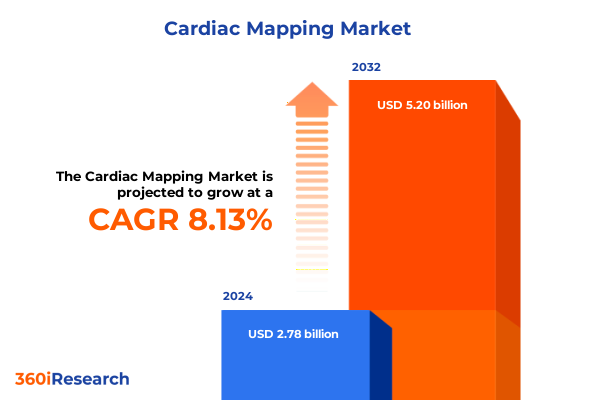

The Cardiac Mapping Market size was estimated at USD 2.99 billion in 2025 and expected to reach USD 3.22 billion in 2026, at a CAGR of 8.22% to reach USD 5.20 billion by 2032.

Introduction to the Evolving Dynamics in Cardiac Mapping That Are Reshaping Clinical Interventions and Technological Innovation

The cardiac mapping landscape is experiencing rapid evolution as clinicians and technology providers converge to address increasingly complex arrhythmias with precision. Innovations in sensor design, signal processing algorithms, and integration with imaging modalities are reshaping how electrophysiologists visualize electrical pathways within the heart. As multipolar and point-by-point catheters become more refined, procedural workflows are streamlining, reducing both fluoroscopy time and patient risk. These developments have fueled a new era of minimally invasive interventions, empowering clinicians to target arrhythmogenic substrates with greater specificity and confidence.

Against this backdrop, the purpose of this executive summary is to distill these multifaceted trends into strategic imperatives for stakeholders across the cardiac mapping ecosystem. The following sections explore transformative market shifts, tariff implications, segmentation nuances, regional dynamics, competitive profiles, actionable recommendations, research rigor, and concluding perspectives. By synthesizing qualitative and quantitative insights, this introduction establishes a foundation for data-driven decisions that align with the ongoing quest to improve patient outcomes and optimize clinical efficiency.

Identifying Transformative Shifts in Cardiac Mapping Driven by Technological Advances Regulatory Changes and Clinical Practice Evolution

In recent years, the cardiac mapping market has been upended by several synergistic forces that collectively elevate both the sophistication of mapping platforms and the scope of clinical applications. Technological breakthroughs, such as the advent of integrated imaging with computed tomography and magnetic resonance compatibility, have enabled real-time visualization of electroanatomical data alongside anatomical structures. Concurrently, regulatory pathways in major markets have been streamlined for devices demonstrating improved safety and efficacy, thereby accelerating product approvals and clinical adoption.

Moreover, healthcare providers are recalibrating their capital investments in response to shifting reimbursement paradigms and the imperative to demonstrate value. Ambulatory surgical centers and diagnostic facilities are increasingly equipped with non-contact mapping systems that leverage body surface and charge density techniques to offer rapid diagnostic insights. This confluence of regulatory flexibility, reimbursement strategy, and technology integration marks a transformative inflection point that redefines how stakeholders engage with cardiac mapping solutions.

Analyzing the Cumulative Impact of United States Tariff Adjustments in 2025 on Supply Chains Manufacturing Costs and Market Accessibility

The introduction of new tariff measures in the United States throughout 2025 has exerted palpable pressure on the global cardiac mapping supply chain. In response to increased import duties on components such as high-precision sensors and electroanatomical mapping modules, manufacturers have recalibrated their procurement strategies, alternating between localized production and selective outsourcing. These adjustments have influenced the cost structures of accessories, mapping catheters, and systems, compelling vendors to optimize their manufacturing footprints and maintain price competitiveness.

Consequently, healthcare institutions have encountered adjustments in capital expenditure cycles, as budget allocations for capital equipment have been revisited to accommodate marginal cost increases. To mitigate the impact, some market participants have accelerated partnerships with domestic contract manufacturers or adopted hybrid production models that blend onshore assembly with offshore fabrication. Together, these strategic responses to tariff shifts underscore the importance of supply chain resilience and cost management in sustaining market momentum.

