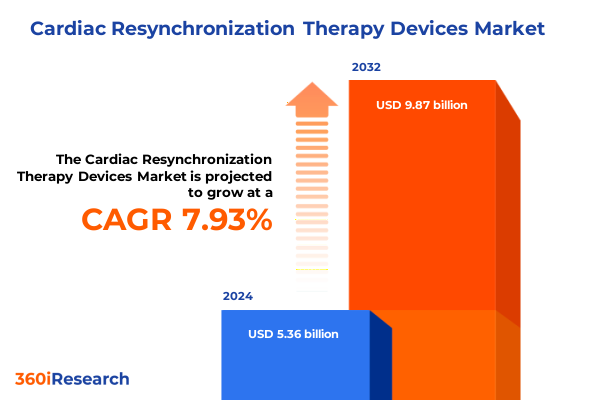

The Cardiac Resynchronization Therapy Devices Market size was estimated at USD 5.78 billion in 2025 and expected to reach USD 6.24 billion in 2026, at a CAGR of 7.94% to reach USD 9.87 billion by 2032.

Understanding the Critical Role of Cardiac Resynchronization Therapy Devices in Addressing Heart Failure Management Challenges and Strategic Implications for Stakeholders

Heart failure continues to impose a significant clinical and economic burden on health systems worldwide, with electrical desynchronization of the ventricles contributing substantially to morbidity and mortality rates. Cardiac resynchronization therapy (CRT) devices have emerged over the last two decades as a critical intervention, aiming to restore coordinated ventricular contraction and improve patient outcomes. As heart failure prevalence rises in aging populations, the demand for refined CRT technologies and strategic insights into deployment patterns has never been more pressing.

This executive summary sets the stage for a deep dive into the dynamics shaping the CRT device sector. By examining current device archetypes, recent technological advancements, regulatory shifts, and market influencers, this report equips stakeholders with essential context. Through a synthesis of industry intelligence and expert perspectives, it identifies both opportunities and challenges that define the path forward for clinicians, manufacturers, and healthcare payers seeking to optimize therapeutic impact and operational efficiency.

Navigating Rapid Technological Advancement and Regulatory Evolution Transforming the Cardiac Resynchronization Therapy Device Landscape Today

The CRT device landscape is undergoing a period of unprecedented transformation driven by parallel advances in device engineering and evolving regulatory paradigms. Innovations in lead design and generator functionality have enabled manufacturers to deliver more targeted pacing, enhancing both safety profiles and battery longevity. Meanwhile, the emergence of novel pacing sites beyond traditional biventricular leads, such as His bundle and left bundle branch area pacing, is reshaping clinical practice, offering alternative routes to electrical synchronization when standard approaches prove suboptimal.

Concurrently, regulatory bodies are refining approval pathways to accommodate these cutting-edge therapies, with expedited review mechanisms and real-world evidence requirements gaining prominence. Reimbursement frameworks are adapting in lockstep, incentivizing value-based care models that emphasize patient outcomes over procedural volumes. As digital connectivity becomes integral to device follow-up, remote monitoring platforms are integrated early in product development, reflecting a shift toward longitudinal patient management and predictive maintenance. Together, these dynamics signal a new era in CRT where agility, evidence generation, and patient-centered innovation coalesce to redefine therapeutic standards.

Examining How Newly Imposed United States Tariff Measures in 2025 Are Reshaping the Economics and Supply Chains of Cardiac Resynchronization Devices

In April 2025, the United States enacted a sweeping 10% global tariff on most medical device imports, supplemented by elevated duties on goods from specific nations identified under trade enforcement measures. This policy baseline is compounded by steep levies on derivative materials, including a 25% tariff on steel and aluminum components integral to device casings and leads, and semiconductors facing rates of up to 50% when sourced from select foreign suppliers. Together, these measures have introduced significant cost pressures across the CRT value chain, prompting manufacturers to revisit sourcing strategies and explore alternative production locales.

Market responses have been swift. Leading device makers reported immediate share price contractions following the tariff announcement, with notable declines in Medtronic and Boston Scientific equities as investors priced in potential margin compression and supply logjams. Advocacy groups within the sector have mounted coordinated appeals for exclusion of life-saving medical equipment from broad tariff regimes, arguing that such goods traditionally benefited from preferential status to safeguard patient access and innovation continuity.

On the provider side, hospitals and specialty clinics are bracing for cost pass-through, with some systems delaying procurement cycles to conduct financial impact assessments. Supply chain executives highlight that while domestic manufacturing investments are accelerating, full-scale reshoring of sophisticated components remains constrained by capacity limitations and complex technical requirements. As a result, stakeholders are navigating a delicate balance between immediate cost-containment measures and long-term resilience planning.

Revealing Key Differentiators Across Product Types Components Pacing Mechanisms and End Users to Illuminate Cardiac Resynchronization Therapy Market Dynamics

Product segmentation in the CRT domain reveals two primary device categories: implantable cardiac resynchronization defibrillators (CRT-D) designed for patients at risk of life-threatening arrhythmias, and pacemaker-only systems (CRT-P) suited to those requiring synchronization therapy without defibrillation capabilities. CRT-D units command a premium positioning, reflecting the added complexity and integrated defibrillation mechanisms that heighten procedural efficacy in high-risk cohorts. By contrast, CRT-P solutions emphasize streamlined energy usage and reduced hardware complexity, often preferred in patients with lower sudden cardiac death risk profiles.

