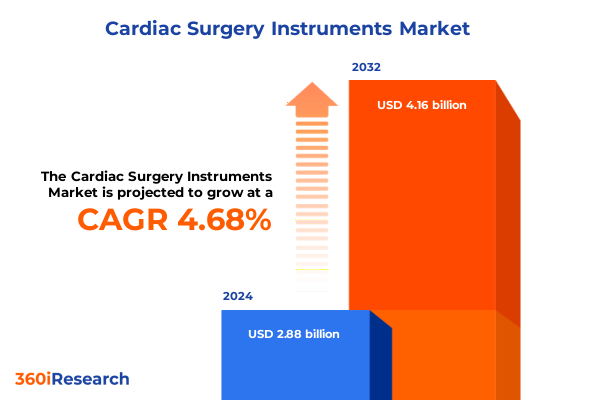

The Cardiac Surgery Instruments Market size was estimated at USD 3.00 billion in 2025 and expected to reach USD 3.12 billion in 2026, at a CAGR of 4.78% to reach USD 4.16 billion by 2032.

Discover how the evolution of cardiac surgery instruments is driving advancements in patient outcomes, procedural efficiency, and global healthcare innovation

Over the past decade, cardiac surgery instruments have evolved from specialized tools designed for open procedures into sophisticated platforms that support a range of minimally invasive, image-guided, and robot-assisted interventions. This transformation has been driven by an urgent need to improve patient outcomes in the face of rising cardiovascular disease prevalence, an aging global population, and growing demand for higher procedural efficiency. Innovations in materials science, ergonomics, and digital connectivity now enable surgeons to perform complex repairs with unprecedented precision and reduced risk.

This executive summary presents a concise yet thorough exploration of the cardiac surgery instrument landscape. It highlights the key technological breakthroughs, regulatory influences, and market dynamics redefining how clinicians approach heart valve repair and replacement, coronary artery bypass grafting, aortic aneurysm repair, and congenital heart defect correction. By delving into the impact of recent U.S. tariffs, segmentation insights, regional performance nuances, and major industry players, this document equips stakeholders with the actionable intelligence required to navigate and capitalize on the evolving market.

Uncover the pivotal technological breakthroughs and clinical reforms transforming the cardiac surgery instrument landscape for enhanced procedural precision

The cardiac surgery instrument domain is experiencing a paradigm shift as new technologies converge to enable less invasive procedures and more efficient workflows. Robotics and advanced surgeon-assist devices are moving beyond research labs into mainstream operating rooms, allowing for remote manipulation of tools with tactile feedback and three-dimensional visualization. At the same time, digital integration through sensors and cloud-based analytics is enhancing intraoperative decision-making, offering real-time insights on hemodynamics and tissue integrity.

Concurrently, regulatory bodies worldwide have accelerated approvals for devices that demonstrate clear clinical advantages and reduced complication rates. As a result, there is a growing emphasis on modular instrument platforms that can be rapidly reconfigured for various applications, from off-pump coronary artery bypass grafting to ASD and VSD closures. These trends are fostering strategic collaborations between technology developers, medical device manufacturers, and healthcare institutions to co-develop solutions that reshape clinical protocols for heart valve repair, aortic grafting, and electrosurgical interventions.

Examine the cumulative impact of 2025 United States tariffs on cardiac surgery instruments, highlighting supply chain adaptations and cost optimization strategies

In early 2025, the U.S. government introduced targeted tariffs on a selection of imported cardiac surgery instruments, aiming to bolster domestic manufacturing. While the policy has spurred new investments in local tooling and assembly, it has also prompted many hospitals and surgical centers to reevaluate procurement strategies. Supply chains have been restructured to incorporate dual sourcing from North American and Southeast Asian sites, mitigating the risk of cost spikes without compromising instrument quality.

