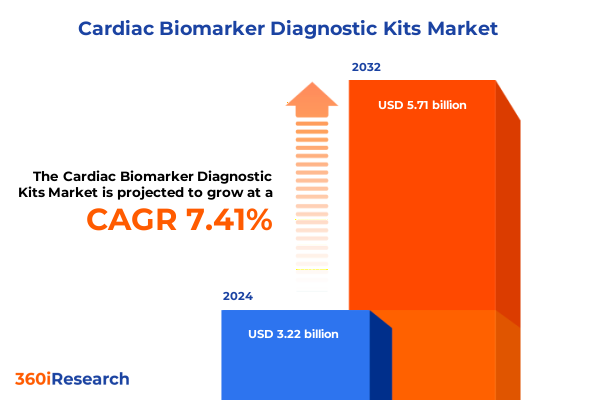

The Cardiac Biomarker Diagnostic Kits Market size was estimated at USD 3.45 billion in 2025 and expected to reach USD 3.69 billion in 2026, at a CAGR of 7.47% to reach USD 5.71 billion by 2032.

Unlocking the Potential of Cardiac Biomarker Diagnostic Kits for Early Cardiac Event Detection and Personalized Patient Care

The field of cardiac biomarker diagnostics has emerged as a cornerstone of modern cardiovascular medicine, driving more precise and timely interventions for patients experiencing acute and chronic cardiac events. Over the past decade, innovations in assay sensitivity and automation have elevated the diagnostic confidence of clinicians by detecting minute concentrations of key biomarkers that signal myocardial injury or stress. As a result, patients who present with chest discomfort or atypical symptoms can now undergo rapid testing protocols that integrate seamlessly into emergency department workflows, minimizing uncertainties and accelerating the path from presentation to treatment. Moreover, the maturation of multiplex platforms capable of simultaneous detection of B-Type Natriuretic Peptide, C-Reactive Protein, Cardiac Troponin, Creatine Kinase-MB, and Myoglobin has advanced clinicians’ ability to differentiate between conditions such as myocardial infarction, heart failure exacerbation, and inflammatory cardiac disorders in a single run.

Transitioning from traditional laboratory assays to high-throughput and point-of-care formats, this diagnostic domain is redefining best practices in cardiac care. Clinicians and hospital leaders are embracing technologies that balance high sensitivity with operational efficiency, thereby reducing turnaround times and optimizing bed occupancy rates. Against this backdrop, researchers continue to explore novel biomarkers and refine existing ones, anticipating an era in which personalized cardiac risk profiles guide precision therapies. This introductory overview sets the stage for a deeper examination of the transformative shifts, regulatory dynamics, and strategic imperatives driving the cardiac biomarker diagnostics sector into its next phase of growth.

Emerging Technological and Regulatory Drivers Reshaping the Cardiac Biomarker Diagnostic Landscape Across Clinical Settings

Over the past several years, rapid technological advancements and shifting regulatory mandates have converged to reshape the cardiac biomarker diagnostics landscape fundamentally. On one front, the introduction of high-sensitivity cardiac troponin assays has revolutionized myocardial infarction diagnosis by enabling detection of troponin concentrations previously below conventional assay thresholds. This leap forward has allowed earlier exclusion of acute myocardial injury, thereby streamlining patient triage and reducing hospital readmissions. Concurrently, the fusion of digital health platforms with diagnostic devices is empowering physicians to monitor trends in B-Type Natriuretic Peptide and C-Reactive Protein remotely, enabling proactive management of heart failure patients and reducing reliance on in-person visits.

Moreover, regulatory bodies in major markets have tightened quality standards and harmonized approval pathways to ensure consistency in diagnostic performance. In the United States, updated FDA guidance on point-of-care device validation and CLIA regulation harmonization are prompting manufacturers to refine their clinical trial designs and invest in robust post-market surveillance programs. These compliance pressures, in turn, are accelerating consolidation among mid-tier assay developers that may lack the resources to navigate complex submission requirements. Taken together, these technological and regulatory drivers are forging a more competitive environment in which agility, data integrity, and strategic partnerships are paramount for any company seeking to lead in cardiac biomarker diagnostics.

