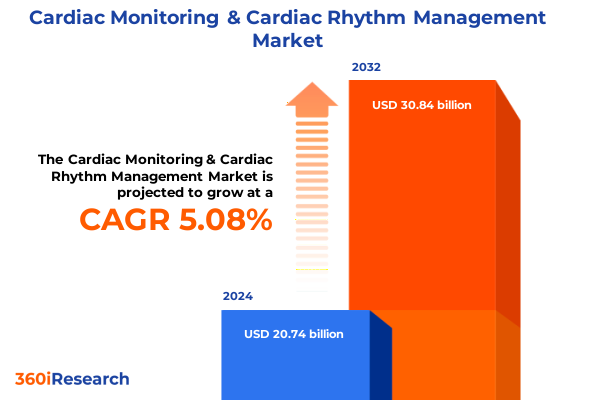

The Cardiac Monitoring & Cardiac Rhythm Management Market size was estimated at USD 21.72 billion in 2025 and expected to reach USD 22.75 billion in 2026, at a CAGR of 5.13% to reach USD 30.84 billion by 2032.

Navigating the Dynamic Intersection of Cardiac Monitoring and Rhythm Management to Empower Clinical Outcomes and Patient Experiences

Cardiovascular diseases remain a leading cause of morbidity and mortality worldwide, prompting unprecedented investment in advanced monitoring and rhythm management solutions. In this dynamic environment, providers, payers, and technology developers are all striving to enhance patient care through real-time data acquisition, predictive analytics, and integrated therapeutic modalities. Recent advancements in sensing technologies, connectivity, and artificial intelligence have catalyzed a paradigm shift, transforming devices from standalone tools into sophisticated components of a holistic care ecosystem.

Against this backdrop, stakeholders are demanding not just incremental improvements but truly transformative outcomes-proactive disease management, reduced hospital readmissions, and more personalized therapeutic regimens. Regulatory bodies and reimbursement frameworks are evolving in response, incentivizing innovations that demonstrate clinical efficacy and cost-effectiveness. These factors, coupled with growing consumer awareness and smartphone ubiquity, have created a fertile ground for novel devices and service models that blur the lines between in‐clinic and at‐home care.

This executive summary synthesizes the most critical themes shaping the cardiac monitoring and rhythm management market in 2025, examining how technology, policy, and patient engagement converge to redefine industry standards. We begin by exploring the key market shifts, followed by an analysis of recent tariff changes in the United States and their ripple effects on global supply chains. We then delve into segmentation insights across device type, therapy type, technology, application, and end user, before highlighting regional variations and profiling leading companies. Finally, strategic recommendations and a transparent research methodology provide a roadmap for decision‐makers seeking to capitalize on emerging opportunities and navigate potential challenges with confidence.

Unveiling the Pivotal Technological and Clinical Transitions Shaping the Future of Cardiac Monitoring and Rhythm Management

Over the past five years, the cardiac monitoring and rhythm management landscape has witnessed seismic changes driven by technological breakthroughs and shifting care paradigms. Wearable sensors and implantable devices alike now offer unprecedented granularity in detecting arrhythmic events and monitoring hemodynamic parameters, enabling clinicians to transition from sporadic snapshots to continuous, contextualized assessments. This evolution has not only improved diagnostic accuracy but also facilitated the development of closed‐loop therapeutic systems that autonomously adjust pacing or defibrillation thresholds based on real‐time physiologic feedback.

Concurrently, the proliferation of cloud‐based platforms and edge computing capabilities has unlocked new possibilities for remote patient monitoring and telehealth integration. Care teams can now analyze longitudinal patient data streams, apply predictive analytics to forecast adverse events, and intervene preemptively-thus reducing emergency department visits and hospitalizations. Patient engagement tools, including smartphone apps and connected health portals, have further democratized access to personalized care plans, fostering greater adherence and patient empowerment.

Meanwhile, strategic collaborations between technology firms, healthcare providers, and academic institutions are accelerating translational research efforts. These partnerships are paving the way for multi‐modal diagnostics that combine electrocardiographic signals with biomarkers, imaging data, and genetic profiles to create comprehensive risk stratification models. As a result, the market is moving toward truly precision‐guided cardiac care where interventions are tailored not only to disease etiology but also to individual patient biology.

