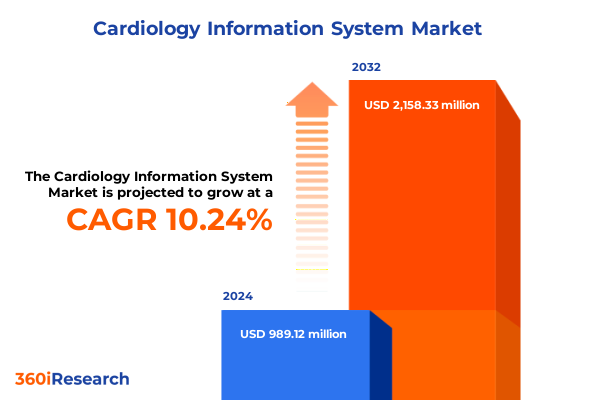

The Cardiology Information System Market size was estimated at USD 1.07 billion in 2025 and expected to reach USD 1.18 billion in 2026, at a CAGR of 10.40% to reach USD 2.15 billion by 2032.

Revolutionary Convergence of Advanced Cardiology Information Platforms Enabling Seamless Patient Data Integration for Enhanced Diagnostic Precision and Clinical Workflows

The escalating complexity of cardiovascular care demands a unified digital framework capable of aggregating diverse data sources into a single, coherent view. Cardiology information platforms have emerged as pivotal tools that integrate imaging, monitoring, and medical record data in real time, thereby empowering clinicians to derive accurate insights swiftly. By unifying these disparate streams, care teams can streamline diagnostic pathways and reduce variability in interpretation, creating a solid foundation for evidence-based decision making.

In response to the growing prevalence of heart disease and an increased focus on preventive cardiology, healthcare organizations are prioritizing interoperability and scalability. Cardiology systems now interface with enterprise electronic health records and ancillary applications, ensuring that critical patient information travels seamlessly across clinical touchpoints. This enhanced connectivity supports multidisciplinary collaboration and enables personalized treatment plans that adapt to evolving patient metrics, reinforcing the importance of a robust digital infrastructure in modern cardiac care.

Recognizing the imperative for timely access to accurate cardiac data, this report delves into the key drivers, emerging trends, and strategic considerations shaping the cardiology information landscape. It synthesizes recent technological advancements and regulatory shifts, offering a comprehensive foundation for stakeholders seeking to optimize platform deployment and maximize clinical impact. By framing the central themes that govern system development and adoption, the introduction establishes the context for a detailed exploration of transformational dynamics and market influences.

Emerging Technological and Regulatory Disruptions Reshaping the Cardiology Information Infrastructure to Elevate Care Delivery and Operational Agility

The rapid proliferation of artificial intelligence and machine learning capabilities has ushered in a new era of predictive analytics for cardiac diagnostics and patient monitoring. AI-driven algorithms now analyze electrocardiogram waveforms and imaging data to detect subtle anomalies that may elude manual review, thereby enhancing early disease identification. Moreover, cloud-native architectures have gained traction, offering scalable compute resources that facilitate seamless data access and real-time collaboration across geographies. Together, these technological forces are redefining the capabilities and expectations of cardiology information systems.

In parallel with technological progress, regulatory frameworks are evolving to accommodate digital health innovations while preserving patient privacy and data security. Standards such as the Fast Healthcare Interoperability Resources specification and strengthened data protection regulations are compelling vendors to adopt open interfaces and robust encryption methods. These mandates not only ensure compliance but also foster a competitive environment where more agile and standardized solutions can emerge. As a result, healthcare organizations are placing greater emphasis on platforms that adhere to stringent interoperability and security requirements.

Furthermore, the integration of edge computing solutions is emerging as a critical enabler for real-time cardiac monitoring and analytics at the point of care. By decentralizing data processing, edge architectures reduce latency and bandwidth dependencies, thereby enhancing the responsiveness of monitoring systems in critical care scenarios. These advances, coupled with the proliferation of telecardiology services, promise to extend specialist expertise to remote and underserved regions. Consequently, stakeholders must evaluate hybrid deployment models that optimize the trade-off between centralized analytics and local data processing.

Comprehensive Analysis of 2025 United States Tariff Policies Influencing Cardiology Information System Procurement Costs and Supply Chain Resilience

In 2025, the introduction of revised tariff schedules by the United States government has significantly affected the importation of specialized cardiology hardware and software components. These adjustments have led to increased duties on critical imaging devices and server infrastructure, driving up procurement costs for health systems and vendors alike. Subsequently, organizations are reassessing their supplier networks and exploring alternative sourcing strategies to mitigate cost escalations and maintain budgetary discipline.

