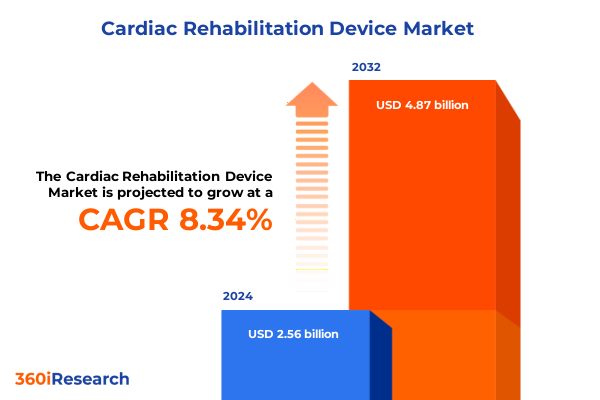

The Cardiac Rehabilitation Device Market size was estimated at USD 2.75 billion in 2025 and expected to reach USD 2.95 billion in 2026, at a CAGR of 8.50% to reach USD 4.87 billion by 2032.

Setting the Stage for Innovation in Cardiac Rehabilitation Devices as Technologies Redefine Patient Outcomes and Industry Growth Trajectories

Cardiovascular disease remains the leading cause of death in the United States, accounting for more than 920,000 fatalities in 2023 and claiming a life every 34 seconds according to the most recent data from the Centers for Disease Control and Prevention. Against this backdrop, the field of cardiac rehabilitation has evolved from purely exercise-based regimens to a multifaceted ecosystem of advanced devices and digital health interventions. Recent years have witnessed an unprecedented convergence of wearable monitoring tools, data analytics platforms, and remote patient management solutions, all designed to optimize outcomes and reduce rehospitalization rates.

Clinical evidence underscores the critical value of structured rehabilitation augmented by technology. A longitudinal Medicare cohort study demonstrated that intensive cardiac rehabilitation programs were associated with a 12% reduction in all-cause mortality over a median 2.4 years compared to traditional approaches, highlighting the potential for device-enabled interventions to drive longer-term survival benefits. Moreover, exercise-based cardiac rehabilitation among patients with atrial fibrillation yielded a remarkable 68% lower odds of all-cause mortality at 18 months, further validating the life-saving potential of integrating remote monitoring and telehealth into rehabilitation pathways. As providers and payers seek to meet growing demand while containing costs, the interdependence of innovative devices, data-driven analytics, and patient-centric service models has emerged as a key differentiator in the cardiac rehabilitation landscape, setting the stage for the strategic insights that follow.

How Artificial Intelligence, Remote Monitoring, and Embedded Analytics Are Reshaping Cardiac Rehabilitation Delivery and Patient Engagement

The integration of artificial intelligence and machine learning has emerged as one of the most transformative forces in cardiac rehabilitation, with algorithms now capable of analyzing vast quantities of patient data to identify early warning signs and tailor exercise prescriptions. AI-powered decision support tools improve diagnostic accuracy and dynamically adapt training regimens based on each patient’s unique physiological responses, enabling more precise engagement and adherence. As these intelligent systems become increasingly embedded in telehealth platforms and wearable devices, providers can leverage predictive analytics to foresee adverse events, personalize therapy intensity, and optimize resource utilization across care settings.

Concurrently, the proliferation of connected devices within the Internet of Medical Things has revolutionized remote patient monitoring by generating continuous data streams that keep clinicians informed in real time. Miniaturized biosensors, smartwatches, and implantable monitors now transmit vital signs such as ECG rhythms, blood pressure, and oxygen saturation directly into secure cloud repositories. This seamless flow of information underpins novel care models, including hospital-at-home and hybrid rehabilitation programs, allowing early intervention when deviations occur and reducing unnecessary in-person visits. Moreover, 5G-enabled connectivity ensures low-latency, high-fidelity data transfer, supporting high-resolution imaging and complex analytics at the edge, which together amplify the reach and impact of remote rehabilitation services.