Uncovering Key Insights from Product Type Technology Application and End User Segmentation That Define Market Complexity and Opportunity

A nuanced examination of segmentation across product type, technology, application, and end user reveals the market’s inherent complexity and latent growth nodes. Within product portfolios, the mapping catheter sphere has bifurcated into contact and non-contact categories, while mapping systems have evolved to encompass both electroanatomical and non-contact mechanisms. These distinctions inform buyer preferences based on procedural requirements and physician familiarity, highlighting the need for channel strategies that align with specific clinical use cases.

Likewise, technology segmentation underscores the rise of multipolar and point-by-point mapping within contact systems, complemented by integrated imaging solutions such as computed tomography and magnetic resonance integration. Non-contact methodologies, including body surface and charge density mapping, are carving out diagnostic niches that promise rapid arrhythmia localization. Applications likewise diverge between atrial fibrillation-with its chronic, paroxysmal, and persistent subtypes-and ventricular tachycardia of ischemic and non-ischemic origin. Finally, end users range from ambulatory surgical centers and diagnostic clinics to hospitals with dedicated cardiac care units and electrophysiology labs. Understanding these interlocking layers of segmentation provides a strategic lens for targeting product development and market outreach.

This comprehensive research report categorizes the Cardiac Mapping market into clearly defined segments, providing a detailed analysis of emerging trends and precise revenue forecasts to support strategic decision-making.

- Product Type

- Technology

- Application

- End User

Assessing Regional Differentiators Across Americas Europe Middle East Africa and Asia Pacific and Their Influence on Adoption and Growth Patterns

Regional dynamics play a pivotal role in shaping market adoption and strategic priorities. In the Americas, robust infrastructure and favorable reimbursement mechanisms have accelerated investment in both contact mapping catheters and electroanatomical mapping systems. This region’s maturity in handling complex arrhythmias has prompted vendors to roll out multipolar mapping solutions and integrate advanced imaging modalities to support high-volume electrophysiology centers.

In contrast, Europe, the Middle East, and Africa exhibit heterogeneous adoption patterns driven by varying regulatory landscapes and healthcare spend. Nations with centralized procurement models often prioritize cost-effective integrated imaging solutions, while more affluent markets in Western Europe gravitate toward premium non-contact mapping systems. Meanwhile, Asia-Pacific demonstrates rapid uptake of portable mapping accessories and point-by-point catheters, driven by escalating cardiac care needs and expanding diagnostic capabilities in ambulatory settings. These regional differentiators underscore the necessity of tailored market entry approaches and localized value propositions.

This comprehensive research report examines key regions that drive the evolution of the Cardiac Mapping market, offering deep insights into regional trends, growth factors, and industry developments that are influencing market performance.

- Americas

- Europe, Middle East & Africa

- Asia-Pacific

Profiling Leading Market Participants Their Strategic Initiatives Partnerships and Technological Capabilities That Enhance Competitive Positioning

Leading organizations have distinguished themselves through strategic alliances, targeted acquisitions, and continuous innovation in mapping technologies. Established electrophysiology device manufacturers have deepened their portfolios by integrating advanced imaging capabilities-such as computed tomography and magnetic resonance-to deliver unified diagnostic and therapeutic platforms. Partnerships with software developers have further enhanced signal processing algorithms and visualization tools, enabling real-time mapping across complex arrhythmic substrates.

At the same time, emerging players have disrupted traditional models by introducing non-contact mapping modalities that reduce procedural complexity and broaden access in ambulatory and diagnostic center settings. These entrants leverage agile development cycles and niche expertise in body surface and charge density mapping to carve out specialized market positions. Collectively, these strategic initiatives highlight how differentiated clinical value and technological leadership form the cornerstone of competitive advantage in the cardiac mapping arena.

This comprehensive research report delivers an in-depth overview of the principal market players in the Cardiac Mapping market, evaluating their market share, strategic initiatives, and competitive positioning to illuminate the factors shaping the competitive landscape.

- Abbott Laboratories

- Acutus Medical, Inc.

- Biosense Webster, Inc.

- Biotronik SE & Co. KG

- Boston Scientific Corporation

- EP Solutions GmbH

- Koninklijke Philips N.V.

- Medtronic plc

- Medtronic plc

- MicroPort Scientific Corporation

- Nihon Kohden Corporation

- Siemens Healthineers AG

Formulating Actionable Recommendations for Industry Leaders to Capitalize on Emerging Trends Overcome Challenges and Drive Sustainable Growth

To gain and maintain market leadership, stakeholders should pursue a multi-pronged strategy that aligns product innovation with healthcare provider priorities. First, focusing on enhancing interoperability between contact mapping catheters and integrated imaging modalities will streamline procedural workflows, reducing procedure time and improving patient throughput. Simultaneously, investing in scalable training programs for electrophysiologists ensures that clinical adoption keeps pace with technological sophistication.