The ripple effects of these tariffs extend beyond immediate pricing pressures, influencing supply chain resilience and project timelines. Health systems relying on overseas manufacturing may experience delays in equipment delivery, potentially prolonging deployment schedules for advanced cardiology information platforms. Furthermore, the heightened cost environment has prompted a shift in vendor negotiation tactics, with longer-term service agreements and local assembly options emerging as viable approaches to shield end users from volatility.

Looking ahead, strategic collaboration between healthcare providers, technology suppliers, and policymakers will prove essential in addressing tariff-driven challenges. Suppliers may expand domestic production or invest in regional distribution centers, while purchasers could prioritize modular architectures that allow component substitution without compromising system integrity. This analysis underscores the necessity of adaptive sourcing frameworks to ensure uninterrupted access to cutting-edge diagnostic and monitoring capabilities in the face of evolving trade policies.

The tariff environment has also pronounced implications for innovative startups that rely on imported components for prototyping and small-scale production. Increased duties may constrain research and development budgets, prompting some firms to explore collaborative partnerships with domestic manufacturers. While larger incumbents may absorb cost increases more readily, smaller vendors could accelerate efforts to localize supply chains or pivot toward software-centric offerings to minimize reliance on hardware imports. This shift may foster a more resilient ecosystem of regional suppliers and spur innovation in modular system designs.

Deep Dive into Product Service Models End User Dynamics and Application Tiers Illuminating Opportunities across Cardiology Information System Segments

A nuanced examination of product and service offerings reveals distinct trajectories for software-based solutions and associated service models. Software platforms now integrate advanced analytics modules alongside conventional record-keeping functions. In parallel, service models have diversified into managed services that deliver ongoing operational oversight and professional services that focus on custom implementation and strategic consulting. This dual-layered approach enables health systems to choose comprehensive support structures or targeted expertise based on their internal capabilities and long-term objectives.

End user classifications further clarify adoption patterns, indicating that academic and research institutes often prioritize advanced analytics capabilities and integration with clinical trials workflows. Ambulatory care centers are increasingly focused on streamlined interfaces and remote monitoring integrations that support decentralized cardiology services. Hospitals, with their complex operational environments, demand scalable solutions capable of handling high patient volumes and interoperability across inpatient and outpatient departments. These distinctions underscore the importance of tailoring system functionalities to the unique requirements of each care setting.

Application-specific segmentation illuminates the diverse clinical use cases that cardiology platforms address. Diagnostic modules concentrate on data aggregation from stress tests and electrocardiography, providing contextual risk assessments. Imaging components span cardiac magnetic resonance, computed tomography angiography, and echocardiography, each requiring specialized rendering engines and reporting pipelines. Monitoring functionalities encompass both remote monitoring for post-discharge management and wearable monitoring devices that continuously track physiological parameters. By understanding the interplay among these product, service, end user, and application dimensions, stakeholders can identify targeted strategies to optimize deployment and enhance clinical performance.

This comprehensive research report categorizes the Cardiology Information System market into clearly defined segments, providing a detailed analysis of emerging trends and precise revenue forecasts to support strategic decision-making.

- Product Type

- Application

- End User

Global Regional Dynamics Shaping Adoption Patterns and Innovation Drivers across Americas Europe Middle East Africa and Asia Pacific Markets

Across the Americas, health systems in North America lead in the adoption of cardiology information platforms driven by robust reimbursement incentives and well-established digital infrastructures. Canada has similarly embraced interoperable solutions, integrating provincial data repositories to streamline cross-jurisdictional care coordination. Meanwhile, Latin American markets are gradually expanding investments in digital health, with a focus on public-private partnerships that aim to modernize cardiovascular diagnostic capabilities in emerging economies.

Europe, the Middle East, and Africa present a complex mosaic of regulatory environments and investment climates. Within the European Union, harmonized data protection standards and cross-border healthcare directives encourage the deployment of solutions that support patient mobility across member states. Conversely, the Middle Eastern region exhibits significant growth potential through government-led digital transformation initiatives, where investments in national health programs foster the adoption of advanced monitoring and imaging systems. In Africa, pilot programs target rural and remote settings, leveraging mobile-enabled platforms to extend cardiology services to underserved populations.