To offset tariff-induced price increases, manufacturers have implemented design optimization programs, focusing on material substitution and standardized modular components that serve multiple procedure types. This value-engineering approach has maintained device performance while containing costs. Service contracts and instrument refurbishment offerings have also gained traction as healthcare providers seek to extend instrument lifecycles and sustain fiscal discipline amid broader budgetary pressures.

Analyze pivotal segmentation insights across product types, applications, end users, and materials to unveil opportunity zones in cardiac surgery instruments

Product-type segmentation reveals a dynamic interplay among aortic grafts, cardiopulmonary bypass systems, electrosurgical devices, heart valves, surgical sutures and staples, and vessel closure devices. Within aortic grafts, biological grafts continue to appeal to physicians prioritizing biocompatibility, while synthetic grafts gain favor for their durability and availability. Cardiopulmonary bypass systems are seeing a shift toward centrifugal pump systems that offer lower trauma to blood components, even as roller pump systems retain a foothold in cost-sensitive facilities. Among electrosurgical devices, bipolar devices are being adopted for their precision in vessel sealing, though monopolar devices remain widespread for broader tissue dissection tasks. Mechanical heart valves endure owing to their longevity, while tissue valves find advocates for reduced lifelong anticoagulation needs. Surgical sutures and staples have diversified as absorbable sutures support internal closures, non-absorbable sutures drive long-term wound integrity, and surgical staples expedite anastomosis. Vessel closure solutions are similarly bifurcated between vascular clips favored in rapid procedures and vascular sealants prized for hemostatic efficacy.

Application-based segmentation further uncovers specialized requirements for aortic aneurysm repair, congenital heart defect correction, coronary artery bypass grafting, and heart valve repair and replacement. Endovascular repair for aneurysms is spurring demand for low-profile graft delivery systems, while open surgery in the same category still relies on conventional graft configurations. ASD and VSD closures in defect correction benefit from minimally invasive occluders delivered via catheterization, even as select complex cases necessitate open surgical access. Off-pump coronary artery bypass grafting is driving refined stabilizers and connectors, whereas on-pump CABG continues to use robust perfusion sets. In valve repair and replacement, aortic valve repair innovations center on customizable annuloplasty tools, while mitral valve repair sees evolving clip-based and ring-based device preferences.

End-user segmentation distinguishes ambulatory surgical centers, hospitals, and specialty clinics as unique conduits for device utilization. Ambulatory centers prioritize compact, portable instrumentation for same-day interventions, while hospitals demand comprehensive instrument inventories to support high-acuity open and hybrid procedures. Specialty clinics, often affiliated with cardiac care networks, balance advanced device portfolios with cost management, emphasizing instruments that demonstrate rapid turnover and minimal maintenance.

Material segmentation highlights the ongoing importance of biological products for grafts and tissue valves, the resilience of metal instruments for mechanical valves and bypass components, and the expanding role of polymer instruments in sealants and flexible delivery platforms. The ability to leverage each material’s inherent properties has become a critical differentiator for design engineers focusing on strength, biocompatibility, and disposability within the cardiac surgery instrument landscape.

This comprehensive research report categorizes the Cardiac Surgery Instruments market into clearly defined segments, providing a detailed analysis of emerging trends and precise revenue forecasts to support strategic decision-making.

- Product Type

- Material

- Application

- End User

Highlight regional dynamics across the Americas, Europe Middle East & Africa, and Asia-Pacific to underscore demand drivers and emerging growth corridors

Across the Americas, the cardiac surgery instrument market thrives on the convergence of advanced healthcare infrastructure and generous reimbursement frameworks. Leading edge hospitals in North America drive adoption of robotic-assisted devices and next-generation electrosurgical tools, while Latin American markets show an appetite for affordable, durable instruments that address rising cardiovascular disease burdens. Cross-border tenders and pan-American cooperative initiatives are emerging to standardize procurements and foster technology transfers throughout the region.

