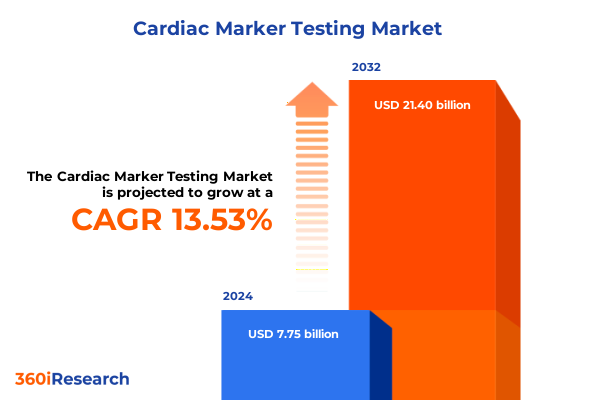

The Cardiac Marker Testing Market size was estimated at USD 8.72 billion in 2025 and expected to reach USD 9.82 billion in 2026, at a CAGR of 13.67% to reach USD 21.40 billion by 2032.

Discover the Critical Role of Cardiac Marker Testing in Revolutionizing Early Diagnosis and Enhancing Patient Outcomes in Acute Cardiac Events

The field of cardiac marker testing stands at the forefront of modern cardiology, playing an indispensable role in the rapid diagnosis and management of acute cardiac events. By quantifying specific biomarkers released into the bloodstream during myocardial injury, clinicians can distinguish between diverse forms of chest pain and rule in or rule out myocardial infarction with precision. In particular, troponin assays have emerged as the gold standard, enabling detection of even minor cardiac damage that might have been overlooked by traditional diagnostic techniques. These advances translate into faster clinical decision-making, reduced time to treatment, and, ultimately, improved patient outcomes in emergency and critical care settings.

As the incidence of cardiovascular disease continues to rise globally, the demand for more accurate, sensitive, and cost-effective testing solutions has intensified. Innovations such as high sensitivity troponin assays, compact point-of-care devices, and integrated automation systems are reshaping laboratory workflows and clinical pathways. Concurrently, evolving regulatory frameworks and reimbursement policies exert significant influence on technology adoption rates across different geographies. In this context, understanding the convergence of scientific breakthroughs, operational efficiencies, and health economics becomes essential for stakeholders seeking to navigate the competitive landscape of cardiac diagnostics. This executive summary provides a concise, authoritative overview of the market dynamics, segmentation nuances, regional drivers, and strategic imperatives that define the future of cardiac marker testing.

Uncovering How Innovations in High Sensitivity Assays and Automation Are Dramatically Shifting the Paradigm for Cardiac Marker Testing Workflows

Over the past decade, the landscape of cardiac marker testing has undergone transformative shifts, driven by breakthroughs in assay sensitivity and laboratory automation. High sensitivity troponin assays now detect cardiac injury hours earlier than conventional methods, enabling earlier intervention in acute coronary syndromes and reducing the incidence of adverse cardiovascular events. This milestone in analytical performance has prompted many healthcare facilities to reconfigure diagnostic algorithms, favoring biomarkers that yield faster and more definitive results. The integration of chemiluminescence immunoassays and automated ELISA platforms into routine workflows has further enhanced throughput and reproducibility, addressing the demands of high-volume laboratories.

In parallel, the proliferation of point-of-care testing devices has decentralized cardiac diagnostics, bringing critical information directly to the bedside, outpatient clinics, and even remote or under-resourced settings. Biosensor-based devices and lateral flow immunoassays permit rapid decision-making outside traditional laboratory environments, fostering a new paradigm of patient-centered care. At the same time, advancements in lab automation-ranging from semi-automated analyzers to fully walkaway systems-have optimized resource utilization, minimized manual errors, and streamlined sample processing. Together, these technological evolutions are redefining what is possible in cardiac marker testing, setting the stage for more integrated, data-driven approaches that promise to enhance diagnostic accuracy and operational resilience.