Assessing the Strategic Impact of Recent U.S. Trade Tariffs on Cardiac Rehabilitation Devices Supply Chains and Cost Structures in 2025

The United States Trade Representative’s extension of Section 301 tariff exclusions through mid-2025 has provided temporary relief to manufacturers of critical medical equipment, but the phased reinstatement of duties threatens to undermine supply chain resilience. While many medical devices continue to benefit from exclusions, the impending expiration of relief measures for items like surgical gloves, respirators, and certain diagnostic consumables introduces new cost pressures. At the same time, high reciprocal tariffs-reaching rates as steep as 145% on some imported components-continue to disrupt global sourcing and compel companies to reevaluate manufacturing footprints, particularly for sophisticated cardiac rehabilitation technologies reliant on specialized sensors and motors.

Against this complex backdrop, 2025 will see significant tariff increases on medical gloves (rising to 50% duty), respiratory devices, and single-use catheters, as well as reinstated duties on intermediate components essential to rehabilitation equipment. Industry associations such as the American Hospital Association have redoubled their advocacy for permanent exemptions, warning that sustained high duties risk shortages, higher out-of-pocket costs for patients, and delayed innovation cycles as firms divert investment toward cheaper, but potentially inferior, alternatives. As regulatory and trade policies evolve, stakeholders must navigate a volatile tariff landscape while safeguarding patient access to life-saving rehabilitation devices.

Unveiling Critical Segmentation Drivers by Product, End User, and Service That Define Market Dynamics in Cardiac Rehabilitation Equipment and Solutions

In evaluating market opportunities, the segment defined by product type reveals distinct dynamics across monitoring devices, rehabilitation equipment, and therapeutic devices. Monitoring solutions range from blood pressure monitors and ECG monitors to multi-parameter monitors and pulse oximeters, each offering varying degrees of sophistication and data integration. Rehabilitation equipment spans arm ergometers, cycle ergometers, and treadmills designed for both clinical and home environments, with form factors and connectivity features tailored to diverse patient cohorts. Therapeutic devices extend the continuum of care through electrical stimulation systems, respiratory therapy apparatus, and ultrasound therapy devices, fostering a holistic approach to post-event recovery and long-term wellness.

Equally pivotal is the segmentation by end user and service model, which influences procurement cycles and reimbursement pathways. Clinics-from specialized cardiac rehabilitation centers to broader physical therapy practices-require scalable solutions that blend clinical-grade accuracy with streamlined workflows. Home care settings, whether caregiver-assisted or self-administered, call for intuitive platforms and remote support mechanisms that empower patients outside of institutional settings. Maintenance and support arrangements, encompassing everything from annual service contracts to pay-per-incident agreements, intersect with remote monitoring and telehealth services-such as real-time alerts and virtual consultations-to create service ecosystems that drive engagement, adherence, and continuity of care.

This comprehensive research report categorizes the Cardiac Rehabilitation Device market into clearly defined segments, providing a detailed analysis of emerging trends and precise revenue forecasts to support strategic decision-making.

- Product Type

- Service

- End User

Examining Regional Dynamics Across Americas, EMEA, and Asia-Pacific That Influence Adoption Rates, Infrastructure Investment, and Reimbursement Trends

North America stands at the forefront of adoption, propelled by widespread reimbursement for remote patient monitoring tools and seamless integration of wearable data into electronic health records. Over 30 million Americans now utilize connected monitoring devices to manage chronic cardiac conditions, reflecting strong public acceptance and regulatory support for innovative care models. Major EHR providers like Epic have established secure interfaces with consumer platforms such as Apple Health and Fitbit, enabling clinicians to incorporate streaming biometric data into clinical decision-making workflows.

In Europe, the confluence of heterogeneous healthcare systems yields a mosaic of adoption rates and reimbursement frameworks. Rest of Europe and Middle East & Africa collectively account for approximately 14% of the global cardiac rehabilitation market, with MEA holding near 7% driven by investments in specialized urban care centers and Latin American markets contributing around 7% amid growing government focus on chronic disease management. Telerehabilitation systems in key EU countries have demonstrated adoption growth at a CAGR of 6.4%, supported by national reimbursement policies for hybrid cardiac rehab programs and remote monitoring of implantable devices.

Asia-Pacific is emerging as the fastest-growing regional market, with digital health for cardiovascular care expected to expand at a 23.7% CAGR from 2025 to 2030. Strategic government initiatives in China, India, and Australia are driving infrastructure modernization, while rapid smartphone penetration and favorable telehealth legislation are expanding access to remote rehabilitation services in both urban and rural communities.

