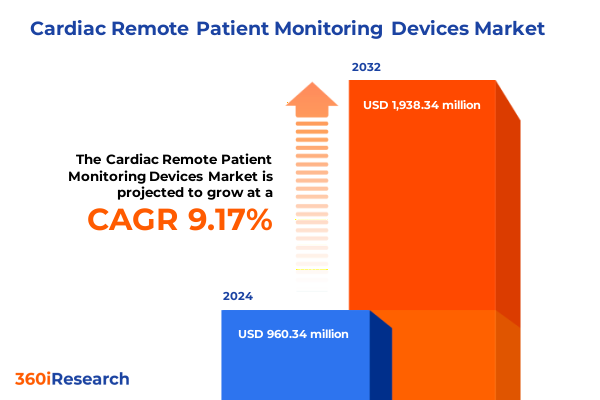

The Cardiac Remote Patient Monitoring Devices Market size was estimated at USD 1.03 billion in 2025 and expected to reach USD 1.13 billion in 2026, at a CAGR of 9.37% to reach USD 1.93 billion by 2032.

Revolutionary Developments in Cardiac Remote Patient Monitoring Are Driving a Paradigm Shift in Cardiovascular Care Delivery and Patient Engagement

Cardiac remote patient monitoring devices integrate advanced sensing technologies with digital data platforms to enable continuous tracking of cardiac vital signs such as heart rate, rhythm, and electrocardiogram (ECG) signals. Historically, clinicians relied on episodic, in-clinic assessments to diagnose arrhythmias or assess therapeutic efficacy; however, the advent of wearable sensors and implantable recorders has ushered in a new era of real-time cardiac surveillance that supports proactive disease management and personalized treatment pathways. These devices range from 24-hour Holter monitors through multi-day patch sensors to fully implantable loop recorders, offering diverse monitoring durations and data fidelity requirements.

Transformative Technological Advances and Patient-Centered Care Models Are Redefining the Future of Cardiac Remote Patient Monitoring Across Healthcare Systems

Emerging artificial intelligence algorithms are transforming remote monitoring by automating the detection of complex arrhythmias and reducing the burden on clinical teams.AI-enabled platforms analyze continuous ECG streams to flag atrial fibrillation, ventricular tachycardia, and other critical events with high sensitivity, enabling faster clinical interventions and reducing false positives compared to traditional rule-based systems. Simultaneously, the proliferation of IoT-enabled sensors facilitates seamless integration between patch-based monitors, chest straps, implantable loop recorders, and centralized cloud repositories, ensuring clinicians can access near-real-time patient data from any location. Furthermore, the shift toward cloud-native SaaS models accelerates device deployment and software updates by leveraging robust cybersecurity frameworks and scalable infrastructure, backed by the EU’s target of 75% corporate cloud adoption to bolster digital resilience across healthcare ecosystems. Consequently, the convergence of AI, IoT, and cloud technologies is catalyzing a highly interconnected cardiac monitoring environment that prioritizes early detection and continuous patient engagement.

Accelerating Tariff Pressures and Regulatory Dynamics Are Reshaping Supply Chains and Cost Structures for Remote Cardiac Monitoring Devices in the United States

Since early 2025, U.S.-imposed tariffs on EU and Chinese imports have introduced material cost pressures for cardiac remote monitoring device manufacturers. Philips recently revised its tariff impact projection to €150–200 million following a U.S.-EU trade agreement that established a 15% tariff rate on EU goods, highlighting the fluidity of international trade dynamics and its influence on healthcare-technology supply chains. Simultaneously, Medtronic has warned that renewed reciprocal tariffs could increase its cost of goods sold by up to $950 million in fiscal year 2026, with limited capacity to rapidly relocate production due to stringent regulatory requirements. Beyond headline figures, providers of remote patient monitoring solutions are contending with higher expenses for imported sensors, semiconductors, and wireless modules sourced from China and Southeast Asia, leading to contract renegotiations and strategic sourcing adjustments. In response, many vendors are exploring nearshoring options and dual-sourcing strategies to mitigate shipment delays and freight surcharges while balancing compliance demands. Concurrently, advocacy efforts by healthcare associations are intensifying to secure tariff exemptions for essential medical devices, reflecting the sector’s reliance on uninterrupted access to critical components and the importance of policy stability for maintaining patient care continuity.