Exploring the Far Reaching Consequences of United States Tariff Policies Implemented in 2025 on Cardiac Marker Testing Supply Chains and Cost Implications

In 2025, the United States introduced a series of tariffs targeting equipment and reagents imported for in vitro diagnostic applications, including cardiac marker testing. These measures, intended to bolster domestic manufacturing, have generated a complex array of downstream effects on supply chain dynamics, procurement strategies, and cost structures. Diagnostic manufacturers reliant on specialized assay kits, bulk reagents, and precision instruments have experienced rising input costs, compelling many to reevaluate sourcing options and renegotiate supplier agreements. Consequently, some organizations have accelerated initiatives to localize production, while others are exploring strategic partnerships to mitigate tariff-induced price escalations.

Beyond the immediate financial impact, the tariffs have prompted a strategic recalibration among laboratories and healthcare providers. Budgetary constraints triggered by higher procurement costs can translate into longer turnaround times, reduced assay volumes, or delayed technology upgrades. In response, stakeholders are increasingly turning to contract manufacturing organizations within the United States or diversifying supply portfolios to include non-tariffed components. Additionally, manufacturers are investing in research and development to create alternative reagent formulations and assay platforms that rely less on imported materials. This evolving environment underscores the need for proactive risk management strategies, close collaboration between supply chain experts and regulatory affairs teams, and timely scenario planning to safeguard both clinical service levels and fiscal sustainability.

Delving into the Nuanced Segmentation of Cardiac Marker Testing Markets by Biomarker Type Product Technology and End User Characteristics

A deep dive into cardiac marker testing reveals a market segmented by several key dimensions, each reflecting unique usage patterns and technological requirements. Marker type has emerged as a primary axis of differentiation, with enzymes such as Ck-Mb and LDH providing historical context, while myoglobin offers rapid but less specific detection. The prominence of troponin assays, split across conventional and high sensitivity formats for both Troponin I and Troponin T, highlights the industry’s pivot toward ultra-precise biomarkers capable of detecting minimal elevations in cardiac proteins.

Turning to product categories, assay kits remain central to diagnostic workflows, ranging from multiplex configurations that assess multiple markers in parallel to single analyte kits tailored for focused applications. Instruments likewise vary from bench top analyzers designed for high-capacity laboratories to handheld devices that facilitate point-of-care deployment. Reagent offerings are also diversified, spanning bulk formulations for established labs and ready-to-use pre-aliquoted reagents that enhance convenience and reduce error potential. Underpinning these product dimensions, technology segments encompass immunoassay methodologies-chemiluminescence immunoassays and ELISA-lab automation approaches from semi-automated analyzers to full walkaway systems, and point-of-care solutions that include biosensor-based devices and lateral flow immunoassays.

Finally, the end user landscape is delineated by care delivery settings. Clinics, from specialized cardiac centers to general outpatient facilities, represent critical access points for early screening and follow-up. Diagnostic laboratories, both independent and hospital-affiliated, drive high-volume testing and confirmatory analysis. Hospitals, encompassing community networks and tertiary referral centers, anchor acute care pathways and integrate testing into emergency and inpatient services. The interplay of these segmentation layers shapes market preferences, informs pricing strategies, and guides targeted product development.

This comprehensive research report categorizes the Cardiac Marker Testing market into clearly defined segments, providing a detailed analysis of emerging trends and precise revenue forecasts to support strategic decision-making.

- Marker Type

- Product

- Technology

- End User

Illuminating Regional Variations in Cardiac Marker Testing Adoption Across the Americas Europe Middle East Africa and Asia Pacific Regions

Examining cardiac marker testing through a regional lens uncovers distinct adoption patterns, regulatory influences, and economic considerations. In the Americas, robust reimbursement frameworks and high awareness of cardiovascular risk have propelled widespread acceptance of high sensitivity troponin assays. Laboratories and point-of-care settings in North America continue to pioneer integrated diagnostic platforms, while Latin American markets are characterized by a blend of centralized testing hubs and emerging decentralized networks seeking cost-effective solutions.

Across Europe, the Middle East, and Africa, the landscape is equally multifaceted. Western European nations benefit from harmonized regulatory standards and mature healthcare infrastructures, fostering rapid uptake of advanced immunoassay platforms. The Middle East exhibits growing investment in laboratory modernization, often through public-private partnerships, whereas African markets face challenges related to limited funding, infrastructure gaps, and supply chain constraints. This diversity drives tailored market entry strategies and collaborative initiatives aimed at expanding access to reliable cardiac diagnostics.