Component innovation further differentiates competitive offerings, with lead systems spread across bipolar, quadripolar, and unipolar configurations to optimize electrode placement and minimize phrenic nerve stimulation. Pulse generators also diverge along the lines of extended-life battery technology versus standard battery modules, with the former targeting centers focused on reducing replacement surgeries and long-term pacing consistency. In parallel, pacing mechanism choices span traditional biventricular deliverables to burgeoning modalities like His bundle pacing and left bundle branch area pacing, each supported by emerging clinical data that inform patient-specific therapy selection. Finally, end users range from high-volume hospitals undertaking complex implantations to ambulatory surgery centers and cardiac specialty clinics where streamlined workflows and rapid turnover are prioritized, underscoring the importance of tailored device profiles aligned with procedural environments.

This comprehensive research report categorizes the Cardiac Resynchronization Therapy Devices market into clearly defined segments, providing a detailed analysis of emerging trends and precise revenue forecasts to support strategic decision-making.

- Product Type

- Component

- Pacing Mechanism

- End User

Analyzing Regional Variations in Adoption Reimbursement and Infrastructure Across the Americas Europe Middle East Africa and Asia Pacific Markets

Regional landscapes for CRT adoption demonstrate marked contrasts in healthcare infrastructure, reimbursement models, and clinician expertise. In the Americas, the United States stands at the forefront, propelled by comprehensive reimbursement coverage for CRT-D and CRT-P procedures, enabling widespread clinician uptake. Canada follows with moderate penetration, supported by public health coverage yet tempered by centralized procurement protocols that extend reimbursement timelines and influence purchasing cycles.

Europe, the Middle East, and Africa present a mosaic of access levels. Western European nations benefit from structured health technology assessment processes and competitive tendering that foster price transparency and value orientation. In the Middle East, substantial government investments in tertiary care infrastructure have catalyzed growth in CRT capabilities, while sub-Saharan African markets face barriers related to limited specialist training and constrained capital budgets, slowing the integration of advanced therapies.

Asia-Pacific markets are equally heterogeneous, characterized by robust growth in emerging economies such as China and India, where large patient populations and rising healthcare expenditure are driving device volume expansion. Australia and Japan exhibit advanced regulatory frameworks and high clinician proficiency, supporting early adoption of novel pacing modalities. Government initiatives aimed at bolstering domestic manufacturing and streamlining approval pathways further shape the regional trajectory.

This comprehensive research report examines key regions that drive the evolution of the Cardiac Resynchronization Therapy Devices market, offering deep insights into regional trends, growth factors, and industry developments that are influencing market performance.

- Americas

- Europe, Middle East & Africa

- Asia-Pacific

Profiling Leading Innovators and Strategic Movers Driving Competitive Positioning and Technological Leadership in the Cardiac Resynchronization Therapy Devices Sector

The competitive landscape is anchored by several global titans whose broad R&D pipelines and extensive clinical trial portfolios underpin their market leadership. Medtronic continues to command a premier position thanks to its deep bench of quadripolar lead solutions and connectivity platforms that facilitate remote patient management. Boston Scientific maintains momentum through strategic acquisitions that bolster its pacing mechanism offerings and deliver integrated ecosystem advantages across electrophysiology suites.

Meanwhile, Abbott’s growing portfolio reflects a focus on smaller footprint generators and enhanced device-to-cloud interoperability, aligning with the digital health trend. Biotronik distinguishes itself through proprietary pulse generator architectures that extend battery life beyond industry averages, and targeted expansions in select Asia-Pacific territories. Additionally, emerging players and regional specialists, including MicroPort in China and LivaNova in Europe, leverage local partnerships and targeted product adaptations to carve out defensible niches, underscoring the importance of geographic footholds and regulatory acumen in shaping competitive trajectories.

This comprehensive research report delivers an in-depth overview of the principal market players in the Cardiac Resynchronization Therapy Devices market, evaluating their market share, strategic initiatives, and competitive positioning to illuminate the factors shaping the competitive landscape.

- Abbott Laboratories

- BIOTRONIK SE & Co. KG

- Boston Scientific Corporation

- Cook Medical, Inc.

- EBR Systems, Inc.

- General Electric Company

- Integer Holdings Corporation

- Koninklijke Philips N.V.

- Lepu Medical Technology Co., Ltd.

- LivaNova PLC

- Medico S.p.A.

- Medtronic plc

- MicroPort Scientific Corporation

- Shree Pacetronix Ltd.