Deep Dive into Segmentation Reveals Critical Insights across Product Types, Applications, End Users, Connectivity Technologies, and Innovative Platform Offerings

Analysis of product type segmentation underscores the enduring role of Holter monitors-offered in 24-hour, 48-hour, and seven-day configurations-as foundational tools for short-term arrhythmia evaluation, while implantable loop recorders have gained traction for long-duration surveillance, particularly through insertable cardiac monitors. Concurrently, wearable systems-ranging from chest-strap sensors to single-lead and multi-lead patch monitors-offer flexible patient-friendly form factors suited for both ambulatory and resting heart rate monitoring. In parallel, application-based segmentation reveals that arrhythmia detection, encompassing atrial fibrillation and ventricular tachycardia, remains the dominant use case, complemented by expanding adoption in cardiac rehabilitation, postoperative monitoring, and differentiated heart-rate profiling during both ambulatory and resting states. End-user analysis highlights the diversified demand profile, with hospitals and physician clinics driving acute-care deployments while home-health and ambulatory care centers capitalize on remote monitoring’s potential to reduce readmissions and optimize resource utilization. Meanwhile, connectivity technology segmentation illustrates the coexistence of Bluetooth, cellular, radio-frequency, and Wi-Fi interfaces, each selected based on trade-offs between power consumption, coverage, and integration complexity. Finally, technology-centric platforms-spanning AI-enabled analytics, cloud-based data management, IoT-enabled architectures, and software-as-a-service delivery models-are increasingly valued for their capacity to accelerate implementation, support advanced analytics, and deliver continuous innovation through regular software updates.

This comprehensive research report categorizes the Cardiac Remote Patient Monitoring Devices market into clearly defined segments, providing a detailed analysis of emerging trends and precise revenue forecasts to support strategic decision-making.

- Product Type

- Application

- End User

- Connectivity Technology

- Technology

Regional Dynamics Highlight Adoption Variances and Growth Drivers in the Americas, Europe, Middle East and Africa, and the Asia-Pacific Cardiac Remote Monitoring Markets

The Americas region, led by the United States, represents the most mature market for cardiac remote monitoring, propelled by robust reimbursement frameworks from CMS and private insurers, high cardiovascular disease prevalence, and widespread digital health adoption. U.S. healthcare providers and cardiology groups are at the forefront of integrating AI-powered arrhythmia detection tools into electronic medical record systems to streamline workflow and reduce rehospitalization rates. In Europe, Middle East and Africa, national telehealth strategies are becoming ubiquitous, with 40 countries in the WHO European region incorporating remote monitoring services into broader digital health plans; 77% of these countries now offer remote patient monitoring, underscoring the region’s commitment to telemedicine-enabled care and cross-provider data exchange. Meanwhile, the Asia-Pacific landscape is characterized by rapid infrastructure investments and government incentives, with countries such as India, China, and Japan pursuing telehealth expansion to address growing cardiovascular burdens; notable initiatives include the introduction of subscription-based remote monitoring models and strategic partnerships to enhance local manufacturing capacity and broaden patient access.

This comprehensive research report examines key regions that drive the evolution of the Cardiac Remote Patient Monitoring Devices market, offering deep insights into regional trends, growth factors, and industry developments that are influencing market performance.

- Americas

- Europe, Middle East & Africa

- Asia-Pacific

Leading Industry Players Are Pioneering Innovations, Strategic Partnerships, and Market Expansions in Cardiac Remote Patient Monitoring Worldwide

Market leadership in cardiac remote patient monitoring is shared by several global players distinguished by their technological innovation, strategic partnerships, and geographic reach. Medtronic leverages its deep expertise in implantable cardiac devices and extensive clinical network to integrate loop recorders with cloud-based analytics, positioning itself to capitalize on both inpatient and at-home monitoring trends. Philips has responded to tariff headwinds while advancing its connected care segment through AI-powered diagnostic platforms and long-term service agreements, reinforcing its ability to navigate trade volatility alongside clinical innovation. Boston Scientific, confronting early stock declines amid broader tariff announcements, continues to invest in multi-lead wearable solutions and strategic acquisitions to bolster its remote monitoring portfolio. Abbott maintains momentum by expanding its arrhythmia detection algorithms and pursuing partnerships within cardiac rehabilitation programs, while emerging specialists such as iRhythm Technologies are driving next-generation AI-driven ambulatory monitoring, as evidenced by the commercial launch of its Zio® long-term ECG service in Japan and real-world data demonstrating superior diagnostic yield compared to short-duration Holter systems.

This comprehensive research report delivers an in-depth overview of the principal market players in the Cardiac Remote Patient Monitoring Devices market, evaluating their market share, strategic initiatives, and competitive positioning to illuminate the factors shaping the competitive landscape.

- Abbott Laboratories

- Biotronik SE & Co. KG

- Boston Scientific Corporation

- General Electric Company

- Idoven , S.L

- International Business Machines Corporation

- iRhythm Technologies, Inc.

- Koninklijke Philips N.V.

- Medtronic plc

- Mindpeak GmbH

- Nihon Kohden Corporation

- Shenzhen Mindray Bio-Medical Electronics Co., Ltd.

- Siemens Healthineers AG

- Zio by iRhythm Technologies, Inc.