In the Asia Pacific, a combination of high-growth economies and mature markets shapes divergent adoption trajectories. Japan and Australia prioritize AI-driven diagnostic enhancements and telecardiology services, supported by strong healthcare funding models. Southeast Asian nations demonstrate an increasing appetite for cloud-based platforms that minimize upfront infrastructure requirements, while China’s rapidly evolving regulatory framework is catalyzing local innovation in remote monitoring and wearable device integration. These regional perspectives highlight the need for adaptive strategies that account for regulatory complexity, infrastructure maturity, and localized clinical priorities.

This comprehensive research report examines key regions that drive the evolution of the Cardiology Information System market, offering deep insights into regional trends, growth factors, and industry developments that are influencing market performance.

- Americas

- Europe, Middle East & Africa

- Asia-Pacific

Strategic Profiles of Leading Cardiology Information System Providers Highlighting Competitive Strengths Partnerships and Technological Differentiation

Market leaders in the cardiology information domain have distinguished themselves through deep clinical partnerships and continual innovation. Established players maintain expansive global footprints and invest heavily in research and development to refine imaging algorithms and analytics workflows. By collaborating with leading medical institutions and device manufacturers, these vendors have accelerated the integration of multimodal data sources and developed proprietary decision support functionalities that resonate with cardiologists seeking reliable diagnostic insights.

Emerging vendors are carving out niches by specializing in cloud-native deployments and offering flexible subscription models that lower barriers to entry for smaller health systems. These companies leverage agile development methodologies to iterate quickly on features such as patient engagement portals and mobile monitoring dashboards. As a result, they can address specific gaps in legacy system architectures and capture market segments that demand rapid implementation timelines and user-centric interfaces.

Across the competitive spectrum, strategic alliances have become a cornerstone for growth. Partnerships with telehealth service providers enable vendors to extend monitoring capabilities beyond hospital walls, while collaborations with academic consortia drive the validation of AI-based predictive models. Furthermore, joint ventures with regional integrators facilitate compliance with local regulatory regimes and enhance after-sales support. Collectively, these strategic approaches underscore the dynamic interplay between technology innovation, partnership ecosystems, and service excellence within the cardiology information arena.

This comprehensive research report delivers an in-depth overview of the principal market players in the Cardiology Information System market, evaluating their market share, strategic initiatives, and competitive positioning to illuminate the factors shaping the competitive landscape.

- Agfa-Gevaert N.V.

- Central Data Networks PTY Ltd

- Cerner Corporation by Oracle Corporation

- Change Healthcare Solutions, LLC

- Esaote SpA

- Fujifilm Healthcare Solutions

- Fukuda Denshi Co., Ltd.

- GE HealthCare Technologies Inc.

- Healthy-IT, LLC

- Infinitt Healthcare Co Ltd

- Intelerad Medical Systems Incorporated

- Koninklijke Philips N.V.

- Laerdal Medical AS

- MCKESSON CORPORATION

- Merative L.P.

- NORAV Medical GmbH

- Olea Medical S.A.S.

- RIOMED LTD

- Siemens Healthineers AG

- SoftLink International Pvt. Ltd.

- Spacelabs Healthcare by OSI Systems, Inc.

- ZOLL Medical Corporation

Actionable Strategic Guidelines for Healthcare Executives and Technology Vendors to Capitalize on Cardiology Information System Opportunities and Navigate Challenges

Healthcare executives should initiate cross-functional governance structures that include clinical leaders, IT specialists, and financial stewards to guide cardiology platform selection and implementation. By fostering an environment of collaborative decision making, organizations can align technological initiatives with clinical objectives, ensuring that system features directly address care quality goals. Moreover, pilot programs that leverage a representative patient cohort can reveal workflow optimization opportunities and mitigate risks before enterprise-wide deployment.

Vendors must prioritize open standards and invest in modular architectures that allow incremental system upgrades as clinical requirements evolve. This agile approach enables end users to integrate emerging innovations, such as advanced imaging analysis or real-time remote monitoring, without undertaking disruptive overhauls. In addition, offering tiered service packages that combine managed services for operational oversight with professional services for strategic consulting can enhance customer satisfaction and create recurring revenue streams.

Finally, industry stakeholders should engage actively with regulatory bodies and professional associations to shape policies that support digital health innovation. Advocacy efforts targeted at reimbursement reform and data interoperability mandates can lower adoption barriers and spur investment in next-generation cardiology solutions. By implementing these strategic recommendations, healthcare organizations and technology providers can unlock the full potential of cardiology information systems and deliver measurable improvements in patient outcomes.