Assessing How Recent U.S. Tariff Policies in 2025 Are Reshaping Supply Chains and Innovation Trajectories in Cardiac Device Markets

In early 2025, the United States implemented updated tariff measures targeting select medical device imports, a shift that has reverberated across component supply chains and cost structures. Manufacturers of external wearable monitors have faced increased costs for electronic sensors sourced from overseas, prompting a reevaluation of procurement strategies and supplier diversification. Simultaneously, implantable device developers reliant on specialized alloys and microelectronic components have experienced margin pressure, leading some to explore nearshoring opportunities or to negotiate long‐term supply agreements to mitigate price volatility.

These policy changes have also spurred innovation in local manufacturing capabilities. Several companies have announced investments in domestic production lines for printed circuit boards and precision machining, aiming to reduce lead times and insulate against future tariff fluctuations. At the same time, stakeholders are engaging in dialogue with regulatory agencies to streamline import approvals and secure exemptions for critical medical technologies. This collaborative approach underscores the recognition that while tariffs introduce short‐term cost challenges, they can also accelerate supply chain resilience and foster the development of domestic expertise.

Looking ahead, device makers are balancing the need to maintain competitive pricing with the imperative to invest in cutting‐edge research and development. The current environment has highlighted the strategic importance of supply chain agility, encouraging organizations to adopt a dual‐sourcing framework and to leverage emerging manufacturing technologies such as additive manufacturing. Collectively, these responses are reshaping the industrial landscape, ensuring that the sector remains innovative and responsive despite geopolitical headwinds.

Exploring Critical Segmentation Dimensions That Illuminate Diverse Patient Needs and Device Preferences in Cardiac Monitoring and Rhythm Management

Understanding the cardiac monitoring and rhythm management market requires a nuanced appreciation of how different segmentation dimensions intersect to influence product development and clinical adoption. When examining device type, it becomes clear that the choice between external monitoring devices and implantable monitoring devices hinges on patient acuity, desired monitoring duration, and risk tolerance. External devices offer greater accessibility and lower procedural risk, making them well‐suited for ambulatory care centers and home healthcare settings, whereas implantable solutions provide continuous, high‐fidelity data streams that benefit hospital‐based or high‐risk patient cohorts.

Digging deeper into therapy type segmentation reveals that cardiac resynchronization therapy devices, implantable cardioverter defibrillators, and pacemakers each address distinct therapeutic needs. The former has emerged as a cornerstone treatment for advanced heart failure by improving ventricular synchronization, while implantable cardioverter defibrillators-whether subcutaneous or transvenous-serve as critical safeguards against sudden cardiac death in high‐risk populations. Pacemaker classification into biventricular, dual chamber, and single chamber variants further underscores the market’s drive toward tailoring electrical support to individual conduction pathologies and patient activity profiles.

Technological segmentation sheds light on how connectivity and platform design are redefining patient engagement and data analysis. Mobile solutions, leveraging smartphone and tablet interfaces, have lowered the barrier to remote monitoring and have enabled real‐time feedback loops between patients and care teams. Remote patient monitoring systems and telehealth frameworks facilitate integrated care pathways that span geographic boundaries, while wireless technologies-ranging from Bluetooth for short‐range data transfer to Zigbee for mesh network deployments-ensure reliable, low‐power connectivity for a wide array of devices.

Application‐based insights reveal that key clinical use cases-arrhythmia detection, heart failure monitoring, and postoperative monitoring-drive distinct feature sets and workflow integrations. Within arrhythmia detection, the focus on atrial fibrillation versus ventricular arrhythmia determines signal processing requirements and alarm thresholds. Heart failure monitoring segments into fluid status versus weight monitoring capabilities, each feeding into tailored decision‐support algorithms. Similarly, postoperative monitoring solutions prioritize rapid device initialization and automated reporting to support early discharge protocols.

Finally, end user segmentation across ambulatory care centers, home healthcare, and hospitals highlights divergent purchasing criteria and implementation models. While hospitals may prioritize comprehensive data integration and interoperability with electronic health records, home healthcare providers seek portable, intuitive systems that minimize training requirements. Ambulatory care centers, in turn, balance throughput efficiency with robust diagnostic performance, ensuring that monitoring devices align with outpatient workflow demands.