Assessing the Far-Reaching Economic and Supply Chain Consequences of United States 2025 Tariff Policies on Diagnostic Kit Availability

The introduction of new tariff measures by the United States government in early 2025 has exerted pronounced pressure on the importation and distribution of critical assay reagents and instrumentation components crucial to cardiac biomarker diagnostic kits. As a result, the cost structure for importing specialized antibodies, calibration standards, and microfluidic cartridges has shifted markedly, compelling multinational suppliers to reassess their global sourcing strategies. This policy environment has also heightened scrutiny of domestic manufacturing capabilities, with device makers exploring partnerships to localize key production steps and mitigate exposure to cross-border duties.

Consequently, laboratory directors and hospital procurement teams have encountered longer lead times and increased variability in delivery schedules, prompting many to secure relationships with multiple third-party suppliers to ensure continuity of care. Such diversification strategies have fostered resilience against tariff-driven supply chain disruptions, yet they have also introduced complexity in quality control and vendor management. In parallel, the industry has witnessed intensified advocacy from professional societies calling for tariff exemptions on life-saving diagnostic reagents. These efforts have underscored the critical balance between national trade policy objectives and the imperative to maintain uninterrupted access to tests that directly impact patient outcomes.

Unveiling Critical Segmentation Perspectives That Drive Precision Targeting in Cardiac Biomarker Diagnostics Across Diverse Clinical and Research Contexts

Understanding the nuanced demands of cardiac biomarker testing requires a layered segmentation approach that spans biomarker selection, clinical indication, and end-user needs. For instance, assay developers must optimize protocols for high-sensitivity cardiac troponin when targeting myocardial infarction diagnosis, while C-Reactive Protein assays serve better in inflammatory cardiomyopathies or chronic heart failure monitoring. Likewise, the decision to deploy in vitro testing within centralized clinical laboratories versus point-of-care in vivo formats often hinges on operational workflow preferences and desired turnaround times. As healthcare institutions seek to balance capital investments with flexibility, direct purchasing models have gained favor among large hospital systems, whereas smaller clinics may rely on third-party suppliers to manage inventory and service contracts.

Further, application contexts diverge between quantitative laboratory testing machines in central labs and rapid tests in emergency settings or research applications exploring novel biomarker candidates. Academic and research institutions often demand multiplex capabilities and advanced data integration platforms to support exploratory protocols, whereas diagnostic laboratories focus predominantly on standardized assays with streamlined quality controls. Hospitals and clinics, in contrast, value the adaptability of point-of-care instruments to rapidly guide treatment decisions. Integrating these segmentation insights enables manufacturers and service providers to tailor product portfolios, sales strategies, and support services to distinct user profiles, thereby enhancing adoption rates and clinical utility across the care continuum.

This comprehensive research report categorizes the Cardiac Biomarker Diagnostic Kits market into clearly defined segments, providing a detailed analysis of emerging trends and precise revenue forecasts to support strategic decision-making.

- Biomarker Type

- Indication

- Testing Type

- Purchasing Mode

- Application

- End User

Exploring Distinct Regional Dynamics and Growth Drivers Influencing Cardiac Biomarker Diagnostics Adoption in the Americas EMEA and Asia-Pacific

Regional markets for cardiac biomarker diagnostic kits exhibit unique dynamics driven by healthcare infrastructure maturity, reimbursement frameworks, and regulatory pathways. In the Americas, robust reimbursement policies and wide adoption of high-sensitivity troponin assays have solidified the region’s leadership in acute cardiac care diagnostics. Meanwhile, the consolidation of hospital networks in the United States is fueling demand for integrated point-of-care solutions that minimize patient throughput times and optimize inpatient bed utilization.

Across Europe, the Middle East, and Africa, standardization efforts by the European Medicines Agency and ongoing EMA-FDA convergence initiatives have created a more predictable regulatory landscape. This harmonization, coupled with investments in public health systems, has accelerated uptake of biomarker panels that combine B-Type Natriuretic Peptide and C-Reactive Protein testing for early heart failure detection. In parallel, emerging economies in the Middle East and Africa are investing in laboratory capacity building, often through public-private partnerships that prioritize scalable and cost-effective assay platforms.

In the Asia-Pacific region, rapid urbanization and rising prevalence of cardiovascular disease have generated strong demand for affordable, decentralized diagnostic kits suitable for outpatient clinics and rural health centers. Manufacturers are responding with compact, battery-operated point-of-care devices that deliver quick results with minimal infrastructure requirements. Collectively, these regional patterns underscore the necessity for tailored market entry strategies and localized partner ecosystems to drive sustainable growth and clinical impact.

