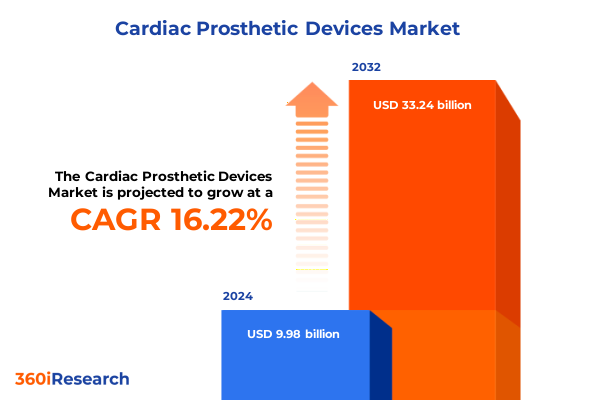

The Cardiac Prosthetic Devices Market size was estimated at USD 11.57 billion in 2025 and expected to reach USD 13.42 billion in 2026, at a CAGR of 16.26% to reach USD 33.24 billion by 2032.

Establishing the Critical Context and Uncovering the Underlying Market Dynamics Driving the Evolution of Cardiac Prosthetic Devices in Modern Healthcare

The cardiac prosthetic devices industry stands at the nexus of technological innovation, demographic shifts, and evolving clinical needs, demanding a clear overview to frame subsequent analysis. Advances in medical engineering and material sciences have expanded the repertoire of therapeutic options, addressing the growing incidence of heart failure, arrhythmias, and valvular diseases. Concurrently, regulatory agencies worldwide have refined approval pathways, emphasizing real-world evidence and post-market surveillance to ensure device safety and efficacy. Moreover, heightened patient expectations and the proliferation of value-based care models are reshaping reimbursement frameworks, incentivizing manufacturers to demonstrate long-term clinical benefits in addition to procedural success. Understanding these interwoven factors is essential for stakeholders aiming to navigate the competitive landscape and capitalize on unmet clinical needs. As the field progresses, aligning product pipelines with regulatory requirements, payer demands, and patient preferences will be critical to driving sustainable growth and delivering superior outcomes.

Tracing the Paradigm Shift Toward Minimally Invasive and Digitally-Enhanced Therapies Redwriting the Future of Cardiac Prosthetics

Recent breakthroughs have catalyzed a shift from open surgical interventions toward minimally invasive and image-guided procedures, markedly reducing patient recovery times and procedural risks. The rapid adoption of transcatheter valve replacement techniques underscores this transformation, as clinicians increasingly leverage percutaneous routes to treat high-risk patient cohorts. Simultaneously, the emergence of leadless and subcutaneous cardiac rhythm management systems reflects a departure from traditional transvenous leads, mitigating complications such as infection and lead failure. Complementing these procedural and design enhancements, digital health platforms now integrate device telemetry with predictive analytics, enabling proactive patient management and remote monitoring. Material innovations, including bioresorbable polymers and novel biomimetics, are further refining device biocompatibility and longevity. Collectively, these advances are converging to redefine clinical standards and patient expectations, propelling the market toward more personalized, less invasive therapeutic pathways.

Evaluating the Ripple Effects of 2025 United States Tariffs on Supply Chains Pricing Strategies and Stakeholder Collaboration

In 2025, the United States implemented tariffs that have reverberated through the cardiac prosthetic device supply chain, reshaping cost structures and strategic sourcing decisions. Imported raw materials such as specialized alloys and biocompatible polymers now carry increased duties, leading manufacturers to reassess supplier contracts and explore local manufacturing partnerships to mitigate cost inflation. As a result, procurement teams are diversifying their supplier base to balance tariff exposure while maintaining rigorous quality standards. Device pricing negotiations with payers have become more complex, as providers and manufacturers seek to absorb or offset additional expenses without compromising access to advanced therapies. Moreover, long-term capital investment plans are being recalibrated to account for potential future trade policy shifts, emphasizing flexible production frameworks and nearshoring strategies. Ultimately, the 2025 tariffs have underscored the necessity for supply chain agility and proactive policy engagement to safeguard both innovation pipelines and patient affordability.