This comprehensive research report examines key regions that drive the evolution of the Cardiac Rehabilitation Device market, offering deep insights into regional trends, growth factors, and industry developments that are influencing market performance.

- Americas

- Europe, Middle East & Africa

- Asia-Pacific

Evaluating Competitive Strategies and Collaborations Among Leading Players Transforming the Cardiac Rehabilitation Devices Ecosystem in 2025

Leading players are forging strategic collaborations to enhance device interoperability and expand market reach. In July 2025, Medtronic and Philips renewed a multi-year partnership to integrate Medtronic’s Nellcor™ pulse oximetry and Microstream™ capnography technologies into Philips’ patient monitoring platforms, complemented by joint training initiatives and bundled consumables. This alliance streamlines procurement for providers and bolsters patient safety through rigorously validated, end-to-end monitoring solutions.

GE Healthcare has doubled down on innovation in diagnostic imaging and AI-driven analytics, unveiling its Revolution™ Vibe CT system at the 2025 ACC meeting. The platform’s Unlimited One-Beat Cardiac imaging and AI-powered workflow tools support fast, accurate diagnoses of conditions ranging from atrial fibrillation to heavily calcified coronaries, enabling more efficient patient throughput and enhanced outcome tracking.

Abbott continues to expand its remote monitoring portfolio, with the CardioMEMS HF System demonstrating a 25% reduction in heart failure-related hospitalizations and significant survival benefits in recent meta-analyses. Its newly FDA-cleared Assert-IQ insertable cardiac monitor further cements Abbott’s position in long-term arrhythmia detection, providing real-time Bluetooth-enabled data transmission for up to six years.

This comprehensive research report delivers an in-depth overview of the principal market players in the Cardiac Rehabilitation Device market, evaluating their market share, strategic initiatives, and competitive positioning to illuminate the factors shaping the competitive landscape.

- Bitmos GmbH

- Brosmed Medical

- Diverse Retails Private Limited

- Dyaco International Inc.

- Ergatta, Inc.

- ergoline GmbH

- Extreme Brands LLP

- Halma plc

- HealthCare International, Inc.

- Honeywell International Inc.

- Hydrow, Inc.

- ICU Medical, Inc.

- iFIT Health & Fitness Inc.

- Johnson Health Tech Co., Ltd.

- Koninklijke Philips N.V.

- LG Electronics U.S.A., Inc.

- Medical Fitness Solutions

- Nureca Limited

- OMRON Healthcare, Inc.

- Peloton Interactive, Inc.

- Stages Cycling LLC

- Technogym S.p.A.

- Welcare Fitness

- Össur hf.

Actionable Recommendations for Industry Leaders to Accelerate Growth, Mitigate Risk, and Enhance Patient Outcomes in the Evolving Cardiac Rehabilitation Landscape

Industry leaders should prioritize investments in end-to-end digital integration, ensuring that device manufacturers, software developers, and healthcare providers co-create cohesive platforms that support seamless data exchange and patient engagement. By establishing open APIs and adhering to interoperability standards, organizations can accelerate innovation while reducing implementation barriers.

Supply chain resilience must be reinforced through diversification of sourcing and nearshoring strategies, particularly in light of evolving tariff regimes. Engaging in long-term partnerships with tier-1 component suppliers and exploring alternative manufacturing hubs can mitigate risk and safeguard equipment availability.

Companies are encouraged to pursue strategic alliances across the telehealth and digital health value chain, leveraging combined expertise in AI analytics, remote monitoring, and virtual care delivery. Co-development programs and cross-licensing agreements can shorten time-to-market for advanced rehabilitation solutions.

Proactive advocacy for sustained tariff exemptions on essential devices and consumables will remain vital. Aligning with industry associations and patient advocacy groups can amplify the call for regulatory clarity and stable trade policies, thereby preserving affordability and innovation momentum.

Finally, organizations must cultivate clinician and patient trust by prioritizing cybersecurity, data privacy, and user-centric design. Continuous feedback loops, clinician training, and robust post-market surveillance will ensure that emerging technologies translate into meaningful improvements in patient outcomes and care experience.