This comprehensive research report examines key regions that drive the evolution of the Cardiac Biomarker Diagnostic Kits market, offering deep insights into regional trends, growth factors, and industry developments that are influencing market performance.

- Americas

- Europe, Middle East & Africa

- Asia-Pacific

Examining Leading Industry Players and Their Strategic Innovations Shaping the Future of Cardiac Biomarker Diagnostic Kit Development

Leading diagnostic companies are deploying multifaceted strategies to solidify their positions in the cardiac biomarker arena. Large incumbents have accelerated consolidation efforts through mergers and acquisitions that expand their assay portfolios and geographic distribution networks. This approach enables rapid scaling of high-sensitivity troponin and natriuretic peptide assays across both centralized laboratories and point-of-care settings. At the same time, several established players are channeling investments toward digital health integrations, creating platforms that merge assay results with electronic health records and telemedicine interfaces to support longitudinal patient management.

Concurrently, mid-sized firms and emerging startups are carving out niches by innovating in microfluidic cartridge design, sample preparation automation, and multiplex detection capabilities. These advances aim to reduce sample volumes and accelerate run times, catering to emergency departments and ambulatory care clinics. Adaptive business models, such as pay-per-test subscription frameworks and reagent leasing agreements, are also gaining traction, offering end users predictable operational expenses along with turnkey support. By balancing product innovation with flexible commercial structures, these companies are driving greater accessibility and operational efficiency in cardiac diagnostic workflows.

This comprehensive research report delivers an in-depth overview of the principal market players in the Cardiac Biomarker Diagnostic Kits market, evaluating their market share, strategic initiatives, and competitive positioning to illuminate the factors shaping the competitive landscape.

- Abbott Laboratories

- Atlas Medical GmbH

- Beckman Coulter, Inc.

- Bio-Rad Laboratories, Inc.

- bioMérieux SA

- Creative Diagnostics

- Eurolyser Diagnostica GmbH

- F. Hoffmann-La Roche Ltd.

- Fujirebio Diagnostics, Inc.

- GenWay Biotech, Inc.

- Guangzhou Wondfo Biotech Co., Ltd.

- J.Mitra & Co. Pvt. Ltd.

- Lepu Medical Technology (Beijing) Co., Ltd.

- Medtronic Inc.

- Meridian Bioscience, Inc.

- MP Biomedicals, LLC

- Radiometer Medical ApS

- Randox Laboratories Ltd.

- Siemens Healthcare GmbH

- Singulex, Inc.

- SSI Diagnostica A/S Group

- Thermo Fisher Scientific, Inc.

- Tosoh Corporation

- Trivitron Healthcare

- Tulip Diagnostics (P) Ltd

Implementing Tactical Recommendations to Enhance Market Positioning and Foster Sustainable Growth in the Cardiac Biomarker Diagnostic Sector

For industry leaders seeking to maintain competitive advantage, prioritizing enhancement of assay sensitivity and specificity should remain central. By investing in next-generation antibody development and digital signal processing, companies can deliver tests that reduce false positives and expedite clinical decision making. Furthermore, localizing critical assay components through strategic alliances or co-manufacturing agreements can mitigate tariff exposure and foster supply chain resilience. Such partnerships should be structured with clear quality governance mechanisms to ensure consistent performance across production sites.

Simultaneously, expanding service offerings to include remote monitoring platforms and integrated data analytics will position providers as comprehensive partners in patient management rather than mere reagent suppliers. Engaging with academic and research institutions through collaborative validation studies can also accelerate the adoption of novel biomarkers while reinforcing scientific credibility. From a commercial perspective, tailoring pricing models to reflect the economic realities of diverse end users-from large hospitals to rural clinics-will enhance market penetration. Lastly, proactive engagement with regulatory agencies to shape forthcoming guidance documents will help preempt compliance challenges and streamline time to market.

Detailing Rigorous Research Methodology Employed to Deliver Accurate and Insightful Analysis of Cardiac Biomarker Diagnostic Market Trends

This research synthesis leveraged a rigorous methodology combining primary and secondary data sources to ensure comprehensive and accurate insights. Interviews were conducted with cardiology thought leaders, laboratory directors, and procurement specialists to obtain firsthand perspectives on diagnostic workflows and unmet clinical needs. In parallel, a systematic review of peer-reviewed journals, regulatory documents, and device manufacturer literature provided contextual understanding of assay performance benchmarks and approval pathways.