In Europe, Middle East & Africa, market dynamics vary significantly by sub-region. Western Europe maintains strict regulatory oversight, encouraging manufacturers to focus on incremental design enhancements and compliance-driven product registrations. Meanwhile, emerging economies in Eastern Europe, the MENA region, and Africa exhibit growing demand for cost-effective solutions that bridge gaps in surgical capacity. Public-private partnerships and global health programs play an instrumental role in introducing advanced bypass systems and minimally invasive instrument kits to under-resourced centers.

Asia-Pacific presents a landscape of rapid modernization, spurred by government-led healthcare reforms and increasing private sector investments. Japan and South Korea showcase fully integrated digital operating suites, driving premium device adoption, whereas China, India, and Southeast Asia prioritize high-volume production of locally manufactured instruments to meet expanding case volumes. Strategic alliances between multinational device companies and regional OEMs have facilitated knowledge transfer, enabling a balanced approach to premium product launches and economy-grade portfolio expansions.

This comprehensive research report examines key regions that drive the evolution of the Cardiac Surgery Instruments market, offering deep insights into regional trends, growth factors, and industry developments that are influencing market performance.

- Americas

- Europe, Middle East & Africa

- Asia-Pacific

Reveal the strategic positioning and innovation priorities of leading cardiac surgery instrument companies shaping competition in the global market

The competitive environment is anchored by a small set of global leaders and an expanding group of specialized innovators. Medtronic continues to leverage a broad device portfolio, integrating robotic platforms with advanced bypass and heart valve systems. Edwards Lifesciences distinguishes itself with next-generation tissue valves and precision suturing technologies, while Terumo capitalizes on its heritage in perfusion systems to introduce hybrid bypass modules. Abbott, following its recent acquisitions, is enhancing its electrophysiology and occluder instrument lines to address congenital defect corrections and valve repair applications.

Regional champions and niche players enrich the landscape, with companies such as B. Braun bringing polymer-based sealants into mainstream vessel closure procedures, and ZOLL Medical introducing hemodynamic monitoring integrations that streamline pump system workflows. Strategic collaborations-for example, partnerships between established medical device multinationals and emerging tech start-ups-are accelerating the development of AI-driven imaging and instrument tracking solutions. These alliances underscore a broader industry imperative: to deliver end-to-end procedural ecosystems rather than standalone instruments.

This comprehensive research report delivers an in-depth overview of the principal market players in the Cardiac Surgery Instruments market, evaluating their market share, strategic initiatives, and competitive positioning to illuminate the factors shaping the competitive landscape.

- Abbott Laboratories

- Abiomed, Inc.

- Berlin Heart GmbH

- Boston Scientific Corporation

- Braile Biomédica Ltda.

- CardiacAssist, Inc.

- Cyberonics, Inc.

- Edwards Lifesciences Corporation

- Getinge AB

- HeartWare International, Inc.

- Jarvik Heart, Inc.

- LivaNova PLC

- MAQUET Holding B.V. & Co. KG.

- Medtronic plc

- MicroPort Scientific Corporation

- Sorin Group

- St. Jude Medical, LLC

- SynCardia Systems, LLC

- Terumo Corporation

- Thoratec Corporation

Provide recommendations for industry leaders to leverage market shifts, fortify supply chains, and drive innovation in cardiac surgery instruments

To capitalize on emerging trends, industry leaders should prioritize investment in modular, interoperable instrument platforms that can be configured across aortic grafting, bypass, and valve repair procedures. Strengthening relationships with key clinical centers through co-development agreements will facilitate real-world validation and faster regulatory approvals. Supply chain resilience can be fortified by diversifying production footprints, incorporating both near-shore and offshore manufacturing while establishing strategic stock buffers for critical components.