Robust Research Framework Detailing Data Collection Analytical Procedures and Validation Techniques Underpinning the Cardiology Information System Study

This research employed a multi-phased approach, beginning with a comprehensive review of scientific literature, regulatory filings, and industry white papers to establish foundational knowledge. Secondary research provided insights into prevailing technological trends, policy shifts, and regional dynamics. The study then progressed to primary data collection, engaging in structured interviews with key opinion leaders, hospital administrators, and IT directors to capture firsthand perspectives on system capabilities and deployment challenges.

Quantitative data was triangulated through analysis of technology adoption indicators and supply chain metrics, enabling the identification of patterns in procurement practices and deployment timelines. Qualitative content from expert discussions was synthesized using thematic analysis techniques, ensuring that emerging insights into user requirements and vendor strategies were rigorously validated. Cross-checks with subject matter experts reinforced the accuracy of market segment delineations and competitive profiles.

To ensure methodological robustness, validation sessions were conducted with external advisors specializing in cardiology informatics and healthcare policy. Feedback from these sessions informed revisions to data interpretations and reinforced the reliability of conclusions. Collectively, this systematic framework underpins the credibility of the report and provides a transparent account of the analytical processes used to generate actionable insights.

This section provides a structured overview of the report, outlining key chapters and topics covered for easy reference in our Cardiology Information System market comprehensive research report.

- Preface

- Research Methodology

- Executive Summary

- Market Overview

- Market Insights

- Cumulative Impact of United States Tariffs 2025

- Cumulative Impact of Artificial Intelligence 2025

- Cardiology Information System Market, by Product Type

- Cardiology Information System Market, by Application

- Cardiology Information System Market, by End User

- Cardiology Information System Market, by Region

- Cardiology Information System Market, by Group

- Cardiology Information System Market, by Country

- United States Cardiology Information System Market

- China Cardiology Information System Market

- Competitive Landscape

- List of Figures [Total: 15]

- List of Tables [Total: 1113 ]

Conclusive Perspectives on the Evolutionary Trajectory of Cardiology Information Systems Informing Strategic Planning and Innovation Roadmaps

The landscape of cardiology information systems is poised for continued transformation as emerging technologies converge with evolving care models. Predictive analytics and AI-driven decision support will increasingly augment clinician expertise, enabling proactive interventions and personalized care pathways. Interoperability standards and cloud-native deployment models will strengthen the digital backbone of cardiac care, facilitating seamless collaboration across multidisciplinary teams.

Nonetheless, challenges related to data governance, cybersecurity, and regulatory compliance will persist, necessitating vigilant risk management and adaptive strategies. Organizations that invest in cross-functional expertise and foster a culture of continuous improvement will be best positioned to navigate these complexities. Furthermore, the impact of external factors such as trade policies and regional infrastructure disparities will require dynamic sourcing and deployment approaches.

In synthesizing these insights, stakeholders are encouraged to adopt a balanced perspective that marries innovation with foundational planning. By leveraging the strategic guidelines and segmentation insights outlined in this report, healthcare providers and technology vendors can chart a clear roadmap for leveraging cardiology information systems to achieve superior clinical outcomes and operational excellence.

Engage with Ketan Rohom to Access the Definitive Market Research Report Guiding Investment and Operational Strategies for Cardiology Information Systems

This report synthesizes comprehensive insights across technological innovations, regulatory developments, regional dynamics, and competitive landscapes to empower stakeholders with actionable strategies. Readers will benefit from detailed analyses of service and software models, end user requirements, application-specific use cases, and the impact of evolving tariff policies. The research methodology underpins the credibility of findings, ensuring that decision makers can confidently navigate the complexities of cardiology information system deployment.

Ketan Rohom (Associate Director, Sales & Marketing at 360iResearch) stands ready to provide personalized guidance on report access and tailored solutions that align with organizational objectives. Reach out to explore customization options, secure licensing arrangements, and arrange a consultative briefing to translate insights into tangible outcomes. Take the next step toward leveraging cutting-edge data and expert recommendations for strategic advantage in cardiac care delivery

- How big is the Cardiology Information System Market?

- What is the Cardiology Information System Market growth?

- When do I get the report?

- In what format does this report get delivered to me?

- How long has 360iResearch been around?

- What if I have a question about your reports?

- Can I share this report with my team?

- Can I use your research in my presentation?