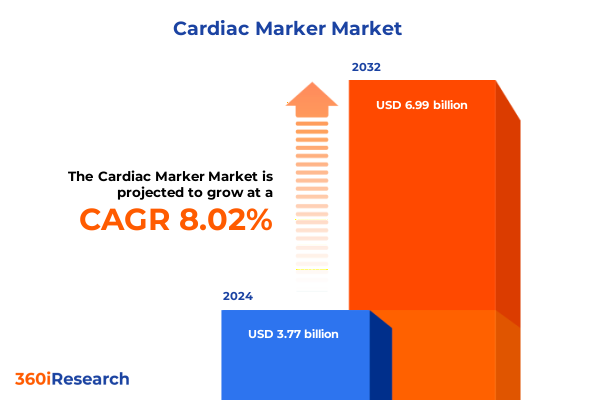

The Cardiac Marker Market size was estimated at USD 4.04 billion in 2025 and expected to reach USD 4.35 billion in 2026, at a CAGR of 8.11% to reach USD 6.99 billion by 2032.

Understanding the Critical Role and Rapid Evolution of Cardiac Marker Diagnostics in Modern Cardiovascular Care for Timely, Precise Patient Outcomes

Cardiovascular disease remains the leading cause of mortality worldwide, responsible for nearly one-third of all deaths. This stark reality underscores the critical importance of cardiac marker diagnostics in modern healthcare, providing timely insights into myocardial injury and stress. As clinicians strive for faster and more precise decision-making, the evolution of high-sensitivity assays has become central to improving early detection of conditions such as acute myocardial infarction and heart failure. These diagnostics not only enhance patient outcomes by enabling rapid intervention but also support risk stratification and long-term management strategies for at-risk populations.

Over the past decade, innovations in assay technology have driven a paradigm shift from conventional markers to high-sensitivity cardiac troponin and natriuretic peptides, transforming emergency department workflows. High-sensitivity troponin tests, such as Roche’s Elecsys Troponin T hs, can detect minute concentrations of troponin T, providing reliable rule-in and rule-out capabilities within one hour of patient presentation. This capability has substantially reduced waiting times, minimized unnecessary admissions, and optimized resource allocation in critical care settings. As healthcare systems face increasing demands from aging populations and escalating prevalence of cardiovascular risk factors, cardiac marker diagnostics have emerged as indispensable tools in both acute and chronic care pathways.

Key Technological Innovations and Clinical Advances Driving Transformative Shifts in the Cardiac Marker Testing Landscape and Precision Cardiology

The landscape of cardiac marker testing is being transformed by breakthroughs in artificial intelligence, digital health integration, and point-of-care innovation. AI-driven algorithms are now capable of analyzing complex biomarker profiles, genomic data, and real-time patient parameters to predict adverse cardiac events with remarkable accuracy. For instance, AI-powered screening programs employed in outpatient settings can assess cardiovascular risk within seconds, shifting the focus from reactive treatment to proactive prevention. These capabilities are further enhanced by advanced imaging modalities and algorithmic triage systems that integrate high-sensitivity assays to streamline diagnostic pathways and reduce emergency department congestion.

Evaluating the Cumulative Impact of Enhanced US Tariff Measures in 2025 on Supply Chains and Cost Structures within the Cardiac Marker Diagnostics Sector

In 2025, U.S. tariff measures on imports from China, Canada, and Mexico have introduced significant cost pressures on medical devices and consumables, including diagnostic reagents and instrumentation components. Under Section 301, tariffs on respiratory devices, syringes, and various personal protective equipment surged to as high as 100% for syringes and needles by September 27, 2024, with additional increases on rubber medical gloves and disposable facemasks scheduled for January 1, 2025 and beyond. These elevated duties have heightened procurement costs for hospitals and laboratories, compelling many to absorb expenses internally or delay capital investments in newer analytical platforms.

Illuminating Critical Segmentation Insights to Inform Product Portfolio, Technology Adoption, Test Mode Preferences, End User Demands, and Clinical Applications

A nuanced understanding of market segmentation reveals critical drivers shaping cardiac marker diagnostics adoption and product development. Within the product domain, demand is rising across instruments, kits, reagents, and software, with benchtop analyzers and immunoanalyzers increasingly preferred for high-throughput settings while handheld devices gain traction at the point of care. Reagent portfolios spanning BNP, CK-MB, myoglobin, and troponin assays are witnessing intensified competition, as high-sensitivity formulations redefine diagnostic accuracy and speed. Technology adoption follows a similar trajectory, with chemiluminescence and fluorescence immunoassay platforms taking center stage due to their enhanced signal-to-noise ratios, while traditional ELISA continues to serve cost-sensitive laboratory environments. Testing modes are also diversifying, as laboratory-based high-precision workflows coexist with decentralized point-of-care solutions that deliver rapid results in emergency departments and outpatient clinics.