This comprehensive research report categorizes the Cardiac Monitoring & Cardiac Rhythm Management market into clearly defined segments, providing a detailed analysis of emerging trends and precise revenue forecasts to support strategic decision-making.

- Device Type

- Therapy Type

- Technology

- Application

- End User

Highlighting Strategic Regional Variations Across the Americas, Europe Middle East & Africa, and Asia Pacific for Global Cardiac Device Deployment

Geographic regions display distinct adoption velocities and clinical priorities that reflect both epidemiological patterns and healthcare infrastructure maturity. In the Americas, sustained investment in digital health initiatives and robust reimbursement policies have accelerated the uptake of remote monitoring platforms and implantable therapeutics. The United States remains a leader in telehealth integration, with home healthcare agencies and ambulatory centers rapidly incorporating smartphone‐enabled devices into standard care pathways. Latin America, by contrast, is characterized by incremental adoption driven by partnerships with global device manufacturers and targeted public health programs addressing rising cardiovascular disease prevalence.

Across Europe, Middle East & Africa, heterogeneous regulatory landscapes and variable GDP per capita levels have fostered a multi‐speed market. Western Europe exhibits high form factor innovation and interoperability standards, underpinned by unified reimbursement frameworks in key countries. Meanwhile, emerging markets in Eastern Europe and the Middle East are prioritizing cost‐effective external monitors to bridge care gaps, and Africa continues to see philanthropic and public–private initiatives driving basic rhythm management solutions into underserved areas.

The Asia Pacific region presents a dynamic tableau of growth drivers and challenges. In advanced economies such as Japan and Australia, aging demographics and well‐established healthcare systems are propelling demand for implantable devices and integrated telehealth services. Rapidly urbanizing markets in China and Southeast Asia are witnessing increasing domestic production capacities and government‐sponsored digital health pilots, while South Asian nations face infrastructure constraints that favor external, mobile‐centric monitoring solutions. Despite these differences, a common thread across the region is the surge in consumer health awareness, which is spurring innovative distribution channels and public acceptance of remote cardiac care.

This comprehensive research report examines key regions that drive the evolution of the Cardiac Monitoring & Cardiac Rhythm Management market, offering deep insights into regional trends, growth factors, and industry developments that are influencing market performance.

- Americas

- Europe, Middle East & Africa

- Asia-Pacific

Profiling Leading Industry Players Driving Innovation, Strategic Collaborations, and Competitive Dynamics in Cardiac Monitoring and Rhythm Management

The competitive landscape is anchored by established multinational medical device manufacturers that combine extensive product portfolios with global distribution networks. These organizations are investing heavily in next‐generation sensors, miniaturized electronics, and advanced materials to differentiate their offerings and secure long‐term service contracts. At the same time, technology disruptors with expertise in data analytics, software development, and connectivity are forming strategic alliances or pursuing acquisitions to integrate their platforms with traditional device architectures, thereby enabling new value propositions centered on predictive maintenance and longitudinal patient management.

Collaborative consortiums involving academic institutions are also playing a key role in validating emerging therapies and refining clinical guidelines. By co‐developing clinical studies and white papers, these partnerships are elevating the evidence base for novel device–software combinations, facilitating faster regulatory approval, and streamlining adoption by care providers. Additionally, contract research organizations and specialized service providers are gaining prominence as outsourced partners for post‐market surveillance, quality management, and market access activities, allowing device makers to focus on core R&D and manufacturing competencies.

Meanwhile, smaller entrepreneurial firms are carving out niche positions by addressing underserved segments, such as pediatric rhythm management or minimally invasive, lead-less pacing systems. These innovators often operate with lean teams and agile development methodologies, rapidly iterating on prototypes and leveraging venture capital to accelerate proof‐of‐concept validation. Their success has prompted traditional players to create internal innovation incubators and corporate venture funds to stay ahead of disruptive threats.

This comprehensive research report delivers an in-depth overview of the principal market players in the Cardiac Monitoring & Cardiac Rhythm Management market, evaluating their market share, strategic initiatives, and competitive positioning to illuminate the factors shaping the competitive landscape.

- Abbott Laboratories

- ACS Diagnostics, Inc.

- AliveCor, Inc.

- Bardy Diagnostics, Inc.