Trade data and policy analyses were incorporated to evaluate the impact of tariff measures on reagent imports and to map supply chain vulnerabilities. Competitive intelligence was amassed through corporate filings, patent databases, and market news to track strategic initiatives by leading companies. All findings underwent triangulation to validate consistency and to reconcile any data divergences. Where qualitative feedback diverged, follow-up inquiries ensured clarity and depth. This hybrid approach delivered an actionable knowledge base that underpins the strategic and operational recommendations presented herein.

This section provides a structured overview of the report, outlining key chapters and topics covered for easy reference in our Cardiac Biomarker Diagnostic Kits market comprehensive research report.

- Preface

- Research Methodology

- Executive Summary

- Market Overview

- Market Insights

- Cumulative Impact of United States Tariffs 2025

- Cumulative Impact of Artificial Intelligence 2025

- Cardiac Biomarker Diagnostic Kits Market, by Biomarker Type

- Cardiac Biomarker Diagnostic Kits Market, by Indication

- Cardiac Biomarker Diagnostic Kits Market, by Testing Type

- Cardiac Biomarker Diagnostic Kits Market, by Purchasing Mode

- Cardiac Biomarker Diagnostic Kits Market, by Application

- Cardiac Biomarker Diagnostic Kits Market, by End User

- Cardiac Biomarker Diagnostic Kits Market, by Region

- Cardiac Biomarker Diagnostic Kits Market, by Group

- Cardiac Biomarker Diagnostic Kits Market, by Country

- United States Cardiac Biomarker Diagnostic Kits Market

- China Cardiac Biomarker Diagnostic Kits Market

- Competitive Landscape

- List of Figures [Total: 18]

- List of Tables [Total: 1272 ]

Summarizing Key Takeaways and Outlook for Stakeholders Navigating the Evolving Cardiac Biomarker Diagnostic Kit Landscape

In summary, the cardiac biomarker diagnostic field stands at a pivotal juncture characterized by advanced assay technologies, evolving regulatory frameworks, and dynamic supply chain considerations. Stakeholders must navigate the interplay of high-sensitivity assay adoption, point-of-care expansion, and regional policy environments to capitalize on emerging opportunities. Critical segmentation insights across biomarker types, testing modalities, purchasing approaches, application contexts, and end-user categories reveal tailored pathways to address varied clinical and operational requirements.

Key regional nuances-from the Americas’ reimbursement maturity to the Asia-Pacific’s decentralized infrastructure needs-underscore the value of market-specific strategies. Moreover, leading companies’ emphasis on digital integration, strategic alliances, and subscription-based models highlights the importance of holistic service offerings. By implementing targeted recommendations around assay innovation, supply chain resilience, and regulatory engagement, industry leaders can fortify their market positions and drive improved patient outcomes. Ultimately, this comprehensive overview equips decision makers with the clarity needed to chart a course through a rapidly evolving diagnostic landscape.

Empower Your Strategic Decisions by Securing Personalized Insights and Tailored Cardiac Biomarker Diagnostic Research Today

To transform complex data into strategic advantage, reach out to Ketan Rohom, Associate Director of Sales & Marketing, to secure your customized cardiac biomarker diagnostic report tailored to your organization’s unique imperatives and innovation roadmap. Ketan brings deep domain insight and will guide you through a seamless engagement that aligns the report’s findings with your decision-making milestones. By connecting with him, you gain privileged access to in-depth analysis, actionable recommendations, and the competitive intelligence your teams require to outpace rivals and anticipate market shifts. Engage now to elevate your strategic planning, enhance your portfolio development, and uncover partnership opportunities that will propel your cardiac diagnostic initiatives forward. Don’t let critical insights remain untapped-initiate the conversation today to ensure your organization holds the leading edge in the rapidly evolving cardiac biomarker diagnostics landscape.

- How big is the Cardiac Biomarker Diagnostic Kits Market?

- What is the Cardiac Biomarker Diagnostic Kits Market growth?

- When do I get the report?

- In what format does this report get delivered to me?

- How long has 360iResearch been around?

- What if I have a question about your reports?

- Can I share this report with my team?

- Can I use your research in my presentation?