In parallel, industry leaders should cultivate resilient supply chains by diversifying manufacturing sites and forging strategic partnerships with domestic and regional suppliers. This approach will mitigate the financial exposure posed by tariff fluctuations. Furthermore, developing tailored value propositions for each end user segment-ranging from ambulatory surgical centers to hospital electrophysiology labs-will drive deeper market penetration. Finally, prioritizing continuous real-world evidence generation with structured clinical data registries will demonstrate superior long-term outcomes, reinforcing reimbursement support and guiding product roadmap decisions.

Detailing Rigorous Research Methodology Including Data Collection Sources Triangulation Techniques and Validation Processes for Credible Findings

This analysis is underpinned by a robust research framework that combines primary interviews with electrophysiologists, device manufacturers, and healthcare administrators alongside comprehensive secondary research. Primary insights were gathered through structured discussions covering technology preferences, adoption barriers, and investment drivers within leading hospitals, diagnostic centers, and ambulatory surgical facilities. Secondary data sources encompassed peer-reviewed journals, regulatory filings, and industry white papers to validate market trends and technological developments.

To ensure analytical rigor, findings underwent triangulation against multiple data points, with discrepant insights resolved through follow-up inquiries and expert consultation. The methodology also accounted for potential biases by integrating a balanced mix of regional and global perspectives. Assumptions regarding regulatory timelines and tariff impacts were explicitly documented, and sensitivity analyses were performed to assess the robustness of key conclusions. This systematic approach guarantees that stakeholders can rely on the findings for strategic planning and decision making.

This section provides a structured overview of the report, outlining key chapters and topics covered for easy reference in our Cardiac Mapping market comprehensive research report.

- Preface

- Research Methodology

- Executive Summary

- Market Overview

- Market Insights

- Cumulative Impact of United States Tariffs 2025

- Cumulative Impact of Artificial Intelligence 2025

- Cardiac Mapping Market, by Product Type

- Cardiac Mapping Market, by Technology

- Cardiac Mapping Market, by Application

- Cardiac Mapping Market, by End User

- Cardiac Mapping Market, by Region

- Cardiac Mapping Market, by Group

- Cardiac Mapping Market, by Country

- United States Cardiac Mapping Market

- China Cardiac Mapping Market

- Competitive Landscape

- List of Figures [Total: 16]

- List of Tables [Total: 2067 ]

Concluding Reflections on How Integrated Insights and Strategic Analysis Inform Future Directions in the Cardiac Mapping Landscape

In synthesizing the diverse facets of product, technology, application, end user, regional, and competitive dynamics, it becomes clear that the cardiac mapping market is entering a phase of accelerated sophistication. The convergence of integrated imaging, advanced mapping algorithms, and more resilient supply chain strategies portends a future in which electrophysiologists can deliver safer, more efficient interventions across a wider range of arrhythmias.

Ultimately, the insights presented here illuminate strategic pathways for stakeholders to optimize their innovation pipelines, align with evolving regulatory frameworks, and address the nuanced needs of different clinical settings. By leveraging this analysis, decision makers can anticipate market shifts, inform targeted investments, and foster partnerships that drive long-term growth and improved patient outcomes in the dynamic field of cardiac mapping.

Seize Strategic Advantage Today by Engaging with Associate Director Ketan Rohom to Secure Comprehensive Cardiac Mapping Market Intelligence

To secure an unparalleled depth of insight and strategic foresight into the cardiac mapping market, engage directly with Ketan Rohom, Associate Director, Sales & Marketing at 360iResearch. He will guide you through the comprehensive research deliverables, ensuring you harness the full value of proprietary data and expert analysis. By connecting with him, you position your organization to derive competitive advantage from the latest trends, regulatory intelligence, and technological breakthroughs in cardiac mapping. Reach out today to align your growth objectives with actionable market intelligence that drives informed decision making and accelerates time to impact.

- How big is the Cardiac Mapping Market?

- What is the Cardiac Mapping Market growth?

- When do I get the report?

- In what format does this report get delivered to me?

- How long has 360iResearch been around?

- What if I have a question about your reports?

- Can I share this report with my team?

- Can I use your research in my presentation?