- BioTelemetry, Inc.

- Biotronik SE & Co. KG

- Bittium Corporation

- BPL Medical Technologies

- GE Healthcare

- Hill-Rom Holdings, Inc.

- iRhythm Technologies, Inc.

- Koninklijke Philips N.V.

- LivaNova PLC

- Medtronic plc

- MicroPort Scientific Corporation

- Nihon Kohden Corporation

- Preventice Solutions, Inc.

- Schiller AG

- Shree Pacetronix Ltd.

- Siemens Healthineers AG

- Sorin Group

- St. Jude Medical, Inc.

- Zoll Medical Corporation

Formulating Practical Strategic Imperatives to Accelerate Growth, Enhance Patient Outcomes, and Sustain Competitive Advantage in Cardiac Device Markets

To thrive in this evolving market, industry leaders should adopt a dual‐track innovation strategy that balances incremental enhancements to established product lines with exploratory investments in emerging technologies. Clinical validation efforts must be strengthened through real‐world evidence studies that demonstrate tangible benefits in patient outcomes and health economic metrics. By forging partnerships with payers and healthcare systems early in the development cycle, organizations can align product specifications with reimbursement criteria and accelerate pathway adoption.

Supply chain agility should be reinforced by adopting multi‐sourcing protocols for critical components, while simultaneously investing in modular manufacturing approaches that allow for rapid scaling and customization. Building on current momentum in edge computing and embedded analytics, companies should prioritize device architectures that support over‐the‐air software updates and interoperable data exchange standards, thereby extending the functional lifespan of installed bases and creating recurring revenue streams.

Furthermore, a patient‐centric approach to user experience design is vital. Engaging end users-both clinicians and patients-in co‐creation workshops can uncover latent needs and drive higher adoption rates. Complementary digital health services, including coaching apps and virtual support communities, can further differentiate product offerings and foster long‐term engagement. Strategic marketing plans should emphasize outcome‐driven narratives, leveraging case studies that illustrate reduced hospital readmissions and improved quality of life.

Finally, proactive regulatory engagement is essential. Companies must anticipate evolving standards for cybersecurity, data privacy, and interoperability by participating in industry working groups and contributing to consensus frameworks. This foresight will reduce approval timelines, minimize compliance risks, and position organizations as thought leaders in the broader healthcare technology ecosystem.

Detailing Rigorous Qualitative and Quantitative Research Frameworks Underpinning Comprehensive Cardiac Monitoring and Rhythm Management Market Analysis

The research underpinning this analysis combined rigorous quantitative data collection with qualitative insights to ensure robust and defensible conclusions. Secondary research entailed an exhaustive review of peer‐reviewed journals, regulatory filings, industry white papers, and government policy documents to map the competitive landscape and identify technology trends. Primary research consisted of structured interviews with key opinion leaders, including cardiologists, electrophysiologists, healthcare executives, and regulatory experts, complemented by surveys of technology procurement managers across hospitals and home healthcare providers.

Data triangulation was employed to reconcile discrepancies between secondary sources and primary feedback, ensuring that emerging themes were validated across multiple stakeholder groups. Competitive intelligence was gathered through an analysis of patent filings, product registrations, and clinical trial registries, offering a forward‐looking perspective on innovation trajectories. Regional market dynamics were assessed through localized expert networks to capture nuances in reimbursement, infrastructure, and patient demographics.

Quantitative modeling techniques, such as scenario analysis and sensitivity testing, were applied to historical adoption curves and cost‐benefit data, elucidating potential inflection points in market growth. Qualitative frameworks, including SWOT and PESTEL analyses, provided strategic context around regulatory shifts, macroeconomic forces, and technology convergence. Ethical considerations and data privacy compliance were maintained throughout the research process, adhering to industry standards and best practices.

This section provides a structured overview of the report, outlining key chapters and topics covered for easy reference in our Cardiac Monitoring & Cardiac Rhythm Management market comprehensive research report.