End user dynamics further delineate the market, as hospitals and diagnostic laboratories remain core customers for comprehensive testing portfolios, while ambulatory care centers and research laboratories prioritize flexible, modular solutions to accommodate varied throughput requirements. Clinical applications encompass acute coronary syndrome diagnostics, heart failure monitoring, and post-myocardial infarction patient management, driving cross-functional collaboration between cardiologists, emergency medicine teams, and laboratory specialists. This integrative framework underscores the importance of tailored product roadmaps that align with distinct clinical workflows and stakeholder needs.

This comprehensive research report categorizes the Cardiac Marker market into clearly defined segments, providing a detailed analysis of emerging trends and precise revenue forecasts to support strategic decision-making.

- Product

- Technology

- Test Mode

- End User

- Application

Leveraging Regional Dynamics and Healthcare Infrastructure Variations to Extract Key Insights for Cardiac Marker Utility and Market Penetration Globally

Regional healthcare infrastructure and regulatory environments exert a profound influence on the adoption of cardiac marker diagnostics. In the Americas, established reimbursement frameworks and extensive hospital networks support widespread implementation of high-sensitivity assays and point-of-care testing, particularly in emergency and ambulatory settings. Collaborative initiatives between payers and providers continue to streamline pathways for novel biomarker assays, fostering innovation in acute care diagnostics. Conversely, evolving regulations within the Europe, Middle East, and Africa region introduce both opportunities and complexities. Harmonization under the EU’s In Vitro Diagnostic Regulation has elevated quality standards and encouraged market entry for advanced assay technologies, while emerging markets within the Middle East and Africa present untapped potential amid increasing healthcare expenditure and rising cardiovascular disease prevalence.

Meanwhile, Asia-Pacific remains the fastest-growing region for cardiac marker diagnostics, propelled by rapid expansion of healthcare infrastructure, rising per capita healthcare spending, and government-led screening programs for noncommunicable diseases. High population density and growing awareness of cardiovascular risk factors drive demand for decentralized testing solutions, as point-of-care platforms enable rapid triage in resource-limited settings. Strategic partnerships between global device manufacturers and regional distributors are further accelerating access to cutting-edge assays, underscoring the region’s pivotal role in shaping the global market’s future trajectory.

This comprehensive research report examines key regions that drive the evolution of the Cardiac Marker market, offering deep insights into regional trends, growth factors, and industry developments that are influencing market performance.

- Americas

- Europe, Middle East & Africa

- Asia-Pacific

Profiling Leading Industry Players and Strategic Partnerships Shaping Innovation and Competitive Dynamics in Cardiac Marker Diagnostics Worldwide

Leading diagnostics companies are intensifying efforts to expand their cardiac marker portfolios through strategic collaborations and continuous innovation. Roche Diagnostics, for example, received CE Mark approval in April 2025 for its Chest Pain Triage algorithm, integrating high-sensitivity troponin testing with clinical decision support to expedite ruling in or out of acute coronary syndrome in emergency settings. This advancement exemplifies the convergence of laboratory assays and digital health tools, positioning Roche as a pioneer in algorithm-driven cardiovascular diagnostics.

Other key players, including Abbott Laboratories and Siemens Healthineers, are leveraging artificial intelligence and machine learning to enhance test performance and clinical interpretation. Abbott’s AI-enhanced troponin I assay provides real-time risk stratification at the point of care, reducing unnecessary hospital admissions and optimizing emergency department workflows. Meanwhile, diagnostics divisions at Danaher Corporation and Thermo Fisher Scientific continue to introduce modular platforms that combine immunodiagnostics, molecular assays, and data analytics, enabling laboratories to tailor testing solutions to evolving clinical needs. Collectively, these strategic initiatives underscore a competitive landscape marked by technological convergence and patient-centric innovation.

This comprehensive research report delivers an in-depth overview of the principal market players in the Cardiac Marker market, evaluating their market share, strategic initiatives, and competitive positioning to illuminate the factors shaping the competitive landscape.

- Abbott Laboratories

- bioMérieux SA

- Danaher Corporation

- DiaSorin S.p.A.

- Guangzhou Wondfo Biotech Co., Ltd.

- Mindray Medical International Limited

- Ortho Clinical Diagnostics, Inc.

- PerkinElmer Inc.

- Roche Diagnostics International AG

- Siemens Healthineers AG

- Sysmex Corporation

- Thermo Fisher Scientific Inc.

- Tosoh Corporation

Formulating Actionable Recommendations for Industry Leaders to Navigate Regulatory, Supply Chain, and Technological Challenges in Cardiac Marker Testing

To navigate the complex interplay of regulatory changes, supply chain disruptions, and technological advancements, industry leaders must adopt proactive strategies that balance short-term resilience with long-term growth. First, engaging in multi-stakeholder advocacy for tariff relief or targeted exemptions can mitigate cost pressures on critical diagnostic reagents and instrumentation. Recent lobbying efforts by U.S. hospitals and generic drugmakers have underscored the necessity of safeguarding medical imports from punitive tariffs, highlighting potential risks to patient access and affordability. By leveraging industry associations and trade organizations, diagnostics companies can shape policy dialogues and ensure that essential clinical tools remain accessible.

