- How big is the Cardan Shaft Market?

- What is the Cardan Shaft Market growth?

- When do I get the report?

- In what format does this report get delivered to me?

- How long has 360iResearch been around?

- What if I have a question about your reports?

- Can I share this report with my team?

- Can I use your research in my presentation?