- Preface

- Research Methodology

- Executive Summary

- Market Overview

- Market Insights

- Cumulative Impact of United States Tariffs 2025

- Cumulative Impact of Artificial Intelligence 2025

- Cardiac Monitoring & Cardiac Rhythm Management Market, by Device Type

- Cardiac Monitoring & Cardiac Rhythm Management Market, by Therapy Type

- Cardiac Monitoring & Cardiac Rhythm Management Market, by Technology

- Cardiac Monitoring & Cardiac Rhythm Management Market, by Application

- Cardiac Monitoring & Cardiac Rhythm Management Market, by End User

- Cardiac Monitoring & Cardiac Rhythm Management Market, by Region

- Cardiac Monitoring & Cardiac Rhythm Management Market, by Group

- Cardiac Monitoring & Cardiac Rhythm Management Market, by Country

- United States Cardiac Monitoring & Cardiac Rhythm Management Market

- China Cardiac Monitoring & Cardiac Rhythm Management Market

- Competitive Landscape

- List of Figures [Total: 17]

- List of Tables [Total: 1908 ]

Synthesizing Core Findings to Illuminate Future Pathways and Strategic Priorities in Cardiac Monitoring and Rhythm Management

The convergence of advanced sensing, connectivity, and data analytics is fundamentally reshaping the cardiac monitoring and rhythm management arena. Continuous, high‐fidelity monitoring solutions, when integrated with cloud‐based analytics and patient engagement platforms, are enabling a shift from reactive to proactive care models. Regulatory and reimbursement environments, while adapting to these innovations, are placing greater emphasis on demonstrable clinical and economic value, accelerating the validation of end‐to‐end remote care pathways.

Supply chain dynamics, influenced by recent tariff policy changes, have underscored the importance of manufacturing resilience and strategic sourcing. Organizations that proactively address these challenges are not only insulating themselves against cost volatility but are also unlocking opportunities for domestic capability building and technological differentiation. Segmentation insights reveal that tailoring solutions across device type, therapy type, technology platform, application focus, and end user context is essential for driving adoption and achieving clinical success.

Regional variations highlight the necessity of a tailored go‐to‐market approach in the Americas, Europe Middle East & Africa, and Asia Pacific, each with its own regulatory nuances, infrastructure capacities, and patient demographics. The competitive ecosystem, comprised of established medical device titans, agile technology firms, research consortiums, and entrepreneurial innovators, presents both collaboration opportunities and disruptive threats.

By synthesizing these findings, decision makers can chart a clear path forward: embracing open, interoperable device architectures; prioritizing patient‐centric end‐user experiences; reinforcing supply chain robustness; and forging strategic alliances across the healthcare value chain. These imperatives will ensure that organizations remain at the forefront of delivering impactful cardiac monitoring and rhythm management solutions in a rapidly evolving market.

Engage with Associate Director Ketan Rohom to Unlock In-Depth Market Insights and Drive Strategic Decision Making with Comprehensive Cardiac Device Research

To explore the depth and breadth of the cardiac monitoring and rhythm management landscape, we encourage you to reach out to Ketan Rohom, Associate Director of Sales & Marketing. Ketan brings together extensive industry expertise and a deep understanding of how to translate data-driven insights into strategic initiatives. By connecting with him, you gain personalized guidance on how to leverage our comprehensive market analysis to inform product development, optimize go-to-market strategies, and anticipate emerging trends that could shape your competitive positioning.

Ketan’s collaborative approach ensures that your organization’s specific objectives and challenges are addressed with precision. Whether you are seeking to refine device portfolios, evaluate partnership opportunities, or navigate complex regulatory environments, his insights will provide the clarity and direction needed to make confident decisions. Initiating a conversation with Ketan also opens the door to bespoke research offerings, interactive workshops, and executive briefings that align with your unique timeline and budget requirements.

Take the next step toward harnessing the full potential of the cardiac monitoring and rhythm management market. Contact Ketan Rohom today to schedule a complimentary consultation and learn how our research can be tailored to support your strategic vision. Unlock actionable intelligence, strengthen your market position, and drive sustainable growth with the guidance of an industry leader who understands both the clinical imperatives and commercial realities of this evolving field.

- How big is the Cardiac Monitoring & Cardiac Rhythm Management Market?

- What is the Cardiac Monitoring & Cardiac Rhythm Management Market growth?

- When do I get the report?

- In what format does this report get delivered to me?

- How long has 360iResearch been around?

- What if I have a question about your reports?

- Can I share this report with my team?

- Can I use your research in my presentation?