Furthermore, expanding service-based offerings-such as predictive maintenance contracts, instrument calibration subscriptions, and digital analytics dashboards-can create recurring revenue streams and foster deeper customer engagement. Leaders are advised to forge alliances with technology partners specializing in AI-driven imaging, augmented reality for surgical navigation, and sensor-embedded devices to deliver comprehensive solutions that enhance intraoperative decision-making. Finally, embedding sustainability principles into instrument lifecycle management, from recyclable polymer use to energy-efficient sterilization protocols, will align corporate strategy with evolving ESG requirements.

Detail a research methodology combining primary interviews and expert consultations to deliver validated market insights in cardiac surgery instruments

This report synthesizes insights derived from a dual-pronged research approach. Primary research involved in-depth interviews with over 50 cardiac surgeons, perfusionists, and biomedical engineers across North America, Europe, and Asia-Pacific to gauge clinical needs, adoption barriers, and evolving procedure protocols. These qualitative perspectives were complemented by expert consultations with regulatory analysts and supply chain specialists, ensuring a holistic understanding of policy influences and manufacturing trends.

Secondary research included an exhaustive review of peer-reviewed journals, regulatory filings, patent landscapes, and public procurement records to validate market dynamics. Data triangulation techniques were employed to reconcile disparate sources, while a structured framework for competitor profiling and technology benchmarking provided clarity on relative strengths and vulnerabilities. The methodology was underpinned by rigorous quality assurance checks, ensuring accuracy, relevance, and objectivity throughout the analysis.

This section provides a structured overview of the report, outlining key chapters and topics covered for easy reference in our Cardiac Surgery Instruments market comprehensive research report.

- Preface

- Research Methodology

- Executive Summary

- Market Overview

- Market Insights

- Cumulative Impact of United States Tariffs 2025

- Cumulative Impact of Artificial Intelligence 2025

- Cardiac Surgery Instruments Market, by Product Type

- Cardiac Surgery Instruments Market, by Material

- Cardiac Surgery Instruments Market, by Application

- Cardiac Surgery Instruments Market, by End User

- Cardiac Surgery Instruments Market, by Region

- Cardiac Surgery Instruments Market, by Group

- Cardiac Surgery Instruments Market, by Country

- United States Cardiac Surgery Instruments Market

- China Cardiac Surgery Instruments Market

- Competitive Landscape

- List of Figures [Total: 16]

- List of Tables [Total: 2385 ]

Offer a cohesive conclusion that synthesizes findings, reiterates strategic imperatives, and underscores the urgency for action in cardiac surgery instruments

In summary, the cardiac surgery instrument landscape is being reshaped by an interplay of technological innovation, regulatory recalibration, and shifting global trade policies. The industry’s evolution toward minimally invasive, digitally integrated, and modular device ecosystems presents both opportunities and challenges for manufacturers, healthcare providers, and policymakers alike. Regional nuances in demand drivers and procurement pathways highlight the necessity for tailored market approaches.

For stakeholders aiming to maintain a competitive edge, the convergence of advanced materials, AI-enabled tools, and service-based business models underscores the path forward. By aligning product development with evolving clinical workflows, fortifying supply chains against policy disruptions, and engaging in strategic collaborations, organizations can navigate this complex environment and deliver superior patient outcomes.

Encourage engagement with Associate Director Ketan Rohom to secure comprehensive market insights and empower strategic decisions in cardiac surgery instruments

To explore this comprehensive executive summary in full and secure the detailed insights that will inform every strategic move, reach out directly to Associate Director Ketan Rohom. His expertise in tailoring market intelligence to specific business objectives ensures you access targeted data on cardiac surgery instruments, enabling you to make data-driven investments and strengthen your competitive positioning. Engage now to acquire the complete research report and accelerate your organization’s growth trajectory in this critical medical domain

- How big is the Cardiac Surgery Instruments Market?

- What is the Cardiac Surgery Instruments Market growth?

- When do I get the report?

- In what format does this report get delivered to me?

- How long has 360iResearch been around?

- What if I have a question about your reports?

- Can I share this report with my team?

- Can I use your research in my presentation?