Second, diversifying manufacturing footprints and strengthening supplier relationships will be crucial for ensuring continuity of supply. Establishing regional production hubs or forging partnerships with contract manufacturing organizations can reduce dependency on single-source imports and streamline logistics. Additionally, investing in digital supply chain platforms will provide real-time visibility into inventory levels and shipment statuses, enabling rapid contingency responses to disruptions. Finally, prioritizing interoperability and data integration across laboratory information systems and clinical workflows will maximize the clinical impact of emerging assay technologies. By aligning product development roadmaps with evolving standards in data exchange and algorithmic validation, diagnostics companies can deliver seamless, end-to-end solutions that meet the demands of providers and payers alike.

Outlining a Robust and Transparent Research Methodology to Validate Data Sources and Analytical Frameworks in Cardiac Marker Market Intelligence

This analysis synthesizes insights drawn from an extensive research methodology encompassing both primary and secondary data sources. Secondary research involved a detailed review of regulatory filings, peer-reviewed publications, company press releases, and industry white papers to establish a robust understanding of cardiac marker assay developments and market dynamics. Primary research included interviews with key opinion leaders in cardiology, laboratory directors, and procurement specialists to validate emerging trends and identify unmet clinical needs.

Quantitative data were triangulated through cross-referencing import-export records from government databases, tariff schedules published by the United States Trade Representative, and financial disclosures from leading diagnostics manufacturers. Qualitative analyses integrated feedback from advisory panels and expert workshops to ensure contextual relevance of strategic recommendations. All findings were subject to rigorous validation protocols, including consensus reviews by internal subject matter experts, to guarantee the accuracy and reliability of the conclusions presented herein.

This section provides a structured overview of the report, outlining key chapters and topics covered for easy reference in our Cardiac Marker market comprehensive research report.

- Preface

- Research Methodology

- Executive Summary

- Market Overview

- Market Insights

- Cumulative Impact of United States Tariffs 2025

- Cumulative Impact of Artificial Intelligence 2025

- Cardiac Marker Market, by Product

- Cardiac Marker Market, by Technology

- Cardiac Marker Market, by Test Mode

- Cardiac Marker Market, by End User

- Cardiac Marker Market, by Application

- Cardiac Marker Market, by Region

- Cardiac Marker Market, by Group

- Cardiac Marker Market, by Country

- United States Cardiac Marker Market

- China Cardiac Marker Market

- Competitive Landscape

- List of Figures [Total: 17]

- List of Tables [Total: 1272 ]

Synthesizing Key Findings to Provide a Comprehensive Conclusion on the Future Trajectory of Cardiac Marker Diagnostics in Cardiovascular Care

The convergence of advanced assay technologies, artificial intelligence, and shifting healthcare policies signals a pivotal era for cardiac marker diagnostics. High-sensitivity troponin and natriuretic peptide assays have redefined clinical workflows, enabling rapid and accurate diagnosis of acute cardiac events. Simultaneously, point-of-care and digital triage solutions are broadening the reach of cardiac screening, from emergency departments to ambulatory settings and remote communities.

Despite the headwinds posed by enhanced tariff measures and supply chain uncertainties, strategic mitigation through policy advocacy, manufacturing diversification, and digital supply chain management can safeguard the continuity of critical diagnostic services. Regional growth disparities underscore the importance of tailored market entry strategies, while competitive innovations from leading industry players reaffirm the sector’s capacity for transformative advancements. Together, these insights chart a future trajectory where precision cardiology is not just a promise but an operational reality, driving improved patient outcomes and sustainable growth within the cardiac marker diagnostics market.

Take the Next Step in Elevating Cardiovascular Diagnostics Excellence by Partnering with Ketan Rohom to Access the Definitive Cardiac Marker Market Research Report

For decision-makers seeking to harness the full potential of cardiac marker diagnostics, acquiring the definitive market research report offers unparalleled strategic value. Engage directly with Ketan Rohom, Associate Director, Sales & Marketing at 360iResearch, to explore tailored insights that align with your corporate objectives. His expertise will guide you through the report’s comprehensive findings, including bespoke data analyses and competitive intelligence, ensuring you make informed investment and partnership decisions.

Contact Ketan to secure your copy of the full cardiac marker market research report and receive personalized support on integrating these insights into your growth strategy. Position your organization at the forefront of cardiovascular diagnostics innovation by leveraging this indispensable resource today.

- How big is the Cardiac Marker Market?

- What is the Cardiac Marker Market growth?

- When do I get the report?

- In what format does this report get delivered to me?

- How long has 360iResearch been around?

- What if I have a question about your reports?

- Can I share this report with my team?

- Can I use your research in my presentation?