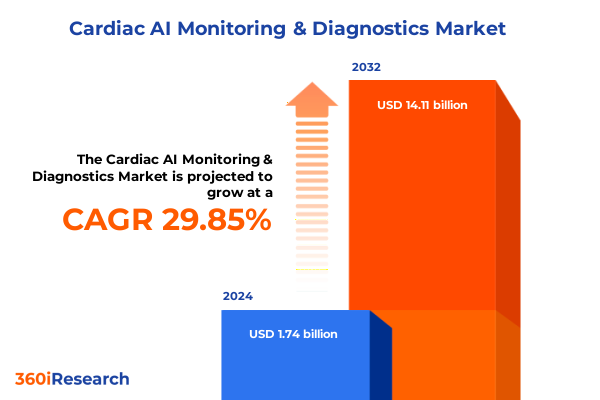

The Cardiac AI Monitoring & Diagnostics Market size was estimated at USD 1.33 billion in 2025 and expected to reach USD 1.54 billion in 2026, at a CAGR of 18.77% to reach USD 4.43 billion by 2032.

Revolutionary Integration of AI in Cardiac Monitoring and Diagnostics Is Catalyzing a Fundamental Shift in Patient Care Practices

AI-driven technologies are redefining the paradigms of cardiac patient monitoring and diagnostic decision-making, marking a decisive shift from conventional methods to data-rich, predictive approaches. Over the past decade, the integration of advanced algorithms with electrocardiogram and imaging data has delivered unprecedented precision in detecting arrhythmias, coronary anomalies, and early indicators of heart failure. This transformation reflects a broader embrace of artificial intelligence by healthcare stakeholders seeking to improve clinical outcomes while managing growing cost pressures.

Beyond mere automation, AI tools now support clinicians in synthesizing multimodal datasets from wearable sensors, implantable monitors, and cloud-connected imaging platforms. The result is a cohesive environment in which real-time physiological metrics inform personalized care pathways. As the healthcare community transitions to value-based care models, these AI capabilities not only streamline workflows but also enable proactive interventions, reducing hospital readmissions and optimizing resource utilization. In this context, AI’s role is evolving from a niche adjunct to a core component of modern cardiology practice.

Consequently, healthcare providers and technology developers are investing heavily to refine algorithmic accuracy and interoperability. Cross-sector collaborations are accelerating the deployment of solutions aligned with regulatory frameworks, ensuring that AI models are rigorously validated and transparent. As we introduce this executive summary, it is clear that the momentum behind cardiac AI monitoring and diagnostics is driven by a convergence of clinical need, regulatory support, and technological maturity.

How Rapid Advances in AI Technologies and Regulatory Milestones Are Driving a New Era in Cardiac Monitoring and Diagnostic Solutions

The landscape of cardiac AI monitoring and diagnostics is experiencing transformative shifts propelled by technological breakthroughs and evolving regulatory policies. In imaging analysis, convolutional neural networks now interpret echocardiograms and cardiac MRI scans with clinical-grade accuracy, reducing the time required for diagnosis from hours to minutes. Similarly, natural language processing applications are being embedded into clinical documentation systems, enabling automatic extraction of relevant patient history that enhances diagnostic precision and continuity of care.

In parallel, regulatory bodies have begun to clarify frameworks for AI-driven medical devices, encouraging innovation while safeguarding patient safety. The U.S. Food and Drug Administration’s expanded guidance on software as a medical device has accelerated premarket reviews, enabling startups and established firms alike to bring cutting-edge AI tools to market more rapidly. Moreover, health systems are embedding AI into telemedicine and remote monitoring programs, supporting chronic disease management in decentralized settings.

Together, these shifts are reshaping stakeholder expectations and competitive dynamics. Technology vendors are transitioning from point solutions to platform-based ecosystems that integrate diagnostic, monitoring, and predictive analytics capabilities. Healthcare organizations are prioritizing investments in data infrastructure and clinician training to capitalize on AI’s promise. As a result, the industry is moving toward an era characterized by continuous, adaptive, and AI-enhanced cardiac care.

Assessing the Dual Challenge of Increased Tariffs on Semiconductors and Structural Materials Impacting Cardiac AI Equipment Supply Chains

The introduction of expanded U.S. tariffs in 2025 has compounded challenges for manufacturers of cardiac AI monitoring and diagnostic hardware and has indirectly influenced software deployment models. Tariffs on semiconductors, which underpin key components of wearable and implantable monitoring devices, have surged to 50 percent, significantly raising the cost base for hardware developers and prompting some to seek alternative chip suppliers domestically or in allied markets. Additionally, derivative tariffs on steel and aluminum-containing products, effective March 12, 2025, have imposed a 25 percent levy on casings, connectors, and structural materials, affecting production timelines and end-user pricing.