- Siemens Healthineers AG

- Zoll Medical Corporation

Actionable Strategic Imperatives for Device Manufacturers and Stakeholders to Capitalize on Market Opportunities and Overcome Emerging Challenges in CRT Therapy

To thrive amid evolving clinical expectations and policy environments, manufacturers must prioritize multi-analyte innovation in lead design and pacing algorithms, ensuring devices adapt to diverse patient anatomies and conduction profiles. By diversifying component supply chains and engaging in strategic partnerships, organizations can mitigate tariff-induced cost pressures while safeguarding continuity in critical material sourcing. Moreover, embedding digital health functionalities enables real-time performance tracking, predictive maintenance, and improved patient engagement, driving stronger health economic outcomes and reimbursement alignment.

Stakeholders should also actively engage with regulatory and payer communities to advocate for modality-specific value frameworks that recognize the long-term clinical benefits of novel pacing approaches. Tailored go-to-market strategies that align device attributes with the procedural preferences of ambulatory surgery centers, specialty clinics, and hospitals will accelerate penetration across care settings. Finally, investment in clinician education and support programs ensures that emerging pacing techniques are adopted safely and effectively, reinforcing confidence in CRT’s therapeutic promise and catalyzing sustainable growth.

Detailing the Rigorous Multi Source Methodology Employed to Ensure Comprehensive Data Integrity and Insights in the Cardiac Resynchronization Therapy Devices Research

Our analysis commenced with an extensive secondary research phase, encompassing peer-reviewed journals, regulatory filings, and clinical trial registries to map the evolution of CRT technologies and payer policies. We then conducted primary interviews with key opinion leaders, including electrophysiologists, biomedical engineers, and hospital procurement specialists, to capture real-world insights on device performance criteria and adoption drivers. All qualitative inputs were rigorously triangulated with quantitative data from surgical procedure databases and reimbursement schedules to ensure validity.

Following data collection, we applied a multi-layered validation framework, cross-referencing manufacturer specifications against published clinical outcomes and post-market surveillance reports. Segmentation analysis and regional breakdowns were constructed using standardized definitions to facilitate comparability across markets. Finally, competitive intelligence was enriched through patent landscape reviews and investment activity tracking, providing a holistic view of innovation pipelines and strategic alliances.

This section provides a structured overview of the report, outlining key chapters and topics covered for easy reference in our Cardiac Resynchronization Therapy Devices market comprehensive research report.

- Preface

- Research Methodology

- Executive Summary

- Market Overview

- Market Insights

- Cumulative Impact of United States Tariffs 2025

- Cumulative Impact of Artificial Intelligence 2025

- Cardiac Resynchronization Therapy Devices Market, by Product Type

- Cardiac Resynchronization Therapy Devices Market, by Component

- Cardiac Resynchronization Therapy Devices Market, by Pacing Mechanism

- Cardiac Resynchronization Therapy Devices Market, by End User

- Cardiac Resynchronization Therapy Devices Market, by Region

- Cardiac Resynchronization Therapy Devices Market, by Group

- Cardiac Resynchronization Therapy Devices Market, by Country

- United States Cardiac Resynchronization Therapy Devices Market

- China Cardiac Resynchronization Therapy Devices Market

- Competitive Landscape

- List of Figures [Total: 16]

- List of Tables [Total: 1113 ]

Summarizing Holistic Insights and Forward Looking Perspectives on the Evolving Cardiac Resynchronization Therapy Devices Environment and Strategic Imperatives

Our findings underscore a CRT landscape characterized by rapid technological evolution, shifting regulatory priorities, and the disruptive influence of external forces such as tariffs. While product and component innovations are unlocking new therapeutic pathways, supply chain constraints and policy adjustments demand strategic agility from manufacturers. Geographically, adoption patterns reflect both macroeconomic conditions and localized healthcare structures, emphasizing the need for nuanced market entry approaches.

Looking forward, the integration of novel pacing mechanisms and digital health capabilities will redefine value propositions for clinicians and patients alike. Sustained collaboration among manufacturers, regulators, and payers will be critical to streamline access and optimize health outcomes. By aligning strategic initiatives with emerging clinical evidence and market trends, stakeholders can navigate complexity with confidence and position themselves at the forefront of heart failure management innovation.

Engaging With Our Associate Director of Sales and Marketing to Unlock Exclusive Access and Customized Support for the Cardiac Resynchronization Therapy Market Report

We invite readers to connect directly with Ketan Rohom (Associate Director, Sales & Marketing) to explore the depth and breadth of our comprehensive cardioresynchronization therapy devices research report. He can provide personalized guidance, respond to inquiries about specific sections, and tailor deliverables to address unique organizational priorities, ensuring stakeholders derive maximum value from their investment.

In partnership with Ketan, organizations can arrange a demo walkthrough of key findings and methodologies, secure custom data extracts, and discuss group licensing options. By engaging with him, decision-makers gain direct access to expert support, expedited procurement pathways, and exclusive opportunities for executive briefings, reinforcing confidence in strategic planning and market entry decisions.

- How big is the Cardiac Resynchronization Therapy Devices Market?

- What is the Cardiac Resynchronization Therapy Devices Market growth?

- When do I get the report?

- In what format does this report get delivered to me?

- How long has 360iResearch been around?

- What if I have a question about your reports?

- Can I share this report with my team?

- Can I use your research in my presentation?