In the Asia-Pacific region, escalating cardiovascular disease prevalence, government-led healthcare reforms, and increasing availability of point-of-care devices are key growth drivers. East Asian markets leverage local manufacturing prowess to produce cost-competitive assay kits and automation systems, while South Asian and Southeast Asian countries focus on extending diagnostic reach into rural areas. Cross-border collaborations, technology transfer agreements, and innovative financing models are shaping a dynamic environment that balances scale with sensitivity to local healthcare demands.

This comprehensive research report examines key regions that drive the evolution of the Cardiac Marker Testing market, offering deep insights into regional trends, growth factors, and industry developments that are influencing market performance.

- Americas

- Europe, Middle East & Africa

- Asia-Pacific

Assessing Strategic Moves and Competitive Dynamics of Leading Players Shaping the Cardiac Marker Testing Ecosystem Through Innovation and Partnerships

Leading companies in the cardiac marker testing arena are distinguished by their strategic investment in high sensitivity assay development, digital integration, and global partnership networks. Many have prioritized the refinement of chemiluminescence immunoassay technologies while simultaneously expanding their point-of-care portfolios to capture a broader spectrum of healthcare settings. By forging alliances with biotechnology firms, contract research organizations, and regional distributors, these players are enhancing their supply chain resilience and accelerating time-to-market for novel diagnostic solutions.

Competitive dynamics are further influenced by mergers and acquisitions, which enable firms to consolidate R&D capabilities, streamline product pipelines, and leverage shared infrastructure. Recent high-profile transactions have centered on securing access to proprietary biosensor platforms and automated analyzers, underscoring the strategic imperative of integrated diagnostics. At the same time, collaborative ventures with hospital networks and academic institutions are yielding co-development opportunities and real-world evidence initiatives. These partnerships not only validate clinical utility but also facilitate market access through early adopter endorsements, clinical guidelines incorporation, and payer engagement. As the landscape continues to evolve, companies that can seamlessly blend technological innovation with strategic alliances will be best positioned to lead the future of cardiac marker testing.

This comprehensive research report delivers an in-depth overview of the principal market players in the Cardiac Marker Testing market, evaluating their market share, strategic initiatives, and competitive positioning to illuminate the factors shaping the competitive landscape.

- Abbott Laboratories

- Becton, Dickinson and Company

- Bio-Rad Laboratories, Inc.

- bioMérieux SA

- Danaher Corporation

- F. Hoffmann-La Roche AG

- LSI Medience Corporation

- Ortho Clinical Diagnostics Inc.

- PerkinElmer, Inc.

- Quidel Corporation

- Randox Laboratories Ltd.

- Siemens Healthineers AG

- Thermo Fisher Scientific Inc.

Empowering Industry Stakeholders with Targeted Recommendations to Enhance Diagnostic Accuracy Streamline Operations and Drive Growth in Cardiac Marker Testing

Industry stakeholders must act decisively to capitalize on evolving diagnostic trends and mitigate emerging risks. First, prioritizing the development and commercialization of high sensitivity troponin assays can yield competitive advantage by addressing clinician demand for early myocardial injury detection and aligning with updated clinical guidelines. In parallel, expanding point-of-care offerings-particularly biosensor-based devices and lateral flow tests-will drive market penetration in outpatient and decentralized settings, where rapid decision-making is critical.

Moreover, building supply chain agility through diversification of sourcing and strategic alliances with domestic manufacturers can shield organizations from the volatility induced by tariff regimes and global disruptions. Aligning procurement strategies with regulatory timelines and implementing flexible inventory management systems will further enhance resilience. From an operational perspective, adopting scalable lab automation solutions-ranging from semi-automated analyzers to fully walkaway systems-can optimize resource utilization and improve throughput, especially in high-volume reference laboratories. Finally, engaging with payers, clinical key opinion leaders, and patient advocacy groups will facilitate favorable reimbursement pathways, drive guideline inclusion, and promote broader adoption of novel cardiac marker testing modalities.