Outlining a Robust Research Methodology Combining Primary Interviews, Secondary Analysis, and Data Triangulation to Ensure Report Credibility and Accuracy

This report employs a rigorous, multi-tiered research methodology to ensure the integrity, accuracy, and relevance of its findings. The process commenced with an exhaustive review of secondary literature, encompassing peer-reviewed medical journals, regulatory filings, U.S. Trade Representative notices, and technical standards documents to establish baseline insights.

Primary research formed the cornerstone of our analysis, involving in-depth interviews with cardiologists, device manufacturers, payers, and health system executives. These discussions provided real-world perspectives on device adoption, reimbursement challenges, and emerging clinical use cases.

Quantitative data collection leveraged a proprietary database of device shipments, tariff schedules, and regional policy updates, which was triangulated against publicly available datasets and expert projections. Statistical techniques were applied to validate trends and identify outliers, ensuring robustness of the regional and segment forecasts.

A cross-functional advisory panel comprising industry veterans, trade policy specialists, and digital health innovators reviewed interim findings to confirm the validity of assumptions and scenarios. Across every phase, meticulous documentation and version control protocols were maintained to uphold transparency and reproducibility.

This section provides a structured overview of the report, outlining key chapters and topics covered for easy reference in our Cardiac Rehabilitation Device market comprehensive research report.

- Preface

- Research Methodology

- Executive Summary

- Market Overview

- Market Insights

- Cumulative Impact of United States Tariffs 2025

- Cumulative Impact of Artificial Intelligence 2025

- Cardiac Rehabilitation Device Market, by Product Type

- Cardiac Rehabilitation Device Market, by Service

- Cardiac Rehabilitation Device Market, by End User

- Cardiac Rehabilitation Device Market, by Region

- Cardiac Rehabilitation Device Market, by Group

- Cardiac Rehabilitation Device Market, by Country

- United States Cardiac Rehabilitation Device Market

- China Cardiac Rehabilitation Device Market

- Competitive Landscape

- List of Figures [Total: 15]

- List of Tables [Total: 1908 ]

Drawing Comprehensive Conclusions on the Interplay of Technology, Regulation, and Market Forces Shaping the Future of Cardiac Rehabilitation Devices

The cardiac rehabilitation device market is at an inflection point where technological innovation, shifting regulatory frameworks, and evolving care delivery models converge to redefine patient outcomes. The accelerated adoption of AI-enabled diagnostics and continuous remote monitoring underscores a broader transition from episodic to proactive care.

Trade policy dynamics, particularly the recalibration of Section 301 tariff exclusions, introduce both challenges and strategic imperatives for stakeholders committed to securing supply chains and maintaining cost competitiveness. Regional growth patterns further highlight the need for tailored go-to-market strategies that align with local reimbursement mechanisms and digital infrastructure readiness.

Segmentation analysis reveals that integrated ecosystems combining monitoring, rehabilitation, and therapeutic devices will command greater value by offering end-to-end solutions that meet the needs of clinics, home-based settings, and telehealth platforms. Collaborations among leading manufacturers, software innovators, and healthcare providers are pivotal in scaling these ecosystems.

Looking ahead, the intersection of patient-centric care models and advanced device capabilities promises to reshape the trajectory of cardiac rehabilitation. Companies that navigate regulatory shifts, forge strategic partnerships, and invest in seamless digital integration will be best positioned to capitalize on the market’s growth and drive meaningful improvements in patient health and quality of life.

Engage Ketan Rohom to Secure Strategic Insights and Gain Competitive Advantage by Accessing the Full Cardiac Rehabilitation Devices Market Research Report Today

If you’re ready to dive deeper into the transformative trends, regulatory impacts, and strategic opportunities outlined in this report on cardiac rehabilitation devices, contact Ketan Rohom, Associate Director, Sales & Marketing at 360iResearch. He can guide you through the comprehensive findings, answer detailed questions about the data and methodologies, and facilitate access to the full market research report. Reach out today to secure the insights you need to stay ahead in a rapidly evolving landscape and empower your organization to make informed, data-driven decisions for future growth.

- How big is the Cardiac Rehabilitation Device Market?

- What is the Cardiac Rehabilitation Device Market growth?

- When do I get the report?

- In what format does this report get delivered to me?

- How long has 360iResearch been around?

- What if I have a question about your reports?

- Can I share this report with my team?

- Can I use your research in my presentation?