Unraveling Multidimensional Segmentation Insights to Pinpoint Innovation Hotspots and Unmet Clinical Needs Across Product Typologies

Analyzing the market through the lens of diverse segmentation criteria reveals nuanced growth pockets and targeted innovation opportunities. Within product typology, implantable cardioverter defibrillators exhibit distinct demand trajectories across dual chamber, single chamber, and subcutaneous variants, while left ventricular assist devices span both durable and temporary classifications. Pacemaker technologies likewise bifurcate into biventricular, dual chamber, and single chamber systems, and valve prostheses differentiate between bioprosthetic and mechanical solutions. Examining procedural approaches highlights the competitive tension between open heart surgery modalities, from minimally invasive techniques to traditional sternotomy, and transcatheter interventions such as aortic and mitral valve replacements. Material preferences further stratify the space into bioprosthetic classes-homograft and xenograft-and mechanical designs encompassing bileaflet and tilting disc valves. The end user landscape spans ambulatory surgical centers, specialized cardiac centers, and hospital settings, each with unique procurement cycles and clinical protocols. Finally, indications across aortic, mitral, pulmonary, and tricuspid pathologies-with focused analysis on regurgitation and stenosis manifestations-underscore areas for targeted device development and clinical trial investment.

This comprehensive research report categorizes the Cardiac Prosthetic Devices market into clearly defined segments, providing a detailed analysis of emerging trends and precise revenue forecasts to support strategic decision-making.

- Product Type

- Procedure Approach

- Material Type

- Indication

- End User

Decoding Regional Drivers and Market Entry Imperatives Across the Americas Europe Middle East Africa and Asia-Pacific

Regional dynamics play a pivotal role in shaping the trajectory of cardiac prosthetic device adoption, with distinct drivers emerging across the global landscape. In the Americas, mature healthcare infrastructures, well-established reimbursement frameworks, and a high prevalence of cardiovascular disease drive sustained demand for advanced devices, propelling both incremental improvements and breakthrough technologies. Across Europe, the Middle East, and Africa, heterogeneity in regulatory convergence, reimbursement policies, and healthcare access influences market entry strategies, necessitating adaptive pricing models and collaborative approaches with regional health authorities. Meanwhile, in the Asia-Pacific region, rapid urbanization, expanding middle-class populations, and evolving clinical capabilities foster a fertile environment for both established and emerging device manufacturers. Governments throughout the region are prioritizing local production capacities and public-private partnerships to enhance device accessibility. These region-specific insights underscore the importance of customized market entry planning and localized value propositions to drive adoption and optimize clinical outcomes.

This comprehensive research report examines key regions that drive the evolution of the Cardiac Prosthetic Devices market, offering deep insights into regional trends, growth factors, and industry developments that are influencing market performance.

- Americas

- Europe, Middle East & Africa

- Asia-Pacific

Profiling Competitive Strategies and Alliances Driving Innovation Commercialization and Lifecycle Management in Cardiac Prosthetic Technology

Leading players in the cardiac prosthetic devices domain are leveraging differentiated strategies to secure competitive advantage, from strategic acquisitions and alliances to targeted R&D investments. Established medical technology firms are expanding portfolios through bolt-on acquisitions of emerging digital health innovators, while also forging partnerships with academic centers for collaborative device validation. Mid-sized enterprises are capitalizing on nimble development cycles to introduce next-generation valve materials and miniaturized rhythm management systems. Additionally, contract manufacturers are scaling operations to accommodate increased demand for customized components, driving efficiencies in production and time-to-market. Cross-sector collaborations with software developers are enhancing remote monitoring platforms and data analytics capabilities, further extending device lifecycles through predictive maintenance. As intellectual property landscapes evolve, companies are proactively managing patent portfolios and exploring licensing agreements to safeguard core technologies while accelerating innovation diffusion. These collective strategies illustrate a dynamic industry where both incumbents and challengers are aligning to the imperatives of quality, cost, and clinical differentiation.

This comprehensive research report delivers an in-depth overview of the principal market players in the Cardiac Prosthetic Devices market, evaluating their market share, strategic initiatives, and competitive positioning to illuminate the factors shaping the competitive landscape.

- Abbott Laboratories

- Artivion, Inc.

- AtriCure, Inc.

- Biotronik SE & Co KG

- Boston Scientific Corporation

- Braile Biomédica

- Colibri Heart Valve LLC

- Edwards Lifesciences Corporation

- Fortive Corporation

- Lepu Medical Technology(Beijing)Co.,Ltd.

- LivaNova, PLC

- Medtronic PLC

- Meril Life Sciences Pvt. Ltd.

- Microport Scientific Corporation

- SGS Société Générale de Surveillance SA.

- Shree Pacetronix Ltd.

- Siemens Healthineers AG

- TZ Medical

- Venus MedTech HangZhou Inc.

- Vitatron Holding B.V.