Actionable Strategies for Industry Leaders to Navigate Emerging Technologies, Regulatory Complexities, and Competitive Pressures in Cardiac Remote Monitoring

To capitalize on growth opportunities, industry leaders should prioritize the development of modular device platforms that support both short- and long-duration monitoring, enabling seamless transitions between Holter, wearable, and implantable configurations in response to evolving clinical needs. Establishing nearshore manufacturing and diversified sourcing strategies can mitigate tariff risks while ensuring uninterrupted access to critical components. Furthermore, organizations must deepen collaborations with payers to refine reimbursement pathways, focusing on outcomes-based contracting that rewards reductions in readmission rates and improved patient adherence. Integrating advanced AI analytics into clinical workflows requires forging partnerships with electronic health record vendors to guarantee interoperability and minimize implementation friction. Equally important is investing in patient engagement solutions-such as mobile companion apps and automated alert systems-to enhance compliance, support shared decision-making, and capture real-world evidence for continuous platform optimization. Lastly, proactive regulatory engagement and participation in standard-setting consortia will enable timely adaptation to evolving approval pathways and data privacy requirements, positioning companies for sustained competitive advantage.

Robust Multi-Stage Research Methodology Combining Primary Expert Interviews and Comprehensive Secondary Data Analysis Underpins the Report’s Insights

This analysis is grounded in a rigorous multi-phase research framework combining extensive secondary data collection with targeted primary inquiries. Secondary inputs include peer-reviewed journals, publicly available regulatory filings, company disclosures, and authoritative trade press. Primary research comprised in-depth interviews with key stakeholders-chief medical officers, device engineers, payers, and leading cardiologists-to capture evolving clinical requirements and adoption barriers. Data validation and triangulation were achieved through cross-verification against government publications, industry association reports, and market intelligence platforms. Qualitative insights were synthesized into thematic findings, while quantitative trends were corroborated by time-series analysis of technology adoption rates and trade data. The methodology ensures that conclusions reflect both the current state of the cardiac remote patient monitoring ecosystem and its trajectory under shifting economic and regulatory conditions.

This section provides a structured overview of the report, outlining key chapters and topics covered for easy reference in our Cardiac Remote Patient Monitoring Devices market comprehensive research report.

- Preface

- Research Methodology

- Executive Summary

- Market Overview

- Market Insights

- Cumulative Impact of United States Tariffs 2025

- Cumulative Impact of Artificial Intelligence 2025

- Cardiac Remote Patient Monitoring Devices Market, by Product Type

- Cardiac Remote Patient Monitoring Devices Market, by Application

- Cardiac Remote Patient Monitoring Devices Market, by End User

- Cardiac Remote Patient Monitoring Devices Market, by Connectivity Technology

- Cardiac Remote Patient Monitoring Devices Market, by Technology

- Cardiac Remote Patient Monitoring Devices Market, by Region

- Cardiac Remote Patient Monitoring Devices Market, by Group

- Cardiac Remote Patient Monitoring Devices Market, by Country

- United States Cardiac Remote Patient Monitoring Devices Market

- China Cardiac Remote Patient Monitoring Devices Market

- Competitive Landscape

- List of Figures [Total: 17]

- List of Tables [Total: 1431 ]

Synthesis of Technological Advances, Market Dynamics, and Strategic Imperatives Underscores the Critical Role of Remote Monitoring in Cardiac Healthcare

The accelerated integration of AI-driven analytics, advanced connectivity protocols, and cloud-native delivery models is fundamentally transforming cardiac care delivery, shifting it from episodic, facility-based diagnostics to continuous, patient-centric monitoring. As tariff landscapes evolve and regulatory frameworks adapt, manufacturers and healthcare providers face both challenges and opportunities in aligning supply chains with clinical imperatives. Segmentation analysis underscores the importance of addressing diverse monitoring durations, user contexts, and technology preferences, while regional insights reveal differentiated adoption curves shaped by reimbursement policies and digital health strategies. Strategic imperatives-including supply chain diversification, payer engagement, interoperability partnerships, and patient engagement platforms-will determine who emerges as the leaders in this dynamic market. Ultimately, remote patient monitoring for cardiac conditions is poised to deliver improved clinical outcomes, enhanced operational efficiencies, and greater patient empowerment, provided that stakeholders proactively navigate the complex interplay of technology, policy, and care models.

Seize Critical Market Intelligence and Strategic Foresight by Acquiring the Full Cardiac Remote Patient Monitoring Market Research Report Today

To secure comprehensive insights and strategic foresight into the evolving cardiac remote patient monitoring landscape, contact Ketan Rohom, Associate Director of Sales & Marketing, to obtain the full market research report today and stay ahead of critical technology trends and regulatory shifts.

- How big is the Cardiac Remote Patient Monitoring Devices Market?

- What is the Cardiac Remote Patient Monitoring Devices Market growth?

- When do I get the report?

- In what format does this report get delivered to me?

- How long has 360iResearch been around?

- What if I have a question about your reports?

- Can I share this report with my team?

- Can I use your research in my presentation?