Outlining Rigorous Methodological Frameworks Employed in the Comprehensive Analysis of Cardiac Marker Testing Trends Data and Stakeholder Interviews

The insights presented in this report are grounded in a rigorous, multi-method research framework designed to ensure comprehensive coverage and analytical depth. Primary research was conducted through structured interviews with leading cardiologists, laboratory directors, diagnostic developers, and procurement specialists, providing qualitative perspectives on market trends, technology adoption barriers, and regional dynamics. Secondary research complemented these interviews with extensive analysis of peer-reviewed literature, regulatory filings, patent landscapes, and financial disclosures to validate key data points and benchmark industry benchmarks.

Quantitative data triangulation was achieved by cross-referencing sales figures, reagent consumption statistics, and instrument installation volumes obtained from proprietary databases and industry reports. Methodological rigor was maintained through systematic data validation, consistency checks, and peer review by internal subject matter experts. Segmentation matrices were constructed to capture the interplay between marker type, product category, technology platform, and end user setting. Regional analyses integrated macroeconomic indicators, healthcare expenditure profiles, and epidemiological trends to contextualize growth drivers and adoption barriers. This robust approach ensures that the findings and recommendations deliver actionable insights with high confidence and real-world relevance.

This section provides a structured overview of the report, outlining key chapters and topics covered for easy reference in our Cardiac Marker Testing market comprehensive research report.

- Preface

- Research Methodology

- Executive Summary

- Market Overview

- Market Insights

- Cumulative Impact of United States Tariffs 2025

- Cumulative Impact of Artificial Intelligence 2025

- Cardiac Marker Testing Market, by Marker Type

- Cardiac Marker Testing Market, by Product

- Cardiac Marker Testing Market, by Technology

- Cardiac Marker Testing Market, by End User

- Cardiac Marker Testing Market, by Region

- Cardiac Marker Testing Market, by Group

- Cardiac Marker Testing Market, by Country

- United States Cardiac Marker Testing Market

- China Cardiac Marker Testing Market

- Competitive Landscape

- List of Figures [Total: 16]

- List of Tables [Total: 2385 ]

Synthesizing Key Insights to Highlight the Pivotal Importance of Evolving Cardiac Marker Testing Practices in Shaping Future Cardiovascular Care Strategies

Throughout this executive summary, it becomes evident that cardiac marker testing is undergoing a period of rapid evolution, fueled by technological innovation, shifting regulatory environments, and dynamic market forces. The transition to high sensitivity assays and automated workflows is redefining diagnostic timelines and clinical decision-making pathways, offering unprecedented opportunities to improve patient outcomes. Simultaneously, external factors such as tariff policies and regional infrastructure disparities present both challenges and opportunities for market participants.

By examining segmentation nuances across marker types, product portfolios, technology platforms, and care settings, stakeholders can refine their development roadmaps and tailor value propositions to specific end user needs. Regional insights highlight the importance of adapting strategies to diverse reimbursement landscapes and healthcare delivery models, while competitive analysis underscores the strategic value of partnerships, M&A, and innovation ecosystems. Collectively, these insights chart a roadmap for navigating the complexities of the cardiac marker testing market and underscore the critical importance of proactive strategy formulation in securing leadership positions in the coming years.

Take the Next Step in Unlocking Comprehensive Market Intelligence for Cardiac Marker Testing by Connecting with Ketan Rohom Today to Acquire the Full Report

To explore the comprehensive insights, methodological rigor, and actionable strategies presented in this cardiac marker testing report, we invite you to engage directly with Ketan Rohom, Associate Director of Sales & Marketing. His expertise in translating complex diagnostic market intelligence into tailored solutions ensures that you receive the precise data and analysis needed to drive informed decisions. By connecting with Ketan, you will gain exclusive access to detailed findings on emerging biomarkers, advanced assay technologies, and evolving regulatory landscapes, enabling you to optimize product development roadmaps and commercial strategies. Reach out to discuss customized licensing options, enterprise-level access, or bespoke consulting engagements. Take the next decisive step toward differentiating your offerings and securing a leadership position in the cardiac diagnostics market by acquiring the full report today.

- How big is the Cardiac Marker Testing Market?

- What is the Cardiac Marker Testing Market growth?

- When do I get the report?

- In what format does this report get delivered to me?

- How long has 360iResearch been around?

- What if I have a question about your reports?

- Can I share this report with my team?

- Can I use your research in my presentation?