Consequently, some medical device firms have accelerated relocation of assembly lines to regions with lower tariff exposure, which, while preserving margins, has led to extended lead times and increased logistical complexity. Healthcare providers, facing higher procurement costs, have renegotiated long-term supplier agreements to lock in pricing, though this has not fully offset the additional expense. In response, several organizations have successfully petitioned for exemptions on critical diagnostic and monitoring equipment, mitigating some immediate financial pressures; however, the broader impact on research and development budgets remains a concern, especially for emerging innovators still establishing scale.

In aggregate, the 2025 tariff measures have shaped supply chain resilience strategies and influenced go-to-market approaches, driving stakeholders to balance cost-containment with the urgent demand for next-generation cardiac AI solutions.

Unveiling Comprehensive Market Segmentation across Products Applications End Users Modalities and AI Technology Paradigms

Market segmentation insights reveal diverse requirements and adoption pathways across product types, end-user environments, and AI technologies. Solutions categorized under diagnostic systems now encompass electrocardiogram analysis platforms and advanced imaging interpretation systems, each playing a distinct role in early disease detection and procedural planning. Monitoring systems have expanded beyond traditional Holter devices to include implantable monitors that track long-term cardiac rhythms, remote monitors enabling continuous virtual care, and wearable monitors designed for real-world patient engagement. In parallel, predictive analytics software-encompassing patient stratification tools and risk prediction models-has emerged as a pivotal segment, offering deep learning-based prognostic assessments that inform preemptive interventions.

Examining applications, arrhythmia detection technologies address both atrial fibrillation and ventricular tachycardia, facilitating timely therapeutic responses. Coronary artery disease diagnosis tools now deliver detailed plaque characterization and stenosis detection, augmenting interventional cardiology workflows. Heart failure management solutions focus on fluid retention monitoring and left ventricular ejection fraction assessments, while hypertension monitoring leverages both continuous blood pressure recording devices and on-demand screening measures to support comprehensive care regimens.

End-user segmentation demonstrates that hospitals and clinics have been early adopters of integrated platforms, whereas ambulatory care centers and diagnostic laboratories are increasingly investing in point-of-care AI solutions. Home care settings are witnessing a surge in the use of remote and wearable monitoring technologies, reflecting a shift toward decentralized chronic disease management. Each modality-ranging from CT analysis and MRI-based interpretation to resting and stress ECG monitoring and Doppler or two-dimensional echocardiogram analysis-addresses specific clinical requirements, and the underlying AI technologies, including deep learning architectures, ensemble methods, and classic machine learning algorithms, are tailored to optimize diagnostic accuracy across these diverse use cases.

This comprehensive research report categorizes the Cardiac AI Monitoring & Diagnostics market into clearly defined segments, providing a detailed analysis of emerging trends and precise revenue forecasts to support strategic decision-making.

- Product Type

- Modality

- AI Technology

- Application

- End User

Comparative Regional Perspectives on Adoption Barriers and Growth Drivers in Cardiac AI Monitoring and Diagnostics

Regional dynamics illustrate distinct adoption trajectories and regulatory landscapes across the Americas, Europe Middle East & Africa, and Asia-Pacific regions. In the Americas, robust healthcare infrastructure and supportive reimbursement policies have driven rapid uptake of AI-augmented diagnostic and monitoring systems. North American providers are integrating cloud-based platforms and real-world evidence repositories, leveraging predictive analytics to optimize patient management pathways. Latin America, by contrast, is prioritizing cost-effective wearable and remote monitoring solutions to overcome healthcare access barriers, with pilot programs demonstrating improved patient adherence and clinical outcomes.

In the Europe Middle East & Africa region, harmonized regulatory frameworks such as the European Union’s Medical Device Regulation have heightened the rigor of AI validation, spurring investments in performance benchmarking and post-market surveillance. Germany and the United Kingdom have led in reimbursing AI-driven diagnostics, while emerging markets in the Middle East are deploying telecardiology initiatives to extend specialist services to remote areas. Africa exhibits growing interest in low-cost, mobile-enabled monitoring devices designed for scalable public health applications.