Implementing Resilient Innovation Supply Chain and Evidence Generation Frameworks to Strengthen Market Leadership and Value-Based Outcomes

Industry leaders should prioritize a proactive approach to innovation by allocating dedicated resources toward next-generation materials and device miniaturization, ensuring offerings align with emerging minimally invasive procedural trends. Cultivating strategic partnerships with key opinion leaders and academic institutions can accelerate clinical validation and support robust health economics outcomes research, further reinforcing reimbursement pathways. Simultaneously, diversifying supply chains through regional manufacturing hubs will enhance resilience against trade policy fluctuations and logistical disruptions. Investing in data integration platforms that seamlessly assimilate device telemetry with electronic health record systems can unlock value-based care models and enable outcome-driven procurement contracts. To navigate regulatory complexities, establishing in-house policy and compliance units will facilitate swift adaptation to evolving international standards. Finally, embedding sustainability principles across operations-from material sourcing to packaging optimization-will resonate with payers and patients increasingly focused on environmental stewardship. Collectively, these recommendations equip stakeholders to capitalize on market momentum while safeguarding long-term growth and patient impact.

Combining Primary Interviews Rigorous Secondary Research and Quantitative Validation to Deliver Robust Strategic Market Insights

This research integrates a robust blend of qualitative and quantitative methodologies to ensure comprehensive market understanding. Primary data were gathered through structured interviews with key stakeholders, including cardiac surgeons, device procurement managers, and clinical researchers, to capture firsthand insights on treatment preferences and adoption barriers. Secondary research entailed a meticulous review of peer-reviewed journals, regulatory filings, investor presentations, and technical white papers to contextualize technological trends and policy developments. Quantitative data points were validated through triangulation, leveraging publicly available clinical registries and device utilization databases, thereby ensuring analytical rigor. The segmentation framework was refined through iterative consultations with in-field experts, aligning product typologies and procedural classifications with clinical practice realities. Finally, the study’s findings underwent peer review by a panel of biomedical engineers and healthcare economists to verify methodological soundness and relevance. This layered approach delivers a balanced and actionable intelligence foundation, empowering stakeholders to make informed strategic decisions.

This section provides a structured overview of the report, outlining key chapters and topics covered for easy reference in our Cardiac Prosthetic Devices market comprehensive research report.

- Preface

- Research Methodology

- Executive Summary

- Market Overview

- Market Insights

- Cumulative Impact of United States Tariffs 2025

- Cumulative Impact of Artificial Intelligence 2025

- Cardiac Prosthetic Devices Market, by Product Type

- Cardiac Prosthetic Devices Market, by Procedure Approach

- Cardiac Prosthetic Devices Market, by Material Type

- Cardiac Prosthetic Devices Market, by Indication

- Cardiac Prosthetic Devices Market, by End User

- Cardiac Prosthetic Devices Market, by Region

- Cardiac Prosthetic Devices Market, by Group

- Cardiac Prosthetic Devices Market, by Country

- United States Cardiac Prosthetic Devices Market

- China Cardiac Prosthetic Devices Market

- Competitive Landscape

- List of Figures [Total: 17]

- List of Tables [Total: 2544 ]

Synthesizing Insights on Technological Convergence Regulatory Dynamics and Strategic Alignment to Chart the Future Course of Cardiac Prosthetic Therapies

As the cardiac prosthetic devices sector continues its trajectory toward less invasive, data-driven therapies, stakeholders must remain vigilant to shifting regulatory landscapes, evolving tariff regimes, and emerging clinical paradigms. The convergence of material science breakthroughs, digital integration, and patient-centric care models presents both opportunities and challenges that require agile responses. By leveraging nuanced segmentation analysis, regional market intelligence, and competitive benchmarking, decision-makers can identify high-potential corridors for growth and operational efficiencies. Moreover, aligning research priorities with payer and provider expectations will be instrumental in securing favorable reimbursement pathways and driving broader adoption. Ultimately, the synthesis of technological innovation, evidence generation, and strategic partnerships will define the next chapter of progress, underscoring the imperative for a cohesive, proactive approach to market participation.

Connect with Ketan Rohom to Secure In-Depth Market Intelligence and Strategic Insights for Cardiac Prosthetic Devices

For decision-makers seeking a deeper dive into strategic imperatives, market nuances, and tailored insights, reaching out to Ketan Rohom, Associate Director of Sales & Marketing, will connect you with the expertise needed to harness emerging opportunities in the cardiac prosthetic devices landscape. Engaging with Ketan ensures personalized guidance on leveraging the comprehensive report’s findings to accelerate innovation pipelines, optimize supply chains, and strengthen competitive positioning. By securing this research, teams can align their strategies with the latest advancements, regulatory projections, and tariff implications, transforming high-level data into actionable initiatives that drive patient outcomes and business growth. Contacting Ketan today paves the way for securing a detailed intelligence package that empowers stakeholders to navigate market complexities with confidence and precision

- How big is the Cardiac Prosthetic Devices Market?

- What is the Cardiac Prosthetic Devices Market growth?

- When do I get the report?

- In what format does this report get delivered to me?

- How long has 360iResearch been around?

- What if I have a question about your reports?

- Can I share this report with my team?

- Can I use your research in my presentation?