The Asia-Pacific region is characterized by widespread adoption of AI in early detection and preventive care, supported by government-led health digitization programs and favorable data governance policies. China’s focus on domestic AI innovation has resulted in a burgeoning ecosystem of local startups, while Japan and South Korea emphasize integration of AI into existing hospital information systems and advanced imaging centers. Across all regions, collaborations between technology vendors and healthcare providers are key to overcoming implementation barriers and realizing the full potential of cardiac AI solutions.

This comprehensive research report examines key regions that drive the evolution of the Cardiac AI Monitoring & Diagnostics market, offering deep insights into regional trends, growth factors, and industry developments that are influencing market performance.

- Americas

- Europe, Middle East & Africa

- Asia-Pacific

Profiling Collaborative Strategies and Technological Differentiators Among Leading Cardiac AI Monitoring and Diagnostics Innovators

Leading companies are shaping competitive dynamics through strategic alliances, proprietary technology development, and regulatory engagement. Established medical device manufacturers are extending their portfolios to include AI-enabled systems; some have acquired specialized analytics firms to integrate deep learning capabilities with their imaging and monitoring hardware. Technology giants are partnering with clinical research organizations to validate AI models in large-scale trials, bolstering credibility and facilitating regulatory approvals. Meanwhile, digital health startups are disrupting traditional workflows by offering cloud-native predictive analytics platforms that can be rapidly deployed in both inpatient and outpatient settings.

Several firms have differentiated their offerings by focusing on niche applications, such as ventricular tachycardia risk prediction or fluid retention monitoring in heart failure patients. Others have pursued modular platform strategies, enabling third-party developers to create and certify AI modules under a unified interoperability framework. Additionally, a number of companies have invested in explainable AI initiatives, developing visualization tools that enhance clinician trust and support regulatory requirements for algorithm transparency.

As the market matures, partnerships between payers and technology providers are emerging, with outcome-based contracting models that align reimbursement with demonstrable improvements in patient outcomes. These collaborative approaches are reshaping the value proposition of cardiac AI solutions, fostering an environment where innovation is rewarded by clear clinical and economic benefits.

This comprehensive research report delivers an in-depth overview of the principal market players in the Cardiac AI Monitoring & Diagnostics market, evaluating their market share, strategic initiatives, and competitive positioning to illuminate the factors shaping the competitive landscape.

- Aidoc Medical Ltd.

- AliveCor, Inc.

- Ambiq

- Apple Inc.

- Biotronik

- Caption Health, Inc.

- Cardiokol

- Cardiologs by Koninklijke Philips N.V.

- Cordio

- egnite, Inc.

- GE HealthCare Technologies, Inc.

- HeartFlow, Inc.

- Idoven , S.L

- International Business Machines Corporation

- iRhythm Technologies, Inc.

- Koninklijke Philips N.V.

- Medtronic plc.

- Microsoft Corporation

- Mindpeak GmbH

- Powerful Medical

- Samsung Electronics Co., Ltd.

- Siemens Healthineers

- Zebra Medical Vision Ltd.

- Zio by iRhythm Technologies, Inc.

Strategic Imperatives for Healthcare and Technology Leaders to Accelerate Adoption and Maximize Value from Cardiac AI Solutions

Industry leaders must adopt targeted strategies to stay ahead in the evolving cardiac AI landscape. First, strengthening data governance and interoperability frameworks is critical; organizations should invest in standardized data architectures and application programming interfaces to enable seamless integration of AI tools with electronic health records. Second, fostering cross-functional collaboration among clinicians, data scientists, and regulatory experts will accelerate the validation and clinical adoption of AI models, ensuring that algorithms address real-world care challenges.

Moreover, forging strategic partnerships with payers can facilitate innovative reimbursement schemes-such as shared savings for reduced readmissions-that underscore the economic value of AI-driven interventions. In parallel, supply chain resilience should be enhanced by diversifying procurement sources and securing long-term component agreements to mitigate tariff-related disruptions. Investing in real-world evidence generation through longitudinal studies and registries will provide robust outcomes data, supporting both regulatory submissions and market access initiatives.

Finally, leaders should prioritize scalable training programs for clinical staff, ensuring that end users are proficient in interpreting AI-driven insights and confident in incorporating them into care pathways. By aligning organizational capabilities with these strategic imperatives, companies can capitalize on emerging opportunities and solidify their position at the forefront of cardiac AI innovation.

Comprehensive Mixed-Methods Research Methodology Detailing Data Sources Validation Protocols and Analytical Frameworks

This market study synthesizes insights from both primary and secondary research methodologies to ensure comprehensive coverage and data integrity. Primary research included structured interviews and surveys with cardiologists, healthcare executives, regulatory specialists, and procurement officers across key global regions. Quantitative data were collected to understand deployment patterns, technology preferences, and operational challenges in real-world settings. Complementing this, secondary research comprised an extensive review of peer-reviewed journals, regulatory guidelines, company white papers, and industry reports published through July 2025.

Data triangulation techniques were employed to reconcile information from different sources, validating trends and identifying discrepancies. The research framework leveraged a bottom-up approach for segmentation analysis, examining product portfolios, application workflows, end-user environments, and AI technology subtypes. Qualitative insights were further enriched by expert panel discussions, ensuring that interpretation of market dynamics accounted for nuanced clinical and regulatory considerations.

Rigorous validation protocols were applied throughout the study, including cross-verification of company disclosures, regulatory filings, and clinical trial registries. Ultimately, this methodology provided a robust foundation for generating actionable insights and strategic recommendations tailored to stakeholders in the cardiac AI monitoring and diagnostics ecosystem.

This section provides a structured overview of the report, outlining key chapters and topics covered for easy reference in our Cardiac AI Monitoring & Diagnostics market comprehensive research report.

- Preface

- Research Methodology

- Executive Summary

- Market Overview

- Market Insights

- Cumulative Impact of United States Tariffs 2025

- Cumulative Impact of Artificial Intelligence 2025

- Cardiac AI Monitoring & Diagnostics Market, by Product Type

- Cardiac AI Monitoring & Diagnostics Market, by Modality

- Cardiac AI Monitoring & Diagnostics Market, by AI Technology

- Cardiac AI Monitoring & Diagnostics Market, by Application

- Cardiac AI Monitoring & Diagnostics Market, by End User

- Cardiac AI Monitoring & Diagnostics Market, by Region

- Cardiac AI Monitoring & Diagnostics Market, by Group

- Cardiac AI Monitoring & Diagnostics Market, by Country

- United States Cardiac AI Monitoring & Diagnostics Market

- China Cardiac AI Monitoring & Diagnostics Market

- Competitive Landscape

- List of Figures [Total: 17]

- List of Tables [Total: 3021 ]

Concluding Perspectives on the Evolutionary Trajectory of AI-Driven Cardiac Monitoring and Diagnostic Solutions in Healthcare Delivery

The cardiac AI monitoring and diagnostics sector stands at a pivotal juncture, driven by the convergence of advanced algorithms, robust data infrastructures, and evolving regulatory support. As healthcare systems pivot toward preventive and value-based care, AI-enabled tools offer the potential to transform patient journeys from reactive treatment to proactive management. Innovations in predictive analytics, real-time monitoring, and multimodal imaging interpretation are poised to enhance diagnostic accuracy, streamline workflows, and improve clinical outcomes.

However, realizing this promise requires addressing key challenges related to supply chain resilience, interoperability standards, and clinician adoption. Strategic investments in data governance, cross-sector collaboration, and evidence generation will be critical for sustaining momentum and demonstrating tangible value. Market leaders who effectively navigate these complexities stand to gain a competitive edge, while fostering broader acceptance of AI as an integral component of cardiac care.

Looking ahead, continuous refinement of algorithmic transparency, integration of emerging modalities such as natural language processing, and alignment with outcomes-based reimbursement models will shape the next phase of growth. In this dynamic environment, stakeholders equipped with rigorous market intelligence and a clear strategic roadmap will be best positioned to lead the transformation of cardiac AI monitoring and diagnostics.

Unlock Exclusive Access to Comprehensive Cardiac AI Monitoring and Diagnostics Market Insights through a Direct Consultation with Sales Leadership

To explore and acquire the comprehensive cardiac AI monitoring and diagnostics market research report, connect with Ketan Rohom who leads Sales and Marketing efforts. Your strategic initiatives will benefit from tailored insights, a deep analytical framework, and a clear understanding of evolving industry dynamics. Reach out today to secure exclusive access to this essential resource and position your organization at the forefront of cardiac AI innovation.

- How big is the Cardiac AI Monitoring & Diagnostics Market?

- What is the Cardiac AI Monitoring & Diagnostics Market growth?

- When do I get the report?

- In what format does this report get delivered to me?

- How long has 360iResearch been around?

- What if I have a question about your reports?

- Can I share this report with my team?

- Can